Multi-Currency Business Account for Unlimited Potential

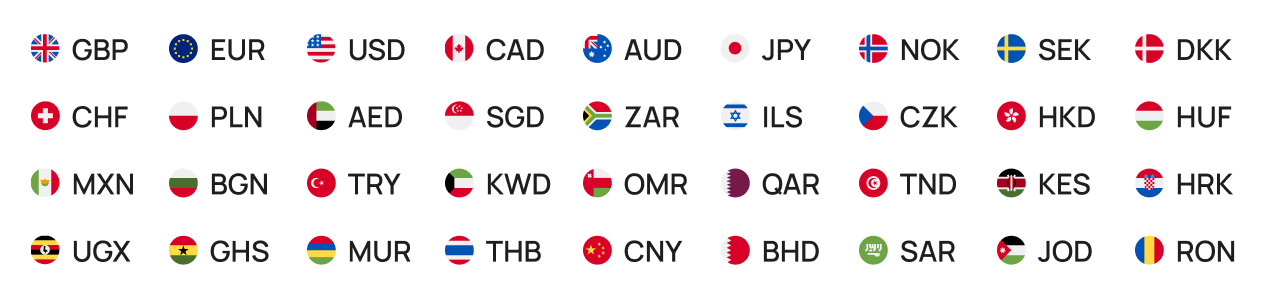

With a multi-currency account, you can seamlessly manage your business finances, send funds worldwide, and control expenses in 45+ currencies.

Worldwide Payments in 40+ Currencies

Effortlessly manage funds in key markets and enjoy unlimited transfers in GBP, EUR, USD, CHF and many more.

Save on Currency Exchange Fees

You can send and receive money in the

same currency your account holds,

eliminating conversion fees.

Simplify Bookkeeping

Make financial management easier by

providing your customers and partners

with a single account number, regardless

of the currency they work with.

Efficient Payments & Global Reach

Send and receive large payments in foreign currency at wallet-friendly rates.

Learn moreUnlock More Perks for Your Business

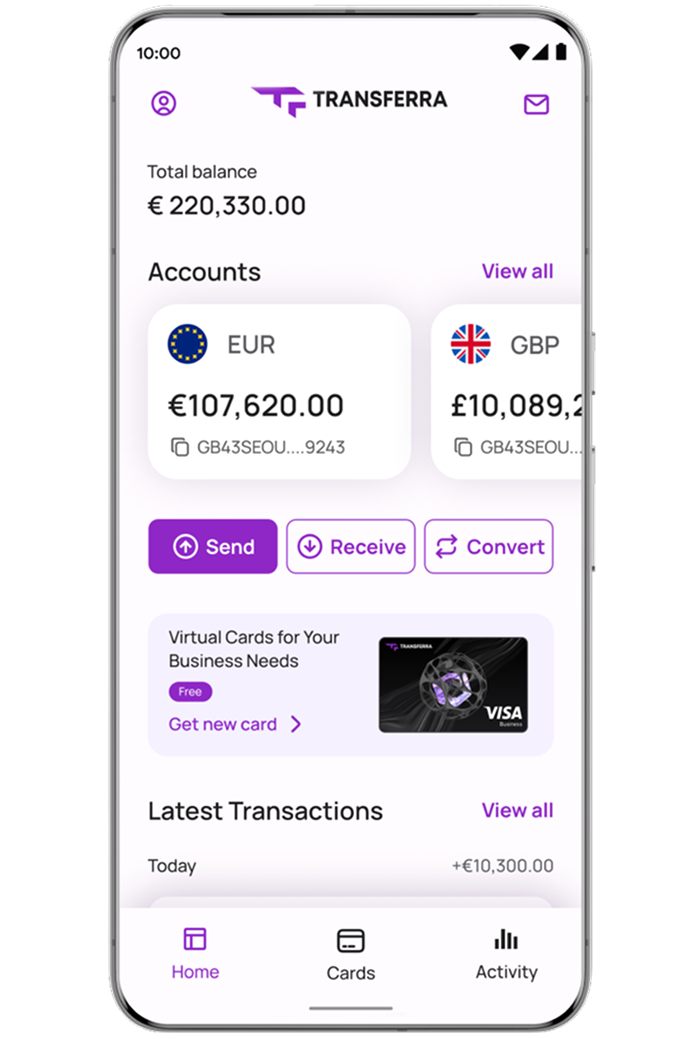

Unlimited Cards with Apple & Google Pay

Handle everything from big purchases to everyday spending with ease. Transferra’s unlimited debit cards integrate seamlessly with Apple Pay and Google Pay, enabling fast, contactless payments.

Recurring Payment Templates

Set up once, pay on repeat. Recurring payment templates let you automate regular payouts, saving time and reducing errors - so your business stays on schedule.

Global Multi-Currency Transactions

Easily transfer money locally in UK and worldwide with SWIFT, Bacs, Chaps, and Faster Payments, reaching over 180 countries.

Dedicated Client Support

Every client is assigned a Dedicated Manager, offering personalised support for account management and transaction issues, ensuring a seamless experience.

Easily Open a Multi-Currency IBAN Account

With Transferra, you can open an account online without visiting a branch.

Register an account on Transferra

Enter your phone number and create a secure password. You'll receive a verification code. Once verified, select whether you want to open a business or personal account.

Provide Supporting Documentation

You must upload copies of documents to the system at this stage. The requirements will differ depending on the type of account you have chosen.

Wait until your data is fully verified

Once your European IBAN account is approved, you can start sending and receiving payments internationally without delays and extra costs.

Frequently asked questions

-

What is the benefit of a multi-currency account?

Such accounts allow to make international payments fast and cheap, have 24/7 access to your finances from anywhere in the world, simplify accounting, strengthen relationships with customers and suppliers.

-

What are the disadvantages of a multi-currency account?

The biggest disadvantage is the high risk associated with exchange rate fluctuations. It is also worth noting the lower interest rates and additional transaction fees.

-

What is the minimum balance for a multi-currency account?

As a rule, owners of foreign currency accounts are not required to have a minimum balance.

-

How do I use a multi-currency account?

You can use such accounts to receive or send money, or to store your savings in different monetary units.

-

What is the best foreign currency account in the UK?

Transferra offers you the best multi-currency business account in the UK. We offer you a simple and fast registration procedure and constant access to your account, and we guarantee the security of transactions.