Top 10 Fintech Options for Expats in the EEA: User Choices

This blog post highlights the top 10 fintech companies for business banking and online accounts that simplify cross-border payments and currency exchanges. Read on to make informed choices for international transactions.

For expats struggling with the financial landscape in the EEA, we’ve compiled the top 10 fintech companies for business banking and online accounts. Based on over 500 real user opinions from discussions across Facebook, Reddit, LinkedIn, and Telegram, we’ve filtered genuine recommendations from the noise. Whether you run a location-independent enterprise, handle cross-border payments, or seek better exchange rates, this guide will help you find the best services for your needs abroad.

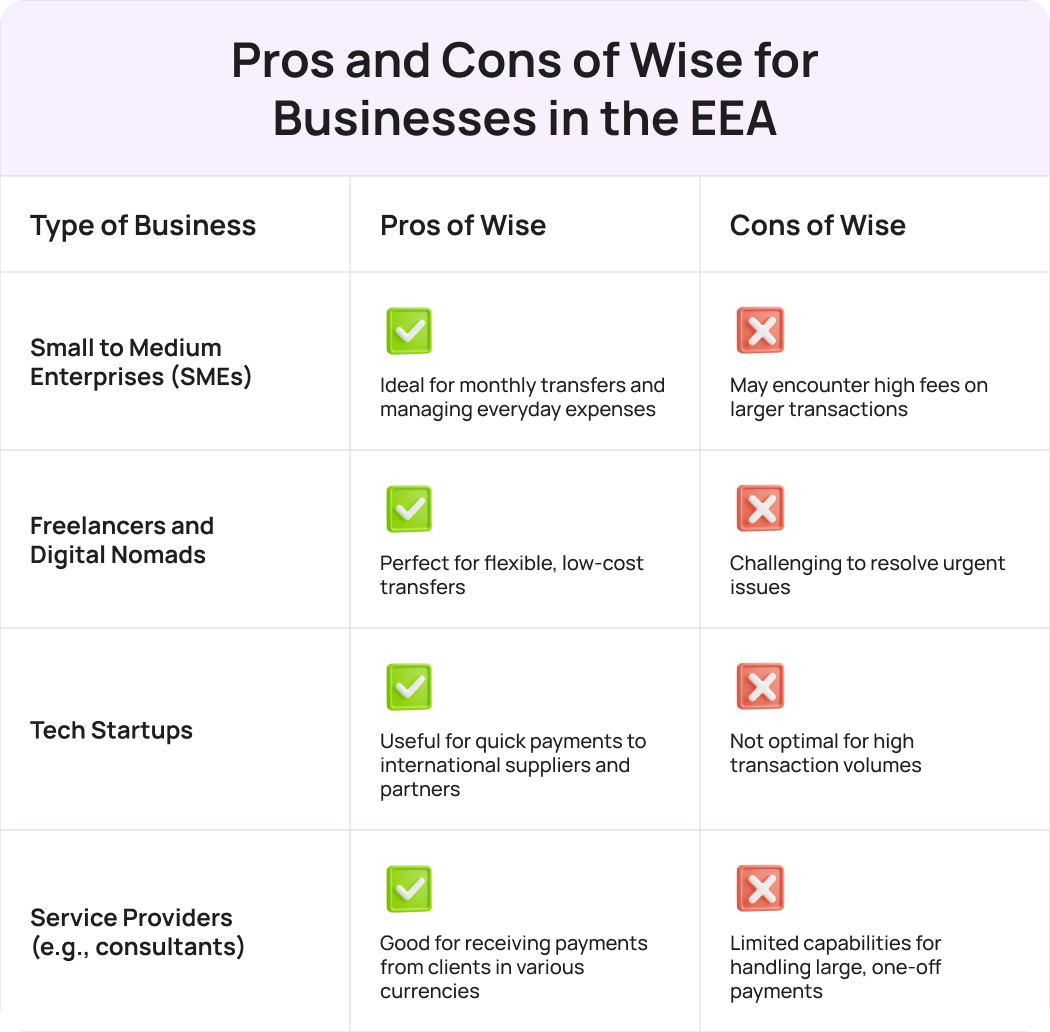

WISE: top choice for foreigners living abroad

Wise, formerly known as TransferWise, was founded in 2011 and has since become one of the fastest-growing UK-based fintech solutions. According to Statista, the customer base is projected to reach 23 million by the end of 2024. Expats, digital nomads, and entrepreneurs can benefit from flexible multi-currency business accounts and transparent fees.

Why does Wise continue to be a top pick for managing finances abroad?

⠀

1. Cost-Effective Transfers

While Wise is excellent for smaller to medium-sized transfers, some users have found limitations when sending larger amounts, particularly when dealing with significant transactions like property purchases. For these cases, clients recommend considering traditional bank remittances instead, even though they may incur higher fees.

This is important for businesses, where every euro counts. Lower transfer fees allow companies to allocate more capital to lending operations or reinvest it back into the organisation. This ultimately enhances profitability, especially for those managing multiple currency wallets.

2. Reliable International Payments

Despite some reports of slower transfer times due to changes in banking partners, Wise remains a trusted choice for cross-border payments. The company is authorised by the Financial Conduct Authority (FCA), which requires strict regulatory oversight and ensures that customer funds are safeguarded in segregated accounts, providing an additional layer of security and trust.

This reliability is particularly crucial for businesses that rely heavily on international deals, such as e-commerce platforms, freelance marketplaces, and import/export firms. Fast payments in various currencies enable them to settle accounts swiftly and meet their contractual obligations.

3. Security

Users value Wise for its strong security measures. The service offers 24/7 fraud protection, two-factor authentication (2FA), continuous monitoring and analysis, and regular vulnerability scans to protect sensitive information related to business expenses.

How do users criticise Wise regarding international transfer services?

⠀

1. Slower Transfer Times

Certain users have reported delays in transfer speeds, particularly with ACH payments, which can take longer than anticipated. This has led to frustration for those accustomed to instant transactions.

In highly regulated and competitive industries like medical equipment manufacturing or pharmaceuticals, any financial delays could impact production schedules and, ultimately, business success.

2. Limitations on Large Transactions

While Wise is excellent for smaller to medium-sized transfers, some users have found limitations when sending larger amounts, especially when dealing with significant transactions like property purchases. For these cases, clients recommend considering traditional bank operations instead, even though they may incur higher fees.

This can be incredibly frustrating for businesses involved in real estate, international investments, or any industry requiring high-value transactions. Imagine a property agency trying to facilitate a property sale where the buyer needs to transfer a substantial deposit. Delays or caps on payment limits could jeopardise the deal and harm client relationships.

3. Inconsistent Customer Support

Several users have mentioned issues with customer support, especially when addressing complex or urgent matters. While Wise has made strides in improving its service, there is still room for improvement in terms of response times.

For businesses that rely on timely transactions — especially those in sectors like import/export, retail, or services — delays in client assistance can be a challenge. For instance, expat companies that handle international payments or remittances may encounter difficulties if they can’t quickly address pressing issues, such as unexpected currency conversion rates or restrictions on the amount of money they can send. This highlights the importance of choosing one of the top 10 fintech companies known for reliable customer support to ensure seamless financial operations.

Situations where expats recommend Wise for business:

- Monthly money transfers from a small UK company to an EU recipient;

- Challenges with high fees and slow processing times from traditional banks;

- Everyday financial operations, such as managing expenses and receiving payments;

- Receiving salaries while waiting to set up local bank accounts;

- Receiving sales earnings for e-commerce businesses, dropshippers, and wholesalers on Amazon.

Revolut: popular financial management platform for expats

Revolut has gained significant popularity among expats in the EEA, offering a range of features that simplify financial management, including multi-currency accounts and international money transfers. As one of the top 10 fintech companies, it boasts over 40 million users as of March 2024, this financial app continues to expand its reach.

How do Revolut’s features help expats stay in control of their business finances?

⠀

1. Multi-currency convenience

Revolut simplifies business finances by supporting multiple currency wallets, which is ideal for expats who are always on the go or working in different places. With the ability to manage funds in several currencies, organisations can pay and get paid globally without incurring hefty conversion fees.

Many businesses that work with international clients will find this invaluable. They can easily transfer money across borders while keeping operational costs low. For example, travel-oriented companies, like tour operators or event planners, can manage expenses in local monetary units, avoiding unnecessary fees while booking services or making purchases abroad.

2. User-friendly for business trips

Whether in Ireland or elsewhere, expat business owners appreciate Revolut’s hassle-free card use and convenient top-ups abroad. The app’s seamless interface ensures smooth financial management during trips, helping clients keep their spending in check.

This can be especially beneficial for digital nomads, freelancers, and small businesses with remote teams who frequently travel internationally. Efficient financial management enables entrepreneurs to concentrate on service delivery instead of becoming overwhelmed by administrative responsibilities like invoicing, expense tracking, and compliance.

3. Innovative features

Revolut’s mobile app, combined with features like Google Pay and Tap to Pay on iPhone, offers worldwide businesses advanced tools for handling daily transactions. The option to generate invoices directly within the app streamlines billing processes, while expense management tools help track spending and improve financial oversight.

By providing advanced solutions for executing routine charges, Revolut enables businesses such as online retailers and subscription-based services to offer seamless billing options. For example, expat-owned startups can manage cross-border transactions seamlessly, while local shops can quickly accept funds using the iPhone’s contactless payment feature, reducing reliance on traditional point-of-sale systems.

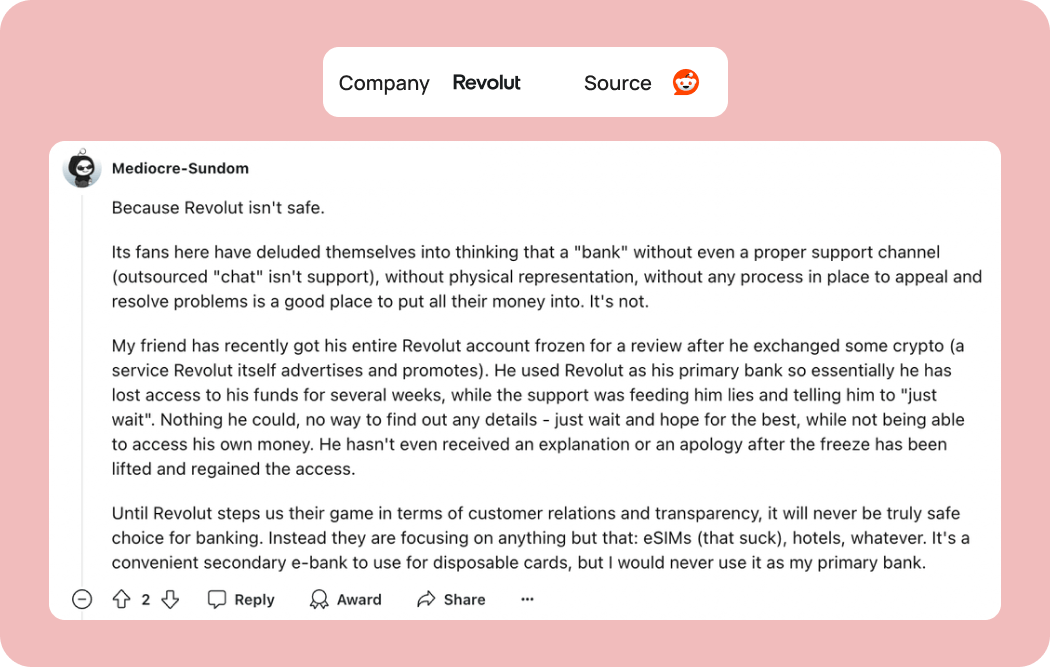

What difficulties can a business face when using Revolut?

⠀

1. Limited cash withdrawal options

Revolut has set a limit on fee-free money withdrawals, which can be a challenge for businesses that rely heavily on cash transactions. Depending on which plan you’re on, that limit can vary, so if you go over it, you’ll be hit with extra charges.

This might be crucial if your suppliers and subcontractors like to get paid in cash. In industries where liquidity is high, such as hospitality or event management, exceeding the limit could lead to increased costs, cutting into profits and adding unnecessary financial strain.

2. Delayed customer support

Some users have experienced long wait times for support, particularly regarding compliance issues, which can delay critical business operations. Sure, utilising virtual company debit cards can make payments smoother, but if support isn’t there when you need it, it kind of defeats the purpose, especially for clients who prefer solutions that are easily accessible on mobile devices.

This can be particularly tricky for businesses in fast-paced fields like e-commerce, where quick response times are crucial for handling purchases and getting orders out the door. Plus, service providers such as consultants or freelancers dealing with international clients might find themselves waiting longer to collect their fees or sort out compliance stuff, which can disrupt their financial liquidity and client relationships.

3. Restrictions on Payments

Expats in the European Economic Area (EEA) have reported difficulties paying local taxes or administrative fees using Revolut. It turns out that this platform doesn’t always play nice with certain local institutions. As a result, transactions might get delayed, lead to penalties, or force you to find other ways to compensate.

This poses a real headache for small businesses and freelancers who need to keep up with tax obligations and other government fees on a regular basis — especially in countries where seamless integration with local banking systems is essential. Additionally, companies relying on timely payments for legal or regulatory reasons might face disruptions.

When foreigners recommend Revolut for business:

- For business trips, as it simplifies currency exchanges;

- For new investment companies, because it provides the opportunity to open accounts specifically tailored for investment purposes;

- For sending money to cryptocurrency exchanges, making it convenient for digital asset transactions;

- When there are difficulties opening a bank account with traditional banks;

- For managing finances prior to applying for a Temporary Residence Permit (TRP).

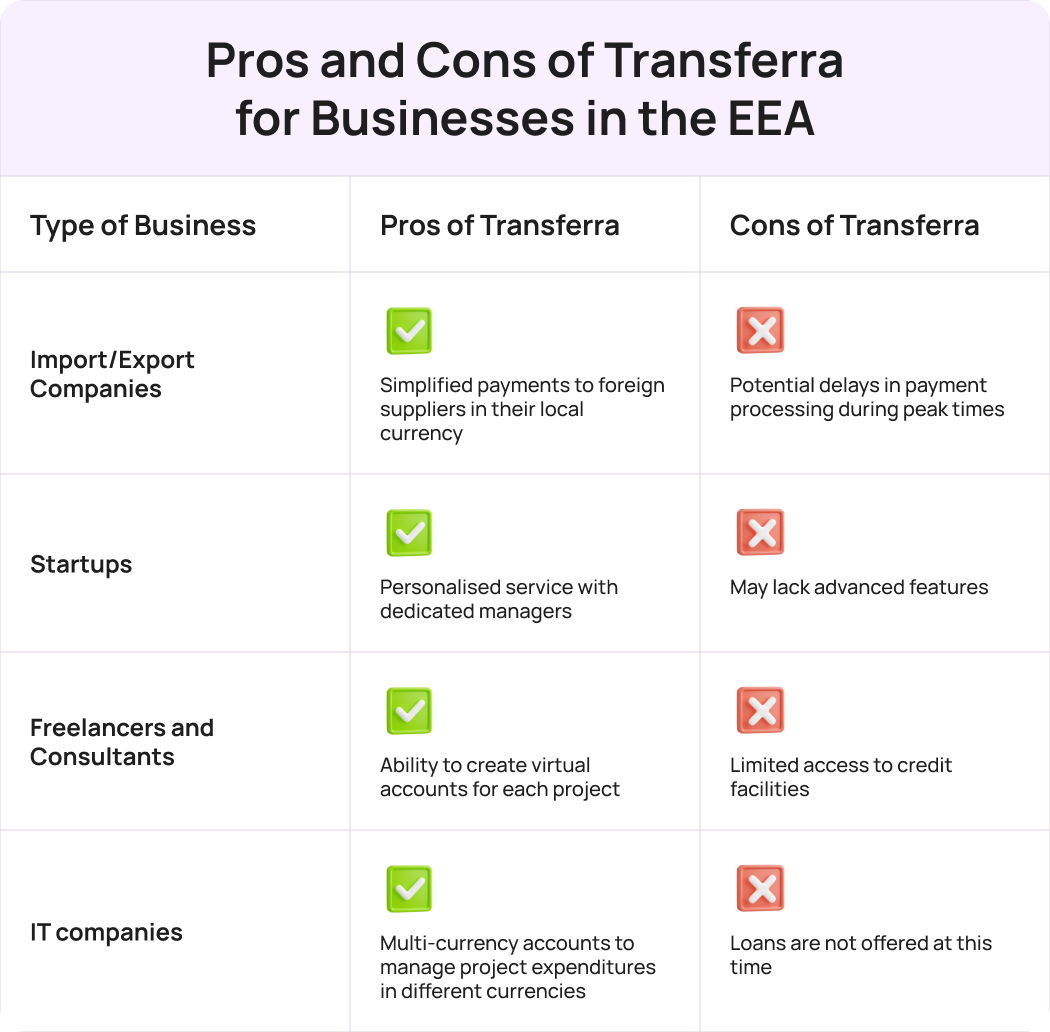

Transferra: modern approach to international payments

Transferra, a licensed electronic money institution regulated by the UK’s Financial Conduct Authority, offers an innovative solution for international payments without the constraints of traditional banking. Despite having only 500 clients so far, the platform provides features such as multi-currency accounts and swift cross-border transfers, empowering users to take control of their finances seamlessly.

How do Transferra’s unique offerings position it among the top 10 fintech solutions catering to the distinct preferences of expats?

⠀

1. Personalised approach

One of the standout advantages of Transferra is its personalised service, with each client assigned a dedicated manager. Non-UK residents and expats value the direct access provided via the platform’s built-in messenger, which offers timely support and customised advice on international payments. Clients appreciate the ability to reach their representative directly, receiving pre-transaction guidance that safeguards their accounts from potential issues.

This personalised support is especially crucial for businesses functioning across multiple EEA countries, where navigating different regulations can create financial complications. Having an experienced specialist ensures seamless cross-border transactions, essential for sustaining cash flow and meeting international commitments. For companies regularly managing high-value payments or complex financial activities, this expert guidance is invaluable, particularly in sectors like import/export or global consultancy where rapid, informed decisions are key.

2. Large transaction handling capability

Expats often highlight Transferra’s ability to facilitate substantial transactions without unnecessary hurdles, particularly for those opening a Start-Up Business Account. This feature has proven particularly beneficial for businesses involved in international trade and e-commerce or those managing multiple projects simultaneously.

For businesses that require swift processing of numerous payments — such as wholesalers or online retailers — the ability to execute large transfers without delays is invaluable. As well, this feature is particularly crucial for industries like construction or manufacturing, where large-scale transactions are common.

3. Fast payments across key markets

Expats appreciate Transferra’s capability to assist with quick fund transfers in the UK, Europe, and the USA. This speed is crucial for businesses operating in multiple time zones, where delays can lead to missed opportunities for securing new contracts or negotiating better deals and potential lost revenue from slow payment processing that could impact cash flow.

For companies engaged in online retail or digital services across EU markets, this aspect is indispensable. It enables swift payment to international contractors and efficient management of multi-currency accounts, including Euro Business Accounts. This speed also proves valuable for businesses dealing with perishable goods or time-sensitive projects, where prompt financial transactions can mean the difference between success and failure.

What barriers can foreign companies encounter when working with Transferra?

⠀

1. Detailed onboarding process

While some users have noted that Transferra’s onboarding process can take longer, it’s designed with businesses’ long-term success in mind. For smaller companies and startups, getting set up is straightforward and efficient.

For larger, more complex businesses, the extra steps ensure all necessary verifications are in place, providing the security and customisation needed for bigger operations. This thorough approach allows even large enterprises to open accounts confidently, knowing they’ve met every compliance and safety requirement.

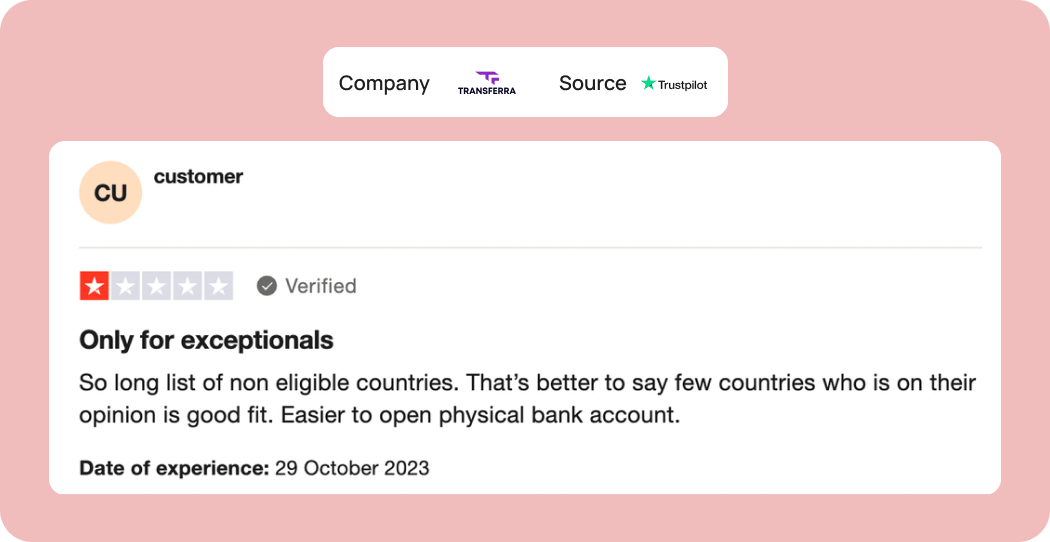

2. Risk-based geographical limitations for non-UK users

Transferra’s risk policy focuses on safeguarding and regulatory adherence, which may limit access for non-UK residents. While this may pose challenges for some businesses, it also ensures that Transferra adheres to strict regulatory standards, providing a secure and reliable platform for its clients. For companies looking to establish themselves in the UK or expand their presence, this focus on compliance can offer peace of mind, knowing that Transferra’s services meet the highest standards.

But those operating in less supported regions might experience some obstacles. For these users, seeking alternative services that cater more specifically to their geographical needs could be beneficial.

3. No Support for GCash Transfers

Some overseas Filipino workers (OFWs) have highlighted the absence of support for GCash transfers as a drawback of the Transferra financial solution. This popular mobile app for money transfers in the Philippines is essential for users who rely on it for daily transactions, such as sending remittances to family for living expenses, paying utility bills like electricity and water, or making purchases from local businesses back home.

For Filipino expats living in Europe, these transactions are important for maintaining economic support and connections with loved ones. The ability to easily transfer funds through GCash can greatly enhance their monetary management, ensuring they can meet their families’ needs, such as tuition fees, medical expenses, and other essential bills, while balancing their finances in a different country.

Business challenges for which Transferra is recommended by expats:

- Payments to foreign suppliers in their local currency;

- Minimising foreign exchange risks associated with rate fluctuations during import and export operations;

- Storing and managing funds in multiple denominations, enabling easier international transactions and reducing the need for constant currency conversions;

- Opening new business accounts when expanding into other European markets;

- Meeting compliance standards, such as Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, without unnecessary delays.

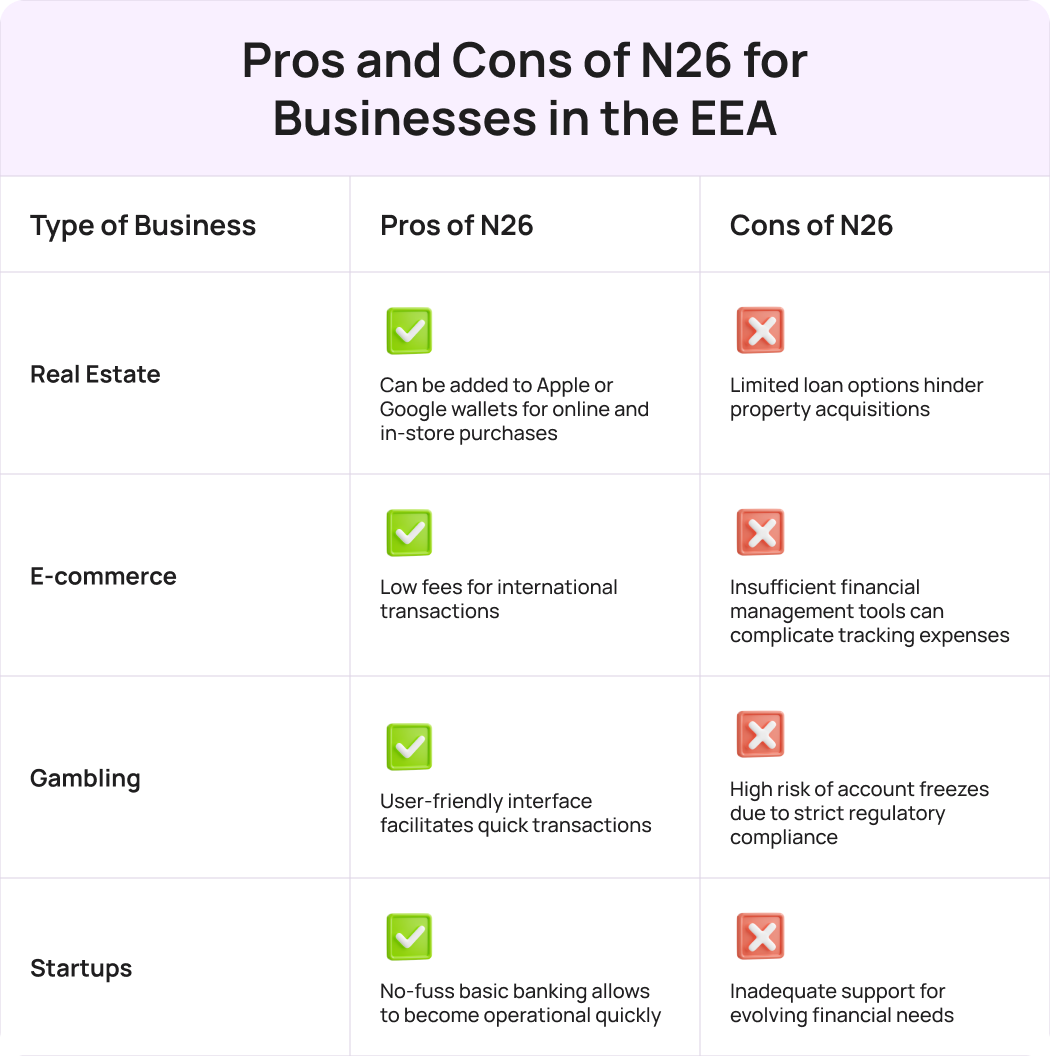

N26: digital banking for expat entrepreneurs

N26, a German neobank, offers a fully digital banking experience that is designed to make life easier for those living abroad. As one of the top 10 fintech companies, it features a seamless app interface and features like no-fee transactions across Europe, this banking solution stands out as a convenient choice for expats. Its customer base is estimated to exceed 8.3 million by the end of 2024, reflecting a robust growth rate of over 4% in just one year.

What positive aspects are users mentioning about N26?

⠀

1. Easy account setup

N26 allows expats to open an account online with just a passport, streamlining the process for business owners on the move. You can enjoy the convenience of fully online onboarding and financial management, complete with customizable debit Mastercards.

This level of convenience is a big win for freelancers and self-employed individuals who want fast access to banking services, including options for unlimited payments abroad. It is especially beneficial when they encounter situations such as managing multiple client invoices from various regions.

2. Cashback on transactions

N26 Business account holders enjoy 0.1% cashback on all purchases, with up to 0.5% cashback for premium cardholders. This feature has been praised by expats in Europe, particularly independent contractors and self-employed professionals, who find it especially useful for managing routine expenses.

This financial incentive rewards regular commercial purchases, such as travel, office supplies, or client-related costs, helping business owners stretch their resources further and make the most of everyday transactions.

3. Integrated financial tools

European expats prefer N26 for its “Spaces” feature, which lets you organise your funds by creating separate sub-accounts for unique goals, like travel or tax payments. It’s akin to having digital envelopes for expense management — super handy for keeping an eye on your spending and hitting those financial targets.

This tool is beneficial for businesses of all sizes, helping them track expenses and avoid overspending. Companies can allocate budgets for different departments or projects, such as marketing campaigns or equipment purchases. Startups can use Spaces to manage initial costs, such as product development and market research, helping them stay within budget.

What are the challenges faced by users when banking with N26?

⠀

1. Sudden account closures

Many users express concern about unexpected account closures, even when they have not engaged in any suspicious activities. Such closures can lead to frustrating downtimes and the hassle of retrieving their funds. The reasons for these account terminations often vary, ranging from suspected fraudulent activity to misunderstandings regarding the terms of service.

The consequences of account shutdowns extend beyond mere financial inconvenience. They can damage a company’s reputation, disrupt customer relationships, and impede long-term growth. New businesses, in particular, are at significant risk; those operating on tight budgets may find a sudden service suspension severely hampers their ability to pay suppliers, employees, and cover operational costs. This highlights the importance of a banking options comparison to ensure stability and reliability in financial services.

2. Strict anti-money laundering measures

N26 has been noted for its rigorous checks, which are primarily aimed at combating money laundering and financing terrorism. These stringent measures reflect the bank’s commitment to compliance and safety. In many cases, account freezes can arise from standard procedures, such as unusual transaction patterns or compliance with sanctions lists.

For businesses that rely on high transaction volumes and rapid sales, account suspensions may result in significant disruptions. Sectors like gambling, cryptocurrency, and luxury goods may be particularly susceptible to scrutiny due to perceived risks, resulting in a higher likelihood of account freezes.

3. Limited product range

N26 primarily focuses on basic banking services, which may not fully address the diverse financial needs of all users. Expats could find themselves wanting extra features that the platform lacks, prompting them to explore alternatives.

This is particularly significant for businesses operating in sectors such as real estate and e-commerce. These industries often have complex financial requirements, including managing payments and accessing customised lending solutions. For expats working in these fields, the absence of essential features could result in delays in securing funding or missing out on valuable investment opportunities.

Typical situations in which foreigners recommend N26 for business:

- For handling tax payments in Spain due to its easy integration with Spanish tax authorities;

- For day-to-day operations, such as purchasing office supplies, paying for online services, or covering travel costs;

- For tracking expenses and managing finances in real-time, thanks to features like notifications and categorization;

- For processing employee reimbursements with instant transfers within the Eurozone;

- For invoicing clients in various currencies.

Starling Bank: a cost-effective banking solution for expats

Expats recommend Starling for its tech-savvy approach to banking, especially if you’re frequently on the move. With around 4.2 million business customers as of March 2024 (Statista), Starling’s growing popularity highlights its convenience.

Its accessibility and zero foreign transaction fees render it a convenient and affordable banking solution. While some limitations exist, particularly regarding cryptocurrency and savings options, Starling Bank’s overall package remains highly attractive for international entrepreneurs.

Why are expats increasingly turning to Starling Bank?

⠀

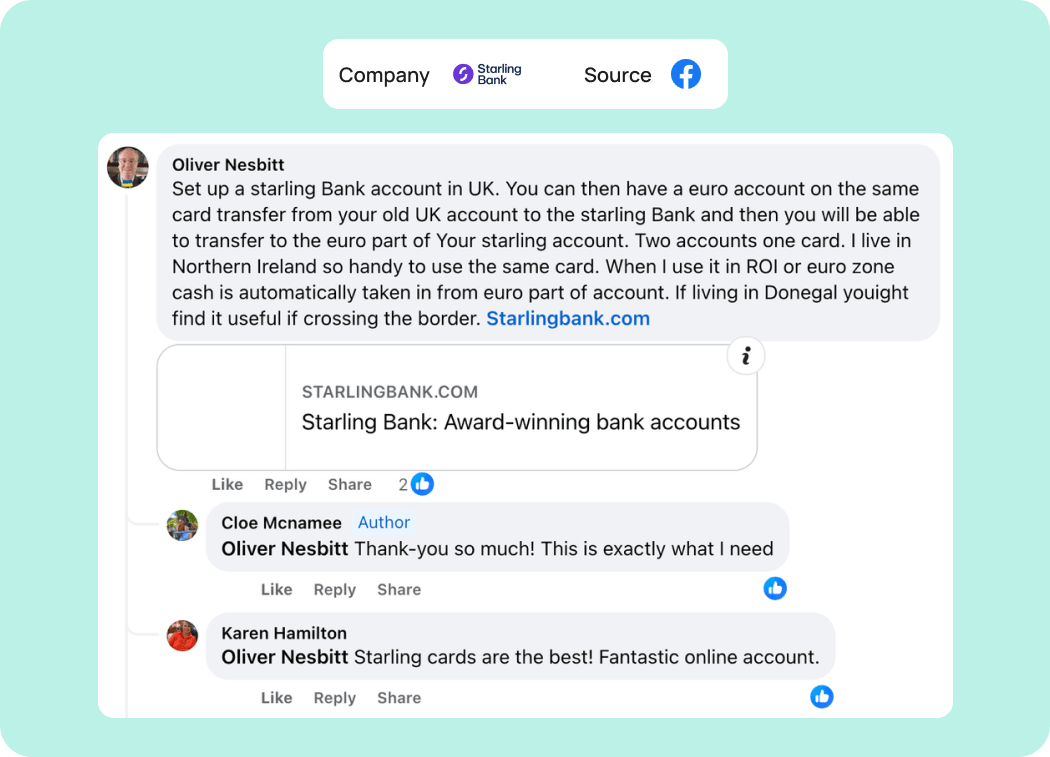

1. Dual currency convenience

Individuals living outside the UK consider Starling Bank, one of the top 10 fintech companies, a lifesaver for managing their finances while navigating life between the UK and Europe. This financial provider allows users to handle both GBP and EUR accounts from a single card, simplifying the banking experience.

For businesses involved in importing or exporting between these regions, Starling Bank makes it easy to handle transactions in both currencies without incurring excessive fees. With real-time notifications for payments, organisations can effortlessly track their spending abroad. For example, an online fashion shop or a brewery shipping products across Europe can significantly benefit from this setup.

2. Integration with accounting software

Starling makes financial life a lot easier by offering integration with popular accounting software like Xero, FreeAgent, and QuickBooks, and the best part? It’s free! This feature streamlines bookkeeping tasks, automates data transfer, and saves valuable time for busy entrepreneurs.

This is particularly advantageous for e-commerce businesses, especially when it comes to receiving payments into the account and keeping tabs on multi-currency transactions. Moreover, tech startups can automate their bookkeeping processes, enhancing productivity, while import and export companies can effortlessly manage financial records related to cross-border money transfers.

3. No maintenance fees

Users highly appreciate that Starling Bank doesn’t impose monthly fees on its business accounts, making it a budget-friendly choice for expats looking to minimise banking costs.

This feature positions Starling Bank as a top pick for businesses striving to remain cost-effective in today’s competitive landscape. For new entrepreneurs, the absence of monthly charges allows them to allocate their funds to other critical areas, such as marketing and product development, rather than worrying about banking fees.

What are the common complaints users have about Starling Bank’s services?

⠀

1. Limitations on savings options

Users are feeling let down by Starling’s recent changes to their business savings accounts, which now primarily offer fixed-term options. This shift may hinder their ability to earn interest on deposits compared to the more flexible investments available previously. For expats seeking comprehensive banking solutions, this development is concerning, as it limits the variety of capital alternatives for their ventures in light of European payment trends.

Many businesses rely on savings as part of their overall investment strategy. With the introduction of the new time-limited account, they may struggle to diversify their assets and investments effectively. This lack of flexibility could ultimately impact their financial health in the long run.

2. Ban on сrypto transactions

Starling Bank currently prohibits cryptocurrency transfers on all accounts. Therefore, if your business model heavily relies on crypto transactions, this banking option may not be the ideal fit for you.

This restriction could result in missed sales opportunities and strained customer relationships, particularly for businesses that accept cryptocurrencies as a payment method. Companies in sectors like e-commerce, digital services, or tech startups may face delays in receiving payments, affecting their ability to cover essential operational costs such as payroll, inventory, and utility bills. These delays can disrupt their financial stability and hinder effective cash flow management, making it challenging to sustain seamless operations.

3. Lack of telephone support

While many users appreciate the responsive chat support, the lack of access to telephone assistance has been noted as a limitation. For expats facing urgent issues, the inability to speak directly with a representative can lead to delays in resolving critical banking matters.

Expats often encounter complex financial situations, including tax implications, currency exchanges, and legal considerations related to their banking needs. These scenarios often require detailed discussions that are more effectively addressed through verbal communication rather than chat. In emergencies — such as the need to transfer a large sum of money for medical bills or legal issues — having a quick conversation with a bank representative can be vital for timely resolution.

Scenarios where Starling Bank is highlighted as a preferred option:

- Managing UK banking operations because it efficiently handles domestic payments, payroll, and supplier transactions;

- Automating accounting due to its seamless integration with Xero, FreeAgent, and QuickBooks, reducing time spent on manual data entry;

- Handling UK and Europe purchases as it simplifies multi-currency transactions, helping businesses avoid exchange rate issues;

- Supporting flexible work arrangements with convenient account access and management for companies with remote teams;

- Cashless business operations because of a fully digital banking system.

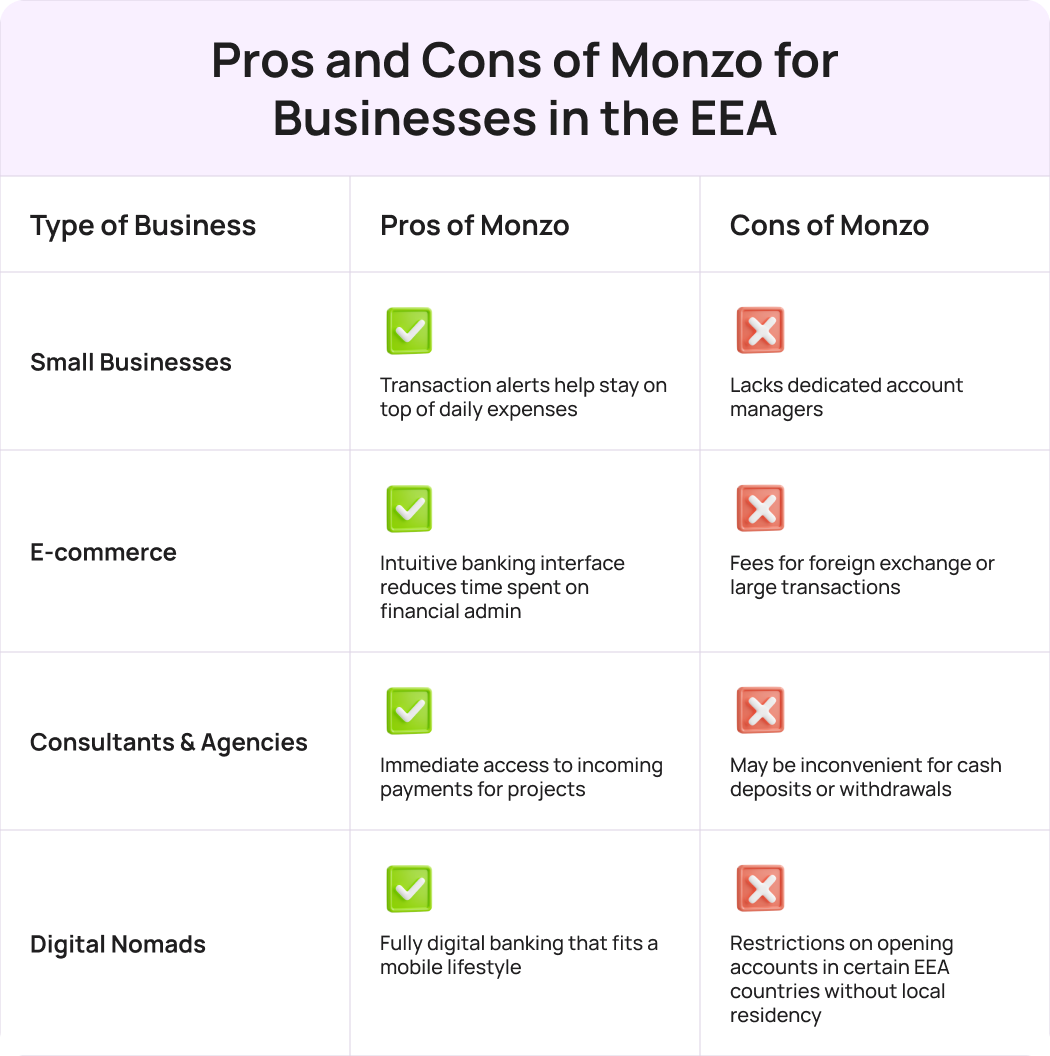

Monzo: tool for expats’ budgeting and expense tracking

Expats are recommending Monzo to each other for its flexible features. With handy tools like tax pots that automatically set aside money whenever you get paid, along with the ability to send payment links, deposit cheques through the app, or issue invoices, it truly simplifies financial management. No wonder, then, that Monzo has gained a loyal following, with an impressive 9.7 million users as of 2024 (Statista).

What are the key user choices available through Monzo?

⠀

1. Intuitive interface and user experience

Clients praise Monzo for its intuitive app design, making it easy to navigate even for those who aren’t tech-savvy. Its mobile-first approach simplifies client payments and invoice management, freeing up time for creative work.

For businesses that prioritise agility, simplicity, and minimal time spent on financial admin, Monzo’s user-friendly app interface can be a real asset. Freelancers and sole traders, in particular, will appreciate how effortlessly it tracks income, expenses, and invoices without the need for advanced tools.

2. Flexible spending options

As one of the top 10 fintech companies, Monzo offers a variety of services to help businesses manage their finances efficiently. With features such as tax-saving pots for automatic savings and quick invoice generation, Monzo simplifies money oversight for small enterprises, freelancers, and expats alike.

For small businesses with limited accounting resources, Monzo’s tax savings feature enables them to efficiently set aside a portion of their income for their monetary obligations. This ensures entrepreneurs stay compliant and reduces the risk of financial mismanagement, especially during periods of growth.

3. Community

Monzo has a strong and active community, which serves as a valuable resource for professionals seeking advice. Approximately 45% of users actively engage in online discussions. The service facilitates this interaction through dedicated forums and groups, including the Monzo Business Community on Facebook.

This active network provides companies with more than just advice — peer support is also available, which can be particularly useful for startups and entrepreneurs looking for guidance on banking and financial management.

What Monzo restrictions could cause problems for expats and their businesses?

⠀

1. Currency exchange limitations

Several expats have pointed out that Monzo’s currency exchange options may not be as competitive as those offered by other banks. Users have reported dissatisfaction with exchange rates, which can affect their overall financial efficiency.

This might be particularly concerning for companies frequently converting between currencies or managing global supply chains. Every transaction may cost more than expected, leading to reduced margins and potential financial strain.

2. Restrictions on cash deposits

Many expats have expressed concerns regarding the limitations on cash deposits with Monzo. Users find it inconvenient that the bank lacks a straightforward method for depositing cash, which complicates transactions for businesses that handle physical currency.

For enterprises that depend on cash transactions or frequently receive payments in this form, this limitation can pose a significant challenge. The absence of an efficient process for cash deposits can lead to cumbersome and inefficient management of daily finances.

3. Limited integration with third-party tools

Expats have noted that Monzo’s connections with third-party financial tools are somewhat limited. Users have expressed a desire for a wider array of compatible services.

For small enterprises that rely on various financial software for invoicing, accounting, and reporting, the lack of seamless integration can result in disjointed processes. This lack of cohesion may necessitate extra time and effort to manage money effectively, diverting attention from essential business activities.

Situations where Monzo is recommended for expat businesses:

- Budgeting and expense tracking because of its intuitive Pots feature, allowing users to easily categorise spending and plan ahead;

- Living or working in foreign countries, especially when physical bank branches are scarce and access to financial services is limited;

- Requiring virtual cards for enhanced security and flexibility in online payments, especially for one-time purchases, reducing the risk of fraud;

- Setting up a business quickly and easily, needing a user-friendly banking interface without unnecessary complexity;

- Quick access to money by being able to easily get cash via ATM.

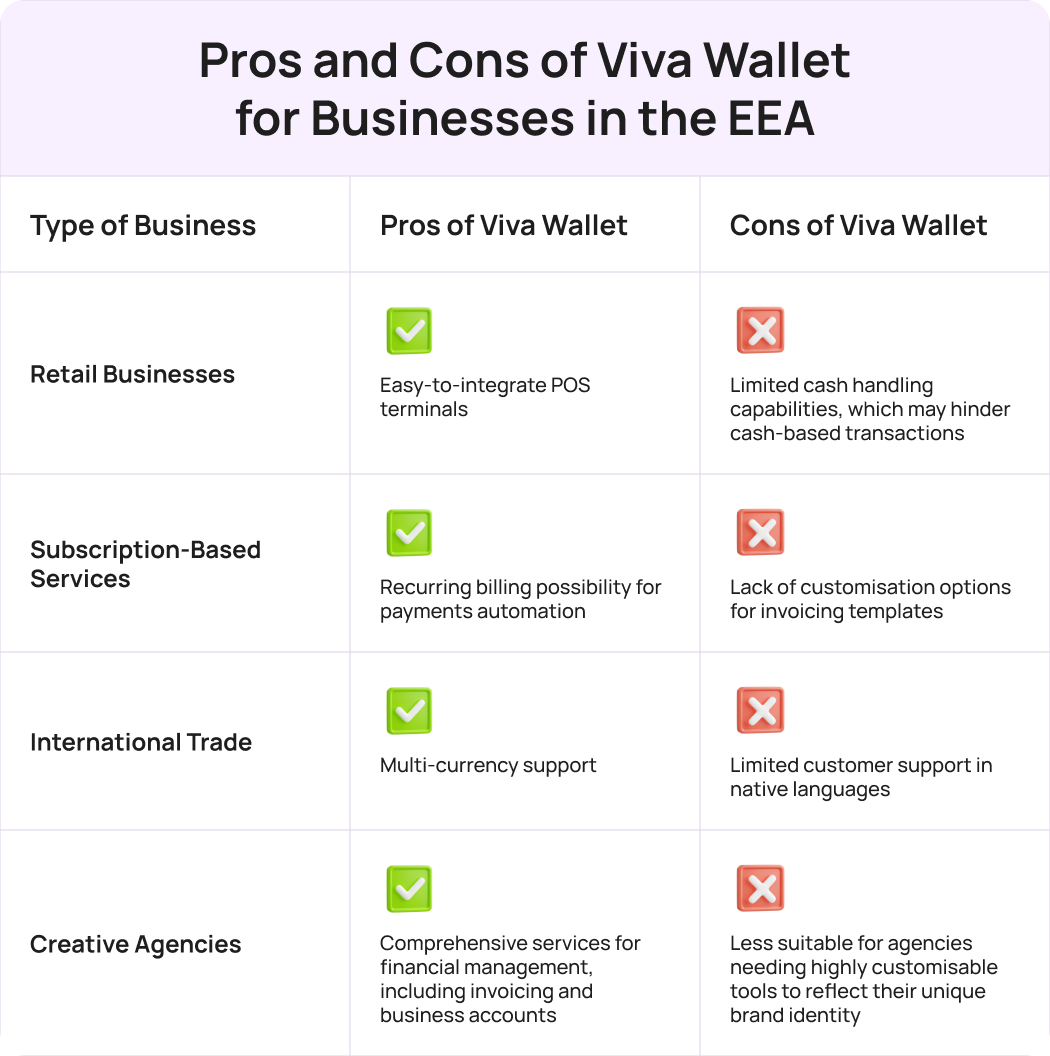

Viva Wallet: a cloud-based neobank for expats

For expats running businesses in the EEA, Viva Wallet offers a versatile and accessible banking solution. As a fully cloud-based neobank built on Microsoft Azure, this provider has a strong presence across 24 European countries, providing a reliable choice for companies navigating the complexities of cross-border finances. With over 50,000 corporate clients across Europe and a retention rate of approximately 85%, Viva Wallet continues to gain popularity. Users often highlight its smooth connection with payment services.

Why does Viva Wallet rank highly among EEA expats?

⠀

1. Refund on debit card fees

Foreign business owners in the EEA praise Viva Wallet for offering a refund on debit card fees, making it more cost-effective compared to traditional banks. Users appreciate how these refunds help reduce overall banking costs, which is particularly valuable for entrepreneurs managing small to medium-sized enterprises.

For businesses primarily handling card payments, the ability to reclaim these fees significantly improves cash flow management. Retailers and service providers processing high transaction volumes see noticeable savings, which positively impacts their bottom line.

2. All-in-one business solution

Expat entrepreneurs frequently commend Viva Wallet’s all-in-one approach, offering services such as POS terminals, online acquiring, and dedicated accounts. The platform’s intuitive invoicing tools also simplify financial management, making it a go-to for businesses with diverse needs.

This becomes especially important for companies expanding across the EEA. Imagine a startup launching operations in multiple EU countries simultaneously – Viva Wallet’s integrated services would streamline their financial setup, saving time and resources typically spent on coordinating separate banking relationships.

3. Responsive customer support

Users highlight Viva Wallet’s customer support as a major plus among the top 10 fintech companies. The platform often provides responsive and helpful assistance, whether it’s through email, phone, or live chat.

For businesses that depend on seamless payment processing, timely and reliable customer service is essential. Expats, in particular, benefit from having a dependable support team to assist with unfamiliar regulations or procedures, ensuring their operations run smoothly.

What drawbacks might expats running businesses in the EEA face when using Viva Wallet?

⠀

1. Limited personalisation options

Many expat business owners have pointed out that Viva Wallet lacks customisation options for certain services, making it feel less tailored to their specific needs. For example, some users have reported difficulties in customising invoicing templates or adjusting the interface to suit their preferences.

For creative agencies or businesses that require highly customisable tools to reflect their brand image, this limitation can be a drawback. In these cases, the lack of personalisation options might hinder smooth client communication or cause inefficiencies in workflow.

2. Reduced сash handling capabilities

Some expat entrepreneurs have noted that Viva Wallet may not be ideal for operations requiring frequent cash transactions. Users have reported that managing large amounts of physical money through this platform can be less convenient compared to traditional banking services.

For companies heavily reliant on cash-based operations, such as street vendors or small retail shops, this drawback becomes particularly significant. Imagine a British expat operating a food truck business in Spain – they would likely find Viva Wallet’s limited currency handling capabilities restrictive, potentially forcing them to maintain separate accounts with conventional financial institutions for cash-related transactions.

3. Potential learning curve

Some expats have mentioned that Viva Wallet’s extensive range of services can sometimes lead to a steeper learning curve. Users have reported needing time to familiarise themselves with all the features and tools available, especially when transitioning from simpler banking systems.

For businesses operating in fast-paced industries, such as technology startups, this potential drawback is especially significant. Picture a British expatriate launching a fintech startup in France – they might find the initial setup and learning process with Viva Wallet challenging, potentially slowing down their ability to quickly adapt financial operations as their venture evolves rapidly.

List of business tasks for which expats recommend Viva Wallet:

- Setting up retail businesses quickly due to its easy-to-integrate POS terminals and rapid account opening process;

- Managing subscriptions by automating recurring payments to keep cash flow smooth;

- Expanding operations across EEA countries, as it simplifies cross-border transactions and provides a unified financial platform;

- Managing international trade with multi-currency support and streamlined payment processes;

- Handling financial reporting for multi-country operations, offering consolidated views of transactions across various markets.

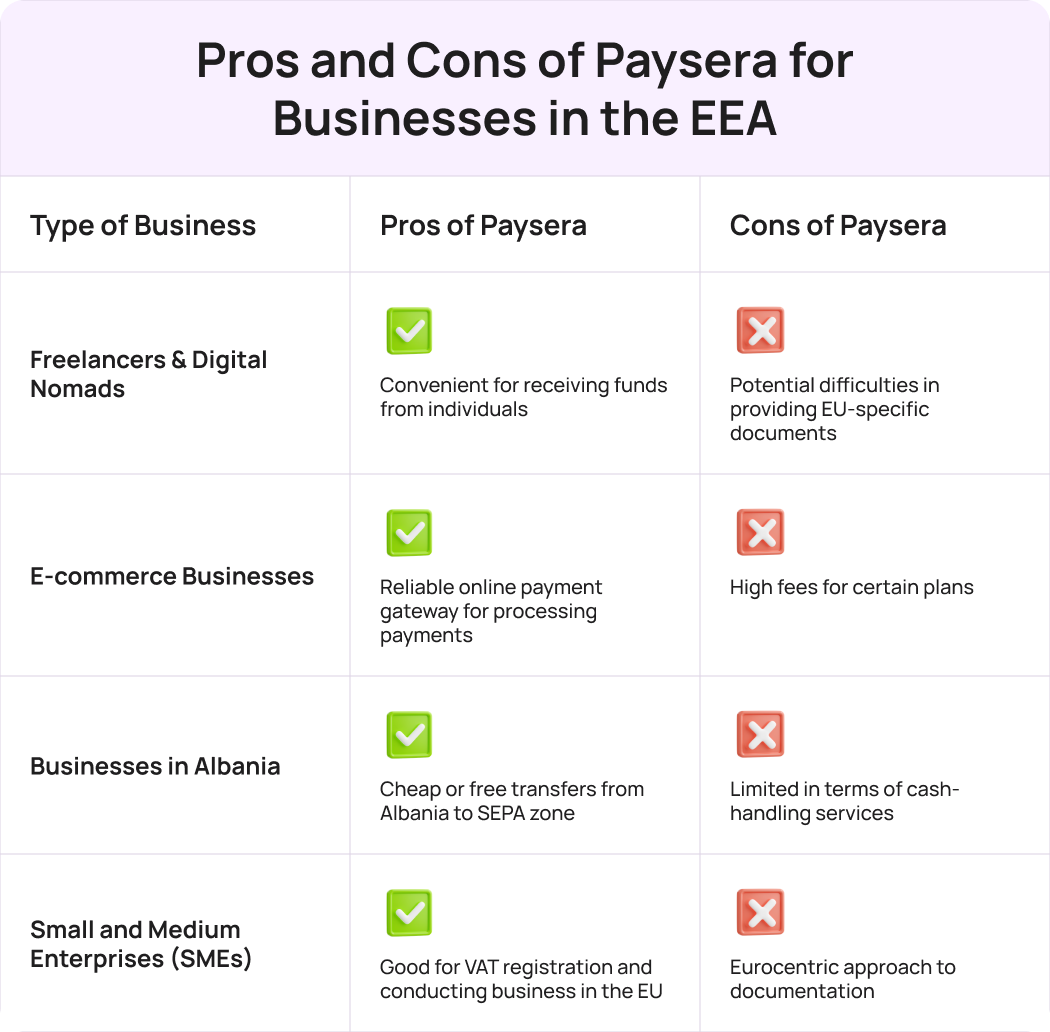

Paysera: a well-liked financing option for foreign companies

When considering financial options for expat businesses in the EEA, Paysera offers a practical, if not always the first-choice, solution. While not a traditional bank, it provides a range of e-money services that can meet the needs of companies requiring EUR accounts. However, expats might discover that Paysera’s support outside Europe is limited, with stricter onboarding conditions for non-EU countries.

How does Paysera perform for expat businesses?

⠀

1. Convenient remote account opening

Paysera enables remote business account opening, a key benefit for expats who are unable to visit a bank in person. This feature streamlines the registration process, allowing users to start their operations quickly. It’s particularly useful for those newly arrived in a country who may not yet have a local residence permit.

This advantage is particularly critical for expat entrepreneurs setting up a business remotely or while travelling across borders. Companies can hit the ground running without delays linked to in-person banking requirements.

2. Reliable payment processing for SMEs

Small and medium businesses frequently highlight Paysera’s dependable payment processing as a key advantage, particularly for online transactions. The platform enables seamless integration with websites and digital platforms, making it straightforward to accept transactions from clients.

It simplifies the task of receiving payments, ensuring that small businesses can grow and manage their cash flow without needing extensive technical expertise or dealing with complex banking procedures.

3. Streamlined VAT invoicing

One of the highly regarded features of Paysera for expat businesses is its VAT invoicing functionality. This tool enables companies to efficiently manage documentation through the event self-service system, ensuring adherence to EU tax regulations. Users appreciate the clear guidance provided for setting up and administering invoices.

This functionality is crucial for companies active across multiple EU countries or expanding into the EEA market. Sectors like event management, logistics, and retail often require invoices to maintain compliance and avoid penalties. Paysera’s VAT invoicing tool simplifies this task.

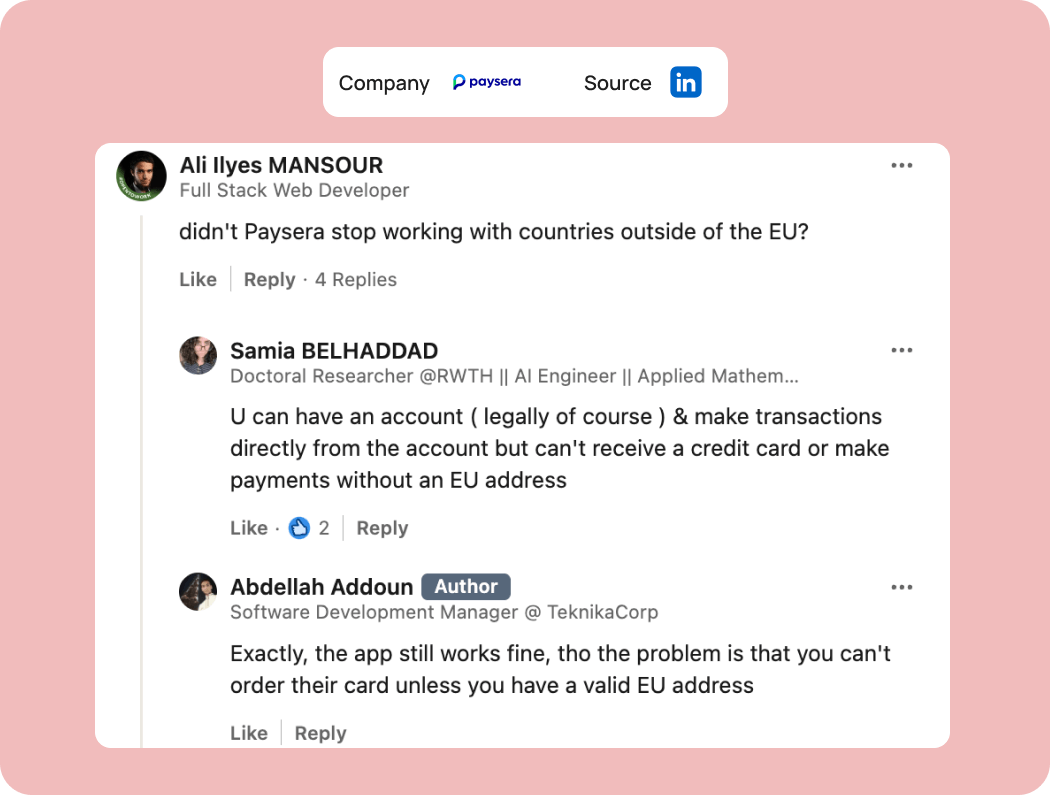

What are the main disadvantages of using Paysera for expat business?

⠀

1. Challenges for non-EU e-residents

A key drawback noted by expats using Paysera, recognized as one of the top 10 fintech companies, is the platform’s stringent requirements for non-EU e-residents, which can complicate account setup. Users have expressed frustration over the need to provide documentation that is only applicable to companies registered in the European Economic Area (EEA), such as a signed shareholder list or notarized proof of registration.

For entrepreneurs operating outside the EU, such as those from the United States, this documentation requirement can be critical. Companies in industries such as technology or consulting, which often engage with international clients, may find it difficult to meet these criteria.

2. High costs for non-SEPA transfers

Users have noted that while Paysera offers competitive rates within the SEPA area, costs can escalate dramatically when transferring funds to countries like Kosovo or Montenegro.

This inconsistency in pricing can frustrate expats who rely on low-cost solutions for their international transactions. For companies that frequently engage in cross-border transactions, such as importers or exporters, these high fees may erode profit margins and make it challenging to compete in price-sensitive markets.

3. Unstable app performance

Expats have voiced dissatisfaction with the Paysera app’s inconsistent performance, noting frequent bugs and usability issues. This instability can result in the loss of payment history and transaction records due to sync errors or crashes, along with delays and difficulties accessing essential documents like digital receipts or invoices.

Companies that depend on mobile applications for financial management, especially in fintech, e-commerce, and logistics, encounter serious challenges with Paysera’s app instability. This unreliability can disrupt transaction processing, complicate reporting, and expose sensitive data to security risks.

Paysera is commonly recommended for solving the following business tasks:

- Opening an EU-based account for VAT registration and conducting business activities within the region;

- Receiving funds from individuals;

- Low-cost or free transfers from Albania to the SEPA zone;

- Processing online transactions for e-commerce businesses that require a reliable payment gateway;

- Frequent currency exchanges with lower commission fees on cross-currency transactions.

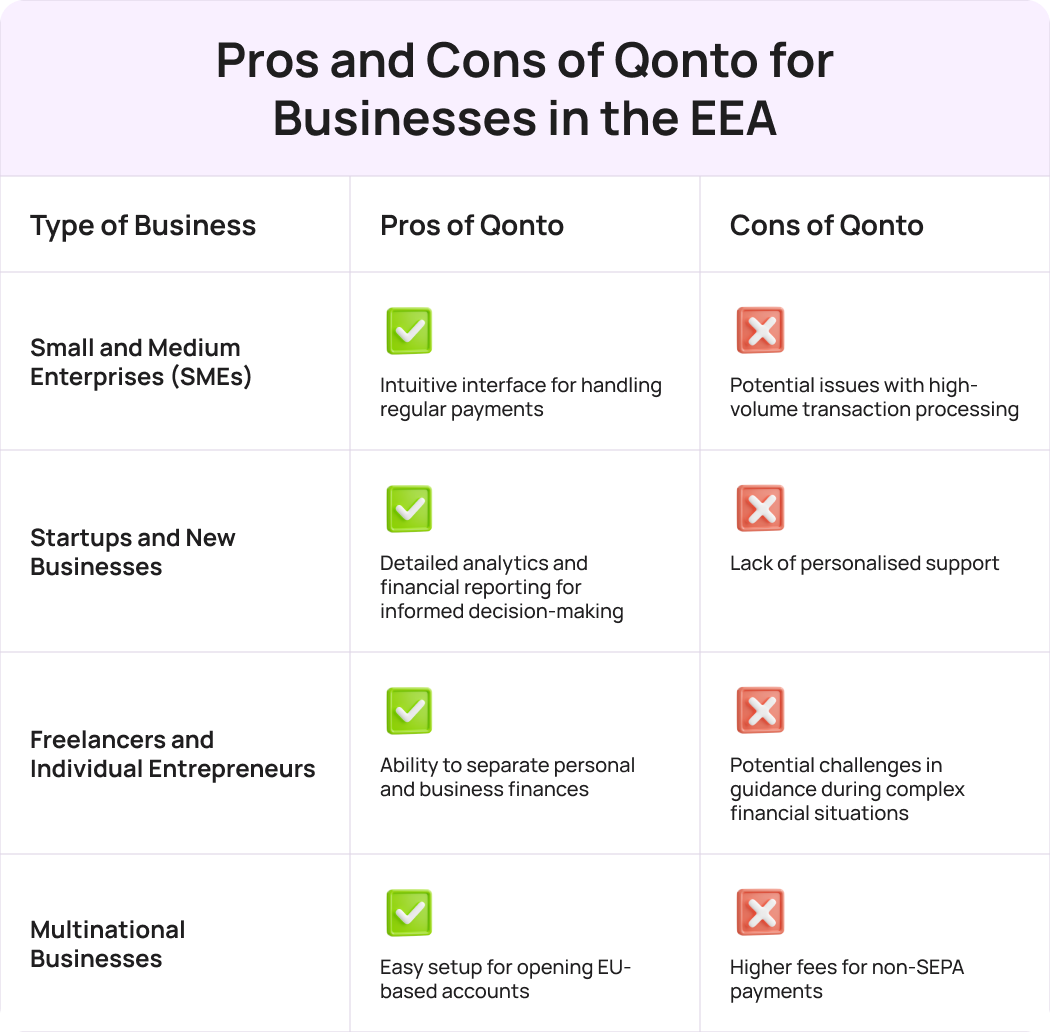

Qonto: financial service that offers flexible multicurrency accounts

Qonto provides financial services without the constraints commonly found in conventional banking for over 500,000 users in France, Germany, Spain, and Italy. The service empowers expats with easy account setups, efficient online payment processing, and automated money management tools. With an intuitive interface and clear pricing models, it helps businesses navigate their economic journeys with confidence.

How can Qonto help expats achieve their business goals?

⠀

1. Flexible multicurrency accounts

Qonto offers the ability to open accounts in various currencies, which is a significant advantage for expats dealing with international clients. Users appreciate this flexibility, especially when engaging in cross-border transactions or catering to a diverse customer base.

This feature not only aids in managing foreign exchange risks but also simplifies financial planning for businesses operating in multiple regions. Companies can avoid the hassle of conversion fees and delays associated with traditional banks, allowing them to maintain cash flow and client satisfaction more effectively.

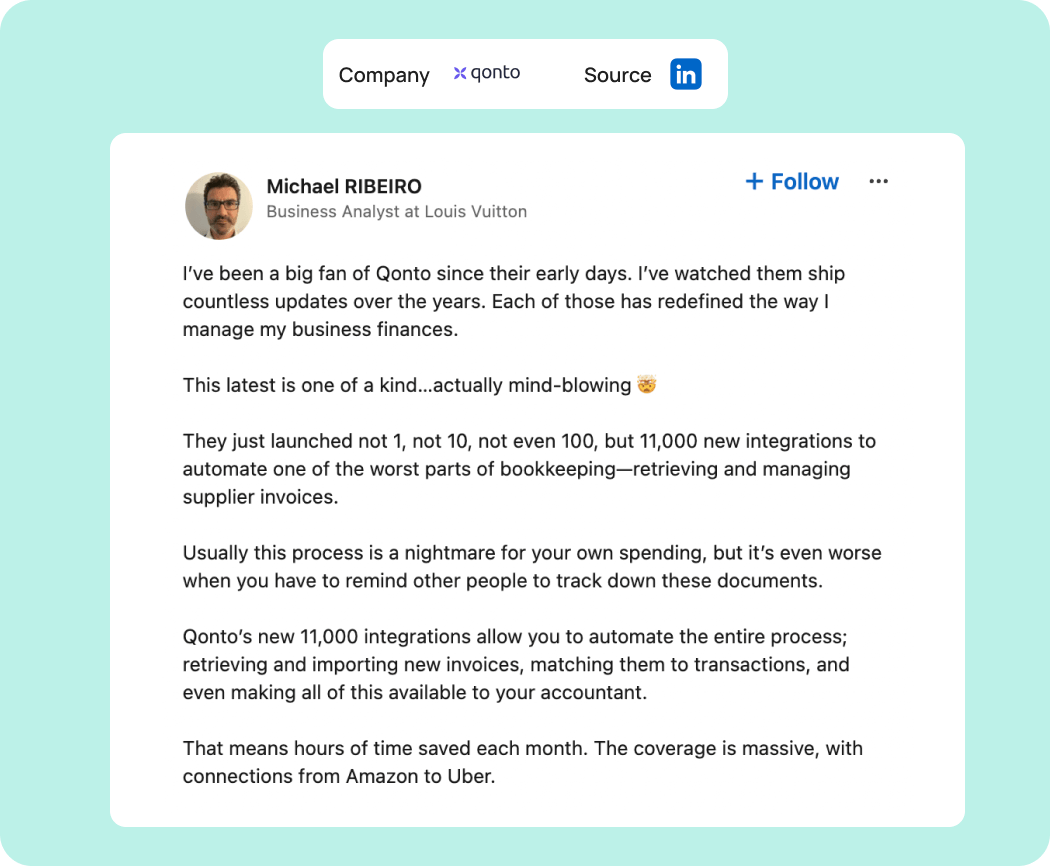

2. Integration with multiple software solutions

Expats highlight Qonto’s integration with various software and services as a significant advantage. This feature enables users to automate many aspects of their bookkeeping, substantially reducing the time spent on financial administration. While Qonto connects with popular accounting software like DATEV and Lexoffice, its capabilities extend beyond just these options.

For businesses with specific needs, Qonto provides API access, allowing users to create custom integrations that fit their unique workflows. This capability is particularly beneficial for entrepreneurs who may require tailored solutions to meet their operational demands.

3. Comprehensive features for small businesses

Qonto is recognised for offering a comprehensive suite of features specifically tailored for small businesses and freelancers. Users can easily manage expenses, generate invoices, and streamline their bookkeeping processes, providing a major benefit for busy entrepreneurs.

For instance, a freelance graphic designer can effectively utilise Qonto to track income from various clients and categorise expenses related to different projects. This feature is not only crucial for maintaining an organised financial system but also facilitates clear visibility into business performance.

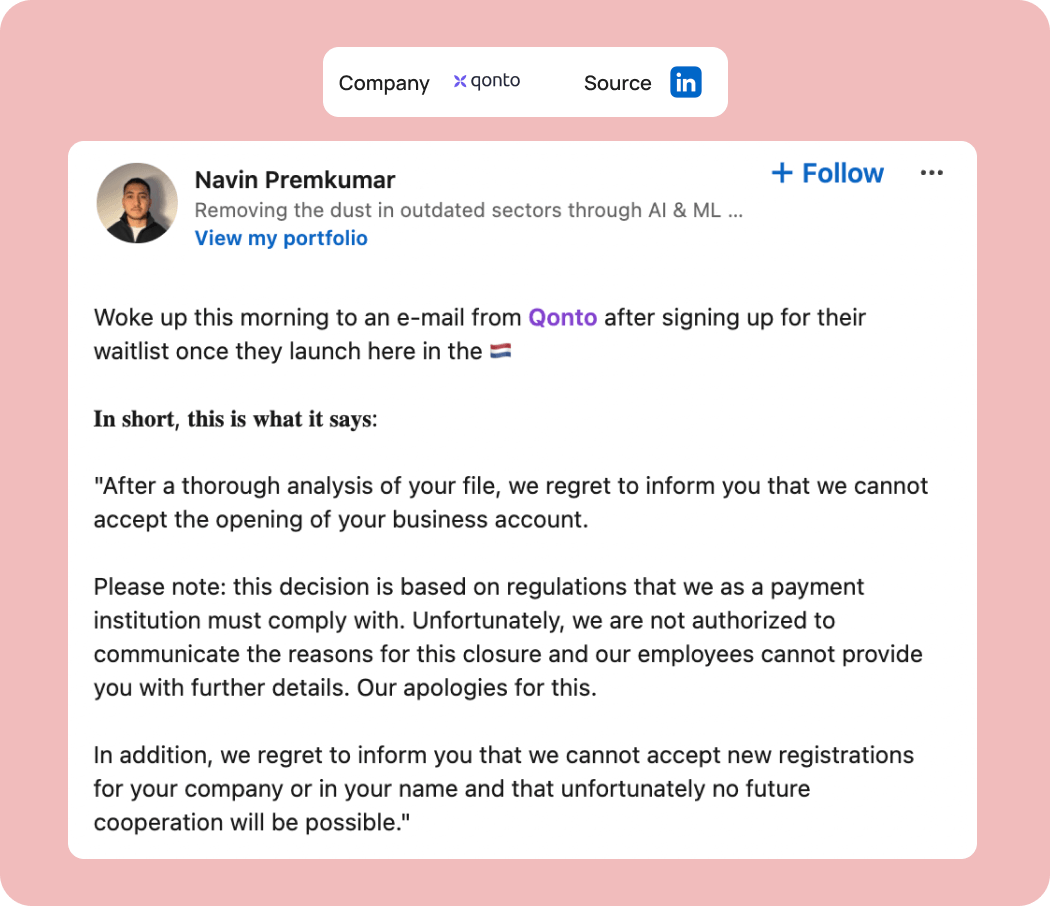

What are the primary negatives for foreigners that use Qonto?

⠀

1. Security сoncerns

Many expats have raised alarm bells over Qonto’s perceived lack of security. Reports of accounts being compromised, with funds disappearing under suspicious circumstances, have led to dissatisfaction among users who feel their financial safety is at risk.

For small businesses operating in the EEA, security is paramount, especially when handling substantial transactions. If a company falls victim to fraud, the financial repercussions can be devastating, impacting not only their cash flow but also their reputation with clients.

2. Inadequate personalised support for growing businesses

Many expats have highlighted the lack of personalised service as a drawback of using Qonto, one of the top 10 fintech companies. As businesses grow, the need for tailored support increases. However, some users feel that its service lacks the human touch that traditional banks offer.

For businesses transitioning from small to medium size, the absence of dedicated account management can lead to inefficiencies. A growing company often faces increasingly complex financial situations, requiring more nuanced guidance and support.

3. Lack of transparency in Qonto’s operations

Some expat users report feeling uncomfortable due to the lack of transparency in Qonto’s operations. They express concerns about how the bank manages sensitive financial information, including unclear terms regarding fees and policies, which can lead to confusion about the actual costs of services.

This apprehension is particularly pronounced among those who value traditional banking methods and prefer face-to-face interactions with financial institutions. For entrepreneurs relying on clear communication in their payment processes, these concerns can create hesitation in fully committing to Qonto as their partner.

Common business use cases for Qonto:

- Tracking expenses for tax purposes and effective communication with tax authorities, including invoice processing and manually paying taxes instead of using direct debit;

- Separating personal and business finances for clearer money management;

- Utilising financial reporting tools that provide detailed analytics, assisting organisations in making informed decisions.

- Serving businesses operating in France, Spain, Germany, and Italy

- Regular payments and transactions, perfectly suited for enterprises that conduct numerous recurring operations thanks to a simple and intuitive interface.

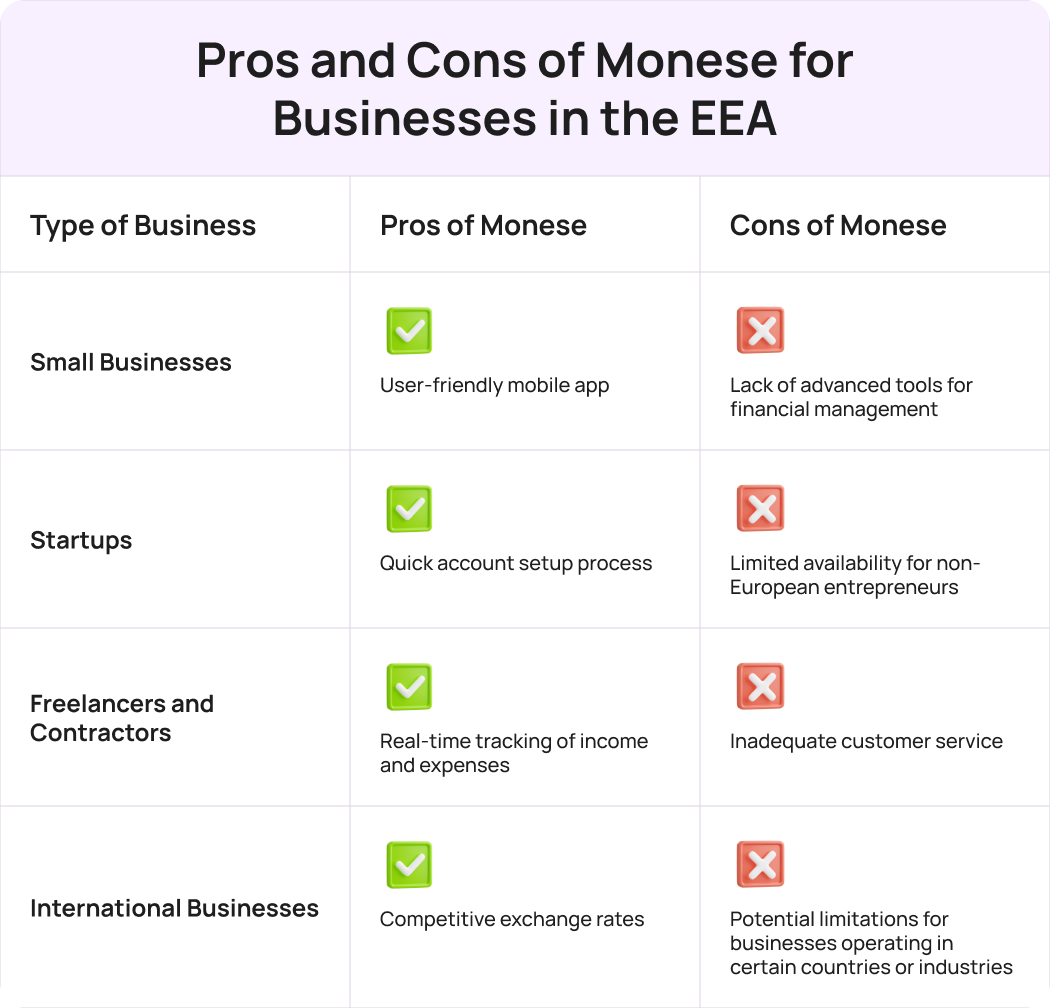

Monese: mobile banking app for expatriates

Monese, a British fintech company has over two million clients across 31 countries. It offers a lifeline for expatriates navigating financial challenges in the European Economic Area. With its financial app, it empowers expats to control their money seamlessly across borders. By choosing this platform, international residents gain instant access to UK bank accounts, multi-currency transactions, and a user-friendly platform.

How can Monese’s features support the financial needs of expat businesses?

⠀

1. Joint IBAN accounts

One of the key advantages of Monese is its ability to jointly maintain IBAN banking profiles from different countries. Expatriates often commend this feature, highlighting how it simplifies financial management internationally. The convenience of having multiple banking accounts allows users to keep track of their money without the hassle of switching between different banking platforms.

For businesses operating in multiple European countries, this feature can be critical. Companies that frequently engage with clients or suppliers across borders benefit from the ability to handle various currencies. Accessing international bank accounts in diverse locations enhances cash flow management and reduces the risks associated with currency exchange.

2. Personal loans

Another notable strength for Monese is its option to take out personal loans, which users find accessible and straightforward. Many expats appreciate the ease of securing funding without the bureaucratic hurdles typical of traditional banks.

This flexibility is particularly valued by those needing quick financial support, as it enables them to navigate unexpected expenses more effectively. Entrepreneurs often face situations where quick access to funds is necessary, such as launching a new product or covering operational costs during a slow season. Monese’s loan offerings can provide essential support, helping these businesses maintain momentum and stability.

3. Competitive fees

Users appreciate the transparent pricing and low fees associated with account maintenance and transactions, making it an attractive alternative to classic banking institutions.

This affordability helps expatriates manage their money more efficiently without incurring excessive charges. For small businesses functioning on tight budgets, having access to competitive fees can be a crucial advantage. These companies often face financial constraints, such as limited cash flow and rising operational costs, necessitating banking solutions that help minimise expenses.

What are the consequences of adopting Monese for businesses owned by foreign nationals?

⠀

1. Limited availability

One notable drawback of Monese is its limited availability, as it is only accessible to European citizens. Expatriates express frustration over this restriction, feeling excluded from a payment service that could simplify their financial lives.

For businesses led by non-European entrepreneurs, this limitation can pose challenges. The lack of accessible banking options can create unnecessary hurdles, delaying operations and expansion plans.

2. Customer service challenges

Users have reported difficulties with Monese’s customer service, often citing long response times and insufficient support. This feedback highlights a pressing concern for many expats who rely on timely assistance for their banking needs.

For entrepreneurs who encounter issues with their accounts or transactions, inadequate customer service can be particularly critical. Delays in resolving problems can lead to financial losses or disrupted operations, ultimately affecting a company’s reputation and bottom line.

3. Minimal features

While Monese provides essential banking services, some expats feel that the platform lacks advanced tools that could enhance their financial management. This perceived limitation can act as a drawback for users seeking comprehensive solutions from the top 10 fintech options available.

Companies involved in complex transactions or those needing specialised financial tools may find themselves at a disadvantage. For example, a growing e-commerce venture has the potential to require processing a large number of refunds or integrate with a specific ERP system, which the platform might not be able to accommodate.

Typical business tasks that Monese is frequently suggested for:

- Tracking banking operations: income, expenses, and transactions;

- Holding and managing multiple currencies;

- Global spending, as Monese cards can be used worldwide with competitive exchange rates;

- Unlimited currency exchanges between GBP and EUR;

- Keeping track of expenses in real-time.

Conclusion: How to choose a financial service for opening a business account for expats

When selecting a financial solution for your expat enterprise, prioritise factors like fee structure, payment methods, and ease of use. A reliable option should be among the top 10 fintech companies, offering multi-currency accounts, facilitating international transfers, and delivering excellent customer support. Ensure the service is compliant with international regulations and has a solid reputation in the industry. Ultimately, choose a provider that balances functionality, cost-effectiveness, and adaptability to your specific cross-border business needs.