Understanding Digital Payments: How Do Virtual Cards Work?

Virtual cards are digital versions of traditional plastic cards designed for online shopping, offering enhanced security, convenience, and flexibility.

With online shopping playing a big role in our lives these days, secure and easy digital payments have become more important than ever. This has led to the popularity of virtual cards, which are digital versions of traditional plastic cards with added benefits like enhanced security, convenience, and flexibility.

A study by Juniper Research shows that online transactions using digital cards reached 28 billion worldwide in 2022, and this number is expected to grow by about 340% to over 121 billion by 2027.

Even though virtual cards are becoming more in-demand, some people still don’t know how to use them. But once you understand their mechanics, incorporating them into your transactions is quite simple. This article will explain their functionality and provide guidance on utilizing them.

What are virtual cards?

Virtual cards are online versions of traditional plastic debit, credit, or prepaid cards. They offer added security and convenience.

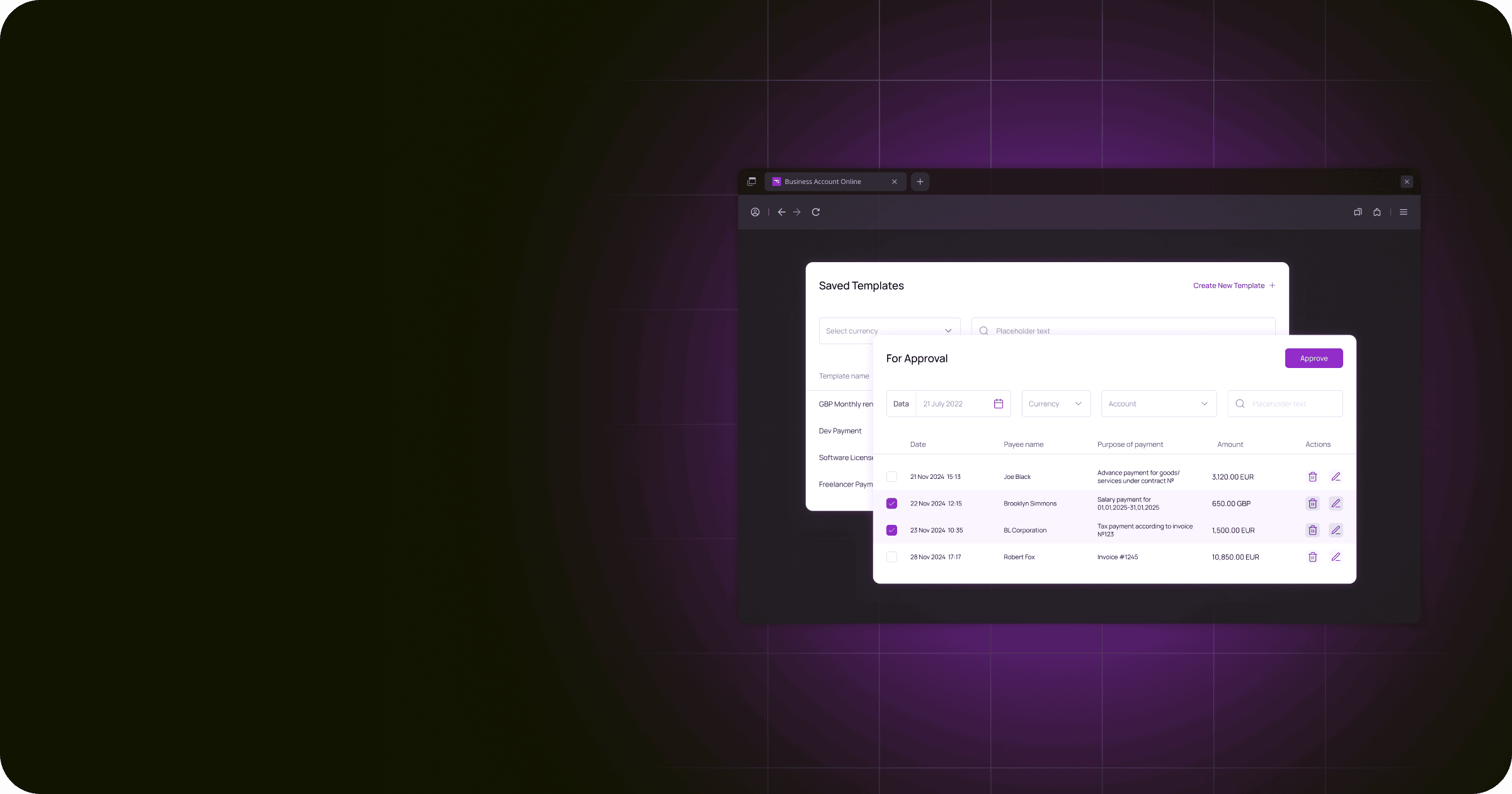

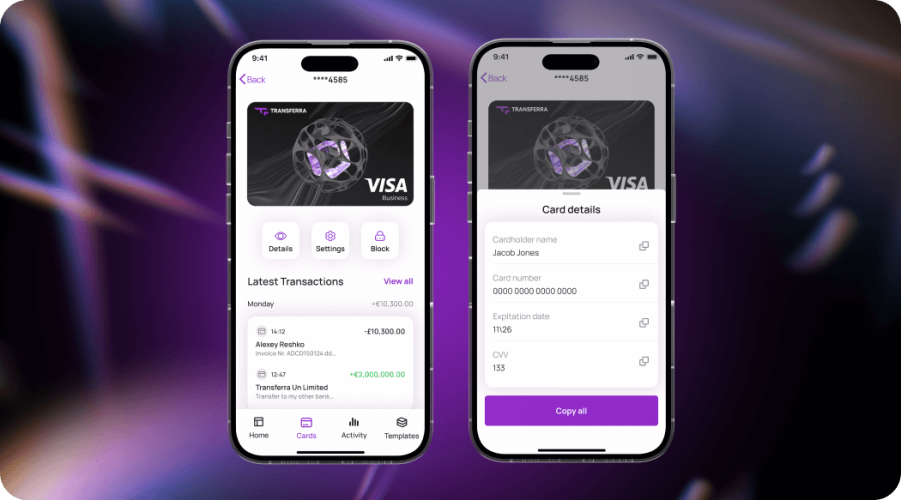

Digital cards can be accessed through a mobile app, online banking, or a digital wallet. They have a unique 16-digit number, expiration date, and CVV/CVC code for online purchases.

Digital cards allow you to make secure online payments without revealing your actual card details. They’re usually connected to your bank account or credit card, so you can manage your money and track spending easily.

Some key features include:

- One-time use or reusability:

These cards can be used once and then expire, or they can be used multiple times with spending limits and validity periods.

⠀ - Custom spending limits:

You can set limits to control expenses and prevent unauthorised use.

⠀ - Instant availability:

They are instantly generated and available for immediate use, so there’s no need to wait for a physical card to arrive.

How do virtual credit cards work?

Using a virtual card online is simple and involves a few steps. Here’s an easy guide on how to pay with a digital card:

- Get a virtual card:

Pick a provider like Transferra that offers virtual cards, sign up, and follow their process to obtain a card. You might need to verify your identity and then top up funds to your wallet.

⠀ - Find your card details:

Log in to your account through the provider’s app or website to see your card number, expiration date, and CVV/CVC.

⠀ - Shop online:

At the checkout page, choose an option to pay with a credit or debit card. Enter your digital card details just like you would with a physical card.

⠀ - Confirm your purchase:

Double-check the details and follow the checkout page prompts to complete the transaction. The funds will be taken from your digital card account or linked funding source.

⠀ - Track your spending:

Keep an eye on your transactions using the provider’s app or website. This helps you spot any unauthorised transactions quickly.

⠀ - Manage your card:

Depending on the provider, you may have options to set spending limits, freeze/unfreeze your card, or request a new card number. Learn about these features to make your experience more secure and convenient.

Follow these steps for a simple and safe shopping experience with a virtual card.

How do digital payments work?

Virtual payment refers to using digital methods for transactions, rather than cash or physical cards. It makes online shopping safer and easier. Here’s a simple explanation of how it works.

Virtual payments are made over an online platform that secures and encrypts the buyer’s and seller’s payment information. The system creates a special, one-time code, or token when you submit your payment information.

The danger of fraud is decreased because this token represents your payment information without disclosing your card information directly. After your bank has verified this token, the payment processor completes the transaction if it is approved. This procedure guarantees that the transaction will be secure for your actual card data.

Virtual payments provide better online payment security, convenience, and flexibility. Understanding how they work helps you enjoy a smooth online shopping experience.

How to pay with a virtual card in shops?

To use a virtual card in shops, first ensure it’s compatible with a digital wallet like Apple Pay or Google Pay. Add the card to your digital wallet, and check if the shop accepts contactless payments.

Hold your unlocked smartphone near the payment terminal and follow the prompts to complete the transaction. Confirmation will appear on your smartphone and the terminal.

Not all virtual cards can be used in physical shops, so always check with your provider.

Are virtual cards a good idea?

Virtual cards might be a good choice, depending on your requirements. While they offer benefits that some users find helpful, they may not be the perfect solution for everyone. Consider the following points when deciding if this type of cards are right for you:

- Online payment security:

Virtual cards have extra security features like one-time card numbers and adjustable spending limits, which help protect your financial information and lower the risk of online fraud.

⠀ - Ease of use:

You can create virtual card and manage it using a mobile app or online platform, making it simple to shop online without a physical card. Plus, they’re issued instantly, so there’s no waiting.

⠀ - Spending control:

With adjustable spending limits and the ability to make multiple virtual cards, you can track and control your expenses more effectively, helping you stay within your budget.

⠀ - Usage limits:

Virtual cards are mainly for online shopping, but some can be added to digital wallets for in-store use. However, they are less versatile than physical cards, which can be used at any location accepting card payments.

⠀ - Tech reliance:

Virtual cards require a reliable internet connection, as they’re managed through a mobile app or online platform. If you prefer traditional payment methods or have limited tech access, digital cards might not be your best option.

In short, virtual cards are a good choice for people who value security, convenience, and control over online spending. But, make sure to consider the benefits and drawbacks to see if they suit your needs and preferences.

Conclusion

Virtual cards are a safe, easy, and flexible option compared to traditional plastic cards. Learning about their benefits and how they work can help individuals and businesses use this digital payment method to make transactions smoother and more secure. As digital banking services keep improving, an instant virtual debit card online will become even more popular and important in our financial lives.

Business owners who want to use digital business cards can rely on Transferra as a financial services partner. We offer a virtual card UK solution designed for businesses, helping them make the most of their financial operations and adapt to the increasing demand for digital payments. If you’re wondering how do digital Visa cards work within Transferra, the answer is simple: they function the same as other cards that we described in this article.

Enjoy a smooth and efficient payment experience while keeping your finances secure and under control with Transferra’s business virtual card services!