IBAN vs Account Number UK: 5 Key Differences You Must Know

Not sure how IBAN and account numbers differ in the UK? This guide breaks it down: know when and why to use each for domestic and international payments.

Understanding the difference between an IBAN and an account number is essential if you’re doing business in the UK or abroad. Many people ask the same question: what’s the real difference between IBAN vs account number UK? In this guide, we explain the five key differences, how each one works, and when to use them for domestic or international payments.

1. What Is an Account Number in the UK?

In the UK, a traditional bank account uses two identifiers:

- Sort Code (6 digits)

- Account Number (8 digits)

Together, these allow UK residents and businesses to send and receive payments locally using services like Faster Payments, BACS, or CHAPS. These two numbers are essential for domestic transactions, but they’re not valid for international use on their own.

The sort code is a system unique to the UK banking infrastructure. It identifies the bank and branch where the account is held. You won’t find sort codes in other countries, including those in the EU.

2. What Is an IBAN?

IBAN stands for International Bank Account Number. It’s used to identify individual bank accounts across national borders. An IBAN ensures that funds are sent to the correct bank account internationally.

A UK IBAN typically contains:

- The country code: GB

- Two check digits

- The sort code (6 digits)

- The account number (8 digits)

Example IBAN: GB29 NWBK 6016 1331 9268 19

In contrast, EU countries like Germany, France, or Spain also use IBANs, but their formats differ. For instance, German IBANs are 22 characters long, while French IBANs are 27. They do not use sort codes – instead, routing is built directly into the IBAN structure.

In short, the IBAN format is country-specific, and although the UK includes a sort code inside the IBAN, most other EU countries do not use this concept at all.

If you’re sending or receiving money across countries, especially in Europe, the IBAN is required.

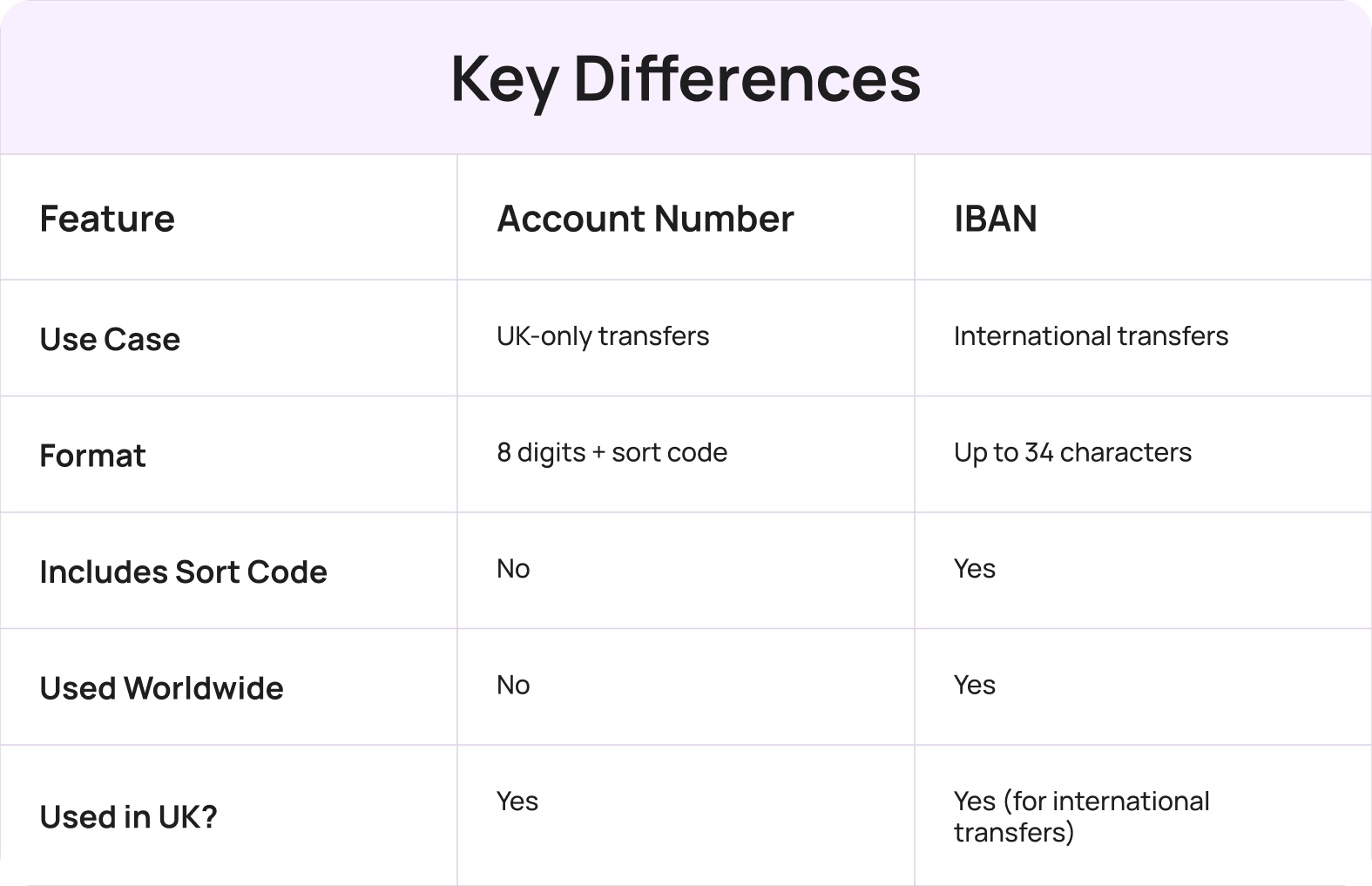

3. IBAN vs Account Number UK: Key Differences

When comparing IBAN vs account number UK, remember: the account number is for local use, while the IBAN is for global transactions.

4. When Should You Use an IBAN in the UK?

Even if you’re operating within the UK, you’ll need an IBAN if you:

- Accept payments from overseas clients

- Pay international suppliers

- Use multi-currency accounts

- Send or receive money via SWIFT or SEPA

Modern digital banks and international platforms usually issue your IBAN automatically when you open a business account.

Yes. An IBAN only enables someone to send money to your account – not withdraw from it. Just like an account number, it’s safe to include on invoices, payment pages, and transfer forms.

Bonus: How to Find Your IBAN in the UK

Most banks and platforms offer simple ways to find your IBAN:

- In your online banking portal

- On a printed bank statement

- Using a bank’s IBAN calculator

IBANs for UK accounts start with GB and are 22 characters long.

Final Thoughts: Which Should You Use? IBAN vs Account Number UK

To summarise the key takeaway of this article on IBAN vs account number UK: Use your account number and sort code for local UK payments. Use your IBAN for international transfers, especially when dealing with EU or global transactions. Remember that sort codes are specific to the UK and are embedded in UK IBANs but not in EU IBANs.

Choosing the correct banking details helps prevent delays, failed transactions, and unnecessary fees—particularly for businesses operating internationally.

Ready to Simplify Global Payments?

Looking for a business account that gives access to EU & UK payments? Sign up today with Transferra and start sending and receiving payments globally – with no delays or hidden fees.