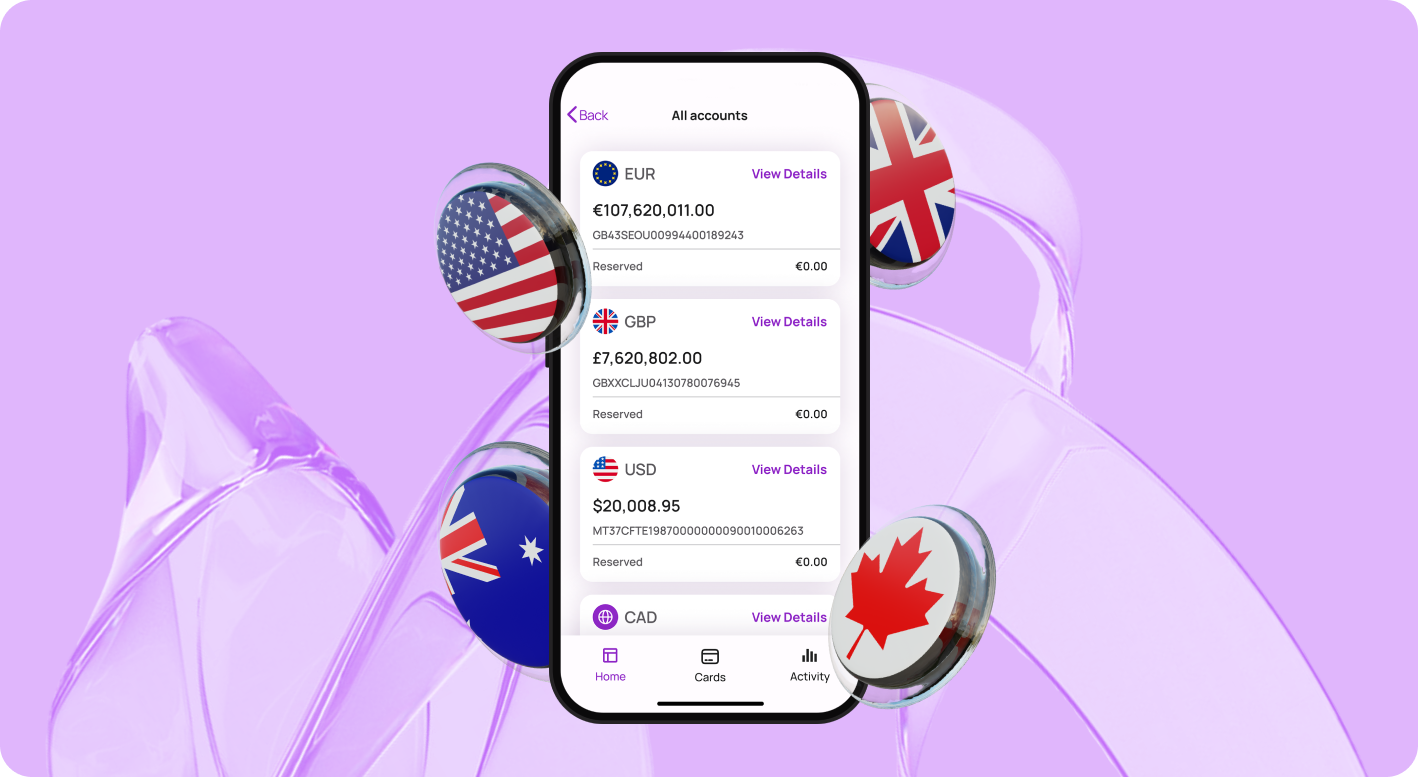

Open a Multiple Currency Account

Experience the benefits of multi-currency accounting for your business.

Send and receive payments in units convenient for you and your

customers.

Reach new heights with a multi-currency account:

optimise online

sales on international markets

-

Accept payments anywhere in the world

Multi-currency business account users have 24/7 online access to their personal accounts, no matter where they are. Keep your workflow running smoothly and increase your income.

-

Expand your target audience

Clients can refuse to cooperate if they do not have the opportunity to make payments in the currency that is convenient for them. Multiple currency accounting is a great way out of this situation. Also, your customers will surely appreciate the speed and reliability of payments.

-

Open an account in a few clicks, avoiding paperwork

To open a multi-currency account in the UK, there is no need to visit a branch and fill out many applications and other documents. The whole procedure takes place online.

Best multi-currency business account from Transferra:

-

Strengthen relationships with customers and suppliers

By opening a foreign currency account, you can provide your customers and partners with one account number regardless of the currency they work with. This will help them avoid unnecessary hassle. And you'll avoid confusion in the details and, as a result, delays in payments.

-

Simplify bookkeeping

Now you can bill customers and receive payments from them in the same currency. You no longer need to spend much time preparing reconciliation statements and other reports.

-

Save on currency exchange fees

If a mono-currency account receives payment in another unit, the financial institution must convert it in order to credit it. This may lead to additional fees. However, you can solve this problem with multi-currency accounts. The money will come in without any extra manipulation.

-

Get unlimited access to your finances

Buy and sell currency anytime, transfer money to a deposit or any other account. Multi-currency accounts for businesses do not imply limitations on operations with your funds.

-

Control your cash flow

All international payments, regardless of the monetary unit, go to one account. This allows you to track all transactions in one account, maintain transparent reporting and quickly provide financial information to various authorities.

How to open a multi-currency business account in the UK:

Want to learn a new approach to doing business in commerce? Then don't put it off until tomorrow to open an account that allows you to receive, store, and send money regardless of currency. Especially since you can do it fast and easy:

-

01

Create an account on the Transferra website

Enter your username, password, and phone number in the appropriate fields to send the verification code. Please note: at this stage, you must decide whether to create a personal or business account.

-

02

Proceed to add an account

This step requires specifying the details of a person or company and uploading scanned copies of the necessary documents. Their list will differ depending on the type of account.

-

03

Wait for confirmation for the created multi-currency account

The verification procedure may take several days. After that, you will receive confirmation that your account is open. For any questions, you can contact your personal manager.

FAQ

-

What are the disadvantages of a multi-currency account?

The biggest disadvantage is the high risk associated with exchange rate fluctuations. It is also worth noting the lower interest rates and additional transaction fees.

-

What is the benefit of a multi-currency account?

Such accounts allow to make international payments fast and cheap, have 24/7 access to your finances from anywhere in the world, simplify accounting, strengthen relationships with customers and suppliers.

-

What is the minimum balance for a multi-currency account?

As a rule, owners of foreign currency accounts are not required to have a minimum balance.

-

How do I use a multi-currency account?

You can use such accounts to receive or send money, or to store your savings in different monetary units.

-

What is the best foreign currency account in the UK?

Transferra offers you the best multi-currency business account in the UK. We offer you a simple and fast registration procedure and constant access to your account, and we guarantee the security of transactions.