Payoneer Vs. Wise: Which Is Right For You?

We would explore the pros and cons of both, allowing you to make an informed decision on the best options for your business.

We live in a truly interconnected world, which means it has never been easier for businesses to connect with clients across the globe. However, as a company’s consumer base expands to other countries, they need to find a way to overcome the challenges that often come from making international payments.

Thankfully, there is a wide range of platforms out there that are designed to help do just that. From our very own Transferra solution, which is designed to provide proven solutions for modern businesses, to well-known brands like Wise and Payoneer.

However, when it comes to Wise vs Payoneer, which option is better for your organisation? Both platforms have their positives, and in this comparison article, we thought we would explore the pros and cons of both, allowing you to make an informed decision on the winner option for your business.

A Closer Look At Payoneer

As globalisation became more popular, it quickly became clear that businesses needed a more effective way to make efficient and reliable payments across borders. Payoneer was one of the pioneers of the digital payment sector and remains one of the most used.

What is Payoneer?

Founded in 2005, Payoneer is a New York-based financial services company that specialises in digital and online payment solutions. The platform is utilised by over four million people across 200 countries, allowing users to quickly send and receive funds in multiple currencies.

The platform is an excellent choice for those seeking to simplify their international payments and can be utilised by a wide range of users, including freelancers, online retailers, and large businesses.

What are the pros of Payoneer?

Now that we have answered the question, “What is Payoneer?” it’s time to start looking at some of the positives of the platform. There are a wide range of benefits and features, including:

1. Global reach. Thanks to being present in over 200 countries and supporting more than 150 currencies, Payoneer has a truly global reach.

2. Multi-currency accounts. Users are able to hold balances in multiple currencies within their Payoneer accounts. This helps to further facilitate easier currency conversions and reduces exchange rate fees.

3. Low fees. Another big advantage of Payoneer is its low fees. There are no costs to open an account or to be paid by another Payoneer customer.

4. Multiple payment options. Users can also choose various ways to send and receive payments, including bank transfers, e-wallets and prepaid Mastercard (although with this, there is a $2,500 daily limit and a 1% fee to transfer or withdraw from an ATM).

5. Easy integration. Finally, Payoneer is also able to be seamlessly integrated into various online marketplaces, including Amazon, Fiverr and Upwork.

What are the disadvantages of Payoneer?

When answering “What is Payoneer?” it is also important to consider some of the potential downsides that the platform has. One of the biggest drawbacks is that private clients are unable to transfer money, only withdraw it. Customers looking to withdraw to a bank account or via a debit card may also find additional fees depending on their location or desired currency.

Some users have also reported that customer service can occasionally take a while to resolve inquiries, although this has improved drastically in recent years.

How much does Payoneer charge per transaction?

The fees Payoneer charges will depend on the payment and location. There is a 3% fee for credit card transactions, while for ACH bank debits in the United States, it is 1%. There are no fees for receiving payments from another Payoneer customer via marketplaces and networks or via receiving accounts.

How safe is Payoneer?

It is only natural that before utilising the platform, businesses ask themselves, “How safe is Payoneer?”. It is extremely secure to use, but this is a reasonable question given that it is one of the biggest and most well-known digital payment platforms in the world. The company employs robust security measures to keep users’ accounts and transactions protected, such as encryption, fraud detection, and compliance with all industry regulations.

How do I contact Payoneer?

Contacting Payoneer is incredibly easy, and users are able to contact the customer support team through various channels, including email, phone and live chat.

How to create a Payoneer business account

Opening a Payoneer account is very straightforward. Users just need to head to the Payoneer website, click the “sign up” button and select the business account type. From there, businesses just need to complete their personal information and complete the required verification steps.

Once verified, companies will be able to start using their Payoneer business account to send and receive payments.

How to delete a Payoneer account

Deleting a Payoneer account can be done via the “Account Settings” section. Customers can also contact the customer support team for help.

A Closer Look at Wise (ex Transferwise)

Wise, or TransferWise as it was formally known, is a close competitor of Payoneer. Before we can explore the comparison question of Wise vs Payoneer, it is first important to understand what the UK-based brand offers.

What is Wise?

Launched in 2011 as TransferWise, Wise is a financial technology company that specialises in international money transfers. Famed for its transparent and low-cost rates, the company has quickly gained popularity thanks to its innovative approach. Currently, the service supports over 40 currencies from across the globe, making it ideal for freelancers, contractors and large-scale businesses conducting international work.

What are the pros of Wise?

As with Payoneer, there are a wide range of benefits that come from utilising Wise, including:

1. Transparent pricing. Wise ensures that users always know precisely how much they will be paying for each transaction by offering real-time exchange rates and fees.

2. Low-cost transfers. When compared to other money transfer providers and traditional banks, Wise also has extremely affordable fees. This makes it a particularly economical choice for businesses looking to make frequent international payments.

3. Borderless accounts. Wise provides its customers with borderless accounts, which let them save balances in many currencies and switch between them without paying extra fees.

4. Fast transfers. In the fast-paced business world, time is crucial. That is why Wise aims to complete transactions within 48 hours. However, depending on the destination and payment method it can be completed in just a few minutes.

5. Integration. Wise also provides seamless integration with banks and online platforms, helping to further improve the efficiency of sending and receiving payments.

What are the disadvantages of Wise?

Due to the way the fees work, it can be hard to make a clear TransferWise vs Payoneer comparison. Wise does have a few limitations though, the primary being that every transfer requires a payout, which can be costly depending on the location and currency.

Wise also implements transfer limits on certain currency routes and accounts, which can be a little restrictive for businesses.

How much does Wise charge per transaction?

When sending money via Wise, fees begin at 0.43%, while withdrawing from a card sees a 1.75% fee for all transactions over £200. There are also fees for receiving money depending on the currency and location that it has been sent from.

How safe is Wise?

When exploring TransferWise vs Payoneer, both platforms offer incredible levels of safety. Wise employs stringent security measures to safeguard users’ funds and personal information, including encryption, two-factor authentication and full regulatory compliance.

How do I contact Wise?

Users can contact the Wise customer support team either through either the company’s website or app. There are also options for email support, live chat and phone assistance.

How to open a Wise account

Opening a Wise business account can be done in a matter of minutes. Users simply need to visit the Wise website and follow the steps to creating the account. As with Payoneer, there are a number of verification steps to fully activate the account.

How to delete a Wise account

Users can delete a Wise account through “Account Settings” or by speaking with the customer support team.

Can you transfer money from Payoneer to Wise?

Yes, you can transfer money from Payoneer to Wise by selecting ‘Wise’ as the recipient in their Payoneer account, entering the account details, specifying the amount, and completing the transfer.

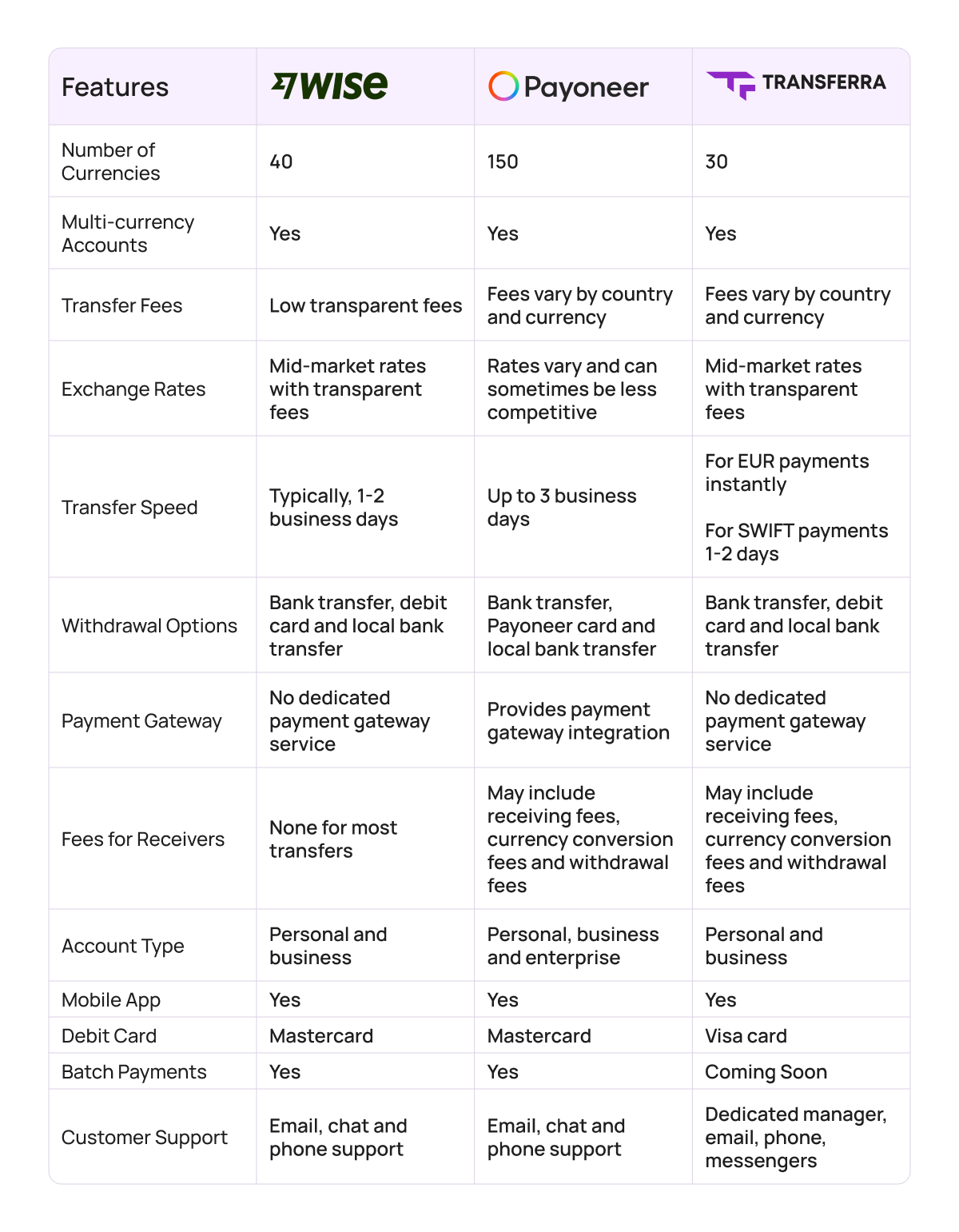

Wise vs Payoneer

Let’s take a closer look at both platforms’ features and make a comparison in order to answer some important questions such as “Is Wise or Payoneer cheaper” or “Is Wise or Payoneer faster”, and how many currencies do Wise and Payoneer support?

Whether opting for Payoneer or a Wise business account, users can take advantage of the flexibility of managing balances in many currencies and making transactions at more affordable rates compared to traditional banks. Additionally, both platforms provide wide-ranging worldwide coverage for both incoming and outgoing payments, enhancing their standing as dependable options for a variety of consumers.

Payoneer and Transferwise Competitors

Of course, while many people are wondering who wins when it comes to Wise vs Payoneer, they are not the only platforms available. Here at Transferra, we provide a wide range of international financial services for businesses, providing you with a proven and reliable partner that you can trust.

From start-ups to corporations, our user-friendly platform has been designed to help you easily manage your international payments, providing tailored solutions designed for the needs of any modern business.

Ready to find out more? Register with Transferra today!