Revolutionize Payments: How Smart Businesses Use APIs for Seamless Global Success

Unlock the power of payment APIs for global businesses. Learn how integrating payment APIs can streamline cross-border transactions, boost scalability, and ensure secure payments worldwide.

In today’s global digital economy, the ability to accept payments seamlessly across borders is a fundamental requirement for success. Whether you’re operating an e-commerce platform, SaaS company, or service-based business, the right technology infrastructure, especially your payment system, can make or break your international operations. At the center of this evolution are payment APIs, powering the future of seamless, secure, and scalable transactions.

What is a Payment API?

Definition and Core Functions

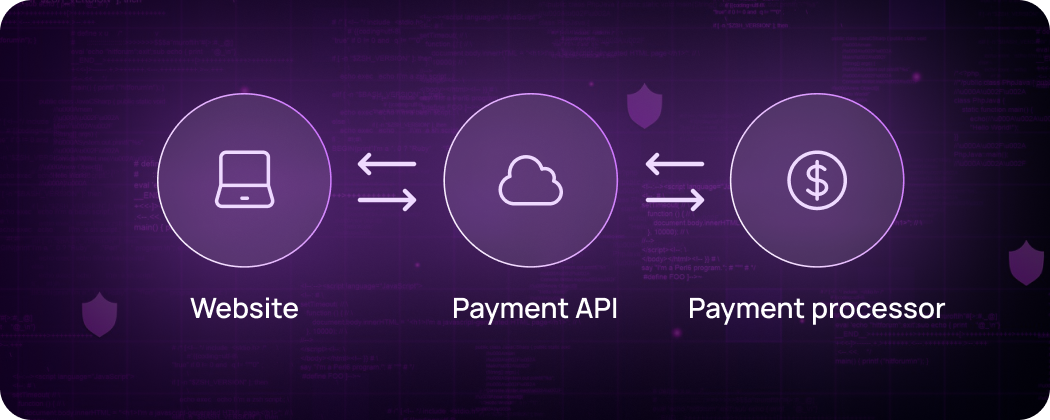

A Payment API (Application Programming Interface) is a set of protocols and tools that allow software applications to interact with payment processing systems. In simpler terms, it acts as a bridge between your website or app and a payment provider, enabling you to accept and process payments in real-time.

Unlike traditional payment gateways that require heavy integrations, payment APIs provide a smoother, faster, and more flexible approach for handling transactions, refunds, subscriptions, and more.

Types of Payment APIs

A Payment API (Application Programming Interface) is a set of protocols and tools that allow software applications to interact with payment processing systems. In simpler terms, it acts as a bridge between your website or app and a payment provider, enabling you to accept and process payments in real-time.

Unlike traditional payment gateways that require heavy integrations, payment APIs provide a smoother, faster, and more flexible approach for handling transactions, refunds, subscriptions, and more.

- Card Processing APIs – Support credit/debit card transactions from providers like Visa and Mastercard.

- Digital Wallet APIs – Integrate with platforms like PayPal, Apple Pay, and Google Pay for modern checkout experiences.

- Cryptocurrency Payment APIs – Enable crypto transactions using blockchain-powered APIs.

- Localized Payment APIs – Cater to region-specific methods like Alipay, Klarna, or UPI for local consumer trust.

Why Global Businesses Need Payment APIs

Streamlining International Transactions

For businesses operating across borders, processing payments in multiple currencies, handling tax implications, and reconciling across various banking systems can quickly become complex and inefficient. Payment APIs simplify this process by automating currency conversions, enabling local bank integrations, and providing real-time transaction processing.

With a robust payment API, global enterprises can eliminate manual steps that often lead to human error, delays, and customer dissatisfaction. By handling payments more efficiently, businesses also reduce operational costs, improve cash flow, and speed up revenue collection. These factors are critical for scaling internationally.

Enhancing Customer Experience

Today’s consumers expect lightning-fast, secure, and frictionless checkout processes, especially when shopping from different parts of the world. A reliable payment API enables businesses to offer tailored checkout experiences based on customer location. This includes displaying local currencies, offering familiar regional payment options, and minimising checkout steps.

Additionally, by supporting one-click payments and mobile wallet integrations, businesses can significantly reduce cart abandonment and increase repeat purchases. Customer-centric payment flows powered by APIs build trust and create a more loyal global customer base.

Scalability for Expansion

Entering new markets often demands more than just localising your website. You need to offer localised payment options that your customers trust. Payment APIs empower you to launch in new regions without major overhauls to your backend infrastructure. Whether it’s accepting UnionPay in China, iDEAL in the Netherlands, or PIX in Brazil, a payment API with global coverage allows businesses to scale with agility.

As business needs evolve, API-based payment systems can also accommodate subscription billing, recurring payments, multi-vendor transactions, and other advanced features essential for high-growth international enterprises.

Key Features to Look for in a Payment API

Security and Compliance

Security should always be the top priority when choosing a payment API, especially when dealing with sensitive financial data across borders. Look for APIs that are PCI DSS Level 1 compliant, ensuring the highest standards of data protection. Additional features such as tokenisation (which replaces card details with secure tokens) and end-to-end encryption safeguard data from breaches during transmission. Many APIs also come equipped with fraud detection systems powered by AI and machine learning, which can flag unusual behaviour and prevent chargebacks or fraud attempts. Compliance with local regulations like PSD2 in Europe or KYC/AML guidelines in specific countries is essential for smooth international operation.

Integration Flexibility

Every business has unique backend systems and workflows. That’s why it’s crucial to select a payment API that offers seamless integration with popular programming languages, eCommerce platforms, and CRMs. RESTful architecture and well-documented SDKs (in Java, Python, PHP, Ruby, etc.) make it easier for developers to connect the API with minimal disruption. APIs should also offer sandbox environments, allowing businesses to simulate payment flows and troubleshoot before going live. The more developer-friendly the integration, the faster your time to market.

Analytics and Reporting

Actionable insights are the cornerstone of data-driven business decisions. Modern payment APIs offer robust analytics dashboards that provide real-time visibility into your transaction history, settlement timelines, approval rates, and geolocation-based payment trends. Some APIs even offer predictive analytics that can identify potential bottlenecks or conversion drop-offs. Having detailed reporting not only aids financial forecasting but also enables teams to monitor performance, reduce disputes, and optimise the overall customer journey.

Top 10 Payment API Providers for Global Businesses

Choosing the right payment API provider is essential for secure, scalable, and user-friendly international transactions. Here are 10 industry-leading providers and we describe pros and cons of every provider.

1. Stripe

- Benefits:

- Supports 135+ currencies and 50+ payment methods.

- Developer-friendly with extensive APIs and documentation.

- Advanced fraud detection and security features.

- Transparent pricing with no setup fees.

- Drawbacks:

- Requires technical expertise for integration.

- Account holds reported for perceived high-risk activities.

- Limited support for high-risk industries.

- Risk of abrupt service termination without sufficient notice or clear explanation.

- Support may be slow, repetitive, and unhelpful in resolving urgent financial issues.

Extended delays in fund disbursement beyond stated timelines, with vague reasons.

2. PayPal

- Benefits:

- Recognised and trusted globally, enhancing customer trust.

- Easy setup with support for 25 currencies across 202 countries.

- Offers buyer and seller protection programs.

- User-friendly platform.

- Drawbacks:

- Higher transaction fees, especially for international payments.

- Limited customisation options for the checkout experience.

- Potential for account freezes without detailed explanations.

- Dispute resolution may favour sellers or scammers, even with clear evidence.

- Funds may be restricted or capped without transparent criteria.

3. Adyen

- Benefits:

- Supports 250+ local payment methods and 200 countries.

- Unified commerce platform integrating online and in-store payments.

- Dynamic currency conversion and advanced risk management tools.

- Quick payouts.

- POS terminals.

- Drawbacks:

- Complex setup process requiring technical resources.

- Pricing structure may be less transparent for smaller businesses.

- Customers experience long wait times or incomplete refunds, even after eligibility is confirmed.

- Charges may be linked to long-forgotten or supposedly cancelled subscriptions.

- Customers report having to send multiple tickets and even threaten legal action to get a resolution.

4. Square

- Benefits:

- All-in-one solution with POS integration.

- Transparent flat-rate pricing.

- User-friendly interface suitable for small businesses.

- Quick onboarding with minimal requirements, ideal for new or small businesses.

- Users report timely transfers of funds to their bank accounts.

- Positive experiences with responsive and helpful service teams.

- Drawbacks:

- Limited international availability.

- Charges all transactions in the account’s currency, potentially leading to customer confusion.

- Users are often told the decision is final, with no route for appeal.

- Merchants can be left with unusable hardware and disrupted operations due to sudden termination.

5. Braintree (a PayPal service)

- Benefits:

- Supports multiple payment methods, including digital wallets.

- Recurring billing options.

- Seamless integration with the PayPal ecosystem.

- Braintree’s API is praised for being simple and developer-friendly.

- Flexible features.

- Drawbacks:

- It may not be ideal for businesses outside the PayPal ecosystem.

- Reports of complex fee structures for certain transactions.

- May be subject to fraud payments.

- No direct phone support and outdated or unmonitored contact channels.

- Users feel misled and abandoned, even after processing payments.

- Critical transactions can fail, leaving users unable to complete urgent purchases.

- Merchants are vulnerable to chargebacks with limited tools for dispute.

6. Checkout.com

- Benefits:

- Supports 150+ currencies with local payment methods.

- Modular API allowing customisation.

- Real-time data and analytics for transaction monitoring.

- Noted for strong performance in transaction success.

- Smooth integration process with attentive support throughout.

- Drawbacks:

- Pricing is quote-based, which may lack transparency.

- Integration may require technical expertise.

- Reports of ignored messages, unresponsive agents, and unhelpful service.

- Requests for clarifying calls are denied, limiting effective problem-solving.

- Unexpected contact terminations.

- Accusations of enabling scams without consumer safeguards or compensation.

7. Authorize.Net

- Benefits:

- Established provider with robust fraud detection tools.

- Supports recurring billing and eCheck processing.

- Virtual terminal for manual transactions.

- Simple, intuitive interface suitable for new business owners.

- CIM integration – Added features are accessible and straightforward to implement.

- Drawbacks:

- Monthly gateway fees in addition to transaction fees.

- Interface is considered outdated compared to newer platforms.

- Long-time, high-value businesses report sudden shutdowns despite full compliance.

- No phone contact, only vague and delayed email responses.

- Merchants report being charged fees even after services are cut off.

- Payments withdrawn from clients aren’t released or refunded, causing major financial issues.

8. Worldpay

- Benefits:

- Global reach with support for multiple currencies.

- Comprehensive reporting and analytics tools.

- Suitable for high-volume international sales.

- Transitions from other providers and setup processes are made easy by attentive reps.

- Businesses receive personalised setups to match their unique requirements.

- Consistent professional support – Some users report ongoing, reliable assistance beyond initial signup.

- Drawbacks:

- Complex pricing structure. Charges exceed those of competitors, with many undisclosed until after signup.

- Customer support experiences vary.

- Users are passed between departments with no resolution or ownership.

- $500 cancellation fee even after long-term use.

- Merchants incur high API/gateway fees from card testing fraud, with no fee refunds or effective mitigation.

- Confusing charges and unclear balances; direct debit and held funds don’t align.

9. Amazon Pay

- Benefits:

- Leverages Amazon’s trusted brand for increased conversions.

- Streamlined checkout process for Amazon users.

- Fraud protection and secure transactions.

- Utility payments may come without extra charges.

- Easily integrates into e-commerce sites for instant checkout.

- Drawbacks:

- Limited to customers with Amazon accounts.

- Higher fees for international transactions.

- Limited customer support.

- Slow fund disbursement.

- Misinterpretation of products can lead to unfair enforcement actions.

- Accounts can be shut down abruptly based on product misunderstandings, with little recourse.

10. Verifone (ex. 2Checkout)

- Benefits:

- Supports transactions in 200 countries and 100+ currencies.

- Multiple payment models, including subscriptions.

- Easy integration with various eCommerce platforms.

- No surprise fees, with costs deducted at the source and no terminal rental or minimum billing.

- Easy transitions with helpful staff throughout ordering, configuring, and returning old terminals.

- Drawbacks:

- Interface may be less intuitive compared to competitors.

- Reports of higher fees for certain transaction types.

- Devices feel antiquated and lack modern performance standards.

- Inconsistent connectivity with sales software; impacts transaction success.

- Users report incomplete disclosure of terms until financial commitment is made.

Challenges and How to Overcome Them

Dealing with Regulations and Localisation

When doing business globally, payment regulations vary from country to country. A payment method that is fully compliant in one region may be restricted or heavily regulated in another. Additionally, localisation goes beyond translation, it requires understanding consumer behavior, preferred payment methods, and legal requirements in each market. To overcome these hurdles, choose a payment API that supports multi-country compliance standards, offers built-in localisation capabilities, and has a proven track record in the regions you’re targeting. Collaborate with legal and financial advisors to ensure your operations align with local laws, tax codes, and data handling practices.

Managing Payment Failures and Refunds

Payment failures can occur for various reasons: insufficient funds, expired cards, technical issues, or fraud flags. If not handled correctly, failed payments can result in lost revenue and damaged customer relationships. A smart payment API should have built-in retry logic, failover gateways, and automated notifications to address these issues proactively. Similarly, refund handling should be transparent, fast, and secure. APIs that offer real-time refund processing, clear refund status updates, and support for partial refunds help businesses maintain customer trust and reduce support tickets.

Handling Currency Fluctuations and Settlement Delays

Currency volatility can affect profitability, especially for businesses dealing with high transaction volumes. Settlement delays, often caused by intermediary banks or regional constraints, can also slow down cash flow. To mitigate these challenges, choose payment APIs that offer real-time currency conversion with rate locks, multi-currency wallets, and fast settlement cycles (daily or next-day options). APIs with built-in treasury services can also help manage foreign exchange risks more effectively.

Best Practices for Implementing a Payment API

Partner with Reputable Providers

Selecting the right payment API provider is a pivotal decision that influences not only your payment processing but also your brand’s reputation. Always choose providers with a global presence, excellent customer support, proven reliability, and uptime guarantees. Consider industry leaders, which offer extensive documentation, high-level security, and scalable solutions.

Evaluate providers based on:

- Geographic coverage and supported currencies

- Customer testimonials and case studies

- SLA (Service Level Agreements) for uptime and response times

- Transparent pricing structures

Building long-term partnerships with trusted payment providers allows your business to grow with confidence, knowing your transactions are secure and scalable.

Prioritise Mobile Optimisation

With the rapid rise of mobile commerce and app-based shopping, your payment infrastructure must support mobile-first transactions. Choose APIs that offer responsive design support, mobile SDKs, and in-app payment integration (including fingerprint, face recognition, or one-tap checkout). Mobile-optimised payment flows reduce friction, increase speed, and significantly improve conversion rates, particularly in markets where mobile shopping dominates.

Monitor and Iterate Constantly

Payment APIs should never be a “set-it-and-forget-it” implementation. Continuous monitoring is crucial to detect and address issues like failed transactions, latency spikes, or region-specific disruptions. Use the API’s reporting tools and third-party monitoring services to analyse trends, identify bottlenecks, and optimise the user experience.

Adopt a cycle of:

- A/B testing different payment flows

- Monitoring conversion metrics across regions

- Regularly updating your integration with the latest API versions

- Soliciting customer feedback to fine-tune the experience.

This proactive approach not only enhances operational efficiency but also keeps your payment system resilient against evolving threats and user expectations.

Conclusion

In a globalised economy where businesses are expected to operate seamlessly across borders, payment APIs have emerged as mission-critical tools for success. They enable real-time, secure, and efficient transactions, providing the technological foundation needed to support international expansion and customer satisfaction.

From reducing manual processes and improving customer experiences to unlocking new revenue streams and navigating complex regulatory landscapes, the benefits of integrating a payment API are both immediate and long-term. However, it’s essential to make informed decisions, from choosing a reputable provider to prioritising mobile readiness and continuously optimising your systems.

The future of commerce is digital, dynamic, and decentralised. Whether you’re a startup looking to go global or an enterprise expanding to new markets, adopting a strategic and well-implemented payment API is not just a tech upgrade—it’s a growth catalyst.

But if you’re looking for a reliable digital IBAN account solution, consider exploring Transferra. We offer a modern platform designed for businesses that need efficient cross-border payments, currency exchange, and multi-currency account management—all in one place. Transferra’s IBAN accounts are ideal for companies operating in the UK and EEA, helping streamline international transactions without hidden fees.

FAQs

What does a payment API do?

It connects your app or website to a payment provider to process transactions, handle refunds, and manage financial interactions.

How do businesses benefit from payment APIs?

They offer seamless transactions, reduce manual errors, support multiple currencies, and improve customer experience globally.

Are payment APIs secure for international transactions?

Yes, with proper compliance (PCI DSS), encryption, and fraud prevention tools, payment APIs are highly secure.

How can a payment API improve customer experience?

By enabling one-click payments, supporting localised methods, and ensuring fast, reliable processing.

What are the challenges of using payment APIs globally?

Navigating regulations, ensuring localization, handling failed payments, and maintaining security.