Empower Your Business Globally. One IBAN. Unlimited Possibilities.

Global payments without boundaries. Send and receive funds in 180+ countries, with unlimited Visa debit cards, instant FX conversions, and premium support.

Processed in Payments

Businesses Trust Us

Transactions per Month

Currencies Supported

Payment Destinations

Send & Receive Like a Local in 40+ Currencies

Manage your business payments through local banking rails with dedicated account details. Lower costs, faster transfers, and no delays.

Open Account

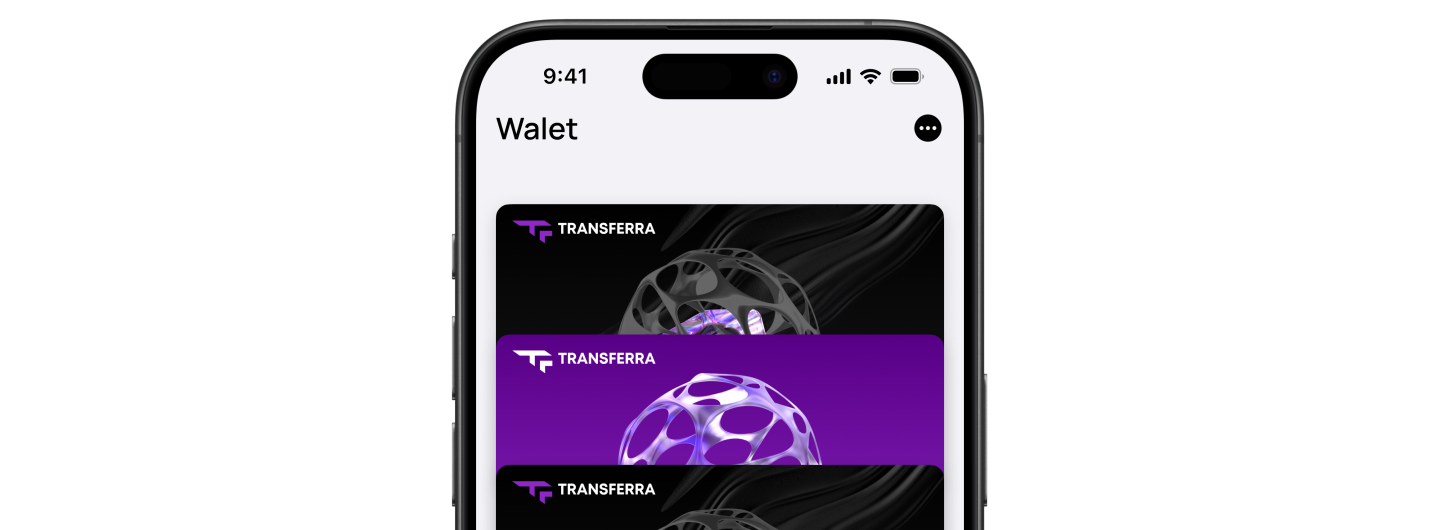

Unlimited Visa Debit Cards with

Create cards for yourself and your team to take control of business expenses and income!

Transferra's virtual VISA debit cards can be issued instantly, eliminating the long wait times associated with physical cards. They offer robust security features like 3D Secure Authentication, integrate with popular mobile payment platforms, and can be used for both in-store and online transactions.

Cross-Border Payments to 180+ Countries

Wherever you are, effortlessly send and receive funds without high fees or delays, ensuring your international transactions remain cost-effective.

Instant FX with No Hidden Fees

Experience real-time currency conversions with fees lower than market rates.

Currency ExchangeHigh-value Transactions

Pay partners for high-value orders without worrying about transaction limits and restrictions.

Dream of Growing Your Business Globally?

Transferra's borderless payments are your key to taking advantage of international opportunities.

Open AccountBusiness Industries Already Benefiting from Transferra's Features

International Trade

- Export management companies (EMCs)

- Import/export merchants

- Commodity trading companies

Logistics

- Transportation companies

- Freight forwarders

- Warehouse operators

IT industry

- Technology startups

- Software development companies

- IT outsourcing companies

Professional Services

- Law Firms

- Financial Auditing

- Accounting firms

Digital Marketing

- Social Media agencies

- Advertising agencies

- Digital agencies

Specialised

- Telecommunications

- Education

Flexible Pricing for Any

Type of Business

Contact us anytime to get a custom offer tailored to the unique needs of your business.

View PricingTransferra is Your Trusted Financial Partner

Transferra Un Limited is an authorised and regulated electronic money institution (EMI) based in the United Kingdom.

Your funds are securely stored in separate accounts within UK/EU banks.

No chatbots in communication with clients. You will be supported by real people.

Your money will never be loaned or invested, meaning it’s always 100% liquid.

Data Security You Can Rely On

With ISO 27001 certification and rigorous security protocols, we ensure your data stays safe, confidential, and under control.

Strong protection for your data

Your data is protected using controls that align with ISO 27001 - one of the most trusted international frameworks. We ensure secure handling of your information through the best-in-class infrastructure.

Low risk for your business

We actively identify, assess, and reduce risks before they affect your operations. Our systems are designed to keep your data secure and your business running smoothly.

Safeguards Against Breaches

We maintain ongoing monitoring and strict operational procedures to detect threats early and prevent data breaches before they happen. Your information is protected through a security-first approach.

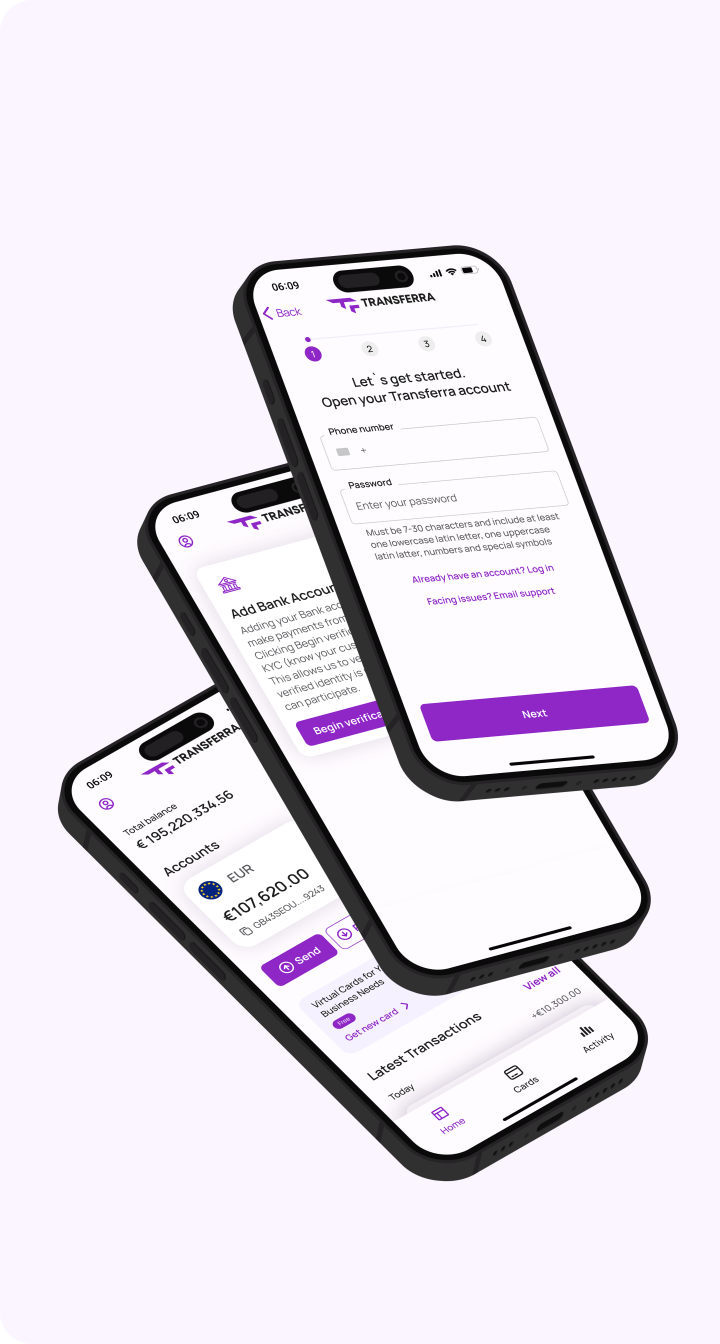

How to Register Business Account with Transferra

Sign Up Online

Start by creating your profile on our website or mobile app

Begin Onboarding

Provide the required information about your business

Verify Your Account

Complete the verification process to ensure compliance.

Start Using Your Account

Once approved, log in to your account and use our payment services

Our Partners Are the Leading Experts in the Financial Industry

Frequently Asked Questions

-

What is a business account?

A Business IBAN Account is a financial account designed specifically for businesses to manage their operations efficiently. With Transferra’s Business Account, you can:

- Hold and manage funds in multiple currencies

- Make seamless international & UK local payments

- Exchange currencies in real-time

- Assign specific teammates access to accounts with limited permissions for better representative management

- Benefit from a personal dedicated manager who provides tailored support on any matter

UK and international payments: Carry out your transactions within the UK and across borders seamlessly.

-

Can I open a business account online?

Absolutely! Transferra's online application process is simple and convenient. You can complete it from anywhere in the world. A dedicated manager might contact you if further information is needed.

-

How quickly can I open a business account?

Our online application can be completed in as little as 15 minutes. However, the full account activation process typically takes 3 working days for review.

-

How much does it cost to open a business account?

Transferra prides itself on transparent pricing. We don't have any hidden fees. We offer a range of plans with various features and services to suit varied business demands. The starting cost for opening a business account is €50. You can find a detailed breakdown of our charging structure in the detailed list on our website.

-

What info do I need to provide to open a business account with Transferra?

To open your Transferra business account, please provide the following key information:

1. Basic personal details (phone number and password) to create a user account.

2. Business details:

- a. Company details (name, finances, partners)

- b. Company representative info (personal & contact)

- c. UBO info (position, ownership %, verification for Simple Structure)

- d. Verification documents (company documents for Standard Structure only)

- e. Proof of address (company & UBOs)

- f. Identity documents (representatives & UBOs)

3. Financial information: a brief questionnaire about your company's finances

This ensures compliance and security for your account!

Read the full instructions in the onboarding guide.

-

How do you keep my money safe?

We prioritise the security of your deposits. Following FCA's safeguarding requirements, all client assets are held in segregated accounts, completely separate from Transferra's own funds. This ensures your finances are protected and can't be used for anything other than your transactions.

To understand the basis of Transferra's approach, please read the detailed explanation.

-

In which currencies can I make transactions?

While we support major currencies like GBP, EUR, and USD, our list extends far beyond that, offering over 30 international options. This comprehensive selection ensures you can conduct business with confidence, regardless of your partner's location. Here's a glimpse of the currencies you can transact with: GBP, EUR, USD, DKK, CAD, CHF, NOK, SEK, HUF, PLN (and many more!).

-

Can I open a Transferra business account if my company is not based in the UK?

Yes, Transferra can open business accounts for companies across Europe and globally. However, some country-specific restrictions may apply due to compliance regulations. We recommend reviewing our acceptance policy to check the eligibility for your country.