SEPA vs SWIFT vs Faster Payments: Which One Should Your Business Use?

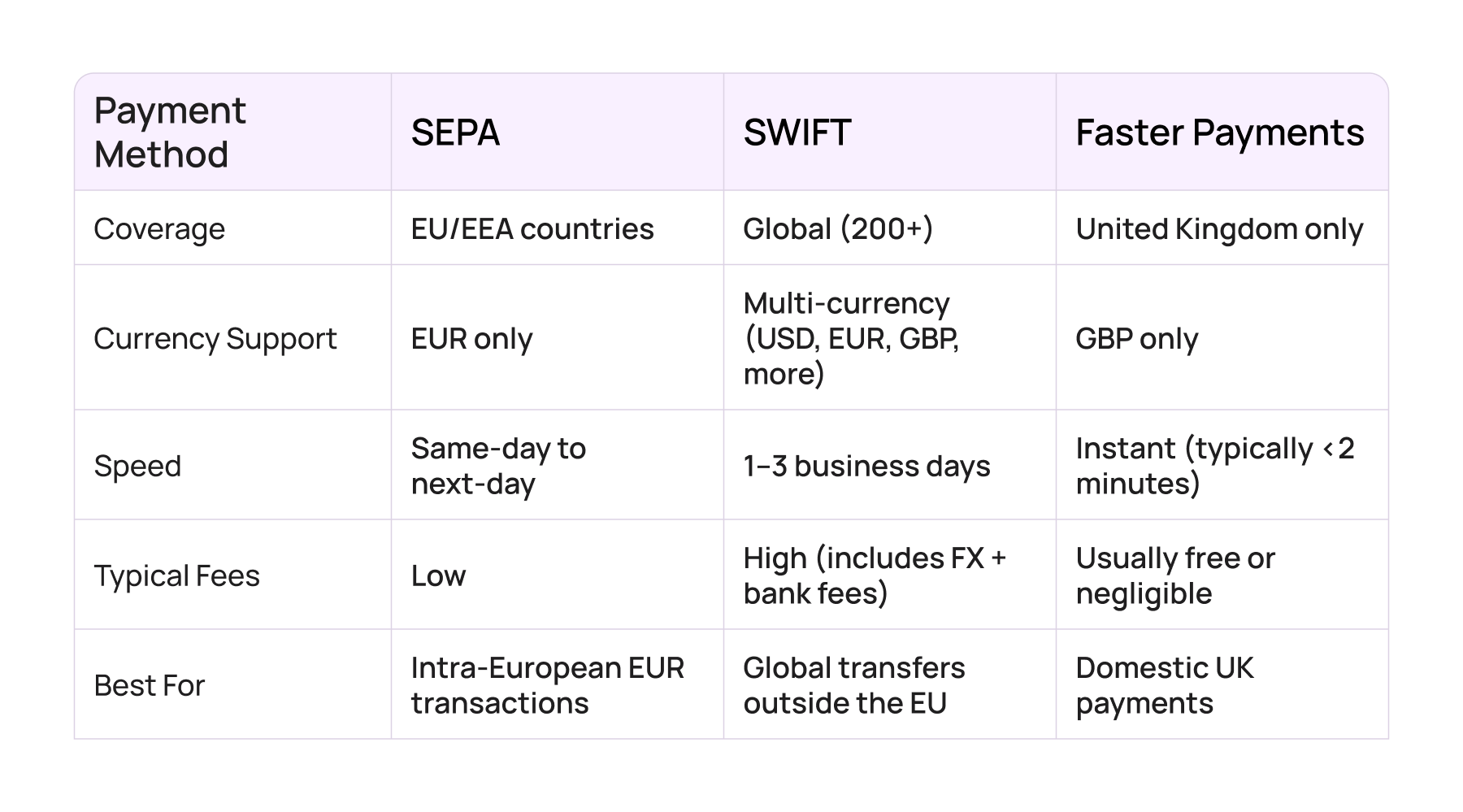

Confused about SEPA vs SWIFT or when to use Faster Payments? This guide breaks down the key differences in speed, fees, and currency support, helping your business choose the best payment method.

For any business that operates internationally or across borders, choosing the right payment network is a critical decision. With options like SEPA, SWIFT, and Faster Payments, it’s important to understand how each one works — and when to use them.

Each rail has its strengths and limitations in terms of speed, fees, currency support, and geographic reach. In this guide, we’ll break down how these systems compare, provide real-world examples of their use, and offer practical tips to help your business save on cross-border payments.

This guide provides a clear comparison of these systems, practical use cases, and tips to help you minimize fees and maximize efficiency.

SEPA vs SWIFT vs Faster Payments: Which One Is Right for Your Business?

Selecting between SEPA, SWIFT and Faster Payments often comes down to geography and currency. SEPA is ideal for eurozone transactions within the EU or EEA, while SWIFT is necessary for global payments and multi-currency support, and Faster Payments for the UK.

Use SEPA if:

- You’re sending money within the European Union or EEA

- You’re paying in euros

- You want low-cost, fast settlement within Europe

Use SWIFT if:

- You’re sending money outside the EU

- Your payments involve different currencies (e.g., USD, GBP, AUD)

- You need global reach

Use Faster Payments if:

- You’re transferring funds within the UK

- You want real-time GBP settlements

- You’re running payroll or paying UK vendors

Each network serves a specific purpose, and understanding their differences can significantly reduce your business’s international payment fees.

Real-World Examples of Choosing the Right Payment Method

- A UK company paying a French supplier in euros should choose SEPA to avoid FX and intermediary fees.

- An EU business transferring funds to the United States in USD must use SWIFT for international currency exchange.

- A tech startup sending contractor payments within the UK can rely on Faster Payments for instant transfers.

Matching the right rail to your transaction type and location is the most effective way to streamline your cross-border payments.

Tips to Avoid High International Payment Fees

Even the best payment rail can become costly if used incorrectly. Here are some key practices to avoid excessive charges:

- Avoid mismatched payment rails. Don’t use SWIFT for EUR payments within the EU — use SEPA instead to save on fees.

- Compare FX rates. Banks and providers often add a markup to the currency exchange. Use the mid-market rate as a reference and avoid providers that hide margins.

- Use local currencies when possible. Sending money in the recipient’s local currency can reduce conversion fees and speed up receipt.

- Ask about intermediary bank charges. Especially relevant with SWIFT, these fees can reduce the final amount received if not accounted for.

- Batch payments. Grouping multiple transfers into one transaction can reduce processing fees and administrative overhead.

Conclusion: Choose the Right Rail, Save More

Selecting the right payment method is no longer just a technical choice — it’s a strategic decision that affects your business’s cash flow, operational efficiency, and international relationships.

Understanding the roles of SEPA, SWIFT, and Faster Payments allows your finance team to align payment flows with business goals. It’s not only about speed or fees in isolation, but about choosing a payment infrastructure that scales with your growth, simplifies accounting, and strengthens supplier confidence.

As global commerce becomes more digitized and fragmented, your ability to use the right rail for the right transaction becomes a real competitive advantage. Businesses that optimize their payment processes can reduce overhead, build trust with partners, and unlock better terms by being more reliable payers.

Transferra supports all three networks, giving you full control over how your money moves across borders.

Optimise your cross-border payments. Choose the right rail with Transferra.