Choosing the Best UK Euro Account in 2026: Which Provider Fits Your Business?

Explore how to choose the best UK euro account in 2026. We compare Transferra, Revolut, Wittix, Airwallex and OpenPayed — pros, cons, fees and who each suits best.

Choosing the right UK euro account has become essential for companies trading with the eurozone. Whether you receive EUR payments from clients, regularly pay European suppliers, or simply want better FX control, the right UK euro account can dramatically cut costs and improve cash flow.

In 2026, UK businesses can choose from a wide range of providers — including Transferra, Revolut, Wittix, Airwallex and OpenPayed. This guide breaks down which account works best for your needs based on customer reviews on Reddit, Trustpilot and other forums.

Below is a detailed look at the leading options – plus guidance on what to prioritise when choosing a UK euro account.

✅ Why UK Businesses Still Need a Euro Account

Having a dedicated UK euro account is more than nice-to-have if your business interacts with the eurozone. Key benefits:

- Lower currency-exchange costs: With a euro account, you receive and send EUR directly — avoiding repeated conversion fees or unfavourable bank markups.

- Faster, smoother euro-zone transfers: Using SEPA and euro-denominated rails makes payments and receipts in Europe far easier and often cheaper than cross-border GBP–EUR conversions.

- Better cash-flow & FX control: Holding a balance in EUR lets you convert only when rates suit — shielding you from volatile exchange swings.

- Trust and credibility for European clients/suppliers: Having a euro account signals that you operate effectively with EU partners — no surprise conversion friction.

For many UK-based exporters, freelancers working across Europe, or companies with euro-denominated expenses – a UK euro account isn’t optional. It’s strategic.

🔎 What to Look For When Choosing a UK Euro Account

Before we compare providers, here are the main criteria you should check when selecting a UK euro account:

- Local-like EUR IBAN/bank details (not just “multi-currency placeholder”).

- Competitive FX/conversion rates & transparency.

- Low or predictable fees for EUR transfers.

- Ease of opening (online onboarding, minimal paperwork).

- Multi-currency support (if you also deal in GBP, USD, etc.).

- Ability to receive payments and make payouts across Europe.

- Reliable customer support and compliance.

With that in mind — let’s see how the top providers stack up.

🌟 Provider Comparison: Transferra, Revolut, Wittix, Airwallex, OpenPayed

Transferra

Pros

- Tailored specifically for UK businesses needing euro-transaction banking — designed to simplify EUR inbound and outbound flows.

- Reliable international payments & great rates: Businesses across Europe highlight smooth SEPA/SWIFT transfers, competitive FX, and multi-currency IBANs—e.g., “saved thousands vs. banks” with quick settlements in days.

- Helpful account managers & easy onboarding: Users love the personal touch—fast setup (under a week), dedicated support that resolves issues quickly, and an intuitive dashboard for tracking everything on the go.

- User-friendly tools for businesses: Virtual Visa cards with Apple/Google Pay, mass payments, and full money flow control get high marks—perfect for e-com and freelancers feeling “in full control” without traditional bank hassles.

Cons

- Compliance checks can delay first-time or unusual payments (e.g., salary deposits needing extra docs).

- Support is dedicated but not 24/7, so off-hours queries might wait.

Best for

Transferra is a breath of fresh air for UK/EU businesses tired of clunky banks, delivering fast, secure global payments with a human-centered platform that puts you in the driver’s seat. With a solid Trustpilot score and glowing feedback on ease and savings, it’s a go-to for scaling ops—users often say it’s their “new favorite” for seamless multi-currency management, UK euro account and 2025’s app enhancements are making it even more indispensable.

Revolut Business

Pros

- Multi-currency magic & FX rates: Businesses love holding 30+ currencies, instant conversions at near-spot rates, and seamless international transfers—e-com and freelancers report saving thousands yearly vs. traditional banks, with SEPA/SWIFT speeds for global payouts.

- Intuitive app & easy integrations: The dashboard shines for expense tracking, virtual cards, and Xero/QuickBooks sync—users call it “a game-changer” for small teams managing payroll and vendors on the go, with quick onboarding in days.

- Cost-effective for scaling ops: Free basic tier (pre-2024 changes) and low-fee plans keep it affordable for startups; many highlight unlimited team cards and API hooks that streamline workflows without the bloat of legacy banks.

Cons

- For larger or frequent EUR transfers, FX margins and fees may stack up, especially beyond free allowances.

- Compliance reviews can pause funds briefly for high-volume or unusual activity, frustrating during peaks.

- Support leans chat-only and can lag on complex issues, though most minor queries resolve fast.

- Recent fee tweaks (e.g., €10/mo basic plan) caught some off-guard, pushing solos toward alternatives.

Best for

Revolut Business is a sleek, powerhouse choice for freelancers, e-com shops, and growing startups craving effortless UK euro account without the fees or fuss of old-school providers. Once you’re set up and flowing normally, it’s reliable, feature-packed, and genuinely boosts efficiency—thousands of users swear by it as their “daily driver” for multi-currency ops, and with 2025’s app polish and 50M+ user base, it’s evolving into an even stronger contender for digital-first teams.

Wittix

Pros

- Quick onboarding & responsive support: Many praise the straightforward account setup (under a week) and fast resolutions – e.g., “support solved my issue in minutes” and dedicated reps building “fantastic relationships” for high-turnover businesses.

- Competitive multi-currency tools: Users highlight efficient IBANs, global payments, and mass payouts that save time, e.g., “upload recipient lists and Wittix does the rest effortlessly” for freelancers and e-com.

- User-friendly platform: Intuitive app/dashboard for tracking expenses and transfers, with “intuitive UI” and real-time features earning nods from satisfied long-term users (6+ months).

Cons

- Compliance & account freezes: Frequent rants about sudden blocks post-funding (e.g., “first €37K wire triggered 15-day review with no comms”), long doc demands, and crypto restrictions.

- Hidden/high fees & slow transactions: €850 onboarding + €99/month surprises users, plus delays (hours/days, no instants) and non-refundable charges.

- Lack of transparency & support drop-offs: Early responsiveness fades during issues; forum users blame it for irrelevant questions and unlisted country blocks—e.g., “lied about eligibility” leading to instant bans.

Best for

Wittix is genuinely loved by EEA-based freelancers, small agencies, and mid-sized e-com businesses who value fast personal support and proper multi-currency IBANs over rock-bottom fees. If you fit their sweet spot (EU/EEA entity, standard business activities), it’s one of the friendliest and most responsive Banking-as-a-Service/EMI options out there right now.

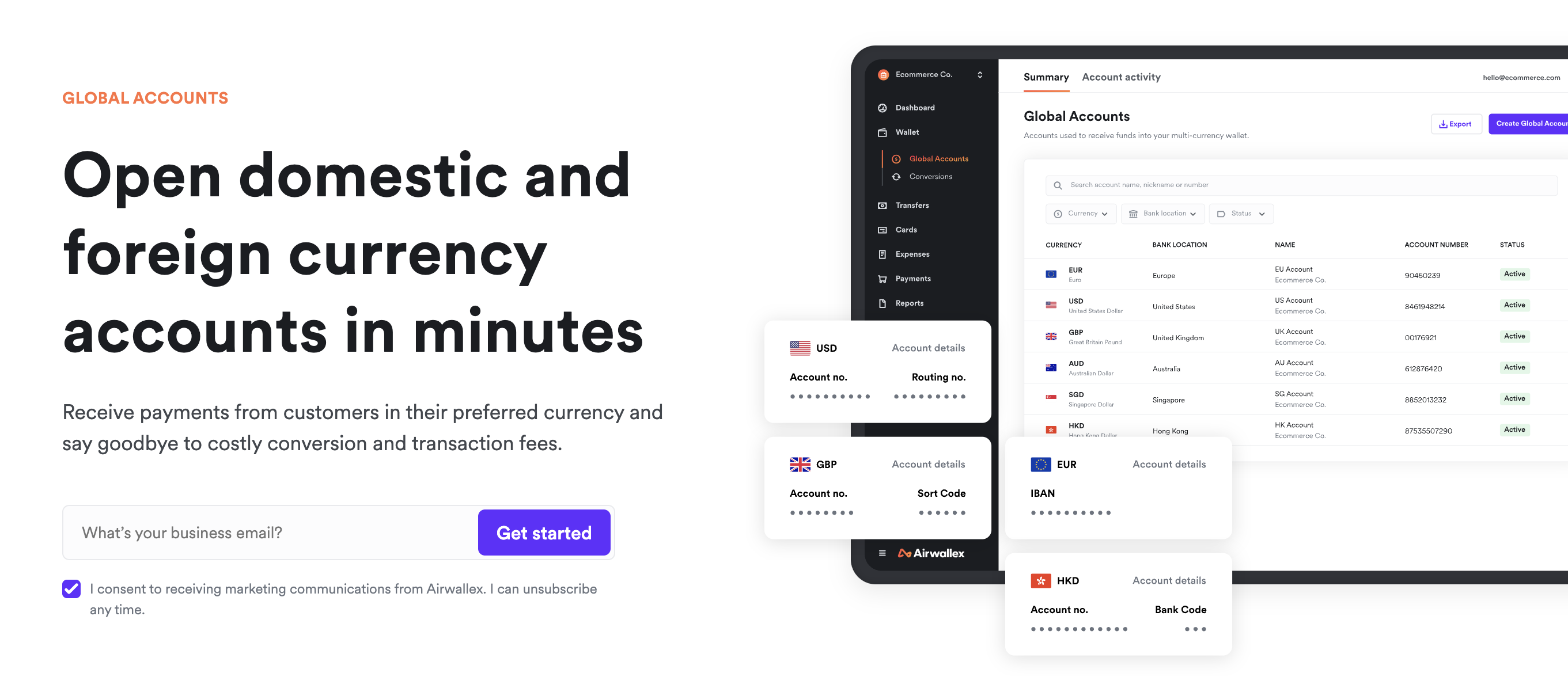

Airwallex

Pros

- Seamless multi-currency & fast transfers: Users love holding 20+ currencies, instant payouts (90% same-day), and competitive FX rates—saving thousands yearly vs. banks; Reddit post hailed quick HK setup for cross-border invoicing.

- Easy integration & user-friendly dashboard: Smooth API/docs for devs, Xero/ERP links, and virtual cards streamline expenses; Trustpilot reviewers call it “intuitive” for scaling businesses.

- Cost savings & global reach: No hidden fees, local accounts in 50+ countries – e-com folks report $40K+ annual cuts on collections; great for freelancers/DNs avoiding PayPal/Wise limits.

Cons

- Support delays & poor responsiveness: Frequent complaints of slow/no replies, dropped account managers, and unhelpful chats—Reddit users say it “disappeared” post-fee changes; Trustpilot rants on hours-long doc prep wasted.

- Account blocks & strict compliance: Sudden freezes/rejections without explanation (e.g., $156 transaction halted), AML doc demands costing $400+, or 6-hour shutdowns—frustrates small biz per r/smallbusiness horror stories.

Best for

Airwallex is a clear winner and daily driver for thousands of scaling e-commerce, SaaS, and marketplace businesses that move serious money across borders. Once you’re fully onboarded and running “normal” flows, it’s fast, reliable, and genuinely cheaper than almost every alternative. If your business is established, transparent, and processes $50K+/month globally, Airwallex is one of the strongest, most loved options on the market right now.

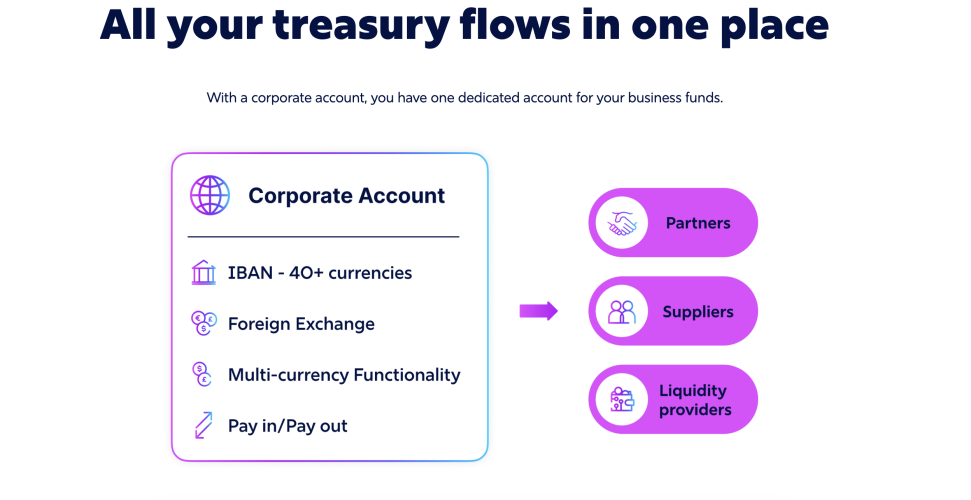

OpenPayed

Pros

- Global reach with instant payments (SEPA, SWIFT, Faster Payments) and seamless fiat ↔ crypto conversion

- Might offer euro-account services tailored to businesses bridging UK ↔ Europe.

- Foresight in integrations: Positive nods to proactive changes (e.g., adding Malta IBANs ahead of EU regs), avoiding disruptions for high-volume users.

Cons

- Tech glitches & delays: Frequent complaints of transaction failures (e.g., instant top-ups breaking, funds stuck in limbo), blamed on OpenPayd bugs; one user lost money to unclaimed FX returns.

- Poor support & opacity: Slow resolutions (days for “tech issues”), surprise account reviews post-closure requests, and finger-pointing with partners like Bitfinex.

Best for

OpenPayd is a backend powerhouse quietly powering top crypto and fintech platforms, delivering fast, compliant global payments that keep high-stakes operations humming without the drama. For dev-led businesses embedding banking services, it’s a smart, scalable choice that saves time and cuts costs—many partners say it’s the “unseen hero” making seamless user experiences possible, and with 2025 expansions, it’s only getting stronger for the digital economy.

🛠️ How to Choose the Right UK Euro Account

- List your needs: volume of EUR payments, frequency, invoicing, supplier payments, FX sensitivity.

- Evaluate account features: local-like EUR IBAN, multi-currency support, SEPA/SWIFT access, payment cards, batch transfers.

- Check costs and FX rates: compare real FX margins and transfer fees — small percentage differences can add up.

- Understand compliance & safeguarding: ensure the provider is regulated, funds are secure, and services meet your region’s needs.

- Test with small amounts first: especially if using lesser-known providers (like Wittix or OpenPayed).

- Consider future needs: growing business, more currencies, global suppliers — choose a flexible, scalable solution.

🔎 Final Thoughts: Which UK Euro Account Makes Sense for You?

- For small businesses or freelancers trying euro payments occasionally — Revolut Business offers the easiest entry point.

- If you run an export or e-commerce business with regular euro transactions or supply chains in Europe — Airwallex is likely the most robust, scalable solution.

- If you handle frequent UK <-> EU trade but want a UK-based euro account — Transferra may be a good balance of convenience and euro-account benefits.

- Providers like Wittix or OpenPayed might offer interesting alternatives — but only if you’re ready to invest time in due diligence and risk-check.

Choosing a UK euro account in 2026 is no longer about convenience – it’s a strategic decision for any business working with the eurozone.

Revolut is great for new companies, Transferra suits UK-EU trade, and Airwallex works best for high-volume cross-border activity. By selecting the right UK euro account, your business saves money, reduces friction and operates more efficiently across Europe.