Business Bank Account in 2025: Top 7 Features to Look For

Explore the top 7 must-have features, from fast onboarding and FX tools to approval workflows and real human support, to help your business scale with confidence.

In 2025, choosing the best business bank account is about more than just storing funds – it’s about empowering your operations with fast payments, global access, and reliable support. As more businesses operate internationally and rely on digital-first finance, having a robust business banking solution is critical for managing growth and maintaining financial control.

Whether you’re opening a new business bank account or switching providers, here are seven essential features to consider.

1. Seamless User Experience (UX)

Modern businesses demand banking tools that are as intuitive as they are powerful. The best business banking apps in 2025 provide:

- Mobile-first dashboards for on-the-go finance management

- Real-time transaction updates

- Smart alerts for payment statuses and approvals

An excellent user experience reduces manual errors and saves hours of admin time for your finance team.

2. Fast and Frictionless Onboarding

Opening a business bank account shouldn’t take weeks of paperwork. Leading platforms now offer:

- Fully online onboarding and verification

- Clear documentation checklists

- Quick KYC/AML approvals for faster access

Look for providers who are experienced in your industry, particularly if you operate in regulated sectors like fintech, crypto, or iGaming.

3. High-Speed Payment Infrastructure

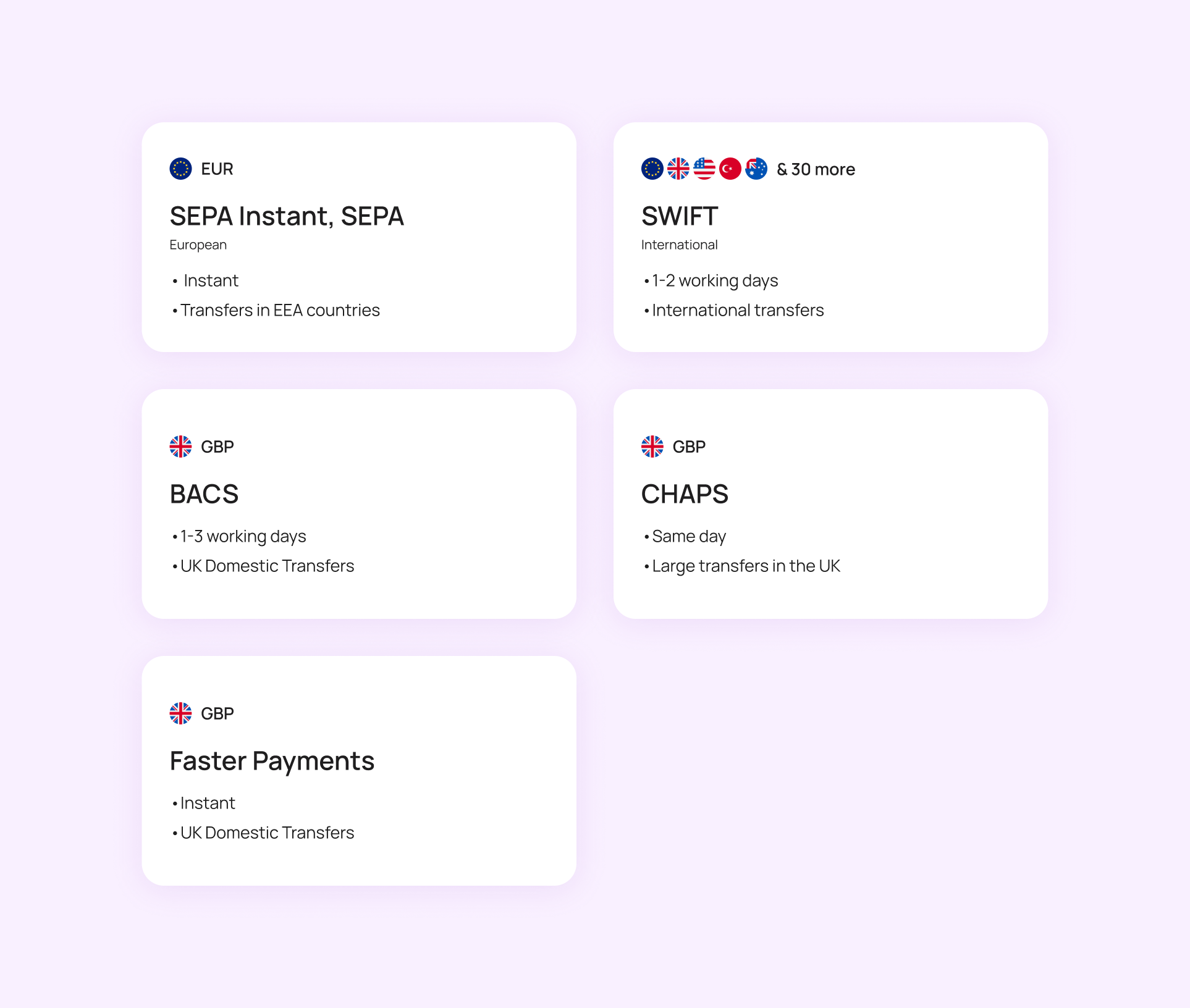

Delays in payments can damage business relationships. That’s why the best business banking platforms support multiple payment rails for speed and reliability:

- SEPA for Eurozone transfers

- Faster Payments for UK transactions

- SWIFT for international settlements

- CHAPS and BACS for domestic UK flows

Fast payments are essential to maintaining cash flow and meeting deadlines globally.

4. Competitive FX Rates & Multi-Currency Accounts

If your business operates internationally, foreign exchange fees can silently drain your profits. Your business bank account should include:

- Access to major currencies like EUR, USD, GBP

- Support for additional currencies (AED, NOK, DKK, etc.)

- Transparent FX rates with no hidden markups

Some platforms even offer bulk conversion tools and discounted FX spreads based on transaction volume.

5. Real Human Support (Yes, Still Important in 2025)

AI is everywhere, but when payments get stuck or accounts are flagged, nothing beats speaking with a real person. The best business banking solutions offer:

- Dedicated account managers

- Live chat, email, and phone support

- Specialists familiar with your business structure and compliance needs

When issues arise, human support ensures quick resolution and peace of mind.

6. Compliance & Risk Management Built In

With financial regulations tightening globally, your business bank account must go beyond basic functionality and help you stay compliant. Look for:

- Automated KYC/AML monitoring

- Real-time transaction screening

- Fund segregation and audit-ready reporting

Strong compliance tools protect your business from fines, delays, and reputational risks.

7. Power Tools: Templates, Approvals, and Advanced Search

A standout business bank account doesn’t just help you move money; it helps you manage financial workflows efficiently. Key features to look for include:

- Recurring Payment Templates: Automate regular transfers like payroll, vendor invoices, and retainers.

- Approval Workflows: Create multi-step authorisations, set user roles, and define transaction limits for added control.

- Advanced Filtering & Search: Quickly locate transactions by date, amount, recipient, or status; tag and categorise payments for easier reconciliation.

These features support growing teams and allow financial operations to scale securely.

Final Thoughts

Finding the best business bank account in 2025 means going far beyond fees and basic functionality. It’s about choosing a platform that helps your business operate globally, comply with regulations, and gain full control of financial workflows.

Before selecting a provider, ask:

- Does this account support our operational needs today and tomorrow?

- Will it help reduce manual work and streamline payments?

- Can it scale with our business and adapt to global expansion?

If your provider ticks all these boxes, you’re not just opening a bank account—you’re investing in your company’s financial foundation.