Best 5 EMIs for a Business Account 2025

Whether you’re a startup or an established enterprise, choosing the right EMI can streamline your operations. This article highlights the top 5 EMIs that offer excellent business account features, helping you manage payments, currency exchange, and more efficiently.

With the advent of 2025, the fintech industry and Electronic Money Institutions (EMI) have progressed and focused more on digital solutions. The global fintech market is expected to surpass $340 billion, thanks to developments in areas like decentralised finance and embedded finance. EMIs are considered to be important in this ecosystem as they provide digital payment services and electronic money that meet the requirements of users and companies. They can operate faster than traditional banks and offer more cost-effective services. Such features make them key players in facilitating cashless payments and access to financial services.

EMI provided IBAN accounts are important for businesses because they are flexible, support global transactions, and align with digital trends. These accounts allow users to execute online transactions more easily and affordably compared to traditional banks. EMIs leverage technology to provide valuable features, including budgeting tools and electronic wallets, which are useful in the expanding digital landscape.

There are a few key factors to consider when evaluating EMI accounts. Key features include the range of services available, such as payment options and integration with other financial services or tools. Secondly, you must consider the fees charged by a particular platform. Generally, EMIs offer lower fees than traditional banks. Thirdly, the user experience is also significant, as it encompasses the ease of account setup and the convenience of using digital platforms on the go. Fourthly, robust security measures are crucial when selecting any EMI account. Strong cybersecurity protocols are necessary to safeguard user funds and personal information and to comply with regulatory requirements.

What Is an EMI Account?

An Electronic Money Institution (EMI) is a financial organization authorized to issue electronic money and offer payment services, primarily to facilitate digital transactions. Unlike conventional financial institutions that provide services such as loans and savings accounts, EMIs focus on managing electronic payments and digital wallets. They do not offer lending services, which distinguishes them from traditional banks. EMIs operate under specific regulations that govern their activities, ensuring compliance while also fostering innovative approaches within the financial sector.

Benefits of IBAN Accounts within EMIs

IBAN accounts offer numerous advantages for both individuals and companies. One of the main benefits is the multi-currency functionality they provide, which allows users to conduct transactions in different currencies without converting them through traditional banks. This feature is especially useful for businesses engaged in international trade or for individuals who frequently relocate. EMI accounts typically incur lower fees than traditional banks, resulting in reduced transaction costs and the avoidance of hidden charges. Additionally, EMIs process transactions more quickly, enabling rapid payments and exchanges that enhance overall productivity. In the evolving landscape of digital finance, EMI accounts cater to diverse customer needs by offering convenience and innovative ways to manage money.

Key Criteria for Choosing the Best Fintech EMI Accounts

When selecting the ideal Electronic Money Institution (EMI) account, it is important to consider several key factors to ensure that the service aligns with your financial objectives. Here are the main aspects to evaluate:

- Features

Evaluate the benefits of an EMI account to determine if it meets your needs. Look for accounts that provide International Bank Account Numbers (IBANs) to simplify foreign transfers. Multi-currency support is essential for users who frequently conduct cross-border transactions or travel, as it enables them to hold and manage funds in various currencies without incurring high conversion fees. Additionally, virtual cards enhance security and convenience by allowing users to shop online without exposing their primary card information. - User Interface and App Experience

A simple, easy-to-use app is crucial for effectively managing your account. The user interface should be intuitive, allowing you to navigate features such as transaction histories, fund transfers, and account settings with ease. A robust mobile app ensures that you can manage your finances anytime and anywhere. An exceptional user experience can significantly impact customer satisfaction and loyalty. - Security and Compliance

Security is paramount when choosing an EMI account. Ensure that the institution adheres to strict security protocols and regulatory requirements. Verify that it complies with guidelines established by authorities such as the UK Financial Conduct Authority (FCA) and, where applicable, the Payment Services Directive 2 (PSD2) in Europe. These regulations are designed to protect your funds and personal information, ensuring that the institution operates in a secure and transparent manner. - Customer Support Quality

High-quality customer service can greatly influence your overall experience with an EMI account. Check whether the institution offers multiple support channels—such as live chat, email, or phone support—and assess the responsiveness and expertise of their customer service representatives. Reading customer reviews and ratings can also provide valuable insights into the reliability and effectiveness of the support provided.

The Top 5 Fintech EMI Accounts

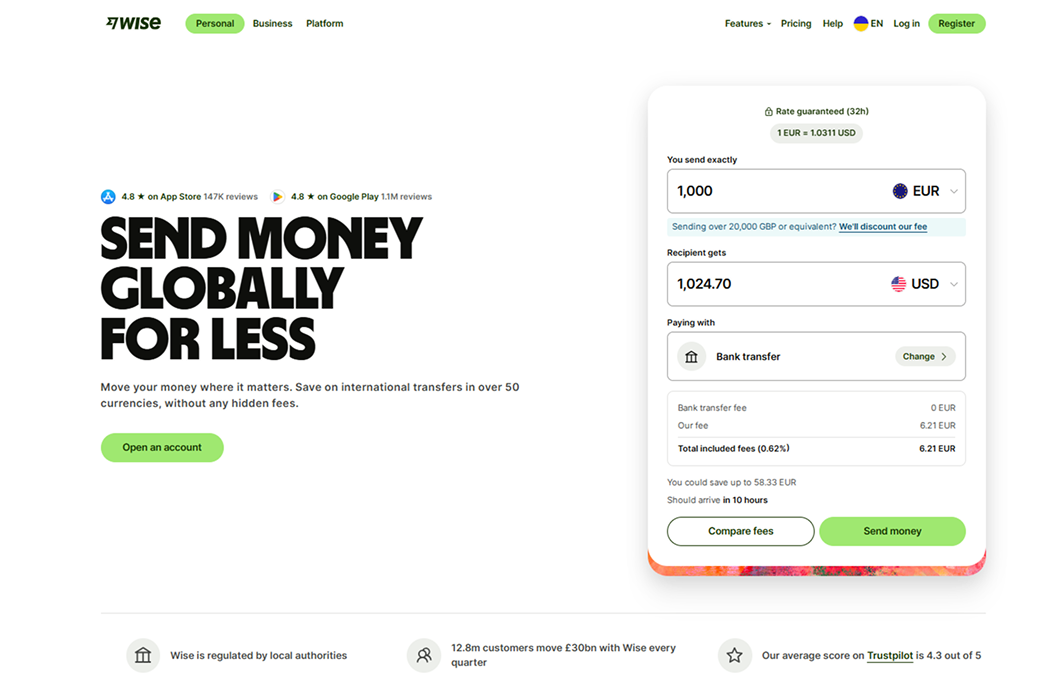

Wise Payments Limited (United Kingdom)

Wise Payments Limited focuses on international money transfers and provides services for both personal and business needs. This includes IBANs, prepaid cards, and international payments. The company works in over 70 countries and offers comparably low exchange rates with no extra fees. Their platform is easy to use, featuring straightforward costs and well-rated mobile apps for iOS and Android.

Main features

- Multi-currency account

- Payments to 70+ countries

- Debit cards

- Bulk payments

- Currency exchange in 50+ currencies

Pros

- Fast transactions to 70+ countries: Wise leverages local bank transfers to facilitate speedy international transactions, ensuring funds typically arrive faster than traditional wire transfers.

- Support of 50+ currencies: By offering transactions in over 50 currencies, Wise makes it easy for users to send, receive, and convert money globally.

- Rates match the midmarket exchange rate with no hidden fees: Wise provides exchange rates that closely mirror the midmarket rate, ensuring transparency and fairness without any concealed charges.

- Suitable for individuals and businesses: The platform is designed to accommodate both personal and commercial needs, offering a user-friendly interface for individuals and robust features like batch payments and multi-currency accounts for businesses.

Cons

- Currency exchange rate fluctuations: Despite using transparent midmarket rates, the inherent volatility of currency markets can lead to fluctuations during the transfer process.

- Not always suitable for high-value transactions: For very large transfers, the structure and fees of Wise might not be as competitive as specialized financial services. Additionally, regulatory checks and additional processing steps can lead to delays with high-value amounts.

- Unexpected account freezings and blockages: There have been reports of accounts being frozen or blocked unexpectedly without notice.

- Limited customer support: Some users find Wise’s customer support less responsive and slow, particularly in urgent situations. This limitation may lead to frustration when quick assistance is needed to resolve account or transaction issues.

Who It’s Best For

Wise is ideal for freelancers and international travellers looking for affordable and efficient ways to send or receive money globally. Enterprises and financial institutions can also benefit from its bulk payment capabilities.

Tariff Plans

Wise offers tailored plans for individuals and businesses, providing competitive rates and easy management of cross-border transactions. Business accounts include additional tools such as IBANs and bulk payment options, making Wise a strong choice for SMEs and larger enterprises. Registration is completely free, and Wise does not charge monthly fees or subscriptions. Instead, fees are applied based on the services used.

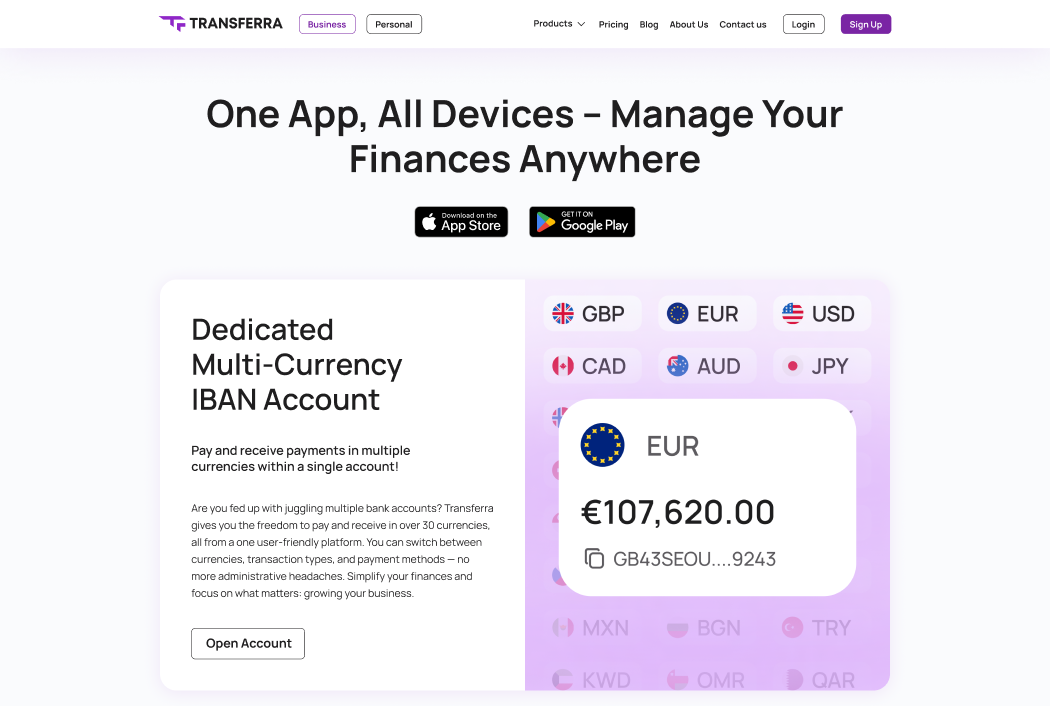

Transferra UN Limited (UK)

Transferra is a UK-based electronic money institution that provides companies with IBAN accounts that support multiple currencies, which is great for foreign transactions. The platform allows SEPA and SWIFT transfers, offers debit VISA cards that work with Apple and Google Pay, and provides top-notch assistance for customers with a personal account manager.

Main features

- Multi-currency accounts

- Payments to 180+ countries: SEPA, SEPA Instant, SWIFT, Bacs, Chaps, Faster Payments

- Currency exchange in 35+ currencies

- Visa debit cards with Apple & Google Pay

- Personal dedicated account manager

- iOS and Android app

Pros

- Personalised Service: Dedicated account managers offer tailored support and advice, promising smooth and informed decision-making for businesses, particularly those with complex or high-value transactions.

- Large Transaction Handling Capability: Transferra can process large transactions without limits, making it suitable for businesses in international trade, e-commerce, and other sectors requiring substantial payments.

- Debit cards: Transferra offers virtual debit cards with unlimited card issuing and Apple and Google Pay options.

- Fast Payments Across Key Markets: Quick transfers in the UK and Europe help businesses meet deadlines and seize business opportunities without delays. Payments to the rest of the world are also available.

Cons

- Detailed Onboarding Process: The thorough onboarding process may take longer, especially for larger businesses due to the high security measures. Small startups may find it more straightforward.

- Geographical Limitations for Non-UK Users: Transferra’s risk-based policy limits access for non-UK businesses, which could impact their access to certain features and services.

- No Support for GCash Transfers: The absence of GCash support may affect Filipino users or businesses that rely on this popular money transfer service.

Who It’s Best For

Transferra is ideal for:

- SMBs and startups are looking for reliable international payment processing.

- E-commerce and digital businesses and those involved in international trade need multi-currency support and fast transactions.

- Companies that require premium customer service and large transaction handling capabilities.

Tariff Plans

Transferra UN Limited offers plans for both businesses and individuals, however, their services are suited more for business clients. For business clients three different account packages are provided, each with its own fees for opening and maintaining an account. Pricing plans differ based on the business risk type, but an individual approach is guaranteed.

PaySet (United Kingdom)

PaySet Limited is a UK-based electronic money institute giving multi-currency IBAN accounts. It offers services for individuals, workers, small businesses, and large enterprises, making it easy to handle foreign transactions. PaySet includes a prepaid card and works with many payment systems, making it great for people handling funds from different countries or using different currencies.

Main features

- Multi-Currency Account

- Payment Networks: SWIFT, SEPA, ACH, Fedwire, Faster Payments, BACS, and CHAPS

- Currency exchange in 34 currencies

- Prepaid Card: Online, in-store, or ATM transactions

- Personal Account Manager

Pros

- Receive money in 34 currencies and send in up to 38 currencies: This feature enables users to conduct international transactions with ease, accommodating a wide range of currencies for both receiving and sending funds.

- Diverse payment networks: By integrating multiple payment networks such as SWIFT, SEPA, ACH, Fedwire, Faster Payments, BACS, and CHAPS, PaySet ensures that users have access to various international and domestic transfer options, enhancing transaction flexibility.

- Prepaid cards are usable globally for online, in-store, or ATM transactions: The availability of globally usable prepaid cards provides a convenient way for users to manage and access their funds wherever they are in the world.

- No fees for sending money to other PaySet accounts: This fee-free feature for internal transfers encourages seamless and cost-effective transactions between users within the PaySet ecosystem.

Cons

- Includes expensive monthly maintenance and transaction fees: The platform imposes high costs through various fees, which may discourage users from utilizing its services for regular transactions.There are no specific limits on transactions, but larger payments might need extra checks to prevent scams.

- No mobile app: The absence of a robust mobile app limits the flexibility and accessibility for users who need to manage their accounts while traveling or away from a desktop.

- Safeguarded funds are not covered under the FSCS scheme: Despite funds being safeguarded, users do not receive the additional protection offered by the FSCS, potentially exposing them to higher risk in adverse situations.

- Not straightforward account registration: Some reviews have pointed out problems with registering.

Who It’s Best For

PaySet is perfect for businesses and people who want to handle international payments easily. Freelancers and small businesses will benefit from its ability to handle multiple currencies, making it easier to pay employees or get money from clients around the world. Startups, businesses, and sellers in partner marketing or import/export can take advantage of its easy cross-border payment options. It’s also good for people who regularly send money to family in other countries or who travel and spend money abroad.

Tariff plans

There are dedicated services tailored to meet individual and business needs. Account opening is free for both personal and business accounts, but the free registration offer for business accounts is available for a limited time. PaySet does not charge any monthly fees for personal accounts; however, a fee of £49 may apply after the first three months for business accounts.

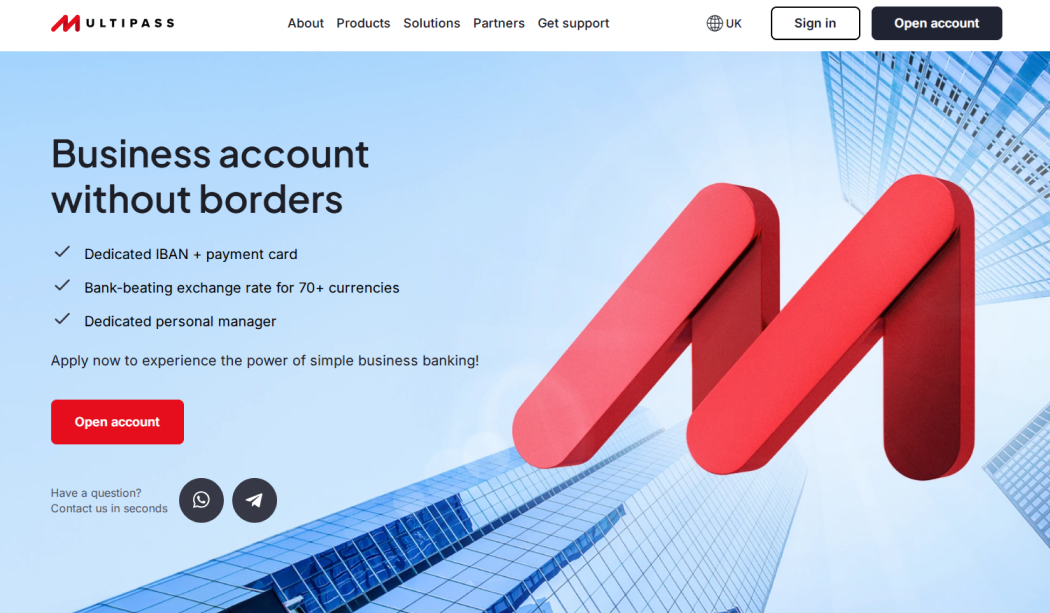

MultiPass Platforms Limited (United Kingdom)

MultiPass is a UK-based startup bank built for foreign companies. It provides virtual IBANs in multiple currencies, local accounts in the UK, US, and EU, and business expense cards. It stands out by making cross-border payments easier for small and medium-sized businesses, using new technology and providing personalised customer support.

Main features

- Multi-currency account

- Currency exchange in 70+ currencies

- Dedicated Personal Manager

- Payments to over 200+ countries

- Batch Payments

- API Integration

- Virtual & Physical card

Pros

- Cost-effective: Offers competitive exchange rates (0.2%–2%) and low payment fees starting at GBP 0.50.

- Global reach: Supports 30+ currencies and enables payments to over 180 countries, including local payment options in 20+ markets.

- Convenience: Provides multi-currency accounts, virtual and plastic cards, and dedicated local account details in the UK, EU, and US.

Cons

- Limited availability: Currently serves businesses registered only in select countries like the UK, EU, and UAE.

- No physical branches: Operates as a fully digital service, which may not suit those preferring in-person banking.

- Higher fees for SWIFT payments: Global transfers via SWIFT can incur higher costs compared to local payment options.

Who It’s Best For

MultiPass is great for small and medium-sized businesses (SMEs), startups, and international enterprises such as IT companies, marketing firms, and e-commerce businesses. It is ideal for businesses that often make payments in different countries or use various currencies.

Tariff plans

MultiPass Platforms Limited primarily serves businesses; there are no tailored services available for individuals. Opening an account and completing the required due diligence involves certain fees. The standard account opening and verification process starts at £500. An additional £500 fee applies if a client requests priority onboarding for faster processing. Adding an extra user costs £100 after the account is set up. Additionally, an annual due diligence examination starts at £100 if ownership remains unchanged.

The monthly account maintenance fee starts at £100. Clients must maintain a minimum balance equivalent to at least three months’ fees. If the minimum balance falls short, a £100 charge is applied each month. A £500 penalty is imposed if the required documentation or information is not provided upon request. If an account needs to be closed, the closure fee is at least three months’ fees.

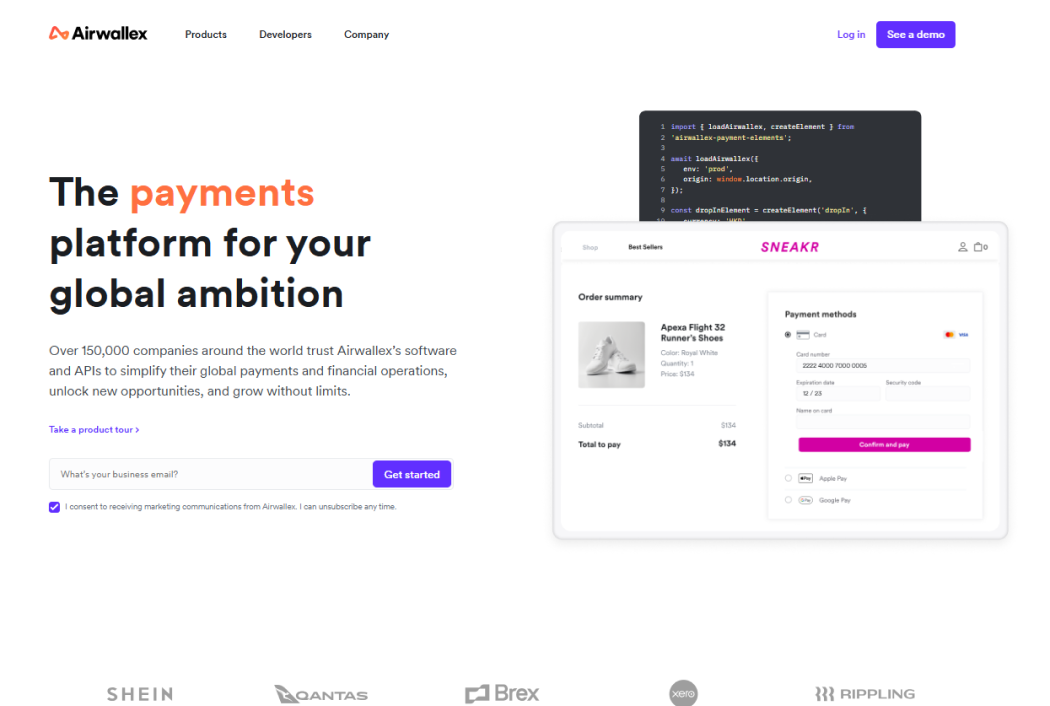

Airwallex (UK) Limited (United Kingdom)

Airwallex provides various digital options for businesses that work globally. It offers fast and cheap worldwide payment options, including global accounts, payment cards, and other financial services for businesses. Its services are especially helpful for companies wanting to make cross-border payments and handle different currencies easily, without worrying about hidden fees. Most foreign transfers are processed quickly, with approximately 70% completed on the same day.

Main features

- Multi-currency accounts

- Payments to 150+ countries

- Currency exchange in 60+ currencies.

- Batch transfers

- Virtual VISA cards

- Individual permissions for employees and third parties

- Connection with accounting software such as HubSpot, Xero, and Quickbooks

Pros

- Low Fees: No account setup or maintenance fees, with competitive rates for international transfers and currency conversion.

- Efficient Expense Management: Automated approval workflows and real-time visibility over team expenses make managing finances easier.

- Flexible Payment Solutions: Integration with platforms like Shopify, WooCommerce, and personalised payment links help businesses accept payments from customers worldwide.

Cons

- Limited Customer Support in the UK: Unlike some competitors, Airwallex lacks dedicated phone support in the UK, offering only online assistance.Detailed information about customer support is also relatively limited.

- Additional Fees for Employee Cards: While the first five employee cards are free, there’s a £5 monthly fee for each additional cardholder.

- High Card Payment Processing Fees: The fees for accepting card payments can be high, ranging from 1.30% to 3.15% plus £0.20 per transaction.

- Interface complexity: Managing multiple accounts and wallets, and understanding the many different fees for each service can be overwhelming.

Who It’s Best For

Airwallex is ideal for individuals, small to medium-sized businesses (SMBs), and businesses, especially those with global operations. Its worldwide presence, ability to handle different currencies, and tools for managing expenses make it a strong option for businesses willing to make their financial management easier across countries. eCommerce businesses can easily connect with platforms like Shopify and WooCommerce. International companies can also pay their workers and sellers in different countries without any hassle.

Tariff Plans

While Airwallex’s pricing structure is simple, it is important to note that fees vary depending on the country in which you open your account. But in most countries account opening is free with zero account maintenance fees. Zero fees are also applied to card issuing.

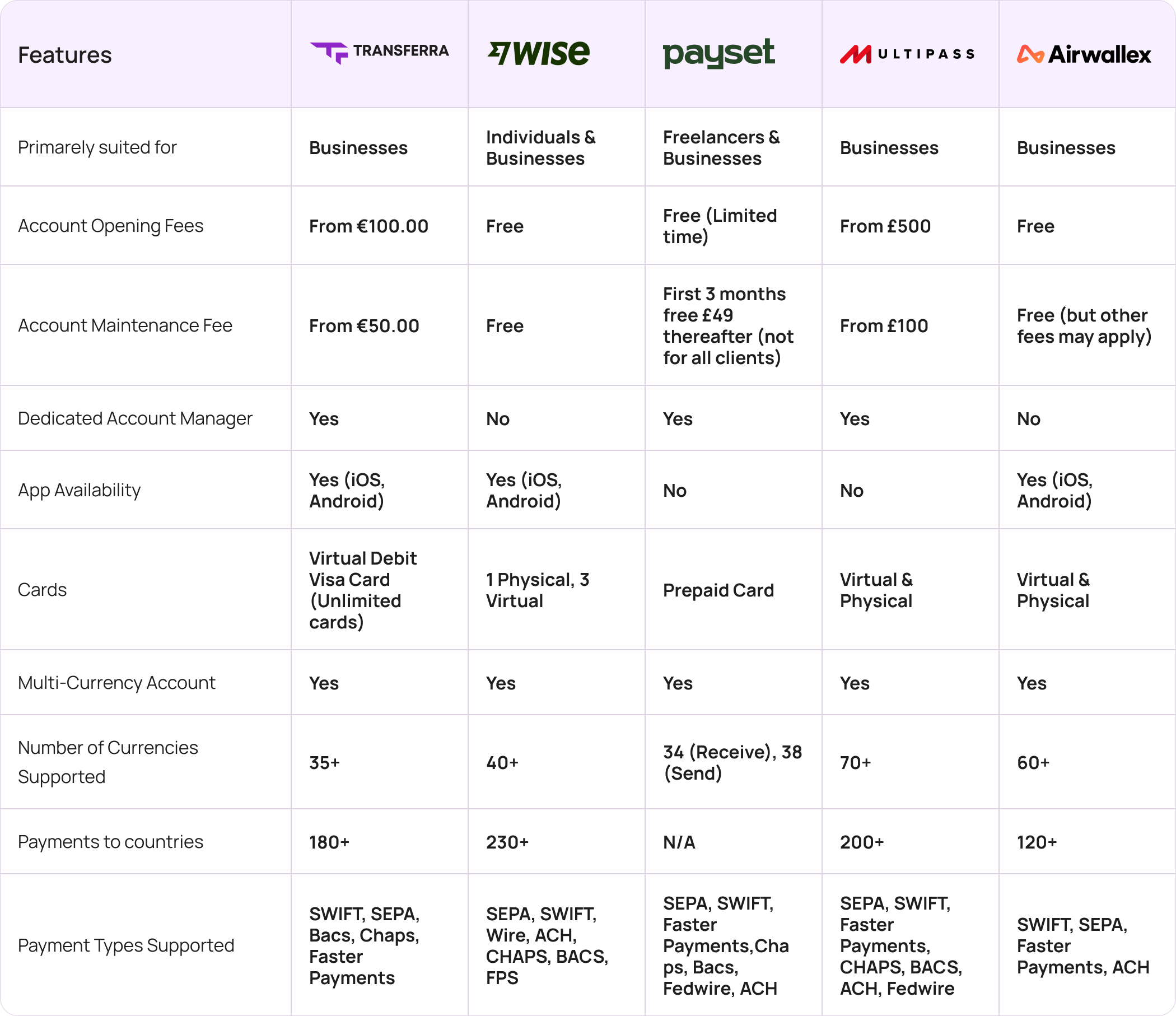

Comparison

How to Choose the Right EMI Account for You

Selecting the right Electronic Money Institution (EMI) account requires careful consideration of your specific needs and priorities. Here are some practical tips to help you make an informed decision:

- Evaluate Your Transaction Frequency: If you plan to make frequent transactions, look for an EMI that offers low fees. Some EMIs charge lower rates for regular transfers, which can save you money over time.

- Consider Multi-Currency Support: For individuals or businesses involved in international trade, it’s essential to choose an EMI that provides multi-currency options. This feature allows you to hold and manage different currencies, making it easier to conduct cross-border transactions without incurring high conversion fees.

- Check the User Experience: A user-friendly interface and a well-designed mobile app can greatly enhance your experience. Make sure that the EMI you choose has a straightforward setup process and easy navigation for managing your account.

- Look for Security Features: Security is crucial when handling financial transactions. Prioritise EMIs that implement strong security measures, such as two-factor authentication and encryption, to protect your personal and financial information.

- Assess Customer Support: Good customer support can make a significant difference if you encounter issues with your account. Choose an EMI that offers responsive customer service through various channels, such as chat, email, or phone.

- Review Additional Features: Some EMIs offer extra features like prepaid cards, budgeting tools, or integration with other financial services. Consider what additional functionalities might benefit you or your business.

By focusing on these factors, you can select an EMI account that aligns with your financial goals and usage patterns.

Conclusion

Selecting the right Fintech EMI account is important for handling your money well in today’s digital age. The best choice will rely on what you need and prefer. If you’re a worker looking for affordable payments or a business that needs help for multiple currencies, your options will vary. It’s important to look at and compare different EMIs to find one that meets your needs. Take time to look at different options in the market so you can make the best decision for your financial future.