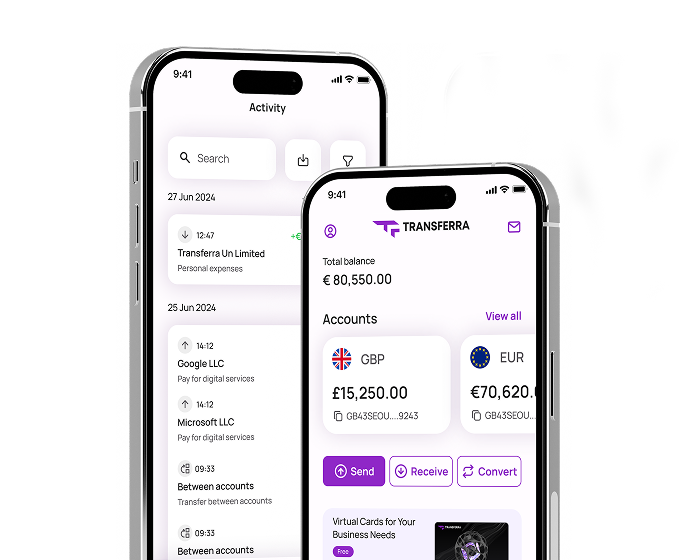

Open a Business Account for Non-UK Residents

If you're a non-resident running an international business, Transferra can help you open a UK account. No complicated steps, no long waiting - just simple access to tools for cross-border payments.

Your Gateway to Global Business Operations

Transferra makes it possible for non-UK residents to open a business account in the UK. Our platform is designed to cater to the unique needs of entrepreneurs that are based overseas. Whether you're looking to set up a UK presence or searching for ways to manage your international transactions, we can help.

Make Payments to 180+ Countries

Whether you're paying suppliers abroad or sending salaries to international teams, Transferra helps you send money easily across borders. We support payments through SWIFT, SEPA, and local methods like CHAPS, BACS, and Faster Payments.

Online Onboarding

Transferra’s online onboarding is fast, simple, and fully remote—no paperwork, no fuss. Get your business account up and running without stepping out of your office.

40+ Currencies

We support over 35 currencies, including EUR, USD, and GBP. You can also send and receive payments in more exotic ones like AED, CNY, CZK and more.

Low FX rates

Transferra offers low FX rates, making international payments cost-effective. With transparent pricing and no hidden fees, you always know exactly what you're paying for.

Unlimited Visa Cards

Transferra provides unlimited virtual Visa cards to simplify expense management and boost financial control. Easily issue, track, and manage cards for your entire team without extra fees.

Open Your Business Account as a Non-UK Resident Fully Remotely

Our platform offers a user-friendly interface that makes it easy to open an account in just a few steps. Apply online, and we'll guide you through the entire process, from start to finish

Register an account and complete the online onboarding

Provide Supporting Documentation

Receive approval and meet your Dedicated Manager

Start enjoying low FX rates, unlimited cards with Apple & Google Pay and much more!

Documents For Opening a Business Account as a Non-Resident

To open a business account in the UK as a non-resident, you'll need to provide proof of identity, proof of address. Our platform makes it easy to upload and submit these documents securely, so you can get your account up and running quickly.

Legal documents:

Company name

Company number

Articles of Association

Good Standing

Fill out the questionnaire

Agreements and invoices

Why Choose Transferra?

With Transferra, your business can easily manage money from abroad. We offer great rates and support multiple currencies. You also get a dedicated account manager for support or consultation on any payment matter.