How to Open a Business Bank Account UK: A Step-by-Step Guide

Learn how to open a business bank account UK quickly and easily. Perfect for startups, freelancers, and international founders.

If you’re wondering how to open a business bank account UK, you’re not alone. Whether you’re launching a startup, working as a freelancer, or expanding into the UK market, setting up the right bank account is one of the first and most essential steps. This guide walks you through exactly how to open a business bank account UK – quickly, legally, and with minimal hassle.

Why You Need a Business Bank Account in the UK

A dedicated business bank account is essential for managing your company’s finances, staying compliant with UK laws, and projecting a professional image.

Benefits include:

- Easier bookkeeping and tax filing

- Professional payment processing

- Separation of business and personal transactions

- Better access to credit and business services

Who Can Open a Business Bank Account in the UK?

✅ UK-Based Business Owners

Most UK residents can open a business account easily, especially with digital-first providers.

🌍 Non-UK Residents

If you’re based outside the UK, you can still open a business bank account UK using online banking platforms that support international entrepreneurs.

🧾 Business Types

This guide applies whether you’re a:

- Sole trader

- Limited company (Ltd)

- Partnership

- Freelancer or consultant

What You Need Before Applying

To open a business account UK, prepare the following:

- Proof of ID (passport, driver’s license)

- Proof of address (utility bill, bank statement)

- Business registration details (e.g. Companies House number)

- Description of business activity and expected turnover

How to Open a Business Bank Account UK: Step-by-Step Process

1. Choose a Bank or Platform

Start by deciding between:

- A high-street bank like Barclays, HSBC, or NatWest

- A digital business bank like Transferra, 3S Money, Tide

If speed, flexibility, and digital tools are priorities, digital accounts are the clear winner.

2. Compare Your Options

Look at:

- Monthly fees

- Foreign currency support

- Transaction limits

- Payment channels

- Virtual cards

- Additional features like batch payments, filtering, and invoicing

- iOS or Android apps

- Customer support channels

3. Submit Your Documents

Have your ID, business documents, and proof of address ready. Digital banks may let you upload these directly from your phone or laptop.

4. Complete the Application

Traditional banks may require a branch visit. Digital banks typically let you apply and verify everything online in as little as 10 minutes.

Notice: Opening a business bank account takes longer, from 1 to 3 days.

5. Get Approved and Start Using Your Account

Once approved, you’ll receive your account number and sort code. You can then:

- Send and receive payments

- Pay salaries or suppliers

- Exchange currencies

- Some digital institutions also provide crypto support

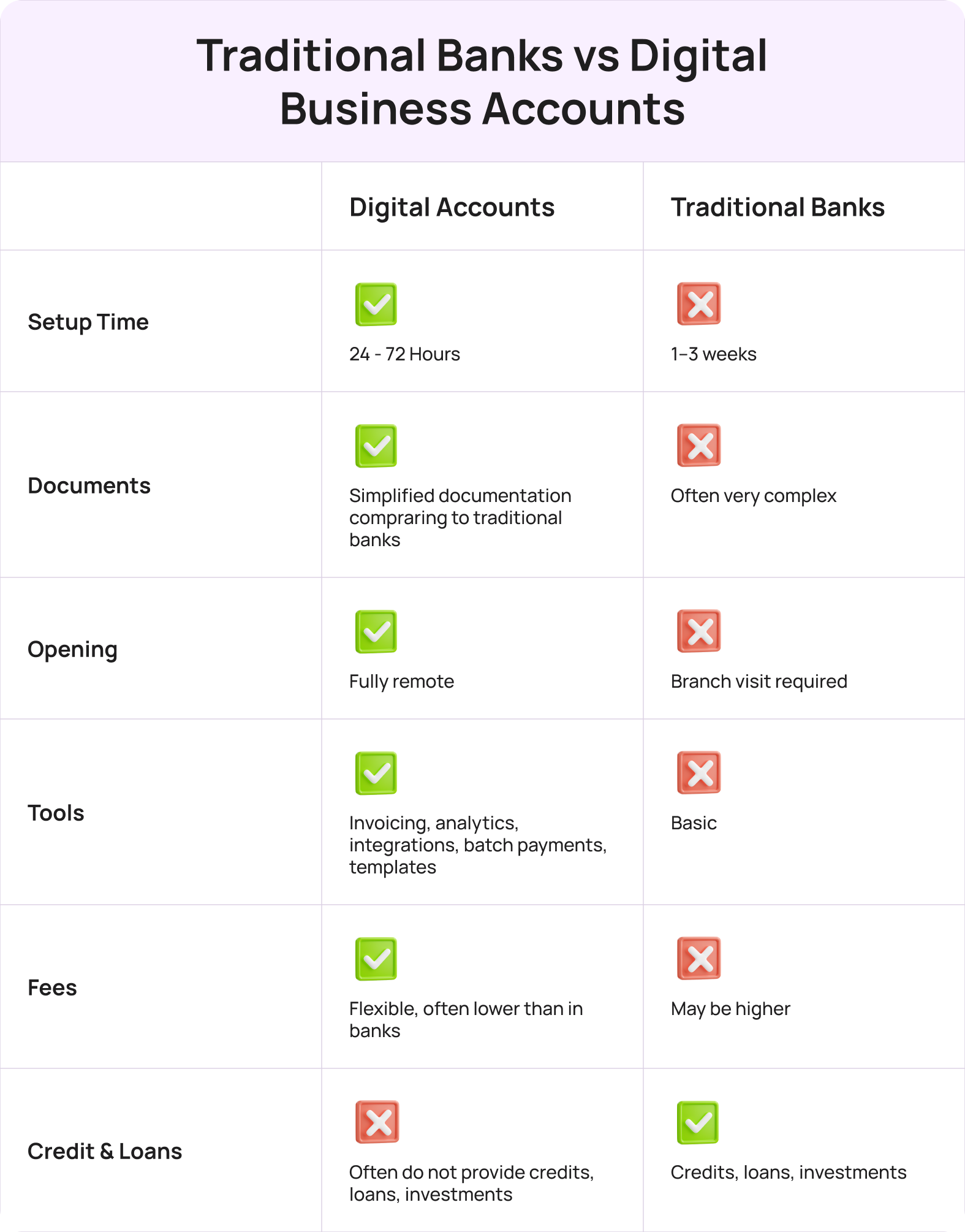

Traditional Banks vs Digital Business Accounts

Why choose digital?

If you want to open a business bank account UK with speed, ease, and modern tools, a digital provider is often the better choice, especially for startups, e-commerce sellers, and remote teams.

Common Mistakes to Avoid

Incomplete Documentation: Missing or inappropriate paperwork can delay your application. Always double-check requirements.

Choosing a Personal Account: Business funds should stay separate—opening a dedicated account is key.

Delaying the Process: Some banks take weeks. Digital options can get you up and running in hours.

FAQs About How to Open a Business Bank Account UK

Can I open a UK business account as a non-resident?

Yes! Many digital institutions like Transferra accept international founders with the right documents.

How long does it take?

Digital accounts can be opened within 24 – 72 hours, depending on your business type and complexity, while traditional banks might take 1–3 weeks.

Do I need a UK address?

Some providers require it, but many digital-first platforms accept overseas directors or international founders, for example, based somewhere in Europe or Asia.

We hope the question of how to open a business bank account UK now is not needed.

Ready to Open Your Business Account? Sign Up Now with Transferra

Opening a business bank account UK no longer needs to be time-consuming or complex.

With our digital platform, you get:

✅ Fast and transparent account setup

✅ Dedicated Account Manager

✅ Digital tools to handle your money

✅ Support for UK and international founders