International

Accounts

Your business operates internationally or you are planning to expand abroad? An international account at Transferra can help you

streamline your financial operations and reduce the costs associated with cross-border transactions.

Open an International Business Account at Transferra - Fully Digital

Get an international account with Transferra for instant global payments to expand into new global markets and manage all your transactions with ease.

New Standard for International Business

Accounts in the UK With Transferra

-

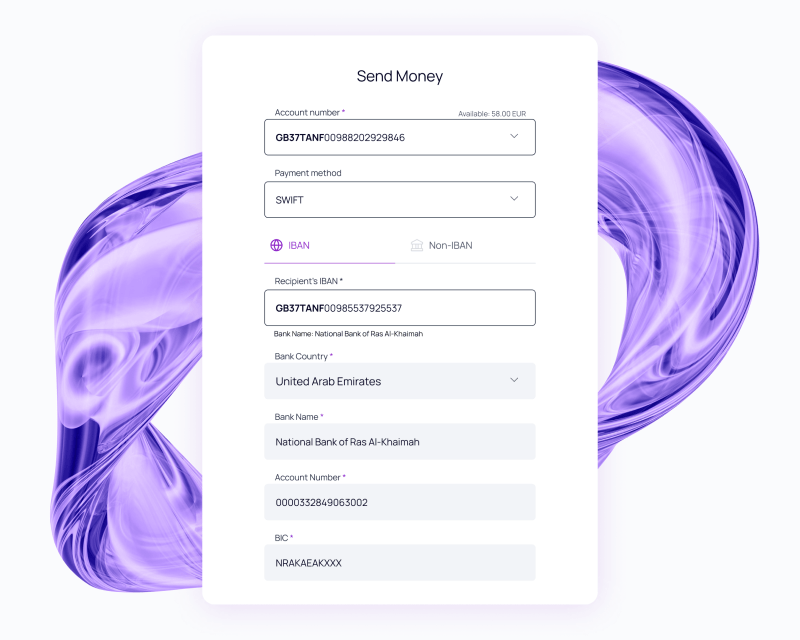

Transferra's platform offers businesses a wide range of payment methods in 10 different currencies. This includes local UK payments such as BACS, CHAPS and Faster Payments, as well as international options such as SWIFT and SEPA.

-

With Transferra's iOS app or via your smartphone browser, you can easily control your funds on the go. This includes checking your balance, making payments and exporting all history in various formats such as CSV and PDF.

-

Transferra's international account allows users to exchange currencies at mid-market rates within seconds, with no hidden fees.This solution ensures that you get the best possible rates, helping you to save money.

-

Transferra uses the most advanced encryption technologies and anti-fraud measures to protect customers' financial information and transactions. All data transmitted between servers and users' devices is secure.

-

SWIFT enables fast, reliable, and secure cross-border payments in over 100 countries, providing a convenient and hassle-free solution for payments to suppliers or receiving funds from customers overseas.

-

Transferra provides users with a comprehensive suite of financial tools that make it easy for business owners to conduct their wealth management.

Benefits of Using an International Business Account

An international account allows users to make and receive payments in multiple currencies and conduct transactions across borders. Also, business owners can get many benefits, including:

-

Multi-currency support helps save money on foreign exchange fees and decreases the risks associated with currency fluctuations.

-

International accounts can process transactions faster than traditional accounts, especially for cross-border transfers.

-

Enhanced security features protect all data, such as two-factor authentication and fraud detection.

-

Online and mobile tools allow users to manage their accounts from anywhere in the world.

Business owners can manage their finances more effectively when conducting global payments. International account providers such as Transferra offer lower fees for international transactions.

How to Open International Account at Transferra

If you are ready to join Transferra and want to apply for an international account, then follow a few simple steps:

-

01

Register and complete the online onboarding process. It's simple, fast and online

-

02

Provide the required data, including proof of identity, proof of address and business registration documents

-

03

After your application is approved, you will be assigned a dedicated manager who will guide you through the rest of the process and a tailored pricing plan.

-

04

Welcome to Transferra! You can use your account to make cross-border payments, exchange currencies and manage your funds more efficiently.

Transferra Offers Customized Solutions and Personalized Support for All Customers' Needs

The Transferra team works closely with all customers to gain a thorough understanding of their individual needs. The company provides bespoke solutions designed to meet any specific requirements. Whether you need help with a technical issue or assistance with any aspect of your account, a manager is always ready to assist you.

FAQ

-

What Documentation Do I Need to Open an International Account, Such as a Passport, Visa, or Proof of Address?

To open an international account with Transferra, you will need to provide proof of identity (this can be your passport or national identity card), proof of a UK address and business registration documents.

-

How Long Does It Take to Open an International Account?

At Transferra, the registration and onboarding process for opening an international account is completely digital and can be completed within 5 days.

-

How Much Does It Cost to Open an International Business Account at Transferra?

Different pricing plans are available for account opening and transfer fees, depending on the company's specific needs and transaction volumes. Transferra offers international account opening fees of EUR 600 and EUR 100 per month.

It only takes 15 minutes to apply for your account

Open an international account to immediately

explore new global markets and grow your business.