Simple EU Transactions with SEPA Payments

Send and receive Euro payments seamlessly across 36+ countries with our fast, secure, and cost-effective SEPA payments.

Send SEPA Payments the Smart Way

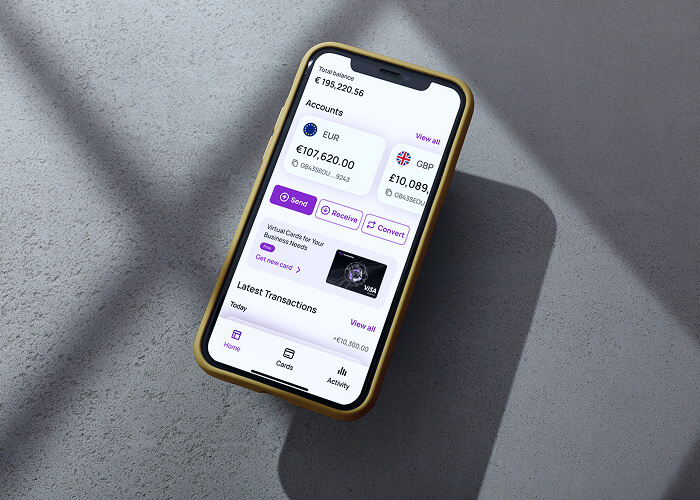

Experience seamless euro transactions across Europe. Transferra empowers you to send, receive, and automate payments effortlessly - all from a single, unified platform.

Now you can track transactions in real time, manage your funds with full control, and reduce unnecessary fees typically associated with cross-platform transfers.

Why Choose SEPA Payments?

Manage euro transfers instantly with SEPA Instant, or within just 1 business day via standard SEPA payments.

Seamlessly send and receive funds across 36+ SEPA countries with fast, borderless euro transactions.

Enjoy low-cost SEPA payments with transparent pricing and no hidden fees for transactions.

No Limits on SEPA Payments

SEPA goes beyond speed, it empowers your business with real-time financial control and unmatched flexibility. Whether you're paying employees, clearing supplier invoices, or covering urgent expenses, you can move funds instantly and without any limits.

Real-Time SEPA Instant Transfers Across Europe

Tap into the full potential of SEPA Instant payments with Transferra. Our direct access to the SEPA network ensures near-instant euro transfers 24/7, even on weekends.

Whether you're supporting remote teams or global suppliers, enjoy low-cost, high-speed payments that reach recipients in seconds.

Create Your Transferra Account

Get Your EU IBAN

Send or Receive Euro Payments Across Eurozone Instantly

Track Transactions in Real-Time

Repeat

Open Your Business Account

Open your account in just a few clicks with our easy-to-use platform. We’ll guide you every step of the way.

Create your account today and get started with the online onboarding process

Please submit the required supporting documents

Meet your personal Dedicated Account Manager

Start using Transferra platform and enjoy all benefits

Frequently Asked Questions

-

How can I make a SEPA payment?

To send a SEPA transfer, simply enter the recipient’s IBAN and BIC, include their full name, specify the payment amount, and double-check all details before confirming. Once submitted, the funds typically reach the recipient within 1–4 business days, depending on the bank and transfer type.

-

Which EU countries are included in SEPA?

All EU member states are part of the SEPA (Single Euro Payments Area). This includes countries like Germany, France, Italy, Spain, the Netherlands, and all others within the European Union. In total, SEPA covers 36 countries, including some non-EU nations such as Norway, Switzerland, and the United Kingdom.

-

Which EU countries are excluded from SEPA?

As of 2023, several EU territories and regions are not part of the SEPA network. These include Northern Cyprus, Greenland, the Faroe Islands, French Polynesia, New Caledonia, the Caribbean Netherlands, Curaçao, Aruba, and others. Gibraltar and Crown Dependencies remain exceptions and are included in SEPA.

-

Are there fees for SEPA transfers?

Most SEPA payments are either free of charge or carry a low flat fee. Fees may vary depending on the payment provider or bank, but SEPA is designed to offer affordable cross-border transfers within Europe.

-

What does “SEPA” mean?

SEPA stands for Single Euro Payments Area. It’s a European Union initiative that simplifies euro-denominated bank transfers across participating countries. SEPA enables individuals and businesses to make cross-border euro payments as easily and cost-effectively as domestic transfers.

-

What’s the maximum amount I can send via SEPA?

There are no limits on SEPA payments.

-

What’s the difference between SEPA and SEPA Instant?

The main difference lies in processing time.

- SEPA Transfers usually take 1–2 business days to reach the recipient.

- SEPA Instant Payments are processed in real time, 24/7, with funds delivered in seconds, even on weekends and holidays.