BACS vs CHAPS: What is The Difference Between These Payment Methods

Looking to understand the difference between BACS and CHAPS payment methods? Discover the pros and cons of each method and gain a better understanding of the payments landscape.

In the United Kingdom, BACS and CHAPS are two popular payment methods. BACS, or Bankers’ Automated Clearing Services, is a simple and straightforward way to transfer money between different bank accounts. CHAPS, or Clearing House Automated Payment System, is a faster and more secure option for urgent transactions of significant monetary value. It is particularly useful for entrepreneurs or individuals who urgently require to send a significant amount of funds.

Both systems have distinct features and benefits, and understanding the distinctions between them can aid in determining which is the best solution for your specific business requirements.

In this article, we’ll dive into the details of both payment systems. We will discuss what is the difference between BACS and CHAPS when they are used, and which one might be the best fit for your needs.

Understanding CHAPS

CHAPS is a fast and secure online payment mechanism used for transactions that involve significant amounts of money in the United Kingdom, overseen by the Bank of England. It is commonly utilized for considerable transactions, e.g., property purchases, business acquisitions, and financial trade settlements.

To make payments through this system, banks, building societies, and other financial institutions must participate in the system. Transactions must be initiated before a specified cut-off time to ensure same-day processing. Because of its rapid processing time, CHAPS transfers may be more expensive than other methods.

However, the benefit of using CHAPS is that transactions made through this method are guaranteed to be settled on the same day, and the recipient typically receives the funds almost immediately. So, if you require to send a large sum of money urgently, CHAPS can be a reliable and convenient option.

Understanding BACS

BACS is a UK-based digital payment system that can process large volumes of transactions. It is a popular option for a range of financial operations, including direct debits, payroll, and supplier payments.

BACS system offers two main payment types: Direct Debit and Direct Credit. Direct Debit allows companies to collect funds directly from a customer’s bank account. Direct Credit enables companies to make payments directly into an individual or organization’s account. Both Direct Debit and Direct Credit offer a secure and efficient way for businesses to manage their cash flow.

BACS Payment Schemes Limited manages the system, making it a low-cost money transfer option that is widely used in the United Kingdom. With BACS, it is possible to shift funds from one bank account to another, but it’s important to note that these transfers usually take up to three working days to be finalized. Therefore, BACS is a slower transfer method compared to CHAPS, but it remains a reliable and worthwhile option for many users.

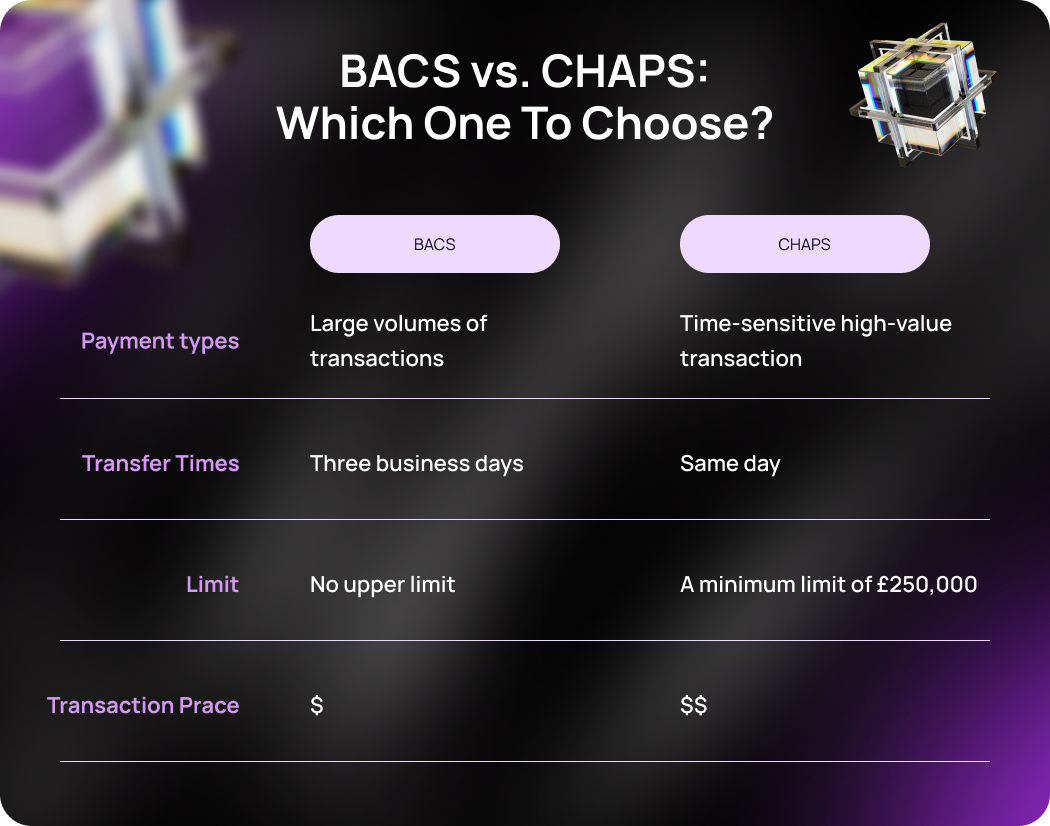

CHAPS vs BACS Payments: Which Is Right for You?

Both BACS and CHAPS are UK-based payment networks, each designed for specific purposes. BACS is often used for handling large volumes of transactions, particularly for regular payments such as wages, pensions, and bills.

On the other hand, CHAPS is normally used for time-sensitive transactions of considerable worth, like property purchases or commercial transactions. While BACS processing time is usually three working days, CHAPS payments are guaranteed to be managed within the same day, making them a reliable option for urgent transactions.

Businesses may opt to use CHAPS over BACS when making these types of high-value transactions due to its speed and guaranteed same-day processing.

Comparing BACS and CHAPS: Understanding the Differences

The two payment methods are different in various ways. Let’s take a closer look at how they differ in terms of transfer times, costs, requirements, and limits.

Comparing Transfer Times

When it comes to transfer times, BACS payments are usually managed within three business days. CHAPS transfers are usually handled on the same day or even within just a few hours. CHAPS payments generally arrive faster than BACS, but the processing time may vary depending on several factors, including the banks involved, the time of day the transaction is initiated, and any intermediary banks.

Understanding the Price Differences

CHAPS is a more expensive option due to its same-day transfer feature, which makes them more costly. In contrast, BACS is usually free or low-cost but takes longer to complete. The specific cost of each transaction may vary depending on the bank or financial institution handling the transfer. To find out more about the expenses associated with CHAPS or BACS payments, it’s best to contact your bank or financial institution.

Understanding The Refund Policies

Both methods allow for refunds, but the process and timeline may differ based on the specific bank or financial institution involved. It’s important to confirm the refund policies and procedures of your bank or payment provider.

Refunds through BACS may take a few business days to process, while refunds via CHAPS can be processed faster due to its real-time transfer capability. However, it’s essential to note that refunds via the latter may come with additional fees.

Comparing Requirements

In order to utilize one of the systems, certain requirements must be met. For BACS transactions, businesses typically require a UK bank account, a sort code, and an account number. The company must also have access to online banking or specialized software to initiate a BACS transaction. Additionally, the firm must be registered with BACS and have a Service User Number (SUN).

To initiate a CHAPS transfer, one must have a UK bank account that accepts this type of transaction. Additionally, the customer must have sufficient funds in their account to cover the transaction amount and any associated fees. CHAPS payments are often made by visiting a bank branch or through online banking.

Comparing limits

It is useful to know that both methods have different limits in place. For BACS, there is no upper limit, meaning you can transfer as much as you want as long as you have enough funds available in your account. Some banks may have their own limits, so it’s important to check with your bank to see if they have any restrictions in place.

On the other hand, CHAPS usually have a minimum limit of £250,000, but there is no official upper limit. Some banks may impose their own maximum limit, so it’s important to check with your bank before initiating a transfer.

FAQ

Which Type of Bank Transfer is a BACS or CHAPS Payment?

A bank transfer can be either a BACS or CHAPS transaction. It depends on the type of transfer requested by the customer. Both are ways to send funds digitally, used by banks in the UK, so if a client sends a payment instruction, the bank will typically use one of the two methods to send the funds.

What Countries Is BACS Used In?

BACS is a payment system that is used only in the United Kingdom.

What is BACS and CHAPS Alternative?

There are several alternative payment methods, and one of them is Faster Payments. It enables instant money transfers between bank accounts. The system operates 24/7, allowing transfers to be made at any time of the day or night, including weekends and bank holidays.

Faster Payments are usually used for low-value transactions, with a limit of £250,000 per transaction. The transfer times are almost instant.

Compared to BACS and CHAPS, Faster Payments is a more cost-effective option for transferring smaller sums of money quickly. Some banks may offer them for free, while others may charge a small fee for using the service.

Does Transferra support BACS and CHAPS?

Yes, Transferra supports both transfer methods. Once you fill in the payment form, the system will check the details and determine the most suitable payment method automatically.