The Role of Cross-Border Payments in Global Transactions

This guide provides essential knowledge for entrepreneurs expanding globally and individuals managing cross-border finances.

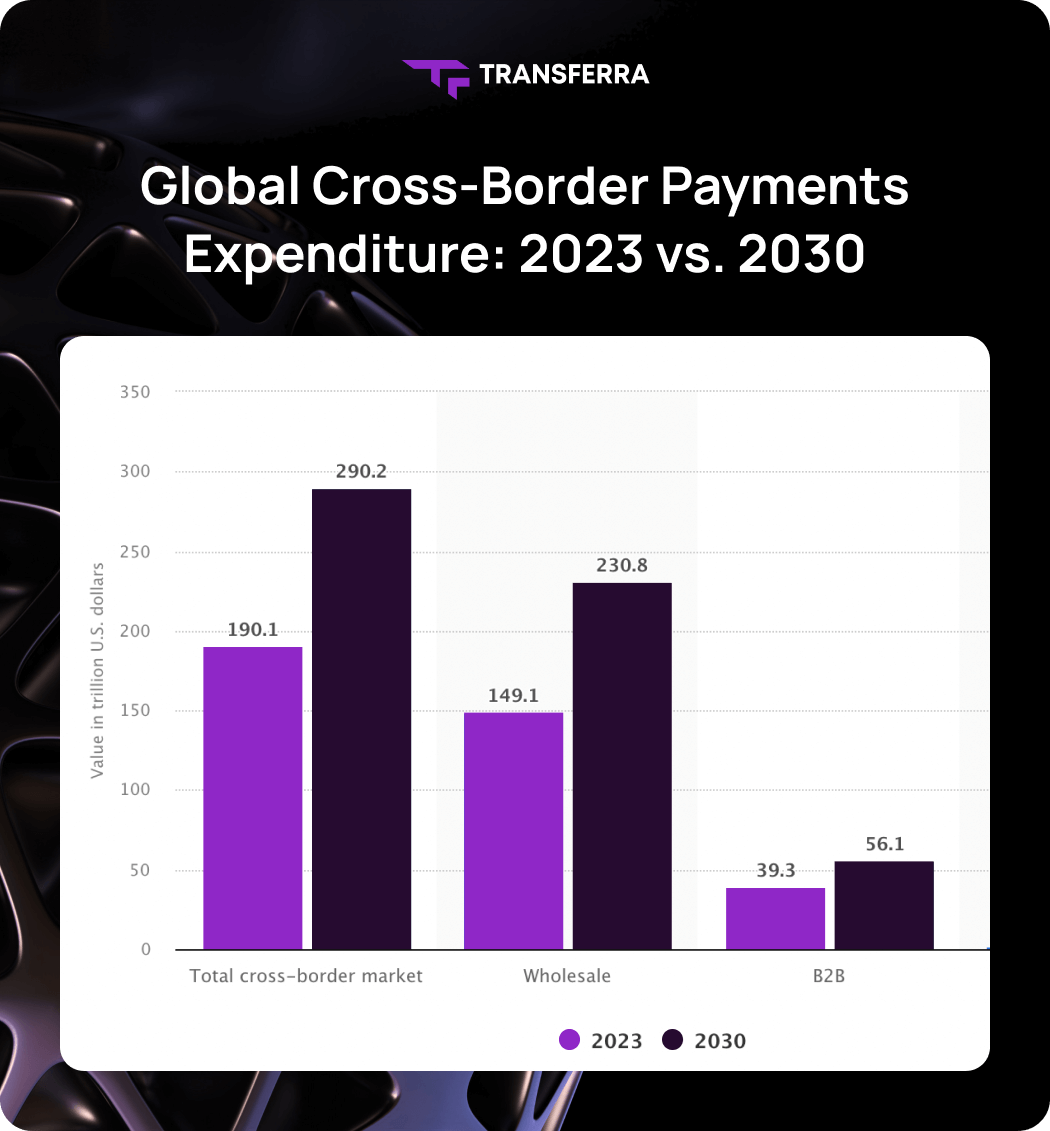

The B2B cross-border payments market is expected to grow by 43% between 2023 and 2030, with e-commerce driving this growth. However, navigating international transactions is tough due to differences in laws and currency rates. Transferra simplifies this process with advanced security, real-time tracking, competitive exchange rates, and customer support.

What are Сross-Border Payments?

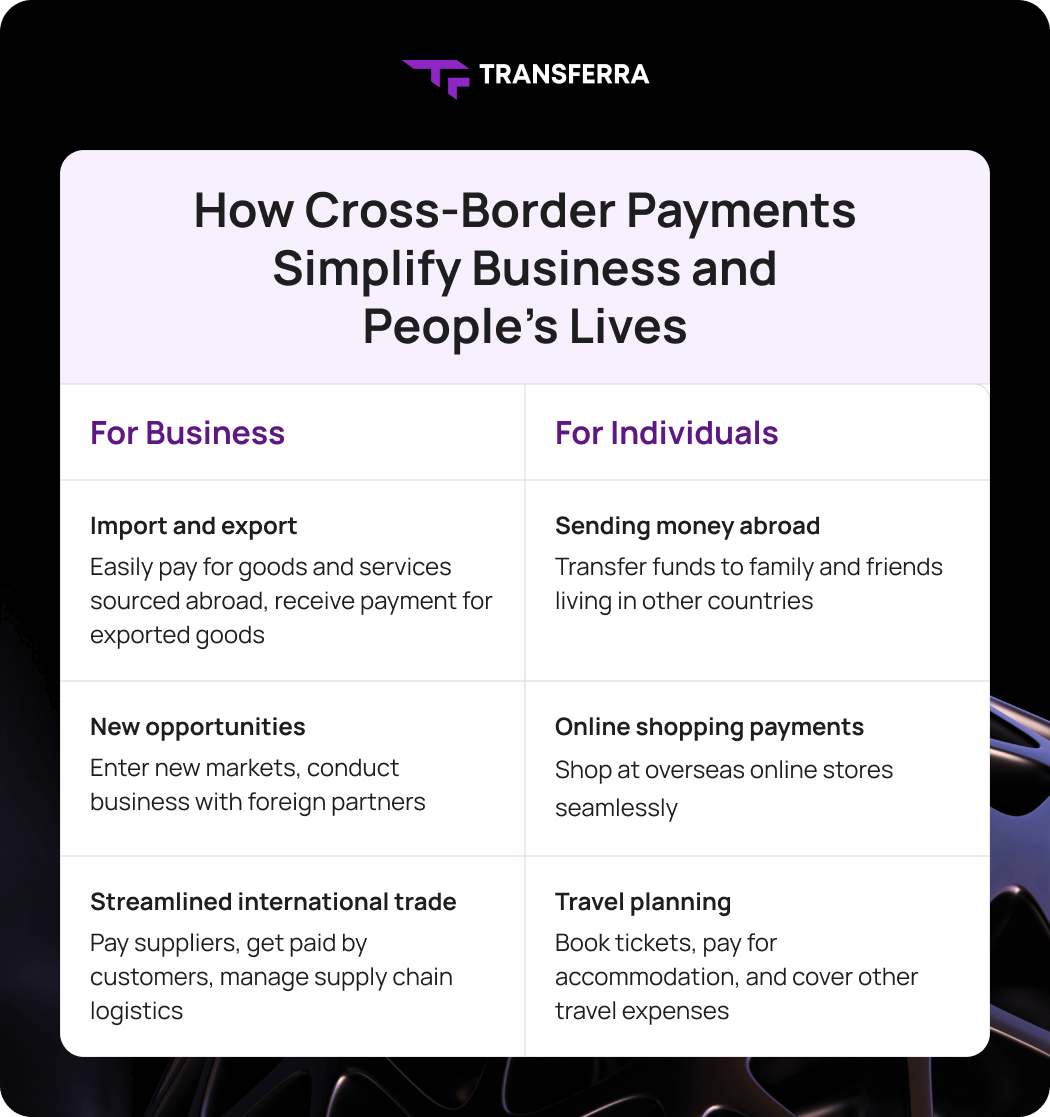

A cross-border payment is a transaction where the payer and the beneficiary are in separate nations, meaning it serves various purposes such as services, personal remittances, trade, and business.

They are necessary to the world economy as they permit companies to grow abroad, let expatriates send money home, and let customers buy products and services from other nations. Instant cross-border payments facilitate these activities by ensuring quick and efficient transactions.

Principal elements of international payments include:

- Exchange of currencies. Currency exchange involves various factors, such as market demand, geopolitical issues, and economic data, all of which influence exchange rates. For individuals frequently involved in international transactions or seeking efficient currency management, we’ve curated a list of user-friendly foreign currency accounts in the UK.

⠀ - Payment networks. SEPA (Single Euro Payments Area) and SWIFT (Society for Worldwide Interbank Financial Telecommunication) play crucial roles in facilitating international transactions. SEPA streamlines euro-denominated money transfers within Europe, while SWIFT ensures secure transmission on a global scale.

⠀ - Banks serve as intermediaries. Several financial institutions often serve as middlemen to enable cross-border payments. By using a network of intermediary entities, these correspondent banks facilitate the transfer of money from the payer’s bank to the recipient’s bank, therefore extending the process’s time and expense. Here we’ve put together a list of the main hurdles you might face when sending large sums abroad.

⠀ - Regulatory compliance. Cross-border payments have to abide by the laws of the nations that are sending and receiving them. This covers the following rules on counterterrorism financing (CTF) and anti-money laundering (AML), as well as the reporting requirements for significant transactions. It also includes KYC (Know Your Customer), meaning that it is necessary to thoroughly verify the identity.

Fintech innovations like Transferra’s are tackling these issues by providing less costly, more transparent, and quicker ways to deal internationally.

Source: Statista

What are the Types of Cross-Border Payments?

International trade payments

These transactions are used by companies that import and export products and services to pay suppliers, get paid by customers, and handle supply chain logistics: manufacturing, retail, logistics, e-commerce, and service providers.

- Letters of credit (LC). In international commerce, letters of credit (LCs) are commonly used by banks to guarantee payment to the seller, subject to specific conditions. These typically involve providing required documents like invoices and shipping records, as outlined in the LC terms. Failure to meet these conditions may result in non-payment.

- Bank wires. Straight bank account transfers between the buyer and seller are made possible by networks like SWIFT and SEPA cross-border payments.

⠀ - Systems of trade finance. Factoring and forfaiting are two examples of products designed to handle the complexity and risks of international trade. These include things like buyer non-payment risk, changes in political situations or government policies, currency fluctuations, and a lack of liquidity to meet financial obligations.

Remittances

Money sent home by workers abroad is called remittances. For many families, particularly in less developed nations, these payments are vital as they cover everyday expenses like food, education, and healthcare.

- Money transfer operators (MTOs). Businesses specialising in expediting remittance and foreign currency transfers, such as Western Union and MoneyGram, are sometimes costly but offer efficient services.

⠀ - Mobile money and digital wallets. Growingly common in areas with significant mobile phone penetration, services like Kenya’s M-Pesa let users transfer and receive cross-border digital payments conveniently through their devices.

Foreign direct investment (FDI)

Investment into commercial interests in another country by a corporation or person based in one nation is known as foreign direct investment. This may include starting up, buying assets, or creating joint ventures.

- Capital transfers. These are large sums of money moved for investment purposes. They often require compliance with the legal systems of both countries.

⠀ - Repatriation of profits. Multinational corporations bring back earnings from their foreign subsidiaries to their home nation.

Payments for tourism and travel

Travellers, both for business and leisure purposes, frequently cover expenses like accommodation, transportation, meals, and shopping in foreign countries. Various methods facilitate these transactions:

- Credit and debit cards. Commonly accepted abroad, although sometimes liable to foreign transaction fees.

⠀ - Travel money cards. Preloaded with several currencies, travel money cards let consumers spend internationally without worrying about exchange rate swings while they’re away.

E-commerce transactions

With the expansion of internet shopping and the rise of fintech, fast international payments have become increasingly prevalent, as people now frequently purchase products from overseas merchants.

- Payment gateways. These are web services that let e-commerce websites handle credit card payments, therefore enabling sales abroad.

⠀ - Digital currencies. Cryptocurrencies like Bitcoin provide a means of making cheaper cross-border payments without the need for conventional financial institutions.

Service payments

Many times, customers that are located abroad pay freelancers, consultants, and remote workers. These withdrawals are possible via:

- Platforms for freelancers. Websites such as Fiverr and Upwork manage payments from outside countries for services rendered.

⠀ - Direct bank transfers. Traditional approaches frequently require middle banks and additional costs.

⠀ - Digital payment platforms. TransferWise (Wise) and PayPal are examples of services that make international payments quicker and more affordable, especially for EU cross-border payments.

What is a Cross-Border Payment in the UK?

In the UK, cross-border payments regulation governs transactions in which money is sent across national boundaries between the payer and the beneficiary, who are located in separate countries.

As they fund travel, foreign commerce, and personal remittances, these money transfers are essential to the UK economy. The Financial Conduct Authority (FCA) oversees a strong regulatory structure that supports safety and openness in the UK’s cross-border payment system. Furthermore, even with Brexit concerns, membership in the SEPA makes euro-denominated transactions inside Europe smooth.

By using the SWIFT network, UK banks also guarantee safe and effective money transfers. In addition, firms that are pioneers in financial technology (fintech) in the UK spur innovation by developing ways to lower expenses, speed up processes, and improve transparency in international payments.

Strong laws, active participation in SEPA, reliance on SWIFT, and fintech advancements collectively establish the UK as a significant player in both current and future cross-border payments.

What is Cross-Border Bill Payment?

If you’re paying bills or invoices from organisations based in a different country than you, that’s cross-border bill payment. In many situations, including international commerce, where companies must pay bills from overseas suppliers, or for expatriates who must control household costs in their home country while living abroad, this kind of transaction is typical.

You can pay bills across borders using fintech platforms, money transfer companies, or conventional banks.

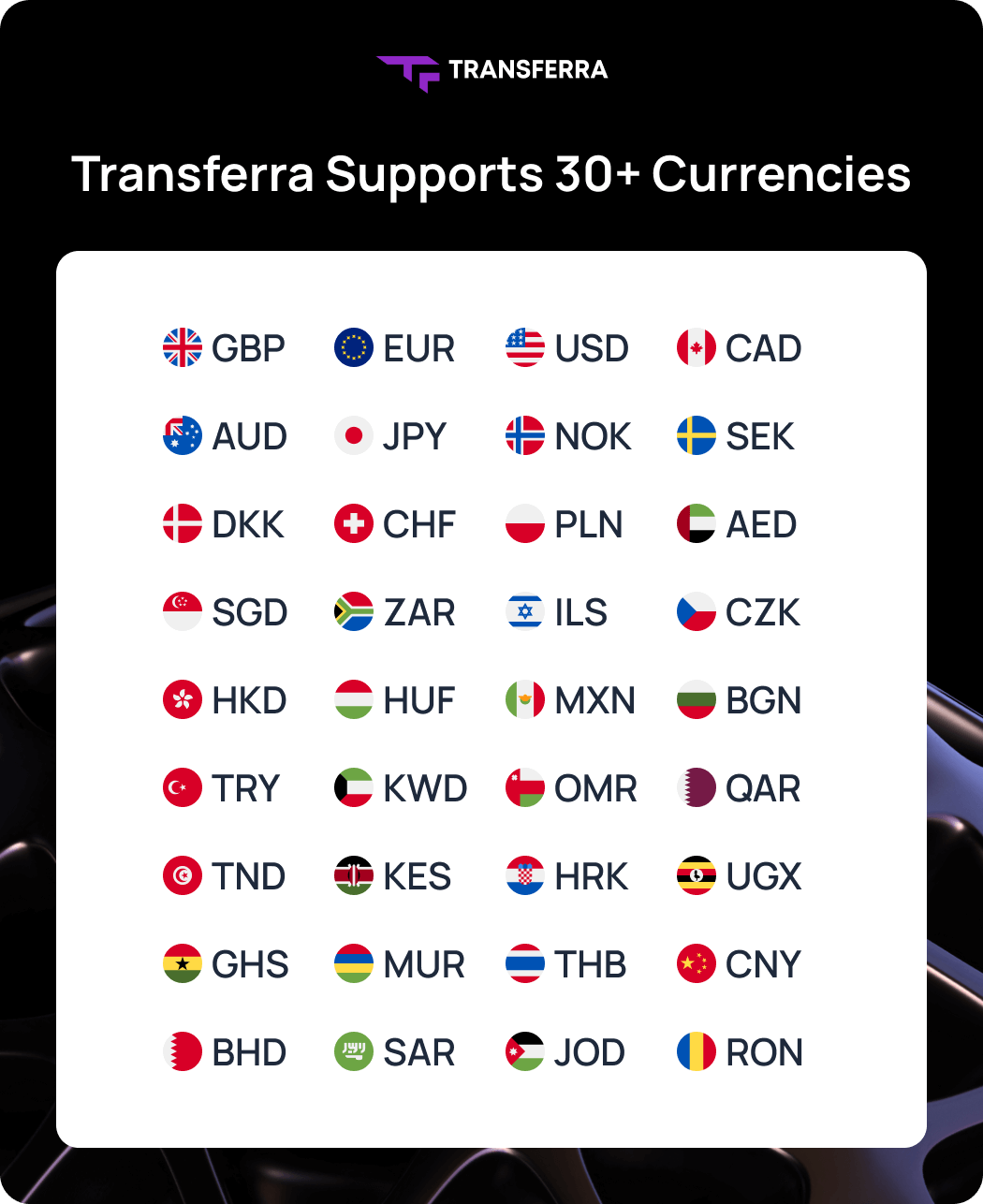

The leading provider of effective and reasonably priced cross-border bill payment options is Transferra, which makes it simple for users to pay international bills and invoices by supporting 30+ currencies.

Cross-Border Payments with Transferra

How does cross-border payment work? Transferra provides a comprehensive cross-border payments platform, addressing common issues such as high fees, lengthy processing times, currency conversion complexities, and transparency gaps in global transactions.

Top 5 Key Benefits for International Payments with Transferra

- Intuitive currency exchange interface for easy tracking of rates and fees is beneficial for both businesses and individuals navigating global transactions

⠀ - Competitive exchange rates with full fee transparency are ideal for savvy consumers and cost-conscious businesses managing international finances

⠀ - Real-time transaction tracking ensures security and peace of mind, which is valuable for anyone sending or receiving funds across borders

⠀ - Clear pricing policy builds trust and understanding, which is especially beneficial for businesses and individuals seeking clarity in their financial dealings

⠀ - Personalised support on international payments and currency exchange enables informed decisions and risk mitigation, a valuable resource for businesses and individuals managing cross-border finances