The Next-Level Virtual Cards for Business

Virtual cards for you and your team — track expenses, stay in control, and pay with Apple Pay or Google Pay.

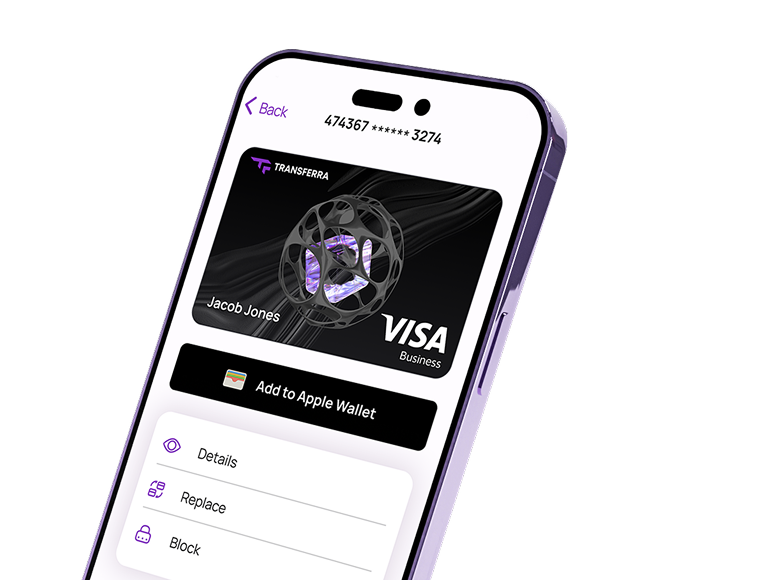

Using Transferra Virtual Cards In-Store & Online

Transferra works seamlessly with leading mobile payment platforms. Simply link your virtual cards and enjoy the convenience of tap-and-go payments wherever you are.

More Benefits for Global Business Owners

Global Acceptance

Transferra's virtual business cards are globally accepted, allowing you and your team to make payments anywhere, anytime.

Unlimited Cards

Create an unlimited number of virtual cards and enjoy high transaction limits that cater to both personal and business needs.

Instant Card Issuance

Transferra offers instant virtual debit card issuance, enabling you to create new cards for team members within seconds.

Centralised Expense Management

With virtual business debit cards, each team member can have their own dedicated card linked to the team account.

Real-time Insights

and Reporting

Transferra provides detailed analytics and reporting, giving you valuable insights into your business spending patterns.

Tailored to Your

Business Type

Our virtual business cards are exclusively designed for business owners, startups, and enterprises.

Open Account

Safeguard Your

Expenses with Secure Virtual Business Cards

Our business cards come equipped with a range of robust security features, ensuring that your funds and sensitive information are protected at all times.

3D Secure Authentication

The 3D authentication protocol verifies the identity of the cardholder, reducing the risk of unauthorised use. With 3D Secure, you can have peace of mind knowing that your online payments are secure and protected against fraudulent activities.

Cards Block/Replacement

Instantly block a business virtual card online to prevent any unauthorised transactions. If needed, our platform allows for seamless card replacement, ensuring uninterrupted access to your funds while maintaining the highest level of security.

Fraud Monitoring

We monitor transactions for suspicious patterns or anomalies, providing an additional layer of protection against unauthorised use or fraudulent transactions. Rest assured that we are continuously working to safeguard your funds and keep your financial information secure.

Frequently asked questions

-

What is a corporate virtual card?

A corporate virtual card is a digital payment method that functions similarly to a physical credit or debit card. A virtual card exists in digital format and is primarily used for online transactions. It contains all the necessary card details, such as the card number, expiration date, and CVV, allowing you to make secure payments over the Internet.

-

What are the business benefits of using corporate virtual cards?

Corporate virtual cards provide a convenient and secure alternative to traditional payment methods. They can be easily managed and accessed through mobile apps or online platforms, offering flexibility and enhanced control over your financial transactions.

-

How long does it take to open a corporate virtual card?

You can open a corporate virtual card as soon as you complete the onboarding process, provided that your company is registered in the European Union (EU).

-

Are corporate virtual cards widely accepted?

Transferra's virtual card supports payments in all currencies, allowing you to conduct business and make payments in various international currencies. Whether you're operating locally or globally, Transferra offers the flexibility to transact in different currencies around the world at favourable exchange rates. Please note that the card balance is available in EUR only.