Bank Account for Holding Companies 2025: How to Choose the Right One

Learn how to open a bank account for holding companies. Discover key requirements, options, and how to choose between banks and fintechs.

Opening and maintaining a bank account for holding companies isn’t always straightforward.

Whether your entity is managing subsidiaries, intellectual property, or investments, choosing the right banking setup is essential for compliance, tax efficiency, and financial management.

This guide explains how holding company accounts work, what documents are required, which jurisdictions to consider, and how fintech alternatives are reshaping corporate banking.

1. What Is a Holding Company?

A holding company is a legal entity that owns shares or assets in other businesses. It doesn’t usually sell products or services itself — instead, it controls or invests in subsidiaries.

Common uses include:

- Managing group finances and investments

- Holding intellectual property (IP)

- Reducing liability exposure

- Centralizing dividends and profits

Because of its structure, opening a bank account for a holding company often requires additional documentation and clarity about the company’s activities.

2. Why a Holding Company Needs a Bank Account

A dedicated bank account for holding companies provides transparency and structure for the holding entity.

It allows you to:

- Receive dividends from subsidiaries

- Pay holding-related expenses (audit, legal, management fees)

- Consolidate funds and distribute capital efficiently

- Maintain compliance with tax and financial reporting

For international groups, the account also simplifies cross-border transactions and currency management.

3. Requirements for Opening a Bank Account for Holding Companies

Banks and fintechs will request clear documentation to understand ownership and source of funds. Expect to provide:

- Certificate of Incorporation

- Memorandum & Articles of Association

- Register of Directors and Shareholders

- Proof of business address

- Valid ID and proof of address for directors/beneficial owners

- Corporate structure chart

- Tax Identification Number (TIN or VAT)

- Explanation of business activities (e.g., “The holding company owns and manages 100% of XYZ Ltd in the UK.”)

Because holding companies are often passive, banks perform extra due diligence to ensure no hidden trading or high-risk activity exists.

4. Best Jurisdictions for Holding Company Banking

The choice of jurisdiction can make or break your banking experience.

United Kingdom 🇬🇧

- Reliable banking infrastructure and strong regulation.

- FCA oversight and access to fintech alternatives.

- Popular for UK or European holding structures.

Switzerland 🇨🇭

- Exceptional stability and privacy.

- Ideal for investment or family holding entities.

- Higher minimum deposits and stricter compliance.

Luxembourg & Netherlands 🇱🇺 🇳🇱

- Strong corporate tax frameworks for holdings.

- Extensive network of double-tax treaties.

- Banks accustomed to complex multinational structures.

Lithuania & Estonia 🇱🇹 🇪🇪

- Fast digital onboarding and SEPA connectivity.

- Growing fintech hubs with EU regulation compliance.

- Ideal for EU-based digital or investment holding companies.

5. Types of Accounts Available

Depending on your goals and banking partner, you can choose from:

- Operational accounts: For paying expenses and managing group costs.

- Investment accounts: For holding financial assets or reserves.

- Multi-currency accounts: For managing cross-border revenue and dividends.

- Escrow or trust accounts: For regulated holdings or M&A activities.

Fintechs now make it easier for holding companies to open multi-currency business accounts online, often with IBANs in EUR or GBP.

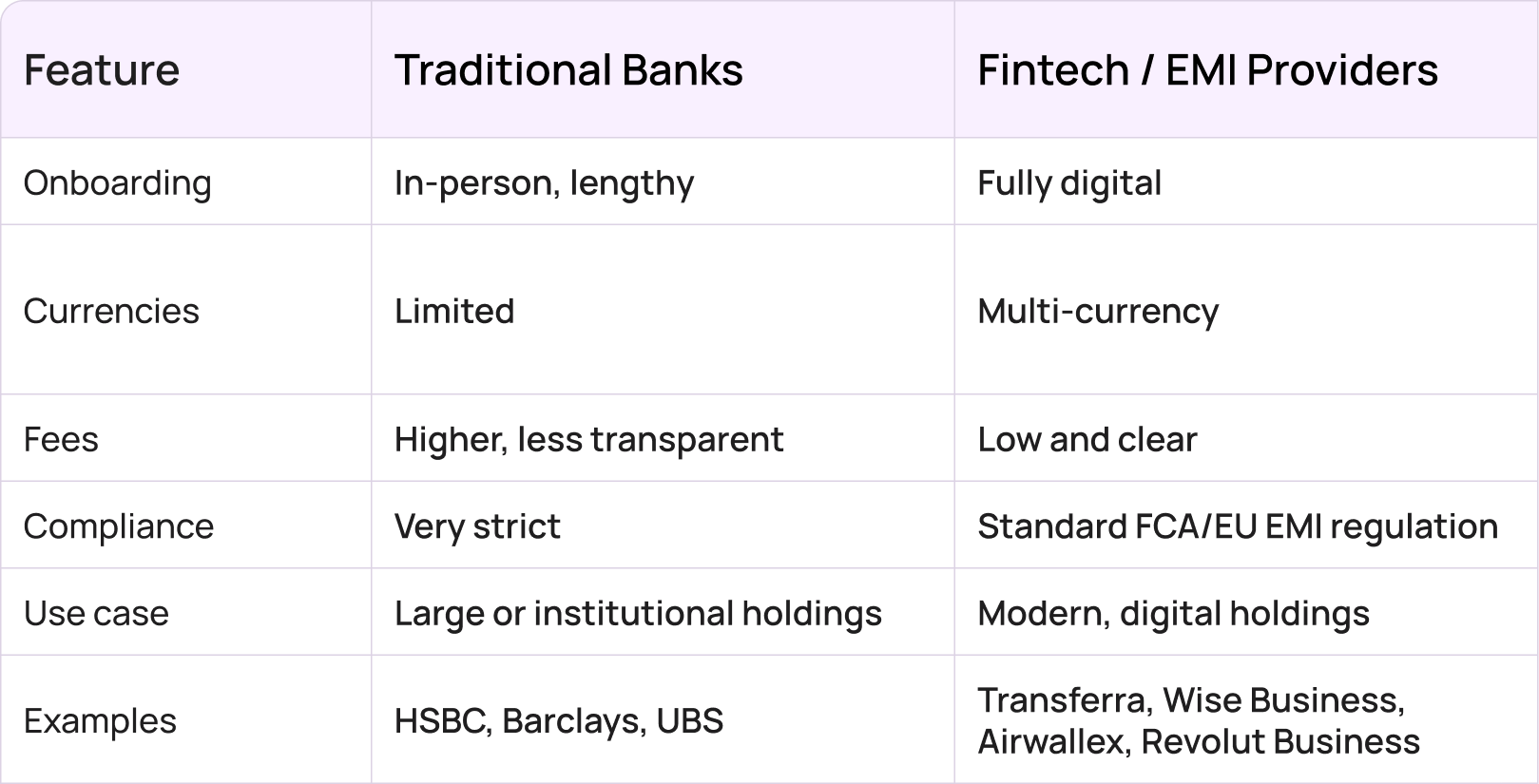

6. Traditional Banks vs Fintech Accounts

Fintech providers like Transferra, Wise or Airwallex are increasingly used by holding entities that don’t need loans or deposits but want easy access to multiple currencies and SEPA/SWIFT transfers.

7. Steps to Open a Bank Account for Holding Companies

Here’s a typical roadmap:

- Choose your jurisdiction (UK, EU, or offshore).

- Select your provider (bank or fintech).

- Prepare incorporation and ownership documents.

- Submit your application (online or in-person).

- Undergo due diligence (KYC and AML checks).

- Get account approval and IBAN.

- Link to subsidiaries or parent accounts for efficient cash flow.

💡 Tip: Clearly explain the company’s purpose and provide transparent ownership details. Banks are more likely to approve well-documented structures.

8. Challenges to Expect

Opening a bank account for holding companies can be more complex than for trading entities.

Here’s why:

- Non-active business model: Banks may view it as higher risk.

- Multi-layer ownership: Ultimate Beneficial Owner (UBO) verification can take time.

- Cross-border complexity: Different regulators, currencies, and AML rules.

- Tightened regulations: Post-Brexit and AMLD5 compliance require detailed source-of-funds evidence.

If traditional banks decline your application, fintech EMIs often provide faster and more flexible alternatives.

9. Tips for a Smooth Account Opening

✅ Prepare full ownership and structure charts before applying.

✅ Choose a jurisdiction aligned with your holding company’s legal base.

✅ Avoid secrecy — disclose real shareholders and beneficial owners.

✅ Consider using fintechs for speed and cost-efficiency.

✅ Maintain annual compliance (updated KYC, tax reports).

10. Why the Right Account Matters

A properly managed bank account ensures:

- Transparent intra-group transfers

- Easier dividend payments

- Simplified audits and reporting

- Clear compliance for regulators and tax authorities

For multinational groups, it also reduces FX exposure and improves financial visibility across subsidiaries.

Final Thoughts

Choosing the right bank account for holding companies isn’t just an administrative step — it’s a key part of your corporate governance and financial control.

Whether you go with a traditional bank in Luxembourg or a fintech platform in the UK, ensure your provider offers stability, transparency, and compliance support.

A holding company exists to protect and consolidate assets — your bank account should do the same.

FAQs

Q: Can a holding company open a bank account in another country?

A: Yes. Many holding companies open accounts abroad for tax efficiency, investment, or group management — provided they meet AML and transparency requirements.

Q: What documents do I need to open a bank account for holding company?

A: Typically: incorporation documents, ownership chart, proof of address, director IDs, and a detailed explanation of business activities.

Q: Are fintech accounts suitable for holding companies?

A: Yes, especially for digital or investment-focused entities. Fintech EMIs like Transferra, Wise or Airwallex offer regulated, multi-currency accounts ideal for non-trading holdings.

Q: What’s the best country to open a bank account for holding company?

A: Luxembourg, the Netherlands, and the UK remain popular for their banking stability and strong legal frameworks for corporate holdings.