The IBAN Account Built for Business

Handle global payments like a pro - fast setup, zero stress. Open your account in minutes with Transferra.

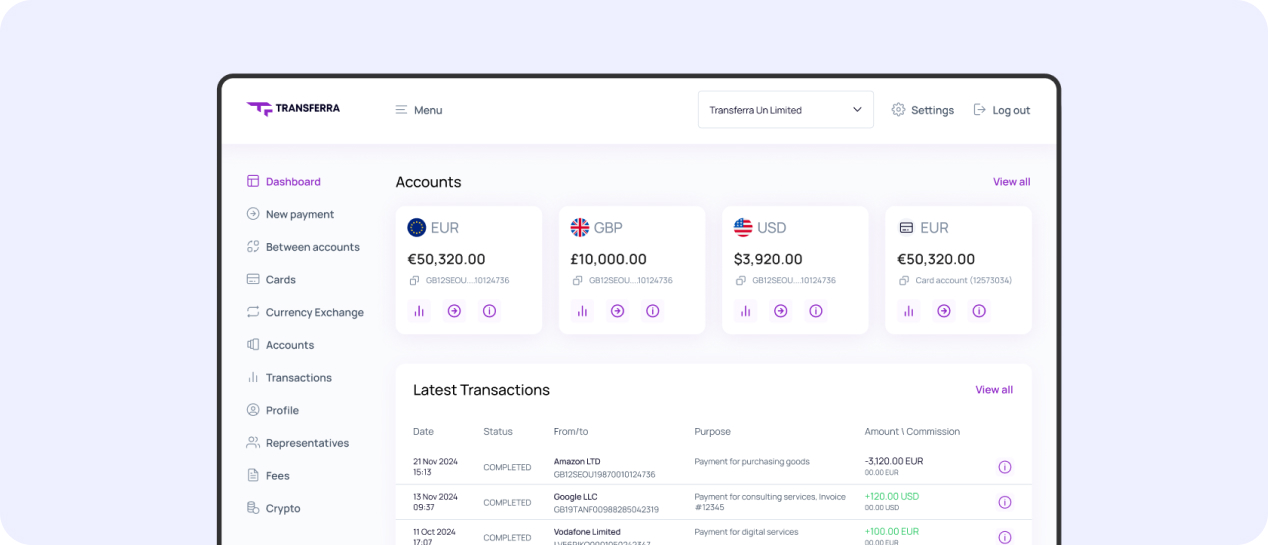

Set up IBAN Accounts from Transferra

As companies enter an international market, they need to process multi-currency payments. And while many financial systems are available today, almost all require a universal IBAN account.

Particular attention should be paid to the European sector, where all financial transactions are checked and monitored to prevent corruption. Moreover, an entrepreneur will be banned from operating if they do not have, for example, an IBAN UK account.

Send and receive money without restrictions. Enjoy the benefits of international payment systems, perform all types of transactions, work with multi-currency conversions, and more. Get rid of your dependence on a financial institution with a single IBAN business account of a generally accepted standard.

Power Up Your Payments

Empower your business to operate globally with the full strength of Transferra’s financial solutions.

International payments without restrictions

Web, iOS and

Android apps

Support of 40+

currencies

Competitive

fees

Fast

transactions

Tools to Scale Without Limits

Send payments to over 180 countries

Pay and get paid through major channels like SEPA, SWIFT, BACS, CHAPS, and Faster Payments.

No Hidden Fees

Say goodbye to surprise charges. Transferra offers clear pricing, low FX rates, and no commissions siphoned off by payment intermediaries.

Dedicated Account Manager

Get personalised support from a real expert who understands your business — no ticket queues, no bots.

Faster Payments with Smart Templates

Streamline recurring transactions using reusable templates — no more retyping the same details over and over.

Multi-currency transactions

Receive and convert funds in over 35 currencies directly into your account, with instant exchange and full control over your balances.

Virtual Cards with Apple & Google Pay

Issue unlimited virtual cards for secure, instant payments. Seamlessly integrate with Apple Pay and Google Pay for added convenience.

Opening Your Account is Fast and Hassle-Free

No paperwork marathons. No government office visits. Just a seamless online process from start to finish.

Create your account and begin onboarding in minutes

Submit your documents

Get approved and once verified, meet your Dedicated Account Manager

Enjoy low FX rates, unlimited virtual cards with Apple & Google Pay, and more