What Is a SWIFT Payment and How Does It Work?

Our guide explains what SWIFT payments are and how they work. Discover the advantages of using SWIFT for international transfers, as well as the fees and processing times associated with this payment method.

Sending money abroad has become a simple task, with the convenience of walking into a financial institution (FI) and making a transfer to any part of the world. Many providers offer financial services online and it really is very convenient. However, have you ever wondered about the mechanism behind it? The answer lies in SWIFT, which is responsible for facilitating most of the world’s money and securities transfers.

So, providers use SWIFT, as a vast network, to send and receive information, including transfer instructions, in a secure, accurate and timely way. This article explains the SWIFT payment meaning, as well as the functionality, mechanics and economics of this system.

Start With the Basics: What Is a SWIFT Payment?

Today, SWIFT is a globally recognised cross-border payment and messaging system linking financial institutions in most countries. With over 11,000 participating organisations, the network has been in operation for nearly five decades and is renowned for its secure transfer capabilities, which have made it a widely adopted standard in many countries.

But what are SWIFT payments? This term refers to electronic transfers that occur across international borders with the assistance of an intermediary institution. Although this network is not a banking system and doesn’t physically transfer money, it enables the transmission of global payments between financial institutions using unique codes. Such a system serves as a reliable and fast means of transferring funds across borders, ensuring accuracy and security throughout the process.

All operations take the form of an exchange of info through messages or annotations, without any actual funds being transferred. Instead, you can receive money at the endpoint using a unique code.

Now you know what is the SWIFT payment system. Through this network, both people and companies can send and receive international funds, even if the customer or supplier uses a different institution’s services than the receiver. The system provides a secure platform for the exchange of financial data and acts as a messenger between financial establishments, without actually handling any funds.

How To Understand the SWIFT Code

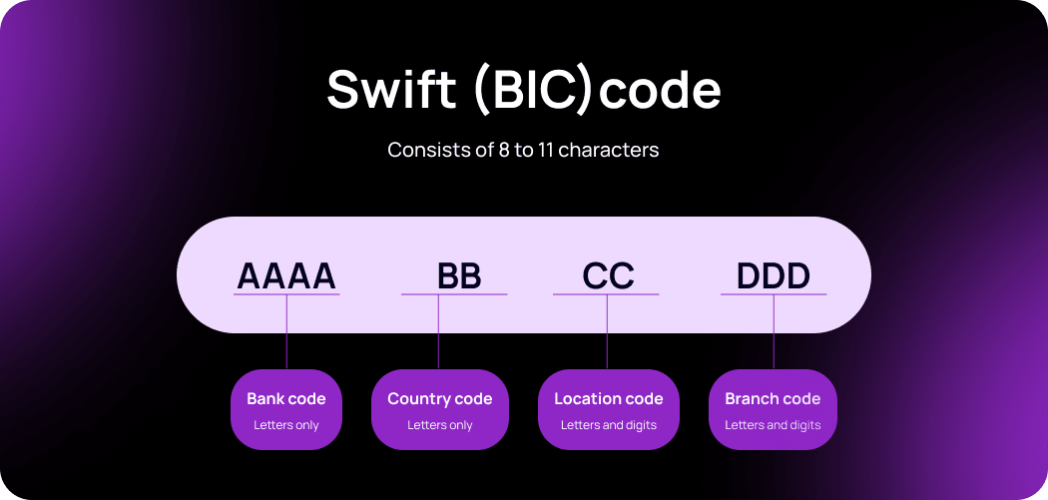

If you want to fully understand the SWIFT transfer meaning, you need to know the BIC structure. Also known as BIC, this is a unique identification code used to identify a specific financial institution on the network and allows you to receive the global transfer. It consists of 8 to 11 characters, provides essential information and can be divided into four parts:

- Financial Institution. The first four characters represent the code that identifies the provider.

⠀⠀⠀⠀ - Country. The next two symbols represent the country in which the FI is located.

⠀⠀⠀⠀ - Location. The following two symbols refer to the location code, which identifies the specific branch of the provider.

⠀⠀⠀⠀ - Branch. The last three characters refer to a specific division of the FI.

For instance, let’s say you want to send money to a friend in London and you have their bank’s number. The SWIFT code for Barclays in London is BARCGB22:

- BARC — Barclays.

- GB — United Kingdom.

- 22 — London branch of Barclays.

It’s important to note that not all institutions have a branch number, so this code may only have 8 symbols instead of 11. In addition, some providers may have multiple SWIFT codes depending on the location of the division. Such codes are critical to ensuring the accurate routing and processing of international transactions.

How Does SWIFT Work for Financial Operations?

This system was created to facilitate faster and more secure interaction between financial institutions, primarily for the processing of international transfers. So, SWIFT is a communication system that allows organisations to interact with each other, rather than a means of transferring money directly. In other words, this tool acts as a messenger, relaying special instructions from the payer to the receiver.

Therefore, when using the SWIFT option, funds don’t actually pass through the network, but rather between the institutions involved in the financial operation. It’s important to understand that SWIFT payments incur charges from both the sending and receiving organisations, as well as any conversion fees.

Making a SWIFT Transfer: A Step-by-Step Guide

If you have been looking for a complete guide to SWIFT payments and want as much detailed information as possible, then read on. So, if you want to initiate a SWIFT transfer, you need to do the following:

- Contact your FI. You will need to contact your provider and submit it with the necessary details of the receiver, including name, account number and SWIFT/BIC code. Also, indicate the amount of the financial operation and the currency you wish to send it in.

⠀⠀⠀⠀ - Confirm the charges. Your provider will inform you of the charges associated with the transfer, including any exchange or intermediary fees that may apply.

⠀⠀⠀⠀ - Provide authorisation. Once you have confirmed the transfer details and fees involved, you will need to provide your authorisation to proceed with the SWIFT.

⠀⠀⠀⠀ - Wait for approval. This transaction may take a few days to complete, depending on the providers involved and any holidays or weekends that may affect processing times. A financial institution will inform you when the money has been transferred to the receiver.

Also, you must have sufficient funds in your account to cover the operation. SWIFT transactions typically incur higher fees than domestic transfers. Don’t forget to ensure that the receiver’s details, including the BIC code and account number, are accurate to avoid any delays or errors in processing.

Nostro / Vostro Accounts: What Does It Mean?

You will not understand what is SWIFT payment system unless you comprehend these two terms. So, the execution of a SWIFT involves a network of Nostro and Vostro accounts set up by the providers involved. These accounts are used for the sole purpose of processing international transactions.

When a transfer is initiated, the financial institutions involved move funds from one account to another through this network. In the context of SWIFT, Nostro and Vostro have specific meanings:

- A Nostro is an account held by one financial institution with another, denominated in the currency of the organisation holding the account. The term “Nostro” means “ours” in Latin and refers to the fact that the account is held by one provider on behalf of another.

⠀⠀⠀⠀ - Conversely, a Vostro is an account held by one FI for another, in the currency of the account holder. “Vostro” meaning “yours” in Latin indicates that the account is held by one provider for another.

If two financial institutions have a business relationship and maintain Nostro and Vostro accounts with each other, SWIFT between them can be executed directly and immediately. However, if the providers do not have a direct relationship, the network must determine the best route for processing the transfer. In such cases, a third-party intermediary may be required to facilitate the operation.

The intermediary acts as a bridge between the sending and receiving institutions, helping to route the payment instructions and ensuring that the funds are transferred to the correct account. It’s important to note that the use of an intermediary may result in additional fees and charges.

Who Can Make Use of SWIFT Transfers?

SWIFT was originally developed with the primary purpose of enabling the exchange of messages related exclusively to treasury and correspondent financial operations. However, this format allowed for significant flexibility and adaptability, which ultimately led to its extensive scalability. Today, SWIFT is used by a wide range of entities:

- Banks use it to communicate with other institutions to make and accept payments and other financial messages.

- Large corporations often rely on SWIFT to make international transfers to suppliers, employees or other business partners.

- Governments may utilise SWIFT to make payments related to trade, foreign aid or other official operations.

- Non-governmental organisations may use SWIFT to send money for humanitarian aid or other charitable purposes.

- While SWIFT payments are typically used for large transactions, individuals can use them to send or receive foreign transfers.

Overall, SWIFT is a critical component of global finances and is used by a wide range of entities to facilitate money transfers and other financial operations.

What Are the Expenses of Using SWIFT?

The cost of using SWIFT for international transfers can vary depending on several factors, such as the volume of operations, the type of messages sent and the level of service selected. SWIFT charges its members based on the volume of transactions transmitted and received. In addition, providers may charge their customers additional commissions for processing.

Now SWIFT does not have a fixed pricing structure and its fees are negotiated between the system and its members. Overall, the cost of using this network can be relatively high compared to other methods, especially for small transactions. However, it’s often necessary for global payments and other operations where security and reliability are critical factors.

What Is the Typical Processing Time for SWIFT Transfers?

Once you know what is a SWIFT transfer and understand how it works, you will probably be interested in the processing time of such payment. This factor is particularly important for business owners who operate internationally.

So, these transfers can take anywhere from a few hours to a few days to reach the beneficiary’s account. The time it takes for a SWIFT payment to clear depends on several factors, including the destination country, the recipient institution and the intermediary involved in the process. The speed of the payment can also be affected by factors such as holidays and weekends in various jurisdictions.

In general, SWIFT can take 1-5 business days to reach the receiver’s account, depending on the issues mentioned above. However, some companies may offer expedited transfers that can be delivered within a few hours. It is best to check with your provider for more info on specific processing times for SWIFT transfers.

Advantages of Using SWIFT Transfers

It is currently the only system that allows banks to make payments to almost any country in a multiple currencies. Such payments offer several benefits to financial service providers and their clients:

- SWIFT transfers, being an established method, undergo strict anti-fraud and anti-money laundering checks, thereby ensuring the security of your account and operations on it.

⠀⠀⠀⠀ - In addition, with over 11,000 organisations in 200 countries using it, SWIFT is a widely available option for transferring money between virtually any two locations.

⠀⠀⠀⠀ - This system uses standardised message formats, ensuring that all transactions are processed consistently and reducing the risk of errors or misunderstandings.

⠀⠀⠀⠀ - SWIFT messages also provide detailed info about each operation, including sender, recipient and amount transferred, which promotes transparency and accountability.

SWIFT can be used in almost every country in the world, and there is a wide choice of currencies for transfers. Both individuals and companies can make payments, and many providers also offer the option of a mobile app.

What Are the Potential Drawbacks of SWIFT Payments?

While SWIFT is an efficient and widely used system, there are some potential drawbacks to consider:

- Such payments can be expensive, especially for smaller amounts. Providers charge commissions for each step of the process, including initiation, transmission, receipt and processing.

⠀⠀⠀⠀ - Sending funds abroad via SWIFT can be a complex process, requiring you to provide detailed info such as the receiver’s name and address, the name of the provider, the code, and the account number.

⠀⠀⠀⠀ - Although SWIFT transfers are generally processed quickly, there can be delays due to time differences between countries and the complexity of the operation.

Overall, while SWIFT is a widely used and reliable system, it is important to be aware of the potential drawbacks and consider alternative methods where appropriate.

To Sum Up

Most SWIFT users handle significant transaction volumes that make manual instruction entry impractical. As a result, there is a growing demand for automated SWIFT message creation, processing and delivery. However, this convenience comes with additional costs and higher operational overheads.

Also, despite the existence of other real-time messaging services, SWIFT remains the dominant player in the global markets. The key to its success lies in its ability to continually expand its message codes to accommodate a wide range of transactions. In essence, it seamlessly adapts to evolving financial needs and fintech processes, making it the world’s most reliable, adaptable and efficient system for international remittances.

FAQ

What Is SWIFT and How Does It Work?

This network doesn’t transfer money but uses codes to send payment information, for example from one personal USD account to another. SWIFT is a global system that facilitates secure and reliable financial messaging between providers of financial services. SWIFT facilitates the automated processing of data required to send payment instructions between institutions around the world.

Transferra offers SWIFT payments for hassle-free cross-border transactions. With these services, you can easily make high-speed payments within the UK, Europe and the USA.

How Long Is a SWIFT Payment?

Such payments typically take between 1-5 business days to complete as they are not instantaneous. This is because the transfer must go through many processes, including anti-fraud and anti-money laundering checks before the money is credited to the receiver.

These controls are essential to ensure the security and legitimacy of the operation, and can sometimes delay the processing of the payment. It’s therefore important to be patient and allow sufficient time for the funds to be processed and credited to the receiver’s account. Some providers, such as Transferra, also offer faster SWIFT transfers for businesses.

What Is the Limit of SWIFT Transfer?

There is no specific limit on the amount of money that can be transferred through the system. The actual limitation is determined by the participating providers involved in the process.

In addition, the limit for a SWIFT will vary depending on several factors, such as the type of account used, the amount being transferred and country regulations. Non-UK resident can also open account in the United Kingdom and use SWIFT as a payment method. For instance, some providers may have a maximum daily transfer limitation or require additional verification for larger operations.

Why Does Everyone Use SWIFT?

The combination of global reach, standardisation, security, compliance and reliability has made SWIFT the system of choice for global transactions and a critical component of the worldwide financial infrastructure. Also, this network has a reputation for being a reliable option that rarely experiences downtime or technical issues, ensuring that all transfers are processed efficiently and with minimal disruption.

What Are the Disadvantages of SWIFT?

SWIFT transactions can have some major disadvantages, such as a slow processing time, which can take up to 5 business days, especially for international transactions involving multiple currencies. In addition, the associated fees can be higher than other methods due to the involvement of multiple institutions in the process. Also, exchange fees may be added to the total cost, which could further increase the expenses to the customer. However, if you choose a provider such as Transferra, you can avoid these disadvantages.