5 Challenges Transferring Large Sums of Money Internationally

There are several ways how to transfer large sums of money internationally. Explore the solutions for smooth sending money overseas.

When it comes to large-sum international transfers, payments ranging from $100,000 to $1 million are processed through a complex chain of interactions involving agreements between reluctant financial institutions and their customers. There are cases where not all financial platforms and banks can carry out these types of transactions. Many providers outright forbid accepting such sizable transfers, making it challenging to transfer money overseas.

In this article, we will look at the details of transferring large sums of money internationally and discuss what difficulties individuals and companies may face when making such transactions

Ways of transferring large sums of money between bank accounts

There are several options for transferring large amounts of money overseas. Here are the main options you can choose from ways to send international money transfers.

Bank transfers

One of the simplest methods is to transfer money via banks. Banks are safe and stable, but they may be slower because of fees or even unfavourable exchange rates.

International payments using banks are the most expensive alternative, according to a 2020 World Bank report that estimated their average cost of between 11% and. This arises from a result of middle bank charges plus poor exchange rates.

Money transfer operators

Using the services of money transfer companies like Western Union and MoneyGram, one can transmit funds easily. You can make payments through their agent outlets or on online platforms. On most occasions, these businesses charge higher transfer fees and do not offer the best exchange rates hence comparison of options and overall cost analysis is essential.

Online payment platforms

International money transmission becomes straightforward through digital payment platforms such as Transferra. These services allow you to link your bank account, debit card or credit card and send money. This international online money transfer service is often cheaper than conventional banks and payment processors. It is also important to note that for transactions to be seamless, both the sender and recipient must have accounts on the same platform.

Cryptocurrency transfers

Cryptocurrencies like Bitcoin and Ethereum are attractive alternatives for cross-border payments. Using cryptocurrencies to send money entails turning your local currency into a digital currency and transferring it to the recipient’s digital wallet. This alternative provides a quick procedure and possible cost savings, but both parties must have a basic grasp of cryptocurrency and its hazards.

Check transfers

These are transfers made between bank accounts by writing a check and depositing money in the other account. They are the easiest and cheapest method to transfer money, but they might take the longest, often five to seven working days. Transfer limitations are governed by the quantity of money in your account and the bank’s check-clearing regulations.

Common challenges in transferring large transfers

Considering the regulatory oversight, extensive documentation requirements in addition to exchange rate risks which include imposed transfer limits, a comprehensive understanding of these processes is critical for achieving successful transactions.

1. Regulatory Scrutiny. Large international transactions are conducted under a dense layer of legal complication, characteristic of financial regulations. The governments and regulatory authorities have enforced tough international money transfer regulations in the uk to fight against money laundering, fraud other financial crimes.

2. Business Payments. For businesses, transfers of significant sums, especially international trades, are more closely monitored to ensure that the moves pass whereby rules concerning anti-money laundering or digital Know Your Customer framework. The financial institutions then meticulously review the type of business, validity of operations and parties involved.

3. Documentation Requirements. Banks and other financial interests may need a lot of detail about the origin or source, motive for credit as well as relations between such transactors. The process of fulfilling these documentation requirements may be lengthy, but it is necessary for efficient operation in the regulatory environment.

4. Exchange Rate Risks. Businesses that conduct international trade have to deal with the risks of exchange rates. Exchange rates can alter the final amount that is in effect received, and ultimately affect how cost-effective a transaction is.

5. Banking Rules and Transfer Limitations. Banks may impose limitations on the amount that can be sent, varying based on transfer type, destination, and account history. Understanding these restrictions, especially for methods like wire transfers associated with higher costs, is crucial.

What to look for when sending money overseas limit?

Consider what you need to prioritise:

- Financial transaction security: Determine if the company you’re contemplating is FCA-protected so that if there are any issues during a money transfer, you’re more likely to get your funds back after currency control.

- Transfer fees: You’ll naturally want to keep the costs as low as possible, but large currency transfers may be expensive, depending on the provider, broker, and transaction in issue.

- Currency rates: Whether or not you receive a fair price on your transfer depends on the currency rate. It’s a good idea to monitor exchange rates at multiple suppliers. Are they comparable to the mid-market exchange rate, which is regarded as the most equitable exchange rate possible?

You will seldom be able to take advantage of the true mid-market pricing since suppliers nearly always add a profit margin. The closer you are to the market rate after paying fees, the better.

Most costs are concealed and may have been included in the exchange rate. Determine if you’re getting a decent bargain by calculating how much money your receiver would get after deducting the fees and considering the conversion rate.

How much money you can transfer between bank accounts?

Each bank has a limit system that determines:

- the maximum amount that can be sent from card to card in one transaction;

- the maximum number of transactions that a client can make per day. In some banks – the maximum number of transactions per period;

- the maximum amount that can be sent from card to card per day.

The bank allows the client to adjust some of these limits, for example, by calling a hotline or using a mobile application. Others are set in stone and cannot be changed. Therefore, be sure to check the information about banking transfer limits.

How long does an international transfer take?

The time for international transfer depends on many factors, such as the way of sending money, the amount transacted, currency denomination and destination country as well as participating banks.

If you request a transfer before your bank’s cutoff time, an international wire should come in 1-5 working days. However, delays may also ensue due to errors or intermediate banks in some transactions.

Whenever you’re planning significant international transfers, reaching out to your bank or financial institution is a smart move. They have the latest information based on their systems and relationships, providing you with accurate details on the expected time for your large transfers.

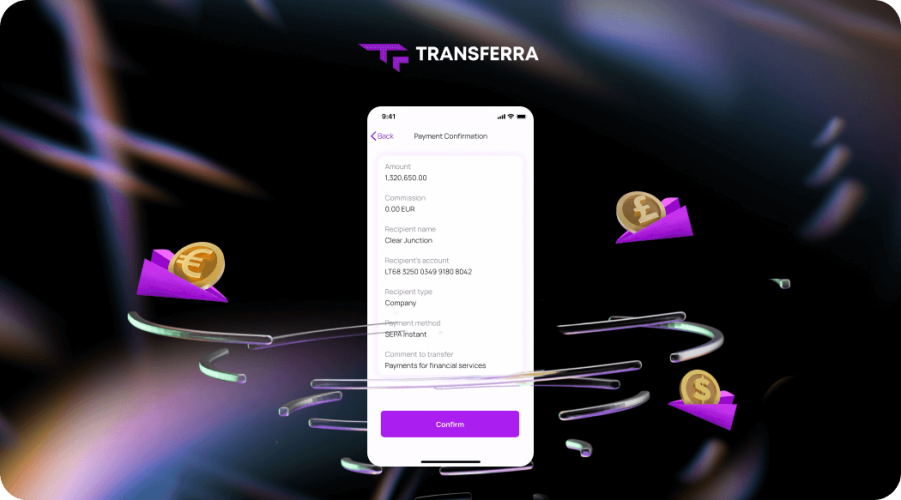

Transfer Money Overseas with Transferra

Transferra allows you to send large amounts of money internationally. To start the process, please send the request through our payment platform Transferra or via your client manager. Once we get your request, we will provide you with details such as the due date and any other instructions specific transactions may require.

Ready to simplify your international transfers? Sign Up today with Transferra to enjoy safe and cost-effective services that are specifically designed for your requirements.