Types of Payment Institutions UK: EMI vs Banks vs PI

Understand the key types of payment institutions UK businesses can operate under: Banks, EMIs, and PIs. Learn their differences and regulations.

The UK has one of the most advanced and regulated financial systems in the world. If your business operates in finance, e-commerce, or cross-border payments, understanding the types of payment institutions UK regulators recognise is crucial.

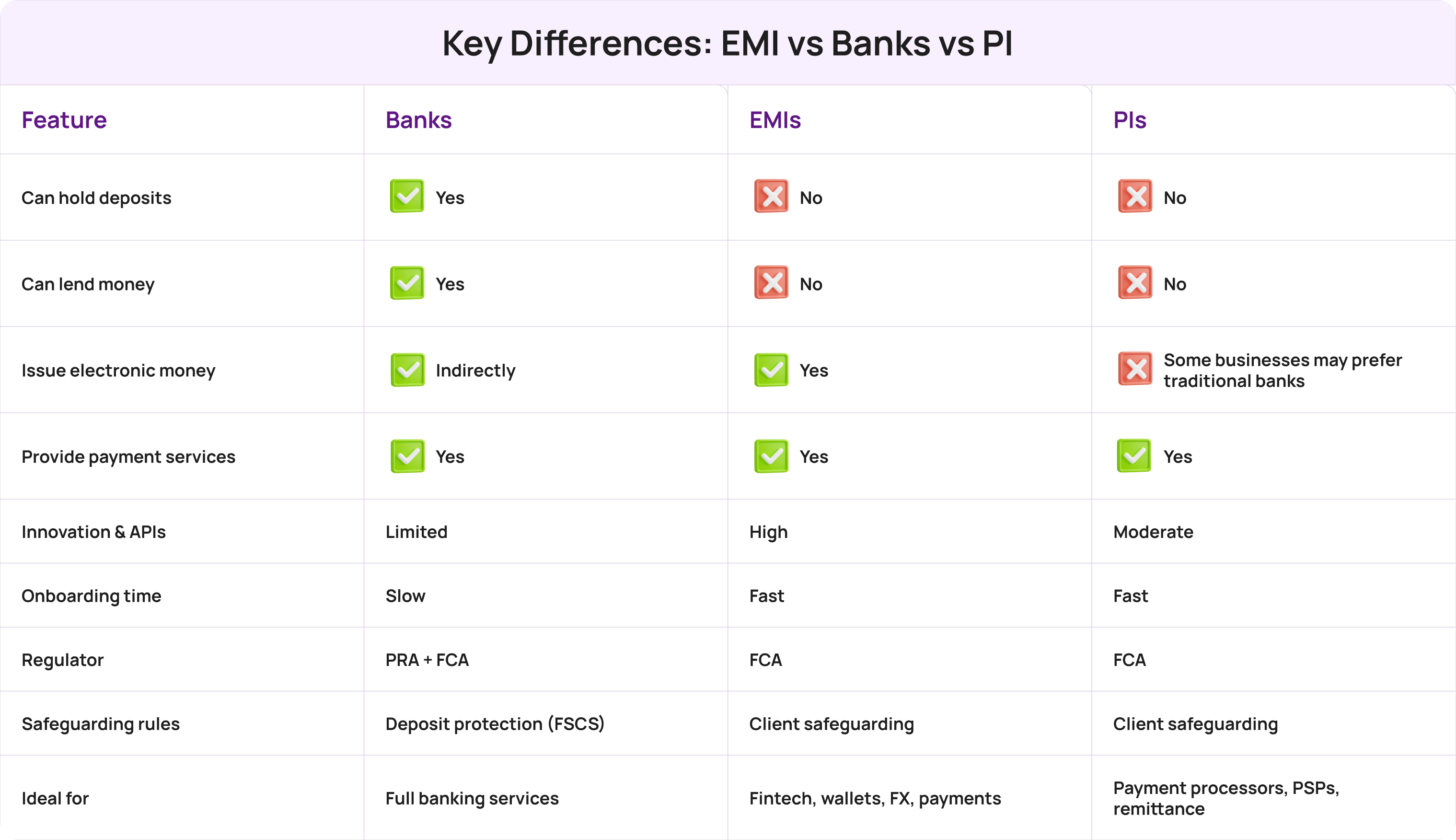

Banks, Electronic Money Institutions (EMIs), and Payment Institutions (PIs) each play unique roles in the UK’s financial system. They differ in how they handle client money, what services they can provide, and how heavily they’re regulated.

This article explains what each institution type does, what features they offer, and the pros and cons to help you choose the right partner for your business.

1. Banks

Banks are the most heavily regulated institutions under UK law. They are authorised by the Prudential Regulation Authority (PRA) and regulated by both the PRA and the Financial Conduct Authority (FCA).

What Banks Offer

- Current and savings accounts.

- Loans, overdrafts, and credit lines.

- Domestic and international payments.

- Deposit protection under the FSCS (up to £85,000 per customer).

Pros

✅ Full range of services: deposits, lending, cards, FX, and payments.

✅ Strongest consumer protection and reputation.

✅ Access to global banking infrastructure.

Cons

❌ Slower onboarding for businesses and more paperwork.

❌ Less flexibility in pricing and technology integrations.

❌ Higher fees for international transfers and FX.

Best for: Large or established companies that need comprehensive financial services and deposit protection.

Compliance focus:

Banks must meet Basel III requirements, maintain strong anti-money laundering (AML) systems, and report regularly to both the FCA and PRA. They have the highest trust level, but also face the heaviest regulatory burden.

2. Electronic Money Institutions (EMIs)

Electronic Money Institutions (EMIs) are fintech companies licensed by the FCA to issue e-money — digital funds backed by real money held in safeguarded accounts.

Unlike banks, EMIs cannot lend or invest customer funds. Instead, they must safeguard customer money by holding it in ring-fenced accounts with authorised banks.

What EMIs Offer

- Multi-currency accounts and e-wallets.

- Payment processing (SEPA, SWIFT, Faster Payments).

- Corporate cards and expense management.

- Currency exchange and cross-border transfers.

- API integrations for online platforms.

Pros

✅ Fast digital onboarding and lower setup barriers.

✅ Excellent for international payments and FX.

✅ Transparent pricing, low fees, and automation options.

✅ Innovative tools (virtual cards, APIs, real-time reporting).

Cons

❌ No lending or overdrafts.

❌ Some still rely on partner banks for settlement.

Best for: SMEs, e-commerce companies, and fintechs needing flexible payment solutions without becoming a full bank.

Examples: Transferra, Wise, Revolut, Airwallex, Payoneer.

3. Payment Institutions (PIs)

Payment Institutions (PIs) are authorised to provide payment services — such as processing transfers, merchant payments, and remittances — but they do not issue e-money.

There are two types:

- Authorised Payment Institutions (APIs) for larger operations.

- Small Payment Institutions (SPIs) for smaller firms with limited turnover.

What PIs Offer

- Payment initiation and execution services.

- Merchant acquiring and card processing.

- Remittance and money transfer solutions.

- Open banking integrations via PSD2.

Pros

✅ Easier authorisation than EMIs or banks.

✅ Ideal for payment processing or remittance services.

✅ Lower regulatory costs and capital requirements.

Cons

❌ Cannot issue or hold e-money balances.

❌ May rely on partner banks or EMIs for certain functions.

❌ Not suitable for storing client funds long-term.

Best for: Fintechs, PSPs, or money transfer services that process but don’t hold funds.

Examples: Checkout.com (API), Remitly, Pay360.

Key Differences: EMI vs Banks vs PI

5. Which Type Is Right for You?

When considering the types of payment institutions UK businesses can work with, it’s important to match your needs to their capabilities:

- Choose a Bank if you need deposit accounts, loans, or a traditional financial relationship.

- Choose an EMI if your business deals in digital payments, cross-border transfers, or multi-currency transactions.

- Choose a PI if you operate as a payment processor, merchant acquirer, or money transfer service.

Each option balances flexibility, cost, and regulation differently.

6. Compliance and Authorisation Considerations

The FCA authorisation process for EMIs and PIs is detailed and resource-intensive. Applicants must demonstrate:

- Robust governance and management structures.

- Detailed safeguarding policies for customer funds.

- Comprehensive AML and CTF (counter-terrorist financing) procedures.

- IT security and operational resilience measures.

Staying compliant isn’t optional — it’s the backbone of operating within the UK’s regulated financial sector.

Final Thoughts

The UK’s financial ecosystem is designed to encourage both stability and innovation. Understanding the types of payment institutions UK regulators authorise — Banks, EMIs, and PIs — helps you make smarter, compliant decisions.

Banks remain the backbone of traditional finance, EMIs power the digital economy, and PIs bridge the gap for payment innovation.

If your business needs a partner to simplify payments while staying compliant, consider working with an FCA-regulated EMI or PI that aligns with your growth goals.