What PSD3 Means for UK Fintech: The Future of Europe’s Payments Landscape

Change is coming to Europe’s payments landscape. Discover what PSD3 means for UK fintech, payments, and businesses – key updates & timeline.

Introduction

Europe’s payments ecosystem is entering a new phase. The upcoming Payment Services Directive 3 (PSD3) promises to reshape how payments, open banking, and fintech interact across the continent. Although the UK is no longer part of the EU, UK-based fintechs and payments firms should pay close attention – the regulatory ripples will cross the Channel and may influence the UK market too. In this article we’ll cover what PSD3 is, when it will be implemented, what it means for payments and fintech actors, what businesses should do now, and why even UK firms need to get ready.

What is PSD3?

The Payment Services Directive 3 is the next iteration of the EU’s payments‐services regulatory framework, following Payment Services Directive 2 (PSD2).

Here are the key facts:

- PSD3 is a directive, meaning it sets out rules that EU Member States must transpose into national law.

- It is being introduced alongside a complementary regulation called the Payment Services Regulation (PSR) which will apply directly in all Member States.

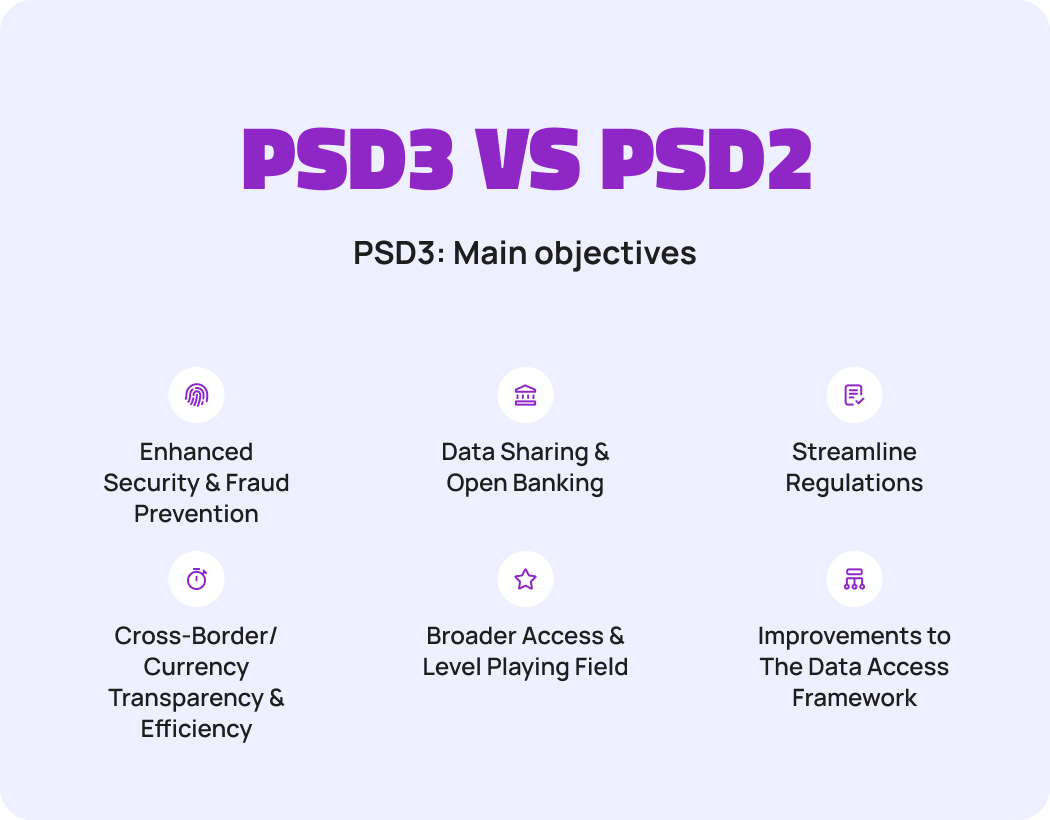

- The stated aims include: stronger consumer protection, enhanced open banking/data access, fairer access to payment systems for non-banks, reducing fragmentation across EU payments markets, and boosting innovation.

When Will PSD3 Be Implemented?

While the precise dates are still subject to final legislative approval and national transposition, the current timeline points to:

- The legislative proposals were published in June 2023.

- The Council of the EU published compromise texts in June 2025.

- Many commentators expect full enforcement no earlier than 2026-2027. For instance, one source notes the final version may take effect during 2026 with national implementation earlier.

- This gives firms roughly 12–24 months (or longer) to prepare after the directive is adopted.

For UK businesses and fintechs, that means now is the time to start assessing impact – even if direct UK legal obligation is uncertain.

What PSD3 Means for Payments & Fintech

1. Enhanced Security & Fraud Prevention

PSD3 tightens up on strong customer authentication (SCA), expands obligations around fraud, and requires better verification of payee details (like IBAN/beneficiary name matching).

For fintech firms, that means investment in stronger authentication, KYC, transaction monitoring, and data-sharing capabilities.

2. Broader Access & Level Playing Field

Under PSD3 non-bank firms (fintechs, Payment Service Providers (PSPs), Electronic Money Institutions (EMIs) will face clearer pathways to access payment systems and a more uniform regulatory environment across EU states.

For UK fintechs with EU ambitions (or servicing EU clients), this is a notable shift.

3. Data Sharing & Open Banking/Finance

PSD3 emphasises open banking and may tie into broader “Open Finance” frameworks. Firms will need to handle data access, user consent, and API standards more rigorously.

4. Cross-Border/Currency Transparency & Efficiency

The directive aims to reduce fragmentation in payments across the EU (different national rules, varying cost structures). This could influence pricing, settlement practices and infrastructure – which UK firms should watch.

What PSD3 Means for Businesses (including UK Firms)

- If you serve EU markets: Even UK firms will feel the ripple. EU clients may increasingly use PSPs and fintechs licensed under PSD3, meaning UK-based providers may need partnerships or licences in the EU to stay competitive.

- If you operate cross-border payments: Expect higher transparency, more demanding verification and potentially tighter cost structures.

- If you’re a fintech or payments business in the UK: While PSD3 is EU-centric, regulatory divergence means there may be competitive advantage if the UK sets its own “UK-equivalent” or links dynamically. UK firms should monitor the UK regulator (Financial Conduct Authority) and consider EU compliance if scaling into EU.

- Operational change: Businesses must review their systems, data flows, APIs, fraud & compliance frameworks now – waiting until the directive goes live could be costly.

- Strategic planning: This is also an opportunity — newer rules may lower barriers for fintechs to access payment infrastructure, enabling business model innovation.

Why the Industry Still Looks to the UK for Leadership

Despite Brexit, the UK remains a global fintech hub, with strong regulatory sophistication, talent, and market depth. UK firms often lead in payments innovation, open banking and cross-border fintech services. The UK regulatory environment (via FCA, Open Banking Implementation Entity, etc.) continues to influence global best practice. For EU firms, and for UK firms servicing EU markets, the UK’s fintech ecosystem remains a bellwether. PSD3’s evolution doesn’t stop at the UK border because the UK remains part of the broader financial ecosystem and many firms span both jurisdictions.

Next Steps: What to Do Now

- Conduct a gap-analysis: Map your payments/fintech operations (EU clients, cross‐border flows, data sharing, APIs, fraud controls) and assess readiness for PSD3-style requirements.

- Engage regulatory and compliance advisors: Especially if you operate in or into the EU, get clear on licensing, authorisation, supervisory requirements under PSD3/PSR.

- Upgrade technology & data architecture: Focus on identity/beneficiary verification, API standards, data rights/consents, fraud monitoring, cross-border settlement flows.

- Strategise business model in light of change: Consider whether to expand EU presence, partner with EU-licensed PSPs/EMIs, or adapt service offerings to take advantage of new regulatory frameworks.

- Monitor UK regulatory developments: While PSD3 is EU-centric, the UK may follow or craft parallel rules. Staying ahead gives you competitive advantage.

Conclusion

Change is coming to the European payments landscape – and even though the UK is outside the EU, its fintech and payments industry will not escape the impact. PSD3 heralds a new era of stronger consumer protection, more open access for fintechs, improved cross-border payments and deeper data-driven finance. UK businesses and fintechs would be wise not to treat it as “EU only” but as part of a global shift. By starting preparation now, you position your business not just to comply, but to lead.

FAQs

Q: What is PSD3 in simple terms?

A: PSD3 stands for the Payment Services Directive 3 — the European Union’s new regulatory framework for digital payments, fintechs, and open banking. It updates PSD2 to improve consumer protection, strengthen security, and give fintech companies fairer access to payment systems across the EU.

Q: When will PSD3 be implemented?

A: PSD3 is currently under negotiation within EU institutions. The final text is expected to be approved in 2025, with implementation likely between 2026 and 2027. That means businesses have roughly two years to prepare for the new compliance standards.

Q: How does PSD3 differ from PSD2?

A: PSD2 introduced open banking and strong customer authentication (SCA). PSD3 goes further — extending consumer protections, clarifying rules for non-bank payment providers, improving fraud prevention, and expanding the scope of open finance. It also introduces the Payment Services Regulation (PSR), which will apply uniformly across EU member states.

Q: Will PSD3 affect UK fintechs even after Brexit?

A: Yes — indirectly but significantly. While the UK is no longer part of the EU, many UK fintechs operate across European borders or serve EU clients. PSD3 will shape European payments infrastructure and customer expectations, so UK firms must stay aligned or risk losing competitiveness in cross-border business.

Q: What does PSD3 mean for businesses and merchants?

A: For EU-based businesses, PSD3 means stronger fraud protection, better payment transparency, and more reliable open banking connectivity. For UK businesses trading with Europe, it could mean adapting to new data-sharing standards, authentication requirements, and payment verification processes.

Q: How should UK fintechs prepare for PSD3?

A: Start by reviewing your compliance policies, customer authentication flows, and data-sharing infrastructure. Partnering with EU-licensed providers or seeking local authorisation may also help maintain seamless access to the EU payments market once PSD3 takes effect.

Q: What is the PSD3 Payment Services Regulation (PSR)?

A: The PSR complements PSD3 and will apply directly to all EU member states. Its goal is to harmonise payment service rules across Europe, making compliance simpler and ensuring equal competition between banks and fintechs.

Q: Where can I find the latest updates on PSD3?

A: Updates and consultation papers are published by the European Commission, European Banking Authority (EBA), and Financial Conduct Authority (FCA). Fintech companies should also monitor guidance from payment associations, compliance consultancies, and industry analysts.