Virtual Cards: a Full Guide to a Modern Payment Method

Unlock the power of virtual cards – a modern payment revolution. Explore enhanced security and streamlined transactions in our comprehensive guide.

In today’s rapidly advancing digital landscape, traditional payment methods are being swiftly replaced by innovative and secure alternatives. One such groundbreaking development is the emergence of virtual cards, which have revolutionized the way we make online transactions. Unlike their physical counterparts, virtual payment tools offer unparalleled convenience, enhanced security, and a host of other benefits that cater to the modern needs of individuals and businesses alike.

What are Virtual Cards?

Virtual cards are a digital counterpart to conventional payment methods, such as credit or debit options. Rather than having a physical form, they exist solely in the digital realm and are designed for online and mobile use. They serve as a bridge between the user’s primary payment method and the merchant, facilitating seamless and secure transactions over the Internet.

How Virtual Cards Work

Digital payment alternatives operate on a sophisticated technology infrastructure that enables secure and seamless digital transactions. Understanding the underlying mechanisms can shed light on their efficiency and widespread adoption.

At the core of this payment method is tokenization, a process that replaces sensitive payment information with unique identification symbols, known as tokens. When a user initiates a transaction, the virtual card’s token, rather than the actual details, is transmitted to the merchant. This ensures that the user’s primary financial data remains secure, as tokens are meaningless to potential cybercriminals.

Tokenization enhances security significantly as even if a data breach occurs at the merchant’s end, the stolen tokens are useless outside of that specific transaction. Moreover, tokenization is often complemented by encryption, making it exceptionally challenging for hackers to decipher the information in transit.

Issuing and Funding Virtual Cards

The process of obtaining an electronic card is typically straightforward and can vary depending on the provider. Users can usually request a it through their banking or financial institution’s website or mobile app. You may need to provide authentication details, such as a one-time password (OTP) or biometric confirmation, to ensure the issuance is secure.

Upon approval, the card is generated with a unique number, expiration date, and CVV. You can fund it by linking it to the existing credit or debit card or transferring funds directly from your bank accounts.

Virtual cards can be issued for single-use, meaning they are valid for one transaction only, or for specific periods with pre-defined spending limits. This level of customization provides users with greater control over their finances and minimizes the risk of unauthorized usage.

Types of Virtual Cards

There are several types of virtual cards to provide users with a wide array of options to suit their specific needs and preferences. From everyday online shoppers to corporate executives managing business expenses, online payment instruments offer a flexible and secure solution for the modern era of digital payments.

Personal virtual cards offer a secure and convenient method for online shopping, subscription services, and other digital transactions. They are typically linked to the user’s existing credit or debit card or can be preloaded with funds from a bank account. This type is often single-use or limited in validity to enhance security, protecting users from potential fraud or unauthorized charges.

Business virtual cards are tailored for corporate use and offer a more efficient way for companies to manage expenses. They provide organizations with enhanced control over employee spending, as each card can be issued with specific spending limits and validity periods. Businesses can issue them to employees for travel expenses, vendor payments, or any other business-related transactions.

Virtual gift cards have gained popularity as a convenient and versatile way to give gifts for various occasions. They function similarly to physical alternatives, but instead of a physical piece of plastic, they are delivered electronically via email or SMS.

Prepaid virtual cards are commonly used for one-time purchases, trial subscriptions, or when users want to control their spending for specific transactions. They are an excellent option for individuals who prefer not to link their primary payment methods to online services or who want to ensure they do not exceed a set budget.

Travel virtual cards offer added security and convenience, particularly when travelling internationally. Users can fund them with the required foreign currency, reducing the risk of currency conversion fees and potential exchange rate fluctuations. Additionally, travel cards can be easily monitored through mobile apps, allowing users to track their expenses while on the go.

Benefits of Virtual Cards

Whether you are using them for business use or personal transactions, these digital wonders offer a plethora of advantages that cater to the diverse needs of modern users.

Benefits for Businesses

- Cost savings. Unlike traditional corporate cards that may carry annual fees or incur transaction charges, the digital alternative often comes with lower costs and reduced overhead, resulting in substantial savings for companies.

- Streamlined expense management and reporting. Electronic corporate cards simplify expense tracking and reporting for businesses. Companies can issue them to employees for specific purposes, such as travel expenses or vendor payments. The transaction details associated with each employee can be easily monitored, providing accurate and real-time data for efficient accounting and financial analysis.

- Enhanced control and spending limits. Business virtual cards allow organizations to exert precise control over spending. You can configure them with predefined spending limits, transaction categories, and validity periods. This level of customization empowers businesses to manage employee spending effectively and mitigate the risk of unauthorized purchases.

Consumer Benefits

- Convenient and instant issuance. Users can create virtual cards through their banking apps or other digital platforms with just a few clicks. This swift issuance ensures that users have access to a secure payment method whenever they need it, without the hassle of waiting for a physical card to arrive in the mail.

- Accessibility for individuals without traditional bank accounts. By linking virtual cards to prepaid accounts, users can enjoy the benefits of digital payments, even without a formal banking relationship. This inclusivity fosters financial inclusion and empowers more people to participate in the digital economy.

- Reduced risk of identity theft and skimming. As electronic cards are primarily used for online transactions and are often single-use or limited in validity, the risk of identity theft and skimming is significantly reduced.

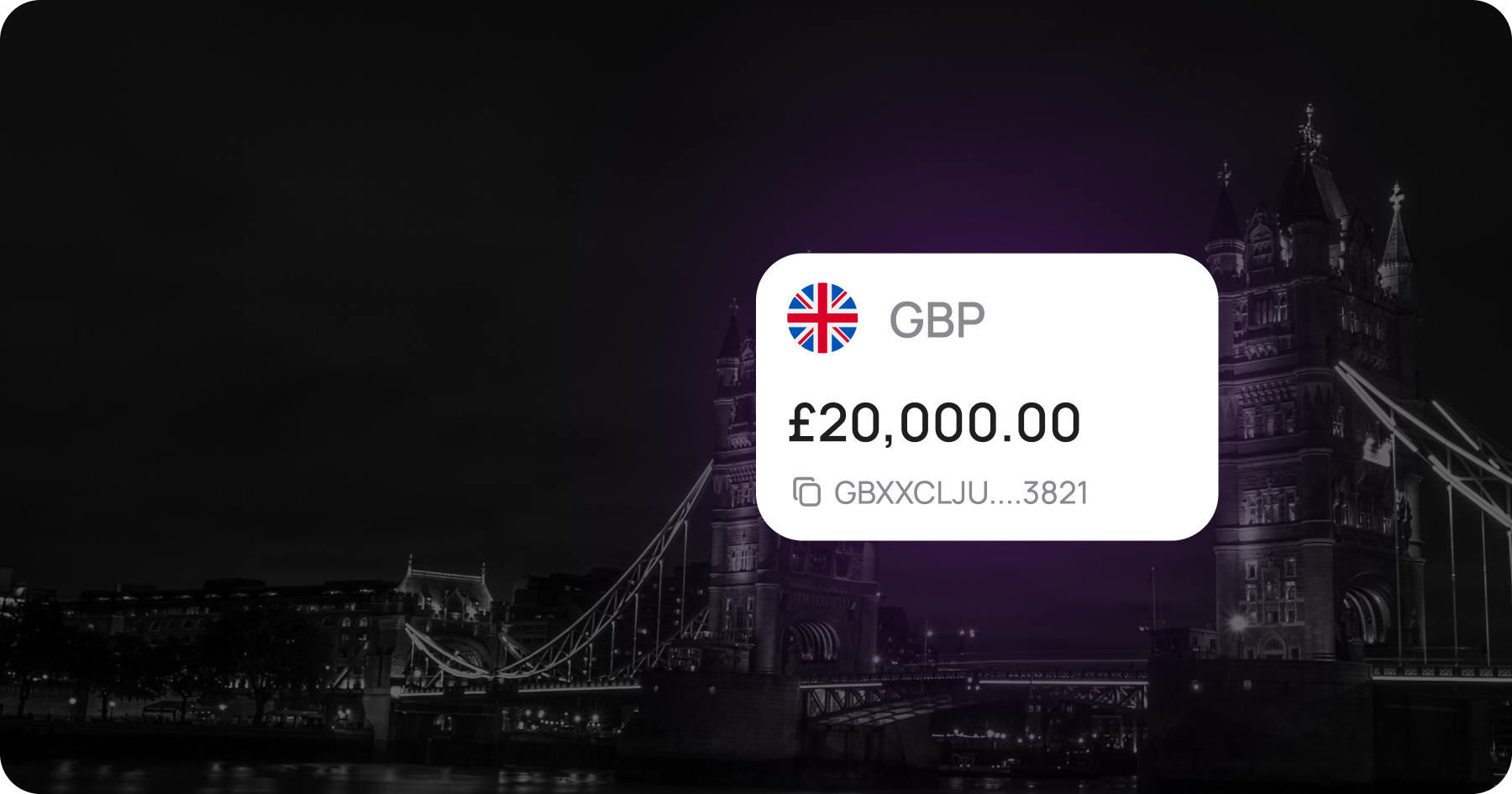

Transferra Corporate Virtual Cards

As the demand for streamlined expense management and enhanced financial control continues to rise, businesses are actively seeking innovative payment solutions that meet their unique requirements. Transferra has stepped up to the plate by offering cutting-edge solutions tailored explicitly for businesses.

Here are just some benefits we offer to businesses:

- Seamless integration and instant issuance. Transferra’s virtual cards seamlessly integrate with existing business processes and financial systems, making the transition to this modern payment solution effortless. Through a user-friendly online platform, businesses can easily request and generate virtual cards for their employees or departments within minutes.

- Enhanced expense management and reporting. Keeping track of business expenses is a critical aspect of financial management. Our solution simplifies this process by enabling businesses to set spending limits and transaction categories for each employee. As employees use them for specific purposes, all transactions are automatically categorized, providing real-time, detailed reports that streamline expense tracking and accounting. This level of visibility and control allows businesses to make informed financial decisions and reduce the administrative burden of expense reporting.

- Tailored spending controls. With Transferra’s solution, you can define spending limits for each employee, ensuring that they can only use the card up to a predetermined amount.

- Advanced security measures. Transferra leverages a cutting-edge 3D authentication protocol to verify the identity of cardholders during online transactions. This innovative security measure goes beyond traditional 2FA by introducing an additional layer of authentication, adding an extra dimension to the security experience.

- Dedicated customer support. Transferra is committed to providing exceptional customer support to clients. A dedicated team of experts is readily available to assist with any inquiries or concerns related to cards or the platform’s functionality.

Sign up for Transferra corporate virtual card waiting list today to optimize your financial operations while reducing costs and risks.

FAQ

Do virtual cards work with mobile wallets?

Yes, they can be easily integrated with popular mobile wallet applications, such as Apple Pay and Google Pay, for secure and convenient in-store and online payments, provided that the virtual card has the required integration. Always verify with the provider whether they support integration with mobile wallets.

Are there any limitations or drawbacks to using virtual cards?

Some limitations include merchant acceptance, reliance on internet connectivity, and potential regulatory considerations. Always verify the acceptance policies of merchants.

Can I use virtual cards for international transactions?

Yes, they are commonly used for international transactions. However, it’s important to note that the currency handling may vary.

In most cases, you will find single-currency cards, and when used for international purchases, the exchange rate is determined by Visa or Mastercard’s prevailing rates at the time of the transaction.

There are also multicurrency virtual cards that can hold multiple currencies within a single account. When making international transactions in a foreign currency, there is no need for FX conversion.

Are virtual cards secure for online payments?

Yes, they are designed with robust security features, such as tokenization, encryption, and two-factor authentication, to protect against fraud and unauthorized use.

Is a digital card the same as a virtual card?

A virtual card exists exclusively on your phone or digital device. It functions like a regular payment card, allowing you to make contactless payments in stores or online. A digital card is a digital copy of your physical bank card that is stored on your phone. It mirrors the information found on your physical card, including the number, expiration date, and CVC. This option serves as a convenient and secure backup, enabling you to make payments using your phone.