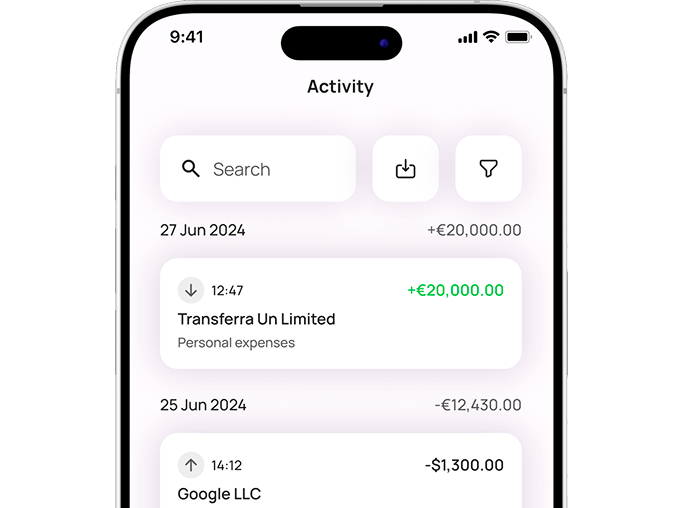

Euro Business Account for Modern Businesses

A Euro Business Account from Transferra gives your company a simple, reliable way to manage euro payments across the EU - all in one platform.

What You Get with a Euro Business Account

A Euro Business Account designed for everyday business operations, cross-border payments, and scalable growth.

Dedicated EU IBAN

Built for EU and international businesses

Seamless SEPA payments

Dedicated EUR IBAN

Your Euro Business Account comes with its own IBAN, allowing you to send and receive euro payments efficiently and professionally.

SEPA Payments Made Simple

Make SEPA transfers quickly and securely across the EEA. Your Euro Business Account supports smooth euro transactions without unnecessary delays.

Key Benefits of a Euro Business Account

Built for Cross-Border Business

If your company works with EU clients, suppliers, or partners, a Euro Business Account helps you operate like a local business while staying international.

Competitive Currency Exchange

Exchange euros alongside 40+ supported currencies at competitive rates, all within one platform.

Clear Payment

Controls

Use payment approvals and templates to manage outgoing payments securely, especially when multiple team members are involved.

Who Is This Euro Business Account For?

Companies

operating in the EU

Holding companies and

multi-entity structures

Businesses managing

regular SEPA payments

International companies that

need a stable EUR account

Security and Compliance You Can Trust

Every Euro Business Account at Transferra operates within a secure and compliant framework. The platform is ISO 27001 certified and follows strict security standards to protect your funds and data. You get modern infrastructure backed by serious compliance — without sacrificing usability.