IBAN vs BIC: What They Mean and Why They Matter…

Learn what IBAN and BIC mean, how they differ, and why they are essential for fast and accurate international payments.

Learn what IBAN and BIC mean, how they differ, and why they are essential for fast and accurate international payments.

As payments grow faster and more complex, data sharing in payments is becoming essential. Secure collaboration helps prevent fraud, improve transparency.

Learn how to open a EUR business bank account in Europe. Discover requirements, documents, top banks, fintech alternatives, and expert tips.

Understand the key types of payment institutions UK businesses can operate under: Banks, EMIs, and PIs. Learn their differences and regulations.

Discover how to reduce currency conversion fees with 7 practical tips for UK businesses. Cut costs and improve your bottom line on transactions.

Virtual IBAN explained for UK businesses. Learn how they work, why they matter, and how to use them for faster, global payments.

Explore the top 7 must-have features, from fast onboarding and FX tools to approval workflows and real human support, to help your business scale with confidence.

Looking for a UK business account for non-residents? Discover top providers offering UK IBANs and easy online setup – no UK address required.

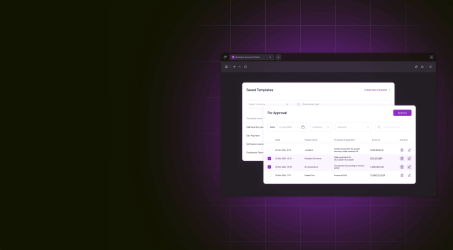

Streamline your payments on the Transferra platform with reusable templates and a secure approval workflow. Learn how to save time, assign roles, and manage funds in just a few steps.

Are you wondering why banks, payment providers or crypto platforms often ask for additional documents to confirm the origin of your money? In this article, you will learn what are the legal source of funds (SoF) is and how to submit them correctly.

This blog post highlights the top 10 fintech companies for business banking and online accounts that simplify cross-border payments and currency exchanges. Read on to make informed choices for international transactions.

This article is a must-read for anyone involved in the European payment landscape, whether you’re a business owner, financial professional, or tech enthusiast. You’ll gain valuable insights.