Best 5 Online Business Accounts in the UK 2025

Choosing an online business account in 2025 is a game-changing move! Dive into this article to discover the best choices available for your evolving needs in the fintech niche.

Choosing the right online business account in 2025 isn’t just a minor decision—it’s a game-changer. With more businesses going digital, traditional banking is taking a backseat, and flexible, tech-driven alternatives are stepping up. Entrepreneurs, freelancers, and small business owners are ditching the long paperwork and rigid banking rules for fast, hassle-free financial solutions.

In the UK, electronic money institutions (EMIs) are leading this shift. These platforms offer business IBAN accounts and payment solutions tailored to today’s fast-paced world. They aren’t banks, but they provide everything a modern business needs—easy international transactions, multi-currency support, and intuitive digital management.

This article dives into five of the top EMI business accounts in the UK: Transferra, Finom, Emerald, Wallter, and Wittix. Whether you’re looking for seamless payments, lower fees, or better international support, these providers are redefining business finance in 2025.

Key Factors to Consider When Choosing an Online Business Account

You need to consider the following factors while choosing an online bank account:

Fees and Pricing Structures

Understanding the cost of an online business account is crucial. Some providers charge a flat monthly fee, while others take a percentage of each transaction. If your business operates internationally, exchange rates and currency conversion fees can make a big difference. Some EMIs offer competitive rates, while others may add hidden markups. Always check the fee structure carefully—what looks cheap upfront might cost more in the long run.

Security and Regulation

Your business finances need to be in safe hands. In the UK, financial institutions must be registered with the Financial Conduct Authority (FCA) to operate legally. Reputable EMIs follow strict compliance regulations to protect your funds and personal data. Look for platforms that use encryption, two-factor authentication, and fraud monitoring tools to keep your transactions secure. If an EMI isn’t FCA-regulated, that’s a red flag.

User Experience and Tools

An excellent online business account should make your life easier. Most EMIs provide sleek mobile apps and web-based dashboards with real-time transaction tracking. Some offer additional features like invoicing, automatic expense categorization, and accounting software integrations. If you’re managing payments on the go, a responsive and intuitive platform is necessary. The last thing you need is clunky software slowing you down.

Scalability

As your business grows, your financial needs will change. Startups might only need basic payment processing, but as revenue increases, features like multi-currency accounts, batch payments, and expense management become crucial. Some EMIs offer tiered plans, so you can scale without switching providers. Choosing an account that supports long-term business growth ensures you won’t have to start over when your needs expand.

Company Overview

Below is the overview of the top 5 online business accounts in the United Kingdom.

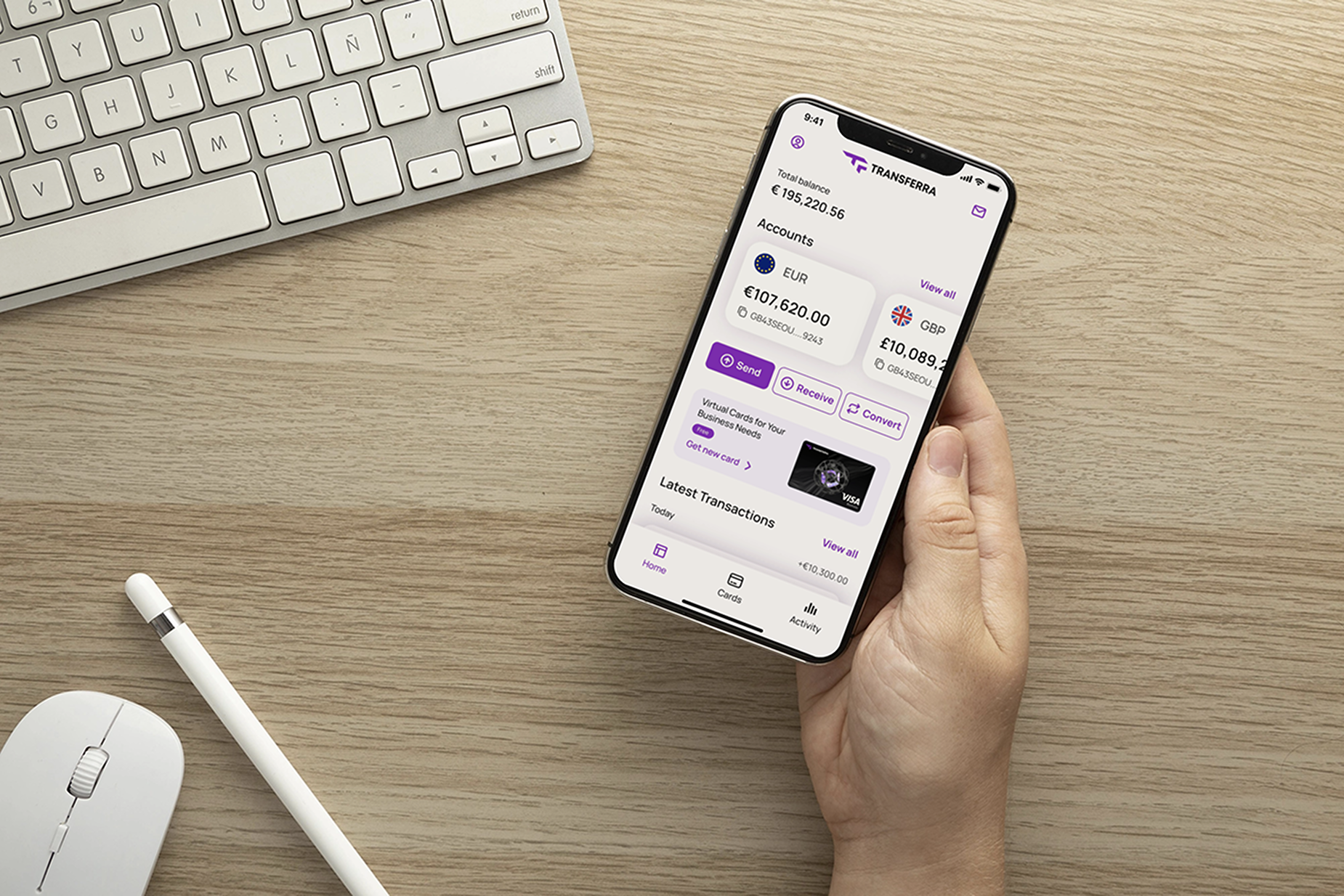

1. Transferra

Transferra is a UK-based financial institution designed for businesses seeking a streamlined approach to managing their finances. Unlike traditional banks, Transferra focuses on digital payment solutions, offering quick and easy access to online business IBAN accounts. It is known for its advantageous exchange rates, security compliance, and user-friendly interface, making it a popular choice among UK startups and SMEs.

Transferra’s online business account is ideal for freelancers, startups, and small businesses looking for a simple, secure, and scalable business IBAN account with global transaction capabilities.

Key Features

- Multiple Business IBAN Account Options – Businesses can choose from different account types based on their financial needs.

- Multi-Currency Support – Supports transactions in various currencies, making international payments seamless.

- Virtual Cards – Issue virtual debit cards for online transactions and business expenses with Apple & Google Pay.

- Wide variety of payment options – Sepa, Sepa Instant, Swift, Bacs, Chaps, Faster Payments.

- Currency exchange – favorable exchange rates in 35+ currencies.

- User-friendly interface – Transferra is available on iOS, Android and Web.

Pros

- Fast payments without delays – Transactions to 180+ countries.

- Competitive payment and exchange rates – Ideal for companies conducting frequent high-value international transactions.

- Transparent pricing – No hidden fees, with clear cost structures for different account plans.

- Responsive customer support – Available in multiple languages to cater to international businesses.

Cons

- Detailed onboarding – Certain transactions, particularly international ones, may have additional costs.

- Limited industry-specific features – Some niche industries may find fewer customisation options for their financial needs.

2. Finom

Finom is a fintech-driven financial institution that offers business accounts with built-in invoicing and financial management tools. It is tailored for startups and SMEs and provides an all-in-one platform for payments, expense tracking, and international transactions.

Finom is ideal for SMEs and startups that need an all-in-one EMI business account with built-in financial management features and multi-currency support.

Key Features

- Multi-Currency Transactions – Supports multiple currencies, making it easy to manage international payments.

- Seamless Accounting Integration – Connects with Xero, QuickBooks, and other accounting software to automate bookkeeping.

- Business Expense Cards – Physical and virtual business debit cards with employee spending limits.

- Automated Invoice Management – Create, send, and track invoices within the platform.

- Bulk payments & cashback

Pros

- User-friendly interface – Intuitive design and smooth navigation.

- Invoicing feature – Smart invoicing, reconciliation of invoices and receipts.

- Cashback – Unlimited cashback up to 0,5% or 1% depending on the pricing plan.

- Global payment coverage – payments available to over 150+ countries

Cons

- Delayed customer service – Sometimes, people find it difficult to get adequate communication from customer support because it is slow and does not provide comprehensive answers.

- Variable rates for payments and services – Finom prices are subject to constant changes. From subscription to sepa fees, prices change from time to time, which may result in additional costs.

3. Emerald24

Emerald24 is an EMI that provides fast, secure, and flexible online business accounts. It caters to digital entrepreneurs and e-commerce businesses looking for an efficient way to handle payments.

E-commerce businesses and digital entrepreneurs looking for a flexible, high-speed EMI business account with 24/7 customer support.

Key Features

- Account Setup in 48 hours – Businesses can open an account and transact quickly.

- Multi-Currency Support – Allows smooth transactions in multiple currencies for international businesses.

- 24/7 Customer Support – Ensures round-the-clock assistance for users.

- Sub-Accounts for Businesses – Open multiple IBAN accounts under one business entity.

- Mobile-Friendly Dashboard – Manage finances easily from a iOS or Android app.

Pros

- Seamless onboarding – No complex paperwork, making it easy for businesses to set up an account.

- High-security standards – Advanced encryption and fraud protection mechanisms.

- Instant transaction processing – Faster than many traditional financial institutions.

- Cash withdrawal – Withdraw cash from cards locally or globally.

Cons

- Potential transaction fees – Some payment types may incur additional costs.

- High onboarding fees for international accounts – onboarding fees range from €200 to €1000, which is a comparably high cost.

4. Wallter

Wallter is an EMI provider specializing in international business transactions and high-volume payments. It is designed for companies engaged in global trade and cross-border commerce.

Online business account is suitable for international businesses and companies involved in high-volume cross-border transactions seeking a secure, efficient business IBAN account.

Key Features

- Multi-Currency Support – Enables transactions in multiple currencies without excessive conversion fees.

- Flexible Account Options – Offers tailored solutions for different business sizes.

- Advanced Security – Implements encryption, fraud monitoring, and FCA compliance for safe transactions.

- High-Limit Business Transfers – Supports large-scale business payments with ease.

- Payroll Cards – Enable businesses to schedule employee salary payments.

Pros

- Ideal for high-volume transactions – Suited for businesses dealing with large sums of money across borders.

- Competitive foreign exchange rates – Helps reduce currency conversion costs.

- Dedicated account managers – Premium clients get personalized financial management assistance.

- Virtual & physical Mastercards – Clients can use cards online or at POS terminals and ATMs around the world.

Cons

- Not ideal for small businesses – Primarily focused on high-volume transactions.

- High fees for account opening – Fees range from €500 to €1800, depending on the company risk profile.

- Customer support delays – Response times can be longer during peak hours.

5. Wittix

Wittix is an EMI that provides secure, scalable, and flexible online business accounts for modern companies. It is best suited for businesses seeking an alternative to traditional banking.

Companies need a secure, flexible EMI business account with international transaction capabilities and strong financial tools.

Key Features

- Multi-Currency Business IBAN Account – Enables international transactions in different currencies.

- Regulatory Compliance – FCA-approved, ensuring maximum security and fraud protection.

- Personalized Financial Reports – Provides insights into spending and revenue trends.

- Bulk payments – Clients can make mass payments to business partners and employees in just a few clicks.

- Virtual and Physical Corporate Cards – Issue business cards with spending control options.

Pros

- Straightforward registration – Businesses can quickly open an account online.

- Robust security features – Wittix has encryption, multi-factor authentication, and real-time fraud detection.

- Different account permissions – customizable access permissions based on the team’s roles and responsibilities.

- Prompt customer support – some people acknowledge that the customer support is very helpful.

Cons

- Unexpected fees for some services – There are fees for payment decline, ATM payment decline, PIN change, chargeback fees, card redemption fees, etc. Customers should take this into consideration.

- High fees for transfers – Sepa payments are starting from €5 + 0.15%. There are fees also for internal transfers.

- Transaction & withdrawal limits – there are specific limits for transaction, POS and ATM limits.

How to Choose the Right Account for Your Business?

Identify Your Primary Needs

Every business has different financial priorities and online business accounts. The first step is to understand what matters most for your operations. Do you primarily make local transactions, or do you need a multi-currency business IBAN account for international payments? If you deal with global clients, choosing an EMI with low currency conversion fees can save you money in the long run.

Customer support is just as important. If something goes wrong, how quickly can you get assistance? Some providers offer 24/7 live chat and phone support, while others rely on email, which can take longer. A delayed response could mean missed payments or transaction issues, so pick an EMI with fast and reliable support.

Transaction fees can quickly add up. Some EMIs advertise zero markup fees, but hidden charges might still apply. Always check the pricing structure. A provider with transparent, predictable costs will help you manage expenses better, especially if you handle frequent transactions.

Consider Security and Compliance

Handling business finances requires trust. Regulated EMIs must comply with strict financial laws, ensuring your funds and data are protected. In the UK, financial institutions should be registered with the Financial Conduct Authority (FCA) to operate legally.

Look for advanced security features such as encryption, two-factor authentication, and fraud detection. These safeguards protect your account from cyber threats. Some providers also offer transaction monitoring to detect suspicious activities in real-time.

If security isn’t a priority, you could risk financial loss or fraud. Choosing an EMI with strong security measures and proper regulatory compliance gives you peace of mind while managing your transactions.

Assess Growth Plans

Think about where your business is headed. A basic EMI business account might work for now, but will it still fit as your company grows? Some providers offer tiered plans, allowing you to upgrade as your needs change. This way, you won’t have to switch accounts when your transaction volume increases.

Look for automation and integrations. If you use Xero, QuickBooks, or other accounting software, having an EMI that syncs with these tools can save time and reduce manual work. Automated invoicing, payment tracking, and financial reporting help keep your finances in check as your business expands.

Your business IBAN account should grow with you, not limit your potential. Whether you’re a freelancer, startup, or established SME, choosing the right EMI ensures smooth, scalable financial management without unnecessary headaches.

Compare Ease of Use and Features

A good online business IBAN account should be easy to navigate. Most EMIs provide mobile apps and web-based platforms, but the quality of these tools varies. A clean, intuitive interface makes a big difference when managing payments, invoices, and financial reports.

Some providers go beyond basic payment processing. Features like automated invoicing, expense categorization, and API access can simplify financial tasks. If your business needs these tools, choose an EMI that offers more than just transactions.

If an EMI’s platform is difficult to use, it can slow down operations and cause frustration. Pick a provider with a user-friendly system that keeps financial management hassle-free.

Check Availability and Restrictions

Not all EMIs serve every business type. Some financial institutions have restrictions on industries they support. If you’re in high-risk sectors like crypto, gambling, or adult services, some providers may reject your application.

Location matters too. While many EMIs operate in the UK and EU, not all offer services worldwide. If you plan to expand internationally, ensure your provider supports transactions in the regions you do business in.

Conclusion

Not all EMIs serve every business type. Some financial institutions have restrictions on industries they support. If you’re in high-risk sectors like crypto, gambling, or adult services, some providers may reject your application.

Location matters too. While many EMIs operate in the UK and EU, not all offer services worldwide. If you plan to expand internationally, ensure your provider supports transactions in the regions you do business in.

The whole article can be concluded through:

Final Thoughts

Every business has unique needs. Some require seamless global payments, while others prioritize low fees and automation. The best e-money account isn’t about having the most features—it’s about having the right ones. Security, ease of use, smart features, and customer support should all be considered before making a decision.

Before opening an online business account, take the time to compare providers and assess your specific financial needs. Visit each EMI’s website, read customer reviews, and explore their pricing structures.