What is SEPA and what it is used for?

SEPA is a transfer standard that defines cashless payments between Euro countries. In this article, we are going to cover everything regarding SEPA payments.

SEPA stands for the Single Euro Payments Area (SEPA). It is a transfer standard that defines cashless payments between Euro countries and follows the European Union’s (EU) rules for such transactions. SEPA was introduced in 2008 and is used today by 36 countries.

What Is a SEPA Payment?

SEPA, or the Single Euro Payments Area, is an initiative that was fully implemented in 2014 and harmonizes euro-denominated cashless payments in the eurozone. The SEPA architecture supports direct debit, rapid card transferring, and credit transfer recurring payment or other mechanisms, all of which are extensively used in Europe by consumers, companies, and governments.

Businesses in these countries may conduct cashless international payments using SEPA with the same simplicity and low cost as domestic payments. The unified Euro payment system is authorized and governed by the Euro Payments Council (EPC).

Single Euro Payments Area (SEPA) credit transfers typically take place the next business day, while SEPA rapid credit transfers may happen anywhere in the Euro Payments Area in a matter of seconds. Whenever it is possible, the majority of SEPA credit transfers are transmitted as SEPA quick credit transfers.

Which Countries Are Included in The SEPA?

SEPA’s 36 members consist of 27 nations from the European Union and 9 other countries from Europe. Even though not all of these nations use the Euro or are members of the European Union, they all have unique monetary agreements that enable them to use SEPA transactions. SEPA payments are allowed if you maintain a bank account denominated in euros.

The following countries have been included in SEPA:

| Austria | Denmark | Greece | Lichtenstein | Norway | Slovenia |

| Belgium | Estonia | Hungary | Lithuania | Poland | Spain |

| Bulgaria | Finland | Iceland | Luxembourg | Portugal | Sweden |

| Croatia | France | Ireland | Malta | Romania | Switzerland |

| Cyprus | Germany | Italy | Monaco | San Marino | |

| Czech Republic | Gibraltar | Latvia | Netherlands | Slovakia |

How Do SEPA Transfers Work?

SEPA aims to make international electronic payments more affordable and accessible so that they are on par with local payment types. In addition to allowing residents, workers, and tourists to instantly debit accounts in other member countries using retail transactions, SEPA also lets them utilize banks in their own country to receive direct deposits and make bill payments by electronic transfer. This enhances the movement of labor among SEPA nations and fosters economic cooperation. The system also creates a single market for payment services, increasing competition and eventually bringing down prices in the payments sector.

SEPA consists of the following four payment processing systems:

• The SEPA Credit Transfer Scheme allows to process cross-border payments in euro in the same secure and effective way as domestic payments.

• Program for SEPA Instant Credit Transfer enables immediate wire transfers up to 15000 EUR 24/7/365.

• The Core Direct Credit Scheme of SEPA provides a creditor with the right to collect funds from a debtor’s account. For this, the creditor must have a signed mandate from the debtor.

• The Business-to-Business Direct Debit Program of SEPA is intended for companies. It allows direct euro transactions between businesses in order to exclude payments of incorrect amounts.

These programs provide the rules and methods by which member states regulate the transmission of euro-denominated electronic payments among themselves.

Transfer Time for SEPA

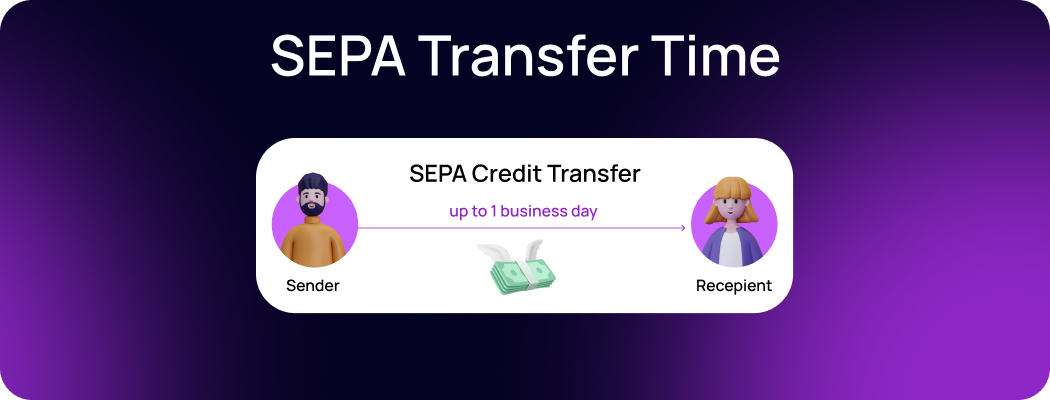

If you send money to another SEPA country using a SEPA Credit Transfer, the money should be deposited into the recipient’s bank account on the next business day after it was sent. Wait times could be longer on weekends and national holidays.

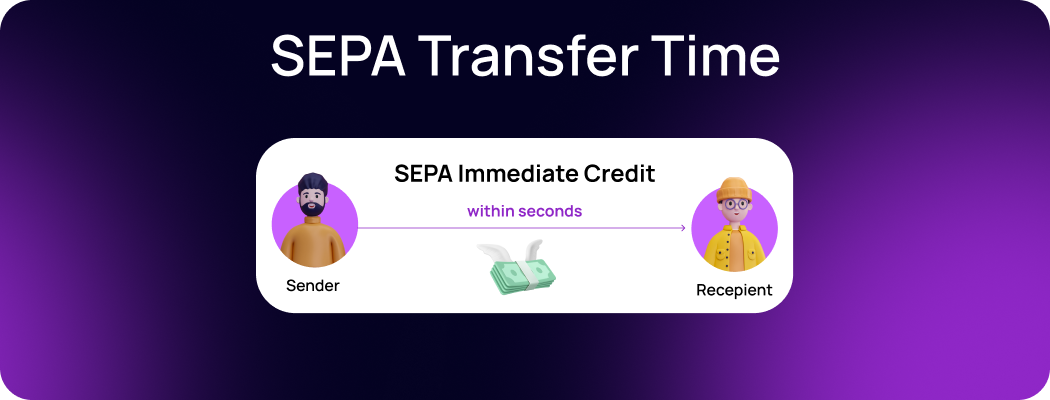

SEPA Immediate Credit is an immediate payment that, as its name suggests, is processed and finalised in a matter of seconds, in a manner that is comparable to payments made on a domestic level. There is no difference in wait times based on the day of the week or the weekend.

The amount of time required to handle SEPA Core Direct Debit transactions is one business day, whereas the amount of time required to process B2B Direct Debit transactions is three business days. If the operation is delayed because of weekends or federal holidays, it may take longer for the funds to reach the account of the beneficiary.

What Is The Cost of SEPA Transfers?

Because there are no hidden fees involved with either the sending money or the receiving of SEPA transactions, the majority of the time they function in the same manner as domestic transfers. If, on the other hand, you are making a payment to SEPA from a country that does not use the euro, you will be forced to pay a currency conversion fee for the payment to be processed in euros. The fee of this transaction is established by the current currency rate as well as by your bank.

Transferra offers three pricing plans for SEPA payments depending on your individual needs. Register and fill in the questionnaire in order to receive the most suitable pricing plan.

Pros and Cons of SEPA Transfers

| Pros | Cons |

| A SEPA transfer operates identically to a domestic transfer. Businesses that use SEPA have access to a variety of benefits, including the ability to accept payments from anywhere within the SEPA zone. This allows the organisation to spread its services to other nations and reach a greater number of customers. In addition, it is quick, secure, and free. | Because SEPA is only available to its 36 member nations in Europe, it is not a practical choice for businesses that are headquartered on other continents, nor is it a way for European payment council to accept payments from countries that are not members of SEPA elsewhere in the world. SEPA is only available in Europe. |

Who Is Eligible For a SEPA Bank Account?

It is feasible to make SEPA transfers without needing to maintain a separate bank account. If your primary banking institution is based in the Eurozone, you should already have the capability to send and receive SEPA bank transactions. You may want to find out whether your bank or other financial institution is compatible with SEPA before opening an Euro account in a country that is not part of the Eurozone or transferring money from such a country. To use SEPA, the transaction must be carried out in euros; otherwise, you will need to use a payment system that is specific to your country.

Transferra supports SEPA and SEPA Instant payments. When you register an account with us, you will receive a UK IBAN and be able to send EUR payments within the Euro zone.

SEPA vs. SWIFT Transfers

The SWIFT financial communications system operates on a global network of banks and financial institutions. Society for Worldwide Interbank Financial Telecommunication is abbreviated as SWIFT. The SWIFT code enables organisations to communicate and receive information about financial transactions in a standardised and secure manner. SWIFT facilitates worldwide and multi-currency money transfers between banks.

Although SEPA and SWIFT bank transfers serve the same purpose, there are substantial differences between the two. SWIFT enables worldwide money transfers, while SEPA only accepts payments inside the SEPA zone. SWIFT transfers may be made in multiple currencies, as opposed to the SEPA initiative, which only enables Euro transactions. Moreover, SEPA transactions are either free or relatively low, but SWIFT transfers may cost anywhere between $15 and $45.

SEPA bank transactions are often easier since they just need the IBAN. In addition to the recipient’s name, IBAN, BIC, and SWIFT code, you need the beneficiary’s address, bank information, account number/branch code, particular currency, and IBAN, BIC, SWIFT code, and business identifier code.

Are There Any Transfer Limits for SEPA payments?

The transfer limit for SEPA Credit Transfers is €999,999,999.99. one cent less than a billion euros. SEPA Instant Credit transfer enables you to transfer up to €150,000 in a single payment, whilst Direct Debits are contingent on your agreement with the payer and have no transfer limit.

How Did Brexit Impact the United Kingdom’s Membership?

Despite electing to leave the European Union in the Brexit vote, the United Kingdom maintains its membership in the Single Euro Payments Area (SEPA). Payments from the United Kingdom to the European Union and vice versa now need more data, despite the fact that the way firms utilise SEPA has not changed much.

Although certain banks in select countries have begun charging more for SEPA payments originating from the United Kingdom, this is not a widespread practice, and the majority of transfers from the United Kingdom to EU nations do not incur additional fees.

To Sum Up

SEPA, or the Single Euro Payments Area, is a technique that was developed to simplify international payments both within and outside of the European Union. At the moment, it can be accessed in 36 states, and it enables same-day, low-cost transactions in euros for both businesses and individual customers.

Direct debit, which is often used by companies to make recurring cash withdrawals, is one of the key payment methods supported by SEPA. The other basic payment method is credit transfer, which allows recipients to receive one-time money transfers.

Compared to the traditional SWIFT system, the Single Euro Payments Area (SEPA) has improved the speed, cost, and efficiency of international payments. Despite this, SEPA has inherent restrictions because of the restricted number of countries it supports and the fact that it only processes payments in a single currency. These constraints prevent SEPA from serving as a globally integrated payment system.

Questions and Answers

Does SEPA just apply to the euro?

Only transactions with prices denominated in euros may utilise the SEPA payment system. As a direct consequence of this, the percentage of customers in each country that are willing to accept payments through SEPA varies.

What distinguishes SEPA payments from SWIFT payments?

The primary distinction between SWIFT and SEPA is their varying geographic ranges. SWIFT facilitates cross-border payments in a variety of currencies, but SEPA only permits transactions between members of the SEPA zone.

How can I transfer money with SEPA?

To initiate a SEPA bank transfer, you must log in to your bank or payment provider account and set up the transfer as usual. After specifying the recipient and any other pertinent information, the following stages include inputting the recipient’s international bank account number and paying for the transfer.

Are SEPA transactions costless?

SEPA transfers are often free or cost the same as domestic transfers. A limited number of banks may, however, charge an additional cost for SEPA transactions if they charge the same amount for domestic bank transfers within the same nation.

Is SEPA Transfer an international system?

A SEPA money transfer is an international transaction using the Single Euro Payments Area (SEPA). SEPA is an international money transfer mechanism that makes utilising euro bank accounts as easy as using them locally.

Does Transferra support SEPA payments?

Yes. Upon registering an account at Transferra, you will receive a UK IBAN and be able to send EUR payments within the Euro zone.