What Is an ACH Payment and Why Does It Matter for Your Business?

Discover how ACH payments work, their benefits for businesses, and how even non-US companies can access ACH for faster, cheaper USD transfers.

If your business operates in the US or deals with clients and partners there, you’ve probably heard the term ACH payment. But what exactly is it, and why is it one of the most efficient ways to send and receive funds?

Let’s break it down.

What Is an ACH Payment?

An ACH payment is a type of electronic bank transfer made through the Automated Clearing House (ACH) network, which connects thousands of financial institutions in the United States.

ACH payments allow businesses and individuals to move money from one bank account to another — without using paper checks, credit card networks, or wire transfers. The process is secure, cost-effective, and ideal for both one-time and recurring transactions.

How ACH Payments Work

Here’s a quick look at how a typical ACH payment flows:

- A business (or individual) initiates the transfer via their financial institution or payment provider.

- The transaction request is sent through the ACH network.

- The receiving bank processes the payment and credits the funds to the recipient’s account.

ACH payments can be either:

- ACH credits (e.g., payroll, vendor payments)

- ACH debits (e.g., subscription billing, loan repayments)

Benefits of Using ACH for Business Payments

✅ Lower Fees

ACH transactions usually cost less than wires or card processing — often just a few cents.

✅ Faster Than You Think

While not instant, many ACH payments settle within 1–2 business days. Same-day ACH is also available in many cases.

✅ Reliable for Recurring Transfers

Perfect for payroll, subscription models, or regular supplier payments.

✅ Secure and Trackable

Encrypted, regulated, and traceable through your payment provider or banking dashboard.

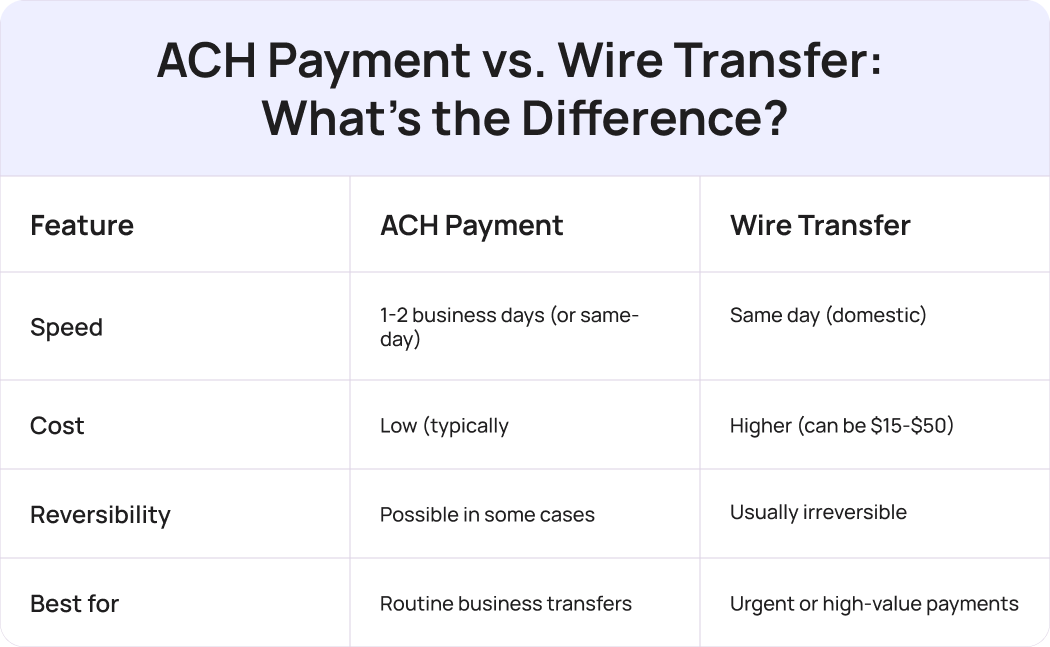

ACH Payment vs. Wire Transfer: What’s the Difference?

ACH is ideal for routine and recurring payments. Wire is better for urgent, large, or international transfers.

Can Non-US Companies Use ACH?

Traditionally, ACH is limited to US-based bank accounts, but that’s changing. Fintech companies like Transferra now offer ACH access for non-US businesses, enabling them to send or receive USD through local rails — with lower costs and faster delivery.

For example, if your business is based in the UK or EU and you work with US partners, you can open a USD account with ACH support, eliminating the need for a physical US bank account.

Final Thoughts

ACH payments offer a smart, reliable, and budget-friendly way to move money within the US. For businesses dealing with American partners, vendors, or customers, having access to ACH is a strategic advantage — and now, even international businesses can tap into it.

If you’re looking for a modern solution that supports ACH and more, platforms like Transferra help you send and receive USD globally, using both ACH and wire options – all from a single account.

Interested in ACH payments for your business?

Make cross-border USD transfers smarter, cheaper, and easier with Transferra.