European Money Transfers: Trends in B2B, B2C, and C2B Payments

This article is a must-read for anyone involved in the European payment landscape, whether you’re a business owner, financial professional, or tech enthusiast. You’ll gain valuable insights.

Companies that sell things and services all over Europe need to know about the newest payment trends. B2B (business-to-business), B2C (business-to-consumer), and C2B (consumer-to-business) are the three main ways that people pay these days. This article discusses key trends in European money transfers for B2B, B2C, and C2B payments that impact wholesalers. Also, we’ll tell you how Transferra can help your distribution business do well in this changing environment.

How European money transfers are shaping user behaviors in the payment landscape?

Mobile banking boosts online shopping

One of the key factors driving online shopping growth is the widespread adoption of mobile technology. As of 2024, smartphone penetration in the EU has reached 87% (Statista). This convenience allows you to order, for example, a packaging machine from China while casually brainstorming with a partner at a bar — ideas discussed, plans devised, and swiftly executed! And that’s not to mention e-commerce sales. Every other buyer purchases goods via the internet using a mobile phone (Redline Digital).

Contactless payment: the new norm

Why handle cash or use ATMs when you can make purchases contactlessly, even online, without leaving your home? In the two years since COVID-19, the adoption of contactless payment methods took flight, reaching over 68% of all card transactions in the EU (VISA report). This growth highlights consumers’ preference for safe and efficient buying options.

SEPA fuels cross-border purchases

Thanks to the Single Euro Payments Area (SEPA), European money transfers within the EU have never been easier. This simplicity of the payment method helps businesses broaden their horizons and enter new markets with confidence. Consequently, EU consumers are becoming more comfortable buying from international retailers.

Distributors need to grasp these flows to facilitate European money transfers for B2B deals, process B2C payments, or ensure smooth C2B checkouts.

! Transferra is a top financial service that helps with money transfers for European distributors and keeps up with the times. Our services make it easier to send money across borders, protect you from currency risks, and add new payment methods, so you have the best experience possible whether you’re moving or getting money.

B2B money transfers

B2B (Business-to-Business) payments refer to transactions between companies, including the purchase of goods or services, payment for supplies, invoice management, and other financial operations.

Common examples of B2B payments:

- supply of goods

- provision of services

- invoice payments

- referral marketing

- investment deals

This kind of transaction is crucial for making deals along the supply chain possible, paying sellers and customers, settling bills, and doing other financial business between companies.

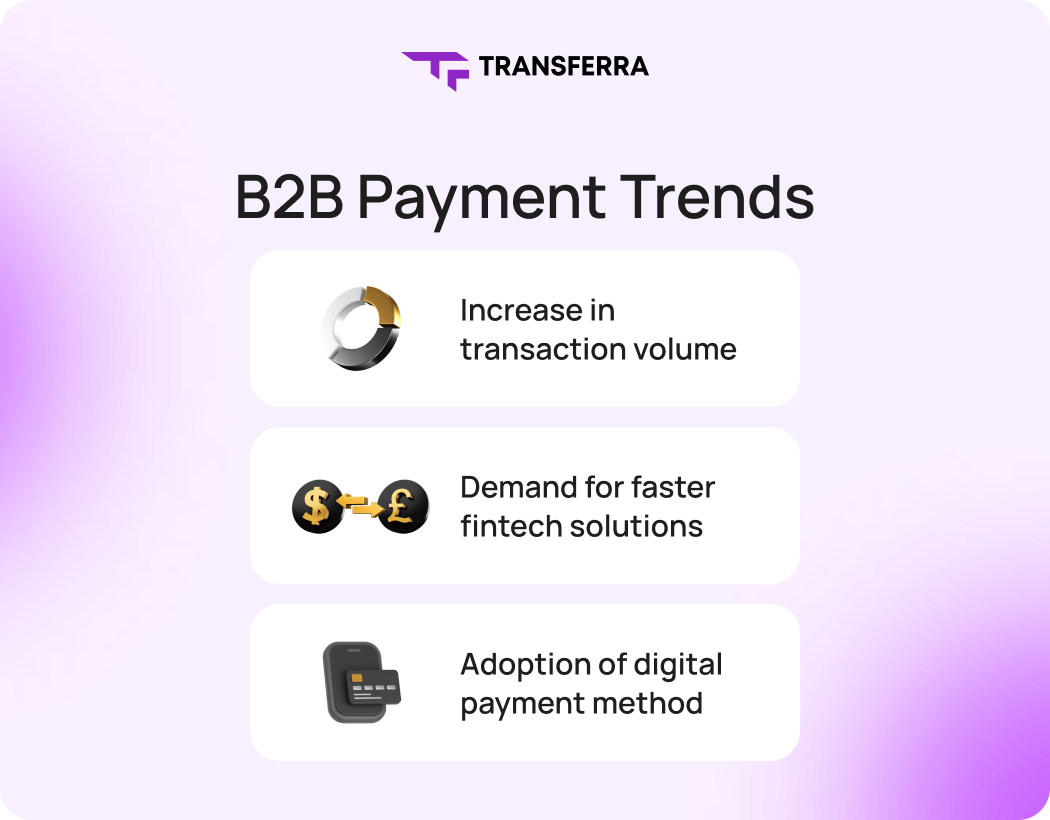

What are the trends in B2B payments?

- Globalisation and cross-border transactions. B2B cross-border payments are expected to increase by 43% by 2030 to exceed $56 trillion, having reached $39.3 trillion in 2023 (FXC Intelligence). This growth is largely driven by global commerce, supported by a significant strategic pivot among U.S. corporations towards international operations. The importance of international B2B purchases is underscored by ongoing geopolitical instability.

- Need for faster and more efficient fintech solutions for European money transfers. European distributors are increasingly adopting faster fintech solutions to improve cash flow, reduce costs, and streamline operations. Technologies like blockchain and faster payment rails are being explored. By 2024, blockchains are expected to handle 11% of international B2B transactions. Additionally, the global crypto payment gateway market is projected to reach $5.4 billion by 2031 (Allied Market Research).

- Implementation of digital payment methods. Digital B2B payment options are gaining popularity in 2024, with businesses increasingly using electronic invoices, virtual cards, and e-wallets to be more open, protect their data, and speed up the accounting process. The total transaction value in the digital payments market in Europe is projected to reach $2,194 billion in 2024, showing an annual growth rate of 8.81% (Statista).

Feeling the pull of the global market? Don’t go it alone! It’s important to have the right cross-border B2B payment options and partners to seize new opportunities while minimising risks. Let’s tackle this together and realise your global ambitions.

B2C money transfers

B2C (Business-to-Consumer) payments refer to transactions between businesses and end consumers. For example, a company might compensate its employees, a source might remunerate a gig worker, or a marketplace might distribute earnings to sellers.

Common examples of B2C payments:

- payments made by employers to employees

- payments to freelancers and agents for work done

- payments to gig workers and buyers on the marketplace

- paying out insurance claims to owners

- lottery winnings or prizes for specific people

Businesses need to be able to process B2C payments quickly and easily in order to hire and keep good employees, maintain good relationships with suppliers, and give customers a great experience.

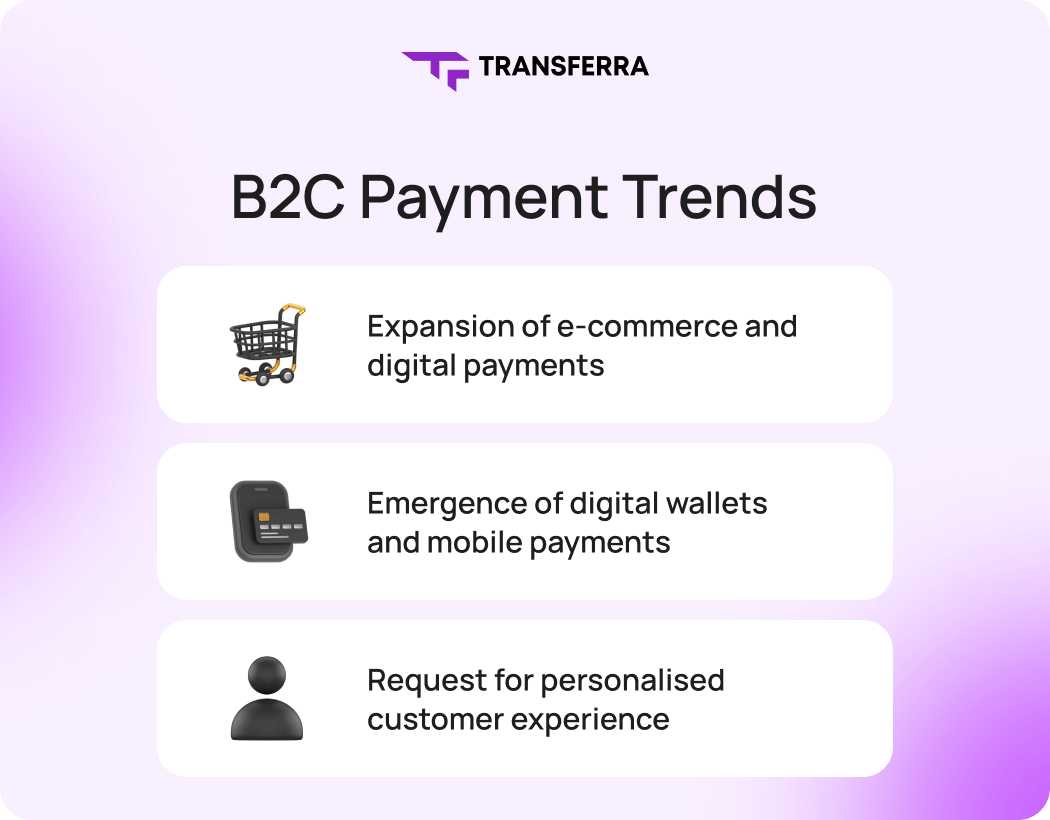

What are the trends in B2C payments?

- E-commerce growth and online payments. The global e-commerce market, valued at $4.9 trillion in 2021, is projected to reach $7.4 trillion by 2025 (Insider Intelligence), driven by the rapid adaptation of businesses to technologies. The rise in Internet shopping has led to the need for optimised payment processes, such as digital wallets and “buy now pay later” services. Additionally, the market is expanding due to greater participation from older generations.

- The emergence of digital wallets and mobile payments. European money transfers are increasingly leveraging contactless B2C payments, including wages and marketplace payouts, facilitated by wallet apps like Apple Pay, Google Pay, and mobile banking apps. Due to a boom in developing countries, the digital wallet segment will likely show the highest CAGR of 14.5% between 2023 and 2032 (Allied Market Research). Businesses need to make sure that mobile payments move smoothly.

- Demand for personalised and seamless customer experiences. Clients want highly customised, on-demand B2C payment experiences. This could include self-service, open payout choices, and payment methods that are specific to the area. 75% of companies say that the way their clients feel is what makes them grow (Salesforce). Implementation examples include mobile payment apps, payment chain integration, and customer behaviour analytics.

Feeling the shift in European payments? Let’s turn it into an opportunity! Imagine happier customers, smoother money transfers, and even new revenue streams — all thanks to a smarter B2C payment strategy.

C2B money transfers

Consumer-to-business (C2B) payments are when people buy things or services from businesses and pay for them directly. In e-commerce, shopping, energy, and many other fields, this type of payment flow is widespread.

Common examples of C2B payments:

- buying things from e-commerce sites and apps

- paying bills for things like insurance, energy, and telecom

- selling tickets for events, trips, and fun things to do

- payments made on a regular basis for digital services

- donations to groups that don’t make money

As customer needs change, it’s important for businesses to offer smooth and safe C2B payment experiences to increase sales and keep clients coming back.

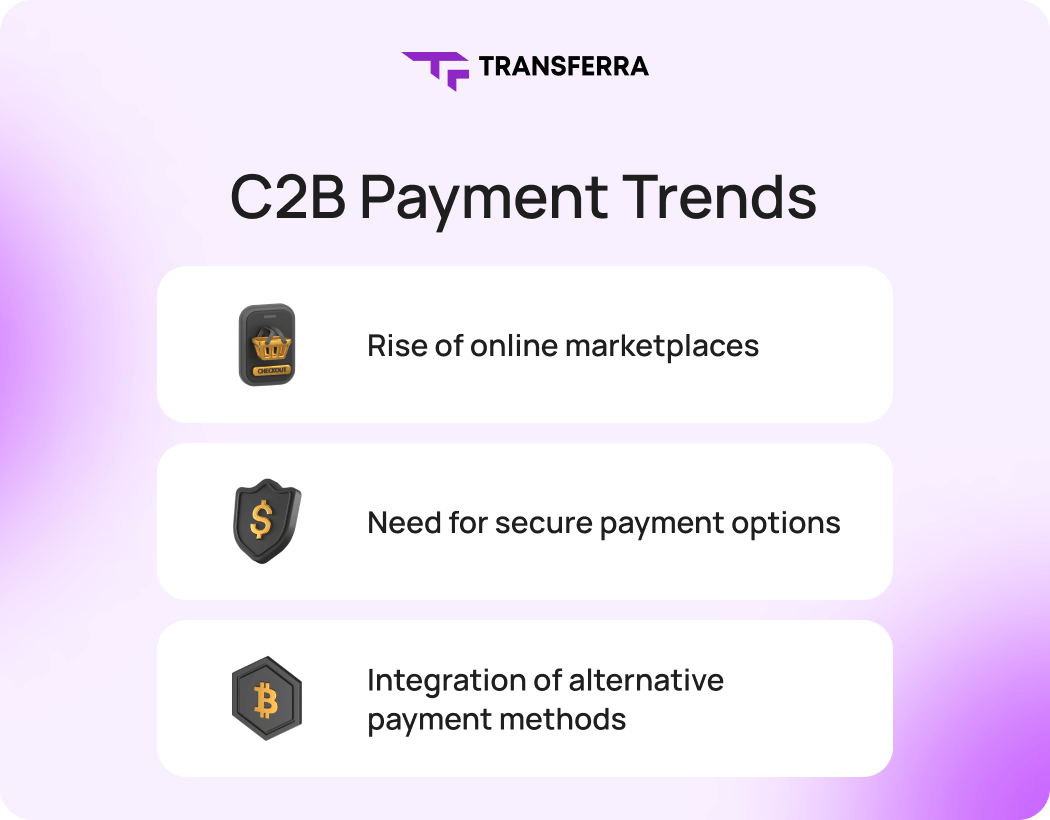

What are the trends in C2B payments?

- Rise of e-commerce and online marketplaces. Over 33% of people worldwide purchase online, making e-commerce a $6 trillion industry now that is expected to grow to $8 trillion by 2027 (Sellers Commerce). Web-based stores like Amazon are used to making it easy for businesses to sell things. To keep up with rising customer standards, traditional companies need to improve how they accept payments.

- Need for secure and convenient payment options. European money transfers face persistent challenges with online scams and security vulnerabilities in business payments. Merchants employ an average of 5 fraud detection tools, with over 50% relying on credit card and identity verification services (Cybersource). At the same time, customers want an easy experience with features like saved payment information. Finding the right balance between safety and ease of use is always hard.

- Integration of alternative payment methods. Businesses need to accept more than just credit and debit cards if they want to reach as many people as possible. E-wallets (like PayPal and Apple Pay), mobile payments, and direct banking are some examples. 73% of retailers realised that sales could suffer if they didn’t take APMs (Ernst & Young).

Are you annoyed about lost sales and abandoned carts? Customer satisfaction and business success are directly correlated with a seamless C2B payment process. Make the change right now and see an increase in sales!

5+1 key insights about payment trends

1. The European money transfer sector is undergoing significant transformation due to factors such as technological advancements, globalisation, and shifting consumer preferences. It is very important for wholesalers to adapt to the main trends in B2B, B2C, and C2B transfers in order to stay in business and grow.

2. In the B2B world, companies are changing how they do business with sellers and partners because they need faster and more efficient ways to pay across borders and because they are starting to use digital methods like blockchain.

3. B2C is changing because of the rise of e-commerce, mobile payments, and the need for more personalised payouts.

4. In the C2B space, on the other hand, companies need to improve their payment options to meet customers’ higher standards for safety, ease of use, and different methods.

5. Major trends like open banking have led to a considerable evolution in European money transfers, giving customers and businesses more access to financial services. To protect sensitive data, this advancement calls for strong data protection and security protocols.

6. Having the right technology partner is crucial in the rapidly transforming European market today. By collaborating with Transferra, you can take advantage of new chances to achieve long-term success, including time and money savings as well as satisfied clients.

Empower your wholesale business with Transferra’s payment solutions

Outdated systems can slow you down, damage customer relationships, and leave you struggling to comply with regulations.

Feeling the pressure to keep pace with the ever-changing payment landscape?

But fear not!

Transferra can be your trusted partner in navigating these changes.

We’ll provide you with a comprehensive toolkit for European money transfers, including:

- European cross-border payments

- Expert FX risk management

- Integration of the latest payment methods

Stay ahead of payment trends and open your business account with Transferra today!