What Is a BACS Payment And How Does a BACS Transfer Work?

BACS payments are one of the UK’s most common types of bank-to-bank transactions. Here’s everything you need to know about BACS.

In the United Kingdom, BACS payments are consistently ranked among the most common types of bank-to-bank transactions. The transfers often take the following two forms: Direct Debit, in which one party is permitted to withdraw money from the bank account of another party, and Direct Credit, in which one party puts money into the account of the other party. In this article, we will explore what exactly BACS payment method is, how it works, how to use BACS payments, what are the costs, and the pros and cons of the system.

What Does BACS Stand For?

BACS stands for Bankers’ Automated Clearing Services, which is a payment system used for processing electronic settlements in the UK. The system was established in the 1960s and is now operated by BACS Payment Schemes Limited, a subsidiary of Pay.UK.

The system is used for various types of electronic transfers, including direct debits, direct credits, and standing orders. Direct debits are a popular way for businesses and organizations to collect recurring payments from customers, e.g., utility bills or subscription fees. Direct credits are used for one-time transactions, e.g., wages or tax refunds while standing orders are a way for customers to set up regular payments from their accounts to another account.

BACS processes millions of instructions each day, making it one of the most widely used systems in the UK. The system plays a critical role in the UK’s payment infrastructure, providing a reliable and efficient way for businesses, organizations, and individuals to process electronic payments.

Types of BACS Payments

There are two basic mechanisms, which may be differentiated by the following:

- Direct Debit refers to the process through which you provide permission to a third party to take money out of your bank account. Your monthly payments of council tax, internet subscription, and maybe even other expenses might be collected by direct debit.

⠀⠀⠀⠀ - Direct Credit refers to the process that takes place when you receive payments straight into your account from another source. Examples of direct credits include reimbursements, receiving a salary or a pension, and so forth.

How Do You Make a BACS Payment?

Understanding how to do a BACS transfer is essential to use the system efficiently. Here are the main steps for making direct credits and debits.

Direct Credit: Either your banking service or your business banking service may be used to credit another account. You will need the payee’s name, the payee’s bank name, the payee’s bank account number, and the sort code. When you debit the account, you will need the same information as before.

Direct Debit: Your customer permits you to take money out of their bank account when they use Direct Debit. You will need the payee’s name, the payee’s bank name, the payee’s bank account number, and the sort code.

There are three alternatives available to choose from if Direct Debit is something that your business is interested in receiving:

- To create direct bank access, the Bacstel-IP software may be used. This programme has been authorised by BACS.

⠀⠀⠀⠀ - You are allowed to utilise a bureau that has been accredited by BACS.

⠀⠀⠀⠀ - It is possible to make use of a third-party provider such as GoCardless.

What Is a BACS Service User Number?

A Service User Number (SUN) is a unique six-digit number that is used to identify and authorize organizations that take payments and use BACS to make electronic transfers in the UK. The SUN is required to make transfers and is issued by BACS Payment Schemes Limited. It is an important part of the transaction process, as it helps to ensure that transfers are made accurately and securely.

Applying for a User Number for BACS Payments

To obtain a SUN, you will need to provide details about your organization, including your legal name, address, bank account details, and the type of payment files you will be submitting to BACS. The sponsoring bank or third-party provider will verify your details and ensure that you comply with rules and regulations before issuing you a SUN.

Once you have a SUN, you can start submitting files to the system. It’s essential to ensure that your files meet standards and that you follow their rules and procedures to avoid any errors or delays in processing your instructions.

Making BACS Payments without a Service User Number (SUN)

It is not possible to make BACS transfers without a Service User Number (SUN), as this is a unique identifier that is required to use the system. However, there are alternative methods that can be used, such as CHAPS or Faster Payments, which do not require a SUN.

If you do need to make a BACS transfer but do not have a SUN, you will need to contact your bank to apply for one. The process typically involves completing an application form and providing proof of identity and address. Once your application has been processed and approved, you will be assigned a SUN and can begin sending instructions.

It is important to note that BACS payments can only be made through a bank or other financial institution that is a member of the scheme. If you are unsure whether your bank is a member, you should contact them directly to confirm.

How Long Does a BACS Payment Take?

Transfers made via Direct Credit and Direct Debit have a cycle of three days and must settle over three business days. On day one, instructions are reported to BACS; on day two, banks process them; and on day three, the funds are simultaneously deducted from the account of the sender and credited to the account of the receiver.

The majority of transactions may be completed in less than two hours when using the Faster Payments Service.

What Are the Fees For a BACS Payment?

One of the most cost-effective ways to receive funds is by using BACS. If you want to set up Direct Debit directly with your bank, you will be required to purchase approved software, which will result in extra costs for you.

In a similar vein, collecting Direct Debit payments via a bureau will probably result in an additional fee to cover the cost of the required software. As a result, using a technology that facilitates direct debit could be the most cost-effective option. The following is a list of the fees that are connected with the various Direct Debit options:

- If you go via a bank, your start-up costs will be £5,000 plus the price of BACS-approved software, which will typically be at least $2,495 and maybe much more. You will also be responsible for transaction charges, which may range anywhere from 5p to 50p, in addition to any additional bank expenditures.

⠀⠀⠀⠀ - If you go via a bureau that is authorised by BACS, the setup will cost you between $400 and $800, and the transaction costs will range from 20p to 50p on top of the monthly charges, application fees, new mandate fees, and penalties. Note that BACS does not support USD payments, for that you will need a separate dollar account with one of the UK banks, as well as use other transfer options such as SWIFT.

⠀⠀⠀⠀ - We provide a variety of options via GoCardless, and each one is tailored to meet the specific needs of your business. When you sign up for our standard plan, we’ll charge you only 1% plus 20p for each transaction, with a maximum fee of £4.

How Safe Is Making Payments Using BACS?

The system is renowned all over the world for safely sending electronic payments since it is a way that is both extremely secure for collecting and sending funds.

Since 1968, BACS has been the organisation in charge of clearing and settling all of the automated payments in the United Kingdom.

- According to recent research, it has been used for over 130 billion transactions, and it has never failed to complete transactions.

⠀⠀⠀⠀ - The network uses the SSL-encrypted technology known as Bacstel-IP. In addition, a password that is both secure and encrypted must be used, and the system must pass frequent validation tests for both the data and the user’s authorisation.

⠀⠀⠀⠀ - The Direct Debit Guarantee protects customers from fraudulent or unauthorised debits, and only recognised organisations are allowed to accept Direct Debits.

When Are BACS Payments Used?

This is a method that utilises digital technology to move money digitally between two different bank accounts. The majority of the time, organisations will use them for direct credits and direct debits. The monies that were put in on Monday will be considered cleared on Wednesday since it takes the instructions three business days to clear.

Which UK banks facilitate BACS payments?

According to the website for the BACS payment system, the following banks and financial organisations are among those that take part in the BACS payment system:

| Allied Irish Bank | HSBC Bank PLC | Starling Bank |

| Atom bank | HSBC UK Bank PLC | The Access Bank UK |

| Bank of England | Lloyds Bank PLC | The Co-operative Bank |

| Bank of Scotland PLC | Metro Bank | The Royal Bank of Scotland |

| Barclays Bank PLC | Modulr | TSB |

| Barclays Bank UK PLC | Nationwide Building Society | Turkish Bank UK |

| Citibank NA | NatWest | Virgin Money |

| ClearBank® | Northern Bank | |

| Clydesdale Bank PLC | PayrNet |

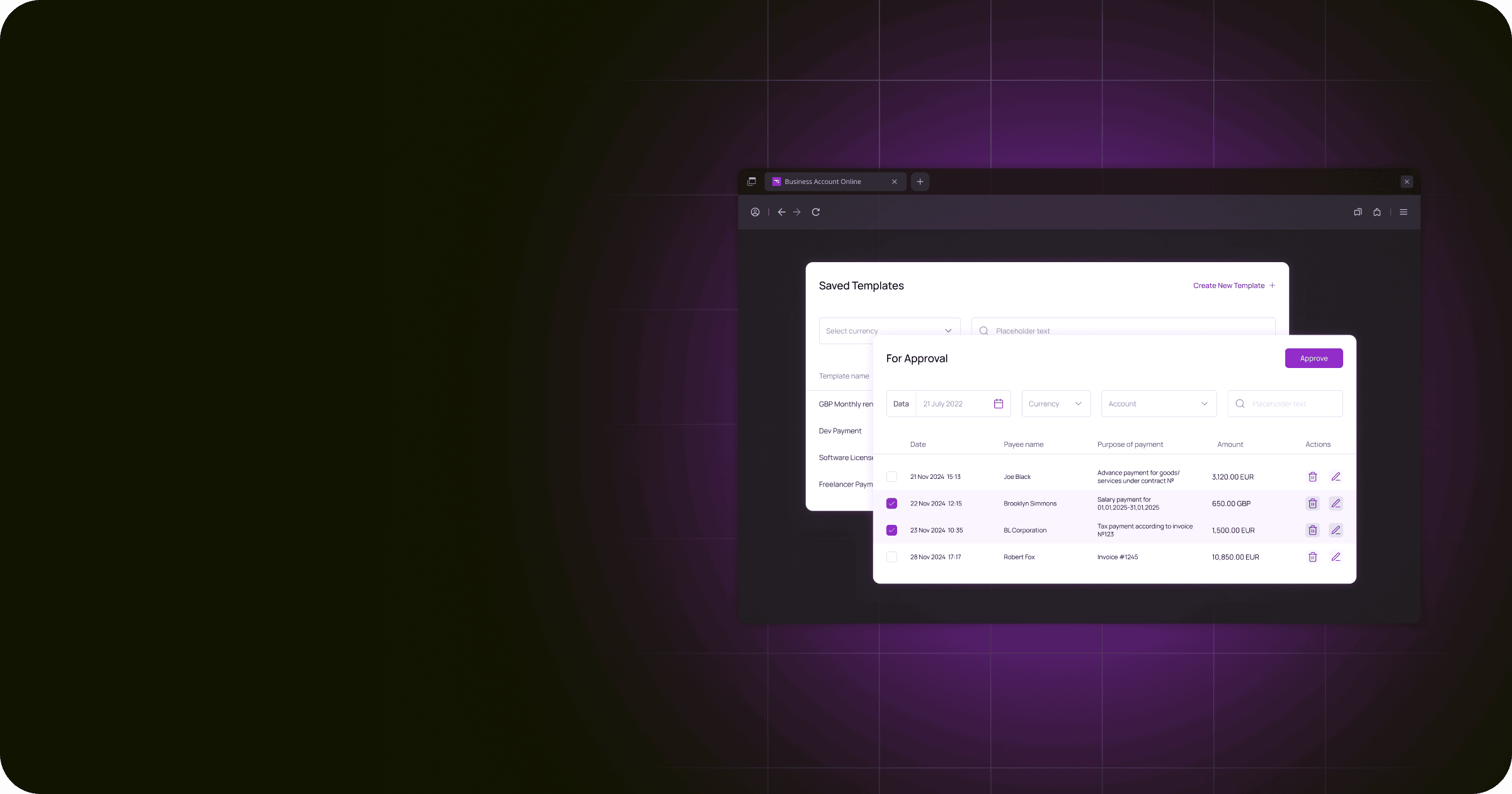

To start using BACS system, you can open a business account online with one of these banks or any other payment provider that supports BACS.

Pros and Cons of BACS Payments

Pros

- The most cost-effective way to transfer money.

- Each and every payroll and accounting program is capable of reading and writing BACS files.

Cons

- Payments can only be cleared on business days.

- Strict time limits for cutoffs.

BACS transfer vs Bank Transfer

BACS is a type of bank transfer, but it is not the same as a standard bank transfer. While it is used for batch processing of payments, standard types of bank transfers can be used for both individual and batch transactions. Additionally, BACS payments may take several days to clear, whereas common bank transfers are usually processed within one business day. It is also important to note that BACS only supports GPB transfers. So if you need to make, for example, a Euro payment in the UK, you would need a separate Euro account with a UK bank.

Recalling BACS Payments

BACS bank transfers cannot be recalled by the sender once they have been sent. This is because they are processed electronically in batches, and once instruction has been included in a batch, it cannot be removed. Therefore, it is important to ensure that all BACS payment details are correct before submitting an instruction, as there is no way to retrieve the funds once they have been transferred.

In certain circumstances, such as in the case of an incorrect payment or fraud, it may be possible to request a recall through your bank, but this is not a guaranteed process and can take time. It is always best to contact your bank as soon as possible if you believe a payment needs to be recalled.

FAQ

Can BACS Be Used for International Payments?

No, it is a UK-based system and is not designed for international transfers. However, there are other payment systems available for international transactions, such as SWIFT. If you have a multi-currency account, you may be able to use other international payment methods to transfer funds in different currencies.

Which Country Uses BACS?

It is used in the United Kingdom. It is the primary method for electronic transfers between bank accounts in the UK.

Why Do People Pay By BACS?

People use this method for a variety of reasons, including paying employees’ salaries, settling bills, and making regular payments like rent or mortgage. It offers a convenient and secure way to make electronic transfers, and it is often more cost-effective than other methods.

What Is the Disadvantage of BACS?

One of the main disadvantages is that it can take several days for payments to clear, which can be inconvenient for urgent transactions. Additionally, BACS payments cannot be recalled once they have been made, so it is important to check payment details carefully before making a payment.

Is BACS a Safe Way to Pay?

Yes, it is a secure payment method that is used by millions of people in the UK every day. The transactions are protected by encryption and other security measures, and payment details are kept confidential. However, it is important to be vigilant and take steps to protect your personal and financial information when making any kind of payment.