Start-Up Business Account

Open your account online, access multiple currencies, and get expert support from a team that understands the needs of startups.

Why Choose Transferra for Your Start-Up?

Fast, fully digital onboarding

Open your start-up business account online in just a few steps without delays.

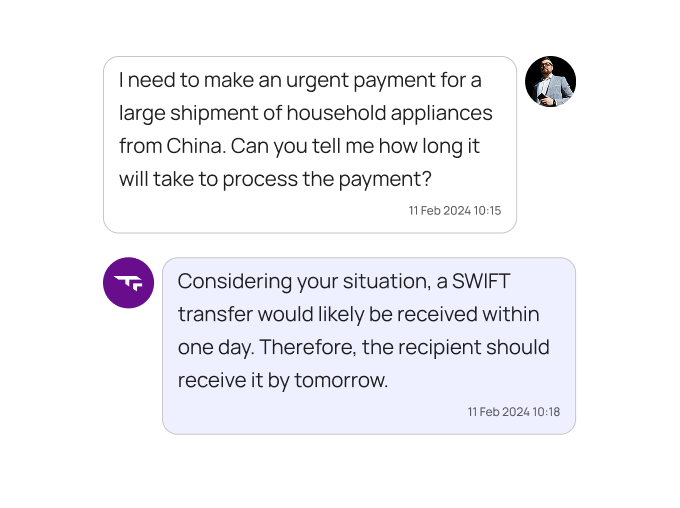

Multi-currency IBANs

Send and receive payments in 45+ currencies using SEPA and SWIFT.

Unlimited virtual business cards

Create as many cards as your business needs. Manage spending per team or project.

Competitive FX rates

Save on international transfers with low conversion fees and no hidden costs.

Real-Time Expense Tracking

Track every transaction as it happens - keep your start-up budget on track.

Smart Payment Templates

Streamline recurring transactions using reusable templates - no more retyping the same details over and over.

A Smarter Way to Manage Your Start-up Finances

Transferra’s Start-Up Business Account is built specifically for new and growing companies in the UK and EU. Whether you're launching your first venture or scaling your idea into a business, we provide everything you need to manage your finances with speed, clarity, and global reach

iOS & Android App

Stay in control wherever you are. With our secure mobile app for iOS and Android, you can manage payments, issue cards, and monitor balances - all in real-time.

Personal Account Manager

You're not alone. Every Transferra client is assigned a dedicated account manager who understands your start-up and is ready to assist whenever needed.

Designed for Global Growth

Transferra’s Start-Up Business Account gives you the infrastructure to manage local and international payments with ease. Whether you're paying suppliers, hiring remotely, or collecting revenue from abroad, you're covered.

Get Started

Who Is This Account For?

UK and European registered start-ups

Founders with straightforward business models

E-commerce, service-based, and tech companies

Entrepreneurs looking for a scalable account solution

How to Open Your Start-Up Business Account

No paperwork marathons. No government office visits. Just a seamless online process from start to finish.

Get started with the online onboarding process

Submit the required supporting documents

Meet your personal Dedicated Account Manager

Start using Transferra platform and enjoy all benefits