Digital Payments for UK Businesses: The Future of B2B Finance

Discover how digital payments for UK businesses are transforming B2B finance. Learn about key technologies, benefits, and cashless transactions.

The way UK companies move money is changing faster than ever. From contactless technology to instant cross-border transfers, digital payments for UK businesses are becoming the backbone of modern finance.

What started as a convenience for consumers is now transforming B2B transactions, making them faster, cheaper, and more transparent. Whether you run a small startup or a multinational firm, understanding how digital payment systems work — and where they’re heading — is key to staying competitive.

1. What Are Digital Payments in the B2B Context?

Digital payments refer to any electronic method of transferring funds between two parties without physical cash. For UK businesses, that can include:

- Online bank transfers (via Faster Payments, Bacs, or CHAPS).

- Card-based payments.

- Direct debit or standing orders.

- Payment gateways and processors.

- Cross-border transfers via fintech platforms or SEPA.

In the B2B world, these technologies have evolved beyond simple transactions — they now power entire financial ecosystems where payments are automated, data-driven, and integrated into accounting and ERP tools.

2. Why Digital Payments Matter for UK Businesses

The shift toward digital finance isn’t just a trend — it’s an efficiency revolution.

Here’s why digital payments for UK businesses are becoming a strategic advantage:

- Speed: Real-time payment networks (like SEPA or Faster Payments) enable instant transfers.

- Cost efficiency: Fintech solutions often have lower transaction and FX fees than traditional banks.

- Automation: Integrations with accounting platforms reduce manual work and human error.

- Transparency: Digital records improve audit trails and financial oversight.

- Customer experience: Clients and partners expect quick, digital-first payment options.

For entrepreneurs and finance leaders, digital payments create an opportunity to streamline operations, improve cash flow, and reduce administrative friction.

3. Key Technologies Powering Digital Payments

Digital payments have evolved thanks to several technological drivers shaping B2B finance in the UK:

a. Open Banking and API Connectivity

Open Banking enables businesses to connect directly to multiple financial institutions through APIs – allowing instant account verification, payment initiation, and reconciliation.

b. Real-Time Payments

Systems like Faster Payments and SEPA Instant enable near-instant money movement between businesses, improving liquidity and reducing payment delays.

c. Blockchain and Stablecoins

Some UK firms are experimenting with blockchain-based settlement and stablecoins for faster international transactions and reduced FX risk.

d. Embedded Finance

Digital platforms now embed financial services (like invoicing or lending) directly into business workflows — turning payments into part of a seamless digital ecosystem.

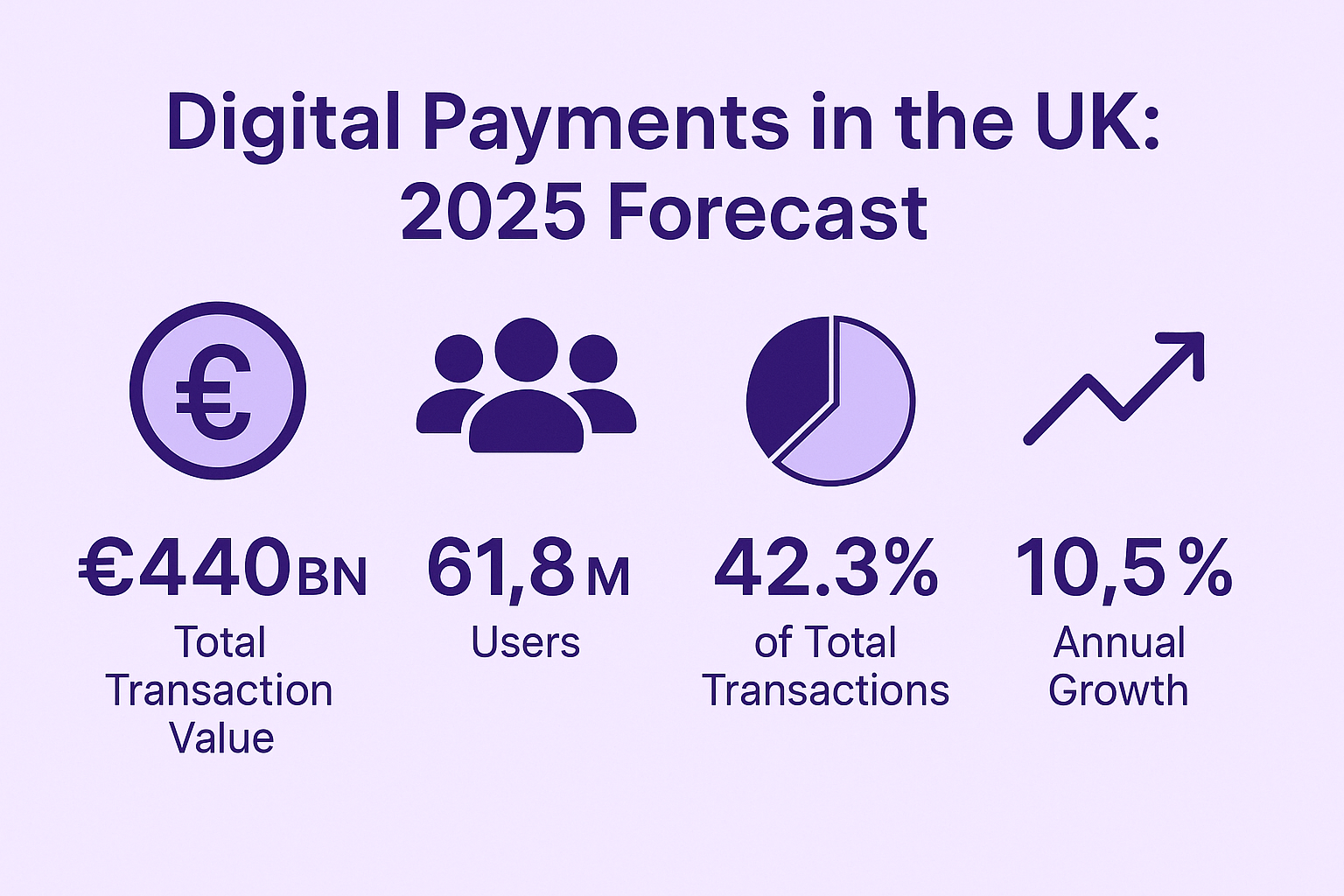

Real-World Statistics (2025)

- The UK digital payments market is projected to reach US $447.9 billion in total transaction value in 2025.

- The UK B2B payments market was valued at US $110.91 billion in 2024 and is forecast to reach US $120.00 billion in 2025, with a CAGR of ~8.2% from 2025-2033.

- Among UK companies, 64% made more than half of their B2B payments electronically in 2022 (indicating a rising trend by 2025).

- More than 48.1 billion payments were made in the UK in 2023, with forecasts for further growth by 2025.

4. Benefits of Adopting Digital Payment Systems

Modern payment systems offer more than speed — they bring control and visibility.

Key benefits include:

- Better cash flow management: Immediate payment receipts improve liquidity.

- Reduced fraud risk: Encryption, tokenisation, and strong authentication add security.

- Enhanced scalability: Digital platforms grow with your business, from local to international trade.

- Environmental sustainability: Fewer paper invoices and cheques mean lower carbon footprints.

For growing companies, implementing digital payment tools isn’t just operationally smart — it’s financially strategic.

5. The Challenges of Digital Payments

While digitalisation offers clear advantages, businesses must also navigate certain challenges:

- Security threats: Cyberattacks and phishing remain concerns.

- Integration complexity: Linking multiple platforms can require technical expertise.

- Regulatory compliance: Firms must comply with PSD2, FCA standards, and data protection laws.

- Customer onboarding: Traditional partners may still prefer legacy systems.

Working with a regulated Electronic Money Institution (EMI) or Payment Institution (PI) can help manage compliance while maintaining flexibility and innovation.

6. The Future of B2B Finance in the UK

The future of digital payments for UK businesses looks promising — and increasingly data-driven.

We’re moving toward:

- Cashless B2B ecosystems, where even supplier invoices are automated.

- AI-driven payment analytics, improving forecasting and decision-making.

- Greater cross-border efficiency, thanks to faster networks and multi-currency wallets.

- Integration of digital identity verification to streamline payment approvals.

As fintech and open banking continue to evolve, digital payments will become the standard for all business finance — not just an option for tech-savvy companies.

7. How Businesses Can Prepare

To stay ahead, UK businesses should:

- Audit current payment processes for bottlenecks or manual tasks.

- Explore partnerships with fintech payment providers or EMIs.

- Prioritise security and compliance in every transaction.

- Educate finance teams about automation and digital tools.

Digital transformation in payments isn’t just about technology — it’s about building smarter financial workflows.

Final Thoughts

In the era of automation and instant transactions, digital payments for UK businesses are shaping the next generation of B2B finance.

From faster transfers to better data insights, adopting these systems means more control, greater efficiency, and a competitive edge in a global market.

For entrepreneurs and finance professionals, embracing digital payments today sets the foundation for the business of tomorrow.