How to Keep Money Safe: Transferra’s Approach

Transferra, as an authorized Electronic Money Institution (EMI), ensures financial security through fund segregation and regular audits. This guarantees that your money are protected.

Worried about keeping your money safe in today’s world? You’re not alone. Cybersecurity threats are real, and financial uncertainty can feel stressful. Safeguarding funds has become a top priority for individuals and businesses alike. Understanding how to keep money safe in a bank and leveraging the security features offered by fintech platforms is essential for ensuring financial stability and peace of mind.

That’s where Transferra comes in. We understand the importance of keeping your hard-earned cash secure. We commit to providing you access to an online payment platform that lets you manage your finances worry-free.

This blog post will answer all your burning questions:

— how does Transferra safeguard your money (spoiler alert: it’s like a fortress for your finances!),

— what’s the smartest way to keep your money secure,

— how can you keep money safe.

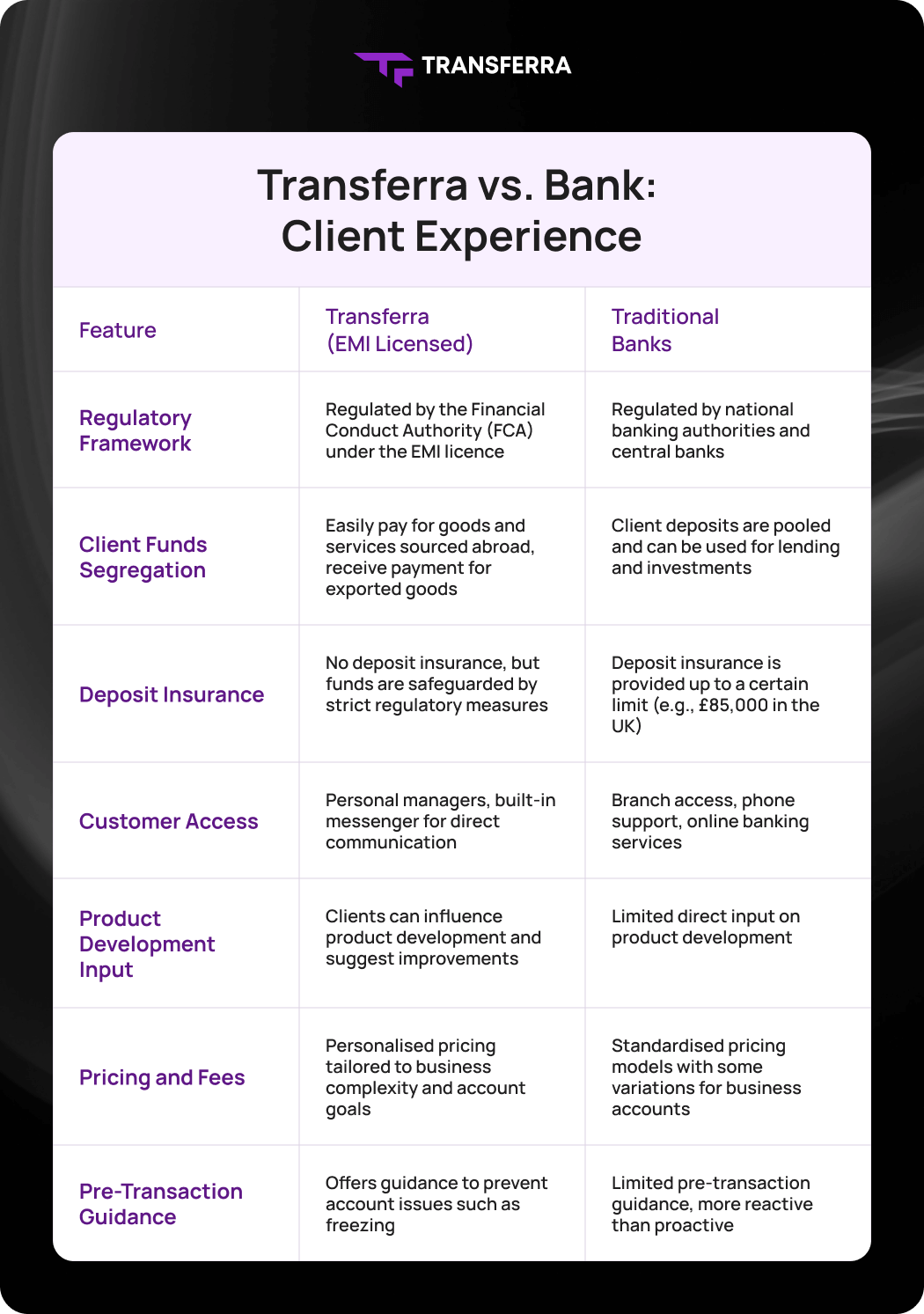

Differentiating Transferra’s Approach from Traditional Banks

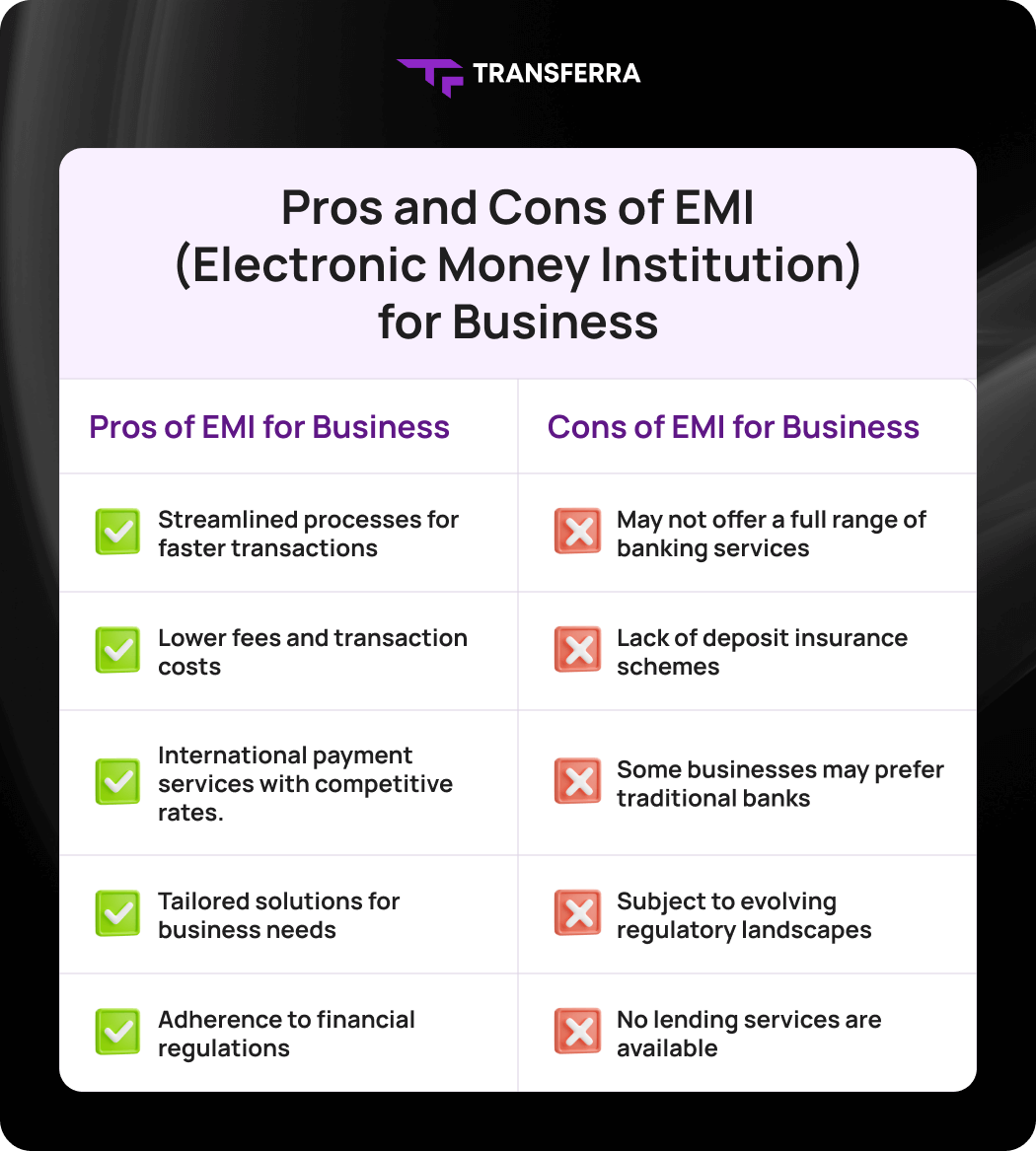

Unlike traditional banks, which operate under a banking licence and can engage in activities such as lending and deposit-taking, online payment platforms often operate under an Electronic Money Institution (EMI) licence or equivalent licences in different regions. When considering which bank is safe to keep money, one needs to know how well that specific bank is regulated or what security measures they put in place.

Deposit Safeguarding Mechanisms in Traditional Banks

How do banks keep money safe? Traditional banks protect funds using measures like deposit insurance and a harsh regulatory framework. These actions safeguard client assets from risks such as insolvency.

Money Safeguarding Mechanisms at Transferra

Transferra uses advanced methods to protect clients’ money. This includes keeping it distinct from the company balance sheet and going through secure, regulated methods for the best safeguarding of funds.

Transferra is a reliable partner for managing monetary operations, providing individual IBANs and personal managers, competitive currency rates, and low fees. It operates as an EMI-licensed platform, registered in England, and regulated by the Financial Conduct Authority (FCA). This licence mandates stringent safeguarding measures for client assets, ensuring they are securely held and kept separate from the company’s operational money, thereby enhancing fund protection and transparency, and the ability to return funds when needed.

Understanding EMI: How to Keep Money Safe

A financial institution authorised to issue electronic money, or e-money is known as an Electronic Money Institution (EMI). E-money is the digital version of currency kept on an electronic device or server. EMIs do not accept deposits or offer loans. Instead, they facilitate payment services.

How Transferra’s EMI License Ensures Money Saving

One basic rule is that companies with EMI licences cannot handle customers’ money directly. This guarantees that Transferra neither holds deposits nor engages in lending activities with customers’ funds.

Transferra’s function is to make transactions between parties easier instead. The assets involved in a transaction stay in the user’s account until the transaction is finished. The platform serves as a custodian, ensuring the safekeeping of these funds and facilitating their transfer based on the client’s requests.

Money Safeguarding Mechanisms at Transferra

- Fund Segregation. Transferra must keep client funds in separate, safeguarded accounts. This ensures that the money remains distinct from the institution’s assets, adding an extra layer of financial security and contributing to how to keep money safe.

⠀ - No Lending Activities. Transferra does not use the deposited money for internal business expenses. This method greatly lowers the likelihood of losing client assets because they are not subject to the same lending defaults and market risks as banks are.

⠀ - Internal and External Audits. Transferra consistently conducts internal audits to check on the general health and operational compliance of the company. To further guarantee adherence to regulatory requirements, independent external auditors thoroughly review the financial statements and protective measures.

⠀ - Regulatory Compliance. All partners involved in providing services to Transferra’s clients are authorised and regulated by reputable authorities, such as the FCA in the UK and Finantsinspektsioon in Estonia. This oversight ensures that these partners adhere to high standards of financial conduct, helping to keep money safe.

⠀ - Transparency and Accountability. Along with regularly updating clients on the progress of their transactions, Transferra maintains thorough records and guarantees operational transparency, ensuring that clients are informed about how their monies are handled. To further encourage more control over financial actions, it provides an intuitive interface that makes transaction history and account statements easily accessible.

⠀ - Financial Stability. Transferra must keep a specific amount of capital reserves on hand to cover operational risks and potential losses. These reserves act as a safety net to protect client funds and guarantee platform stability.

Transferra’s Compliance with International Regulations for Client Fund Safeguarding

Transferra ensures the safety of client finances by closely following international regulations to keep money safe, such as:

– The EU Directive on Payment Services (PSD2): Mandates robust security measures and operational transparency, enhancing the protection of client funds.

– Anti-Money Laundering (AML) Regulations: Enforces stringent protocols to thwart illicit activities.

– Know Your Customer (KYC) Regulations: Requires thorough verification of client identities to prevent fraud and safeguard funds.

– Payment Card Industry Data Security Standards (PCI DSS): Enforces high standards for the safe management of card payments and sensitive client data.

– Data Protection Legislation: Ensures that all sensitive information is handled with the utmost confidentiality and security, further protecting funds from unauthorised access and breaches.

Transferra is committed to showing you how to keep money safe by adhering to these rigorous standards and continuously updating our security protocols to mitigate risks effectively.

Key Points for Choosing Transferra for Making International Payments

- Convenience. Transferra’s services digitise transactions, enabling faster and more convenient processes than traditional banking.

⠀ - Cost Savings. Clients save a significant amount of money because of lower costs and favourable currency rates, especially those who do frequent international transactions.

⠀ - Specialisation in Payments. By focusing solely on electronic money transactions and related financial services, Transferra can offer specialised expertise that traditional banks may not provide.

⠀ - Personalised Approach. Transferra offers a built-in messenger for contacting a personal manager, pre-transaction guidance, and expert advice on international payments, currency exchange, and financial operations.

⠀ - Security. Transferra employs advanced security measures and international regulations to keep money safe, ensuring the utmost protection for your finances.

Who Benefits from Transferra?

Businesses that handle a lot of cross-border payments and want to cut costs will find Transferra to be quite effective. It serves clients who prioritise secure and transparent transactions, offering an international business account option. Entrepreneurs benefit significantly from its convenient financial management solutions, which include separate accounts and personalised support.

Choosing Transferra for cross-boarding payments offers a transparent and secure approach to safeguarding your money. Your funds are protected by EMI regulations, separate account holding, and the inability to use your assets for loans or investments.

FAQ

How can my beneficiaries access my funds held in my Transferra account in case of my death?

Your beneficiaries can access your account by notifying Transferra, verifying the required documents, and following the legal process to keep money safe. This may involve probate or similar proceedings, ensuring the transfer of the remaining balance to the designated beneficiaries or legal representatives.

When and how can I recover my funds in the event of my account being frozen?

This is not likely to happen because Transferra takes proactive steps to prevent account freezes by thoroughly onboarding clients and informing them ahead of potentially dangerous activities. Get in touch with your support manager if your funds are frozen, explain the circumstances, formally request a review, and wait for Transferra to take care of the problem. After that, you can carry on with your regular financial management.

What actions will be taken if Transferra’s licence is temporarily suspended?

Such an event happening is highly improbable, given that Transferra follows all requirements and undergoes regular audits. However, if such an incident does occur, there’s no need for concern. We will work with regulatory bodies to address the issue, give clear instructions on money withdrawal, promptly notify our clients of any temporary suspension, safely hold their funds in segregated accounts, maintain uninterrupted service, and provide regular updates on the status and resolution progress.

Why Is It not Safe to Keep Money in a Bank in the EU?

Despite deposit insurance systems in the EU, there are limits. Deposits are protected up to €100,000 per individual and institution. This ensures clients receive their money back up to this amount even if a bank fails. It’s advisable to split sums over €100,000 across multiple institutions for complete coverage.

Glossary for Understanding the Safeguarding Money Topic

Safeguarding Money: Protecting measures taken by financial institutions to keep money safe and ensure the security of your funds.

Deposit Insurance (Safeguarding Account): A government-backed program that protects a portion of your money in case the bank holding your deposit fails. This guarantees that, even in the event of the institution’s bankruptcy, you will get some or all of your money back.

Regulatory Compliance: The process of adhering to laws, rules, guidelines, and standards set by governing bodies. Financial institutions must comply with requirements to ensure transparency, accountability, and legal operation.

EMI-Licensed Platform: A platform operated by an Electronic Money Institution (EMI), which is authorised to issue electronic money and provide payment services under regulatory oversight.

Сhecking Account: This is a type of bank account designed for daily transactions and to cover short-term money needs. But is it safe to keep money in a checking account? Withdrawals can be made through cheques, wire transfers, ATMs, or debit cards for real-life or online purchases. You can also set up automatic bill payments through a checking account. To safeguard bank account balances, many individuals opt for additional security measures.

Conclusion

Understanding the licensing and operational practices of traditional banks and EMIs is crucial for ensuring financial stability, especially when it comes to international money transfers. For banks, this involves grasping the limitations of insurance coverage. Meanwhile, for EMIs, it entails understanding how assets are segregated and safeguarded by regulation. Equipped with this understanding, you may arrange your funds wisely, striking a balance between the protection of segregated accounts and the advantages of insurance coverage.