Virtual IBAN Explained: Essential Facts Every UK Business Should Know

Virtual IBAN explained for UK businesses. Learn how they work, why they matter, and how to use them for faster, global payments.

For UK-based businesses operating in a global economy, managing cross-border payments can be complicated, costly, and slow. That’s where virtual IBANs come into play. This article offers a full breakdown of vIBANs explained, including what they are, how they work, and why more UK companies are adopting them to streamline international banking.

Whether you’re a startup, freelancer, e-commerce seller, or established enterprise, understanding how virtual IBANs work can save your business time, money, and operational headaches.

What Is a Virtual IBAN?

To begin with vIBAN explained clearly, a virtual IBAN (International Bank Account Number) is not a physical bank account. Instead, it is a unique account identifier that routes payments to a real bank account behind the scenes. From a customer or sender’s perspective, it looks and works like a regular IBAN – but the underlying infrastructure is handled by a third-party payment platform or financial institution.

For example, you might be issued an IBAN by a fintech provider. When a client sends money to that vIBAN, the funds are automatically forwarded to your main settlement account, typically in your preferred currency or country.

How Does it Work?

A virtual IBAN functions similarly to a traditional IBAN but without being tied to a single, physical bank account. Here’s how it works:

- You receive a vIBAN from your provider – often for specific currencies like EUR, GBP, or USD.

- You share this IBAN with clients, partners, or marketplaces to receive payments.

- Incoming payments are routed through the virtual IBAN and deposited into your main settlement account.

- The reference data (sender, purpose, currency) is preserved for tracking and reconciliation.

The core benefit is it gives you the ability to segment, manage, and reconcile incoming payments from different customers, countries, or marketplaces, without opening multiple traditional bank accounts.

Virtual IBAN Explained vs Traditional IBAN

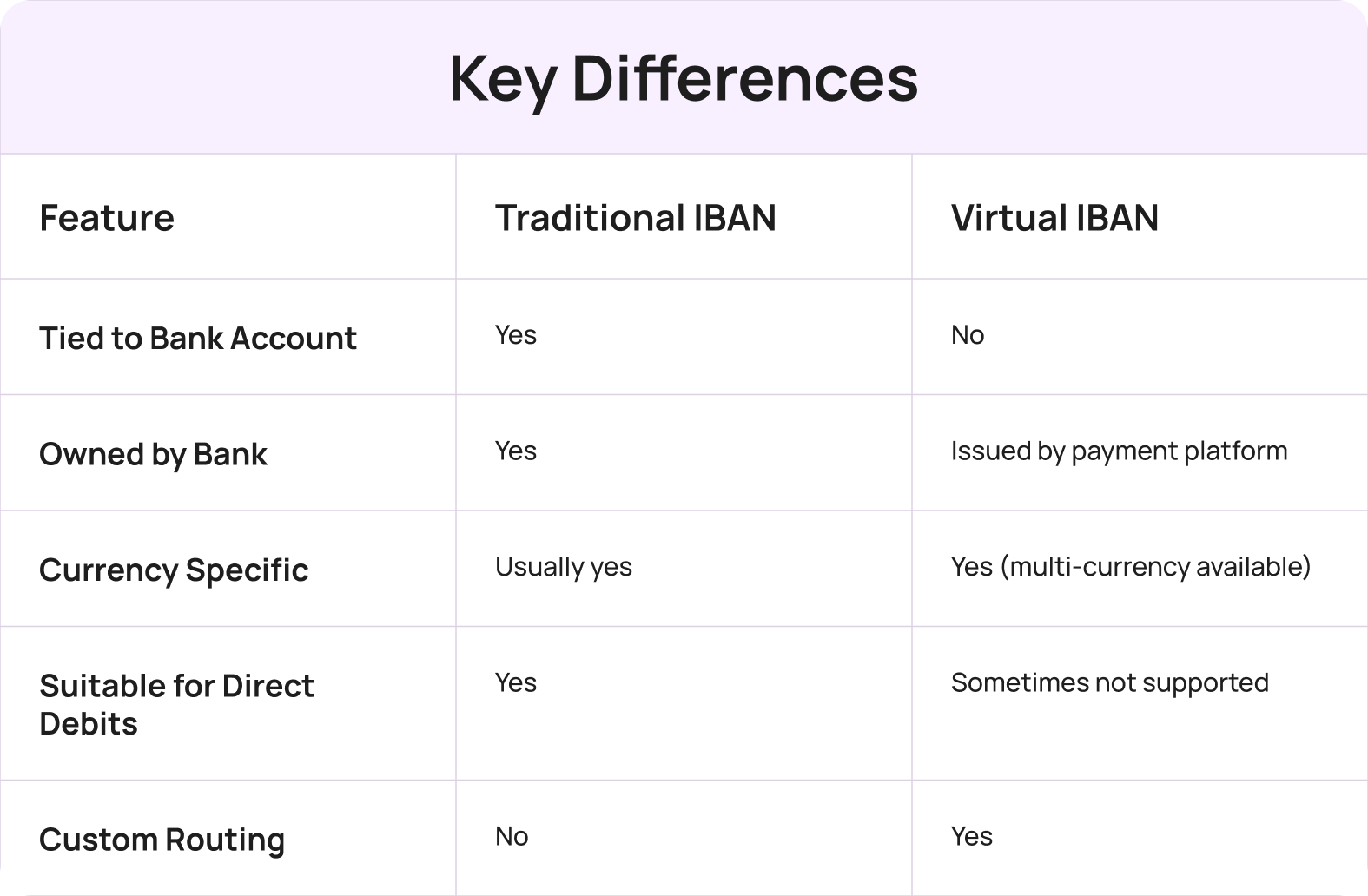

To fully grasp virtual IBAN explained, it helps to compare it with a traditional IBAN:

IBAN offers greater flexibility but may not support all bank functions like direct debits or overdraft facilities. However, for inbound payments, international invoicing, and managing FX flows, vIBANs are often the superior solution.

Why UK Businesses Use Them?

As more companies go digital and international, traditional banking models fall short. Here’s why UK businesses are turning to virtual IBANs:

1. Accept Payments Like a Local

With a virtual IBAN in another country or currency (e.g., a EUR IBAN in the SEPA zone), you can accept local transfers – avoiding high SWIFT fees or slow payment processing.

2. Simplified Reconciliation

Each IBAN can be assigned to a specific client, marketplace, or revenue stream. This enables clearer accounting and payment tracking, reducing errors and manual reconciliation.

3. Faster Settlement

vIBANs allow you to receive money quickly, often with same-day settlement, depending on the provider and region.

4. Multi-Currency Support

Many providers offer accounts in multiple currencies. This makes it easier to receive foreign payments and convert funds at competitive FX rates, especially useful for e-commerce sellers or SaaS businesses.

5. No Need for Overseas Bank Accounts

To receive payments in other currencies, a traditional approach might require setting up a foreign bank account – which can be expensive, time-consuming, or impossible for non-residents. A virtual IBAN removes this barrier entirely.

6. Improve Customer Experience

For your clients, IBANs provide a frictionless payment process. They send funds to a standard-looking IBAN, without needing to worry about SWIFT codes or international payment routing.

Are Virtual IBANs Safe?

Yes, virtual IBANs are safe, assuming you’re working with a regulated financial institution or payment platform. While the virtual IBAN itself doesn’t hold funds, it directs payments into your secure underlying account. Most providers are authorized by the FCA or equivalent bodies in the EU or US.

Always check that your provider complies with relevant financial regulations, data protection laws, and anti-money laundering (AML) standards.

How to Get a Virtual IBAN in the UK

Setting up a virtual IBAN is simple when using a modern digital payment platform. Here’s what the typical process looks like:

- Create an account with a trusted provider that offers virtual IBANs, for example, EMI.

- Complete KYC checks, including proof of business, identity, and address.

- State to which regions you will send the payments and in which currencies you will hold and send money, such as EUR, USD, or GBP.

- Receive your virtual IBANs – usually within 24 to 72 hours.

- Start sending and receiving payments globally and managing them from a dashboard.

With our platform, UK businesses can access multiple virtual IBANs in major currencies, complete with payment tracking, FX, and real-time reconciliation.

Use Cases for vIBANs

Here are a few practical use cases that show why virtual IBANs are more than just a tech upgrade:

- E-commerce sellers managing multi-marketplace sales (Amazon, Shopify, Etsy)

- Freelancers or agencies invoicing clients across Europe and North America

- SaaS platforms collecting subscription revenue from global users

- Import/export businesses receiving bulk payments from international buyers

- Payroll companies or marketplaces that need individual identifiers per end user

Final Thoughts

Now that you have a virtual IBAN explained clearly, the advantages are easy to see. They offer UK businesses a modern, scalable way to manage international payments – without needing multiple accounts or complex banking relationships.

vIBANs are secure, fast, and built for today’s cross-border digital economy. They make it easier to collect payments globally, streamline operations, and scale your business efficiently.

If you’re looking to simplify global payments, reduce costs, and get better visibility over your international income, it’s time to explore virtual IBANs.

Get Started Today

Ready to take your international payments to the next level?

Transferra helps UK businesses set up virtual IBANs in 36+ currencies with real-time payment tracking, transparent fees, FX and virtual cards.

Sign up now and unlock smarter payment solution for a global business.