Global Money Account for International Business

Transferra’s Global Money Account is built for modern businesses operating across borders. Send, receive, and hold funds in multiple currencies to 180+ countries.

Top Reasons for Opening a Global Currency Account

Built for International Business

Easily transact with global clients, suppliers, or global-money-account. A Global Money Account helps streamline international operations and minimize currency conversion costs.

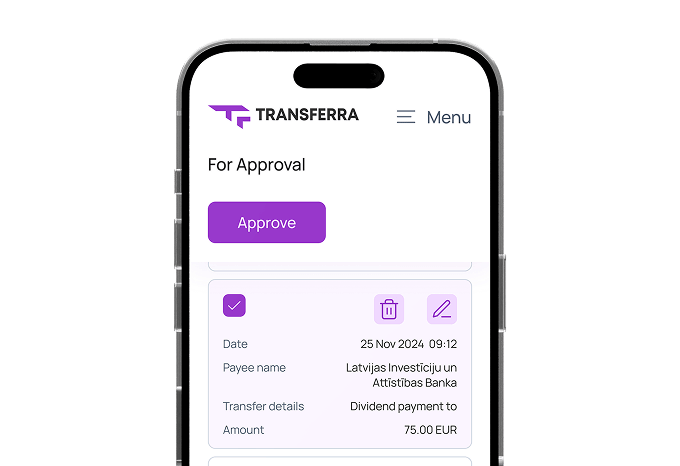

Modern iOS & Android Apps

Easily manage your funds from anywhere using our web or mobile app. Stay connected to your business finances 24/7.

Hold and Convert 45+ Currencies

Manage multiple currencies under one account. Avoid unnecessary conversions and gain flexibility in handling your global payments.

Enterprise-Grade Security

Protect your business with secure login though 2FA or Whatsapp code. Transferra ensures every transaction meets strict compliance and security standards.

Smarter FX Management

Transferra’s Global Money Account lets you hold and convert over 35 currencies on your terms. Protect your funds from unfavourable exchange rates and manage your international operations with ease.

Payment Templates & Approval Workflows

Save time on transfers by using pre-filled payment templates for recurring operations. As well as set up multi-step approval flows to stay in control of outgoing payments. This ensures accuracy, compliance, and full visibility across your finance team.

Benefits of Having a Business Global Account

Global Transfers via SEPA & SWIFT

Transfer money seamlessly through trusted global payment networks. With SEPA and SWIFT your business can send and receive international payments quickly and securely.

Unlimited Virtual Business Cards

Create unlimited virtual cards for your team. Perfect for online purchases or team expenses — all controlled in real-time from your Transferra dashboard.

Competitive FX with No Hidden Fees

With transparent pricing and no hidden charges save time and money while keeping your international transactions cost-effective.

Open a Business Global Account

Experience the convenience of modern financial management by opening a fully digital global account

Create your account today and get started with the online onboarding process

Please submit the required supporting documents

Meet your personal Dedicated Account Manager

Start using Transferra platform and enjoy all benefits

Personalised Service, Every Time

Gain direct access to a dedicated account manager who knows all about your business and is always ready to assist with expert guidance.

Frequently Asked Questions

-

What Is a Global Money Account?

A Global Money Account is a type of account that allows you to hold, send, and receive funds in multiple currencies. It’s ideal for businesses or individuals who work with international partners, receive payments in foreign currencies.

-

What Are the Benefits of Global Account?

With a Global Account, you get access to 45+ currencies, interbank FX rates, faster international transfers, and virtual cards. It helps businesses avoid unnecessary conversions, improve cash flow, and operate smoothly across borders.

-

Are There Any Currency Limits or Restrictions?

No, you can hold and transfer funds in over 35 currencies with no hard limits. Transferra supports international payments to 180+ countries using SWIFT, SEPA, Faster Payments, and more.

-

How Do I Open a Global Money Transfer Account?

You can open a Transferra Global Money Account entirely online. Click “register” and submit your company details and documents, and our team will guide you through onboarding. Most accounts are approved within days.