The Best UK Euro Accounts Revealed for 2024

Dive into the strategic advantages of UK Euro accounts in 2024. Explore top options, including Transferra, for seamless Euro management excellence.

Managing Euros within the UK offers a range of advantages, from facilitating seamless cross-border transactions to avoiding the pitfalls associated with conventional banking methods. Not all financial institutions are equipped to open a Euro account, which can often come with burdensome fees and less-than-favourable exchange rates. In this article, we explore the benefits of having a UK Euro account, shedding light on why Transferra stands out as a reliable and efficient choice in a market where not all providers can meet these unique currency management needs.

Strategic Benefits of a UK Euro Account

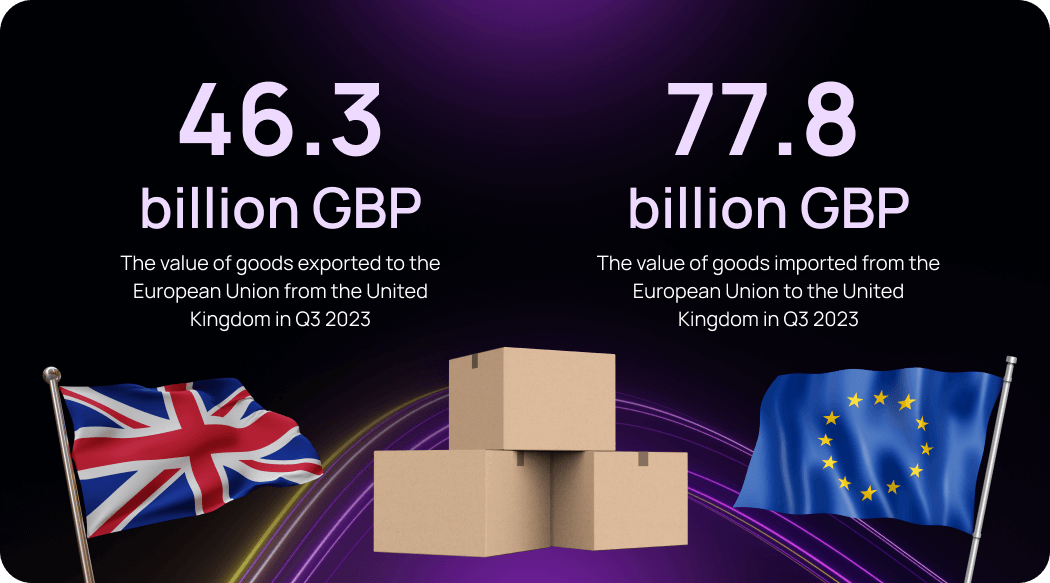

Having a dedicated UK Euro account is not just a convenience but a strategic necessity. The unique economic ties between the United Kingdom and the Eurozone make it imperative for individuals and businesses to manage Euros within the UK.

One primary advantage lies in the facilitation of cross-border transactions. Operating with a UK Euro account streamlines the process of sending and receiving money, eliminating the complexities and delays associated with currency conversion. This becomes especially crucial for businesses engaged in trade or individuals with financial ties across Eurozone countries.

In addition to the broader advantages of managing Euros within the UK, having a dedicated UK Euro account proves immensely beneficial for specific scenarios, such as:

- Travel

- Shopping

- Recurring EUR Payments (such as a mortgage on a holiday home or any other recurring payments in Euros)

- Freelancers with Overseas Clients

- Business Owners with Eurozone Connections.

Opening a UK Euro Account

Individuals and businesses in the UK have the option to open a dedicated Euro account, and the choices are diverse. Highstreet banks, digital banking platforms, and specialized online providers all present opportunities for securing a EUR account tailored to your needs.

When exploring Euro account options, it’s crucial to note the distinctions among them. Some accounts are exclusively designed for Euro transactions, allowing users to hold and transact solely in Euros. On the other hand, multi-currency accounts offer a broader spectrum, providing access to dozens of currencies, including Euros. This versatility proves advantageous for those who frequently travel or engage in transactions involving multiple currencies, offering both time and cost savings.

Before settling on a particular Euro account, consider your unique needs, transaction patterns, and the flexibility required for your financial activities. A comprehensive understanding of the features and benefits offered by different providers will empower you to make an informed decision, ensuring that your Euro account aligns seamlessly with your financial objectives.

Finding The Best UK EUR Account In 2024

Choosing the right Euro account is like finding the perfect fit for your unique needs. Let’s make it easy for you by checking out the availability, features, and fees of some popular Euro accounts in the UK.

| Provider | Availability | Features | Fees |

|---|---|---|---|

| Wise Euro Account | Wise’s Euro account is accessible globally. | – Competitive exchange rates. – Low fees. – Multi-currency wallet for transactions in multiple currencies. | Transparent and low-cost fees for currency conversion and international transfers. Business account: £45 registration fee, starting from 0.43% commission for sending money. |

| Revolut Euro Account | Revolut’s Euro account is available to users worldwide seeking a digital banking solution. | – Instant currency exchange at interbank rates. – Budgeting tools. – Fee-free spending abroad with a sleek app. | The basic plan is free, premium plans start from £19 per month. |

| Starling Bank Euro Account | Starling Bank provides Euro accounts to its UK-based customers. | – Real-time notifications. – Budgeting tools. – Fee-free spending and withdrawals in the Eurozone. | No fees for holding, sending, and receiving euros. For UK businesses: £2 per month for holding a EUR account. |

| Monese Euro Account | Monese caters to a diverse audience, including those with no UK credit history. | – Instant transactions. – Fee-free international transfers. – User-friendly mobile app. | Transparent fee structures with three plans, the most expensive costing £14.95 per month. |

| Santander Euro Account | Santander offers Euro accounts to its UK-based customers. | – International payments. – Dedicated relationship manager. – Access to a wide network of ATMs. | Various account options with different fee structures. No monthly fee for EUR accounts, but SWIFT payments incur a £20 fee. |

| HSBC Euro Account | HSBC provides Euro accounts to customers in the UK and beyond. | – Seamless international transactions. – Comprehensive banking services. – Global network of ATMs. | Specific fees may apply for certain transactions, but no monthly fee. No fee for sending EUR payments to other accounts in the EEA in EUR. |

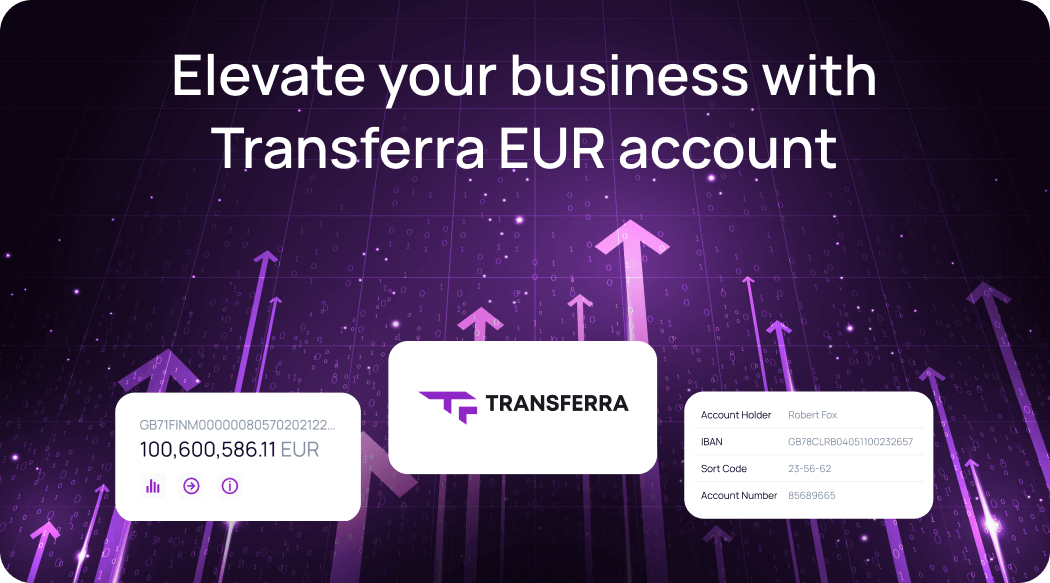

Transferra: Your Premier Choice for Seamless Euro Management

In the realm of Euro accounts, Transferra stands out as a comprehensive solution, offering a range of features designed to elevate your financial experience. Here’s why Transferra emerges as the best option for managing Euros within the UK:

- Dedicated IBAN: Transferra provides a dedicated IBAN, serving as a powerful tool to drive global success for your business.

- EUR, GBP, and 80+ More Currencies: Broaden your business reach with access to major currencies, including EUR, GBP, and over 80 others, ensuring you can cater to a diverse range of transactions.

- Visa Corporate Card: Add an extra layer of convenience to your corporate transactions. With this feature, enjoy seamless and secure payments, further expanding your financial capabilities.

- Competitive FX Rates: Transferra offers competitive foreign exchange rates, enabling you to optimize your currency exchange operations and maximize your financial efficiency.

- Instant Payment Processing: Accelerate your business operations with Transferra’s instant payment processing, ensuring timely and efficient transactions.

- Advanced Permission Management: Empower your team with advanced permission management features, giving you control and flexibility in delegating responsibilities.

- Dedicated Manager Support: Enjoy the assurance of dedicated manager support at every step of your business journey, ensuring that you are supported and guided to success.

Transferra’s commitment to providing a robust and user-friendly platform makes it the ideal choice for individuals and businesses seeking a reliable solution for managing Euros within the UK.

Opening a EUR Account with Transferra: Effortless and Quick

Embark on a journey of seamless Euro management by opening an account with Transferra. The process is designed for your convenience, ensuring a quick and straightforward experience. To get started, simply start the onboarding process. Transferra’s fully digital onboarding eliminates the need for paperwork, allowing you to complete the process conveniently online. Moreover, the onboarding is free, reflecting our commitment to providing a cost-effective solution for managing your Euros.

FAQ

Why is having a dedicated UK Euro account beneficial for business owners?

Business owners can benefit from a UK Euro account by simplifying cross-border transactions, minimizing currency conversion costs, and efficiently managing financial ties within the Eurozone.

Can anyone open a Euro account in the UK?

Yes, it’s possible to open a Euro account in the UK. Various high street banks, digital banks, and online providers offer Euro accounts, each with different features, fees, and eligibility criteria.

Are there fees associated with opening a Euro account in the UK?

Fees vary among providers. It’s essential to review the fee structures of different Euro accounts, considering aspects like transaction fees, currency conversion fees, and account maintenance fees.

What features should I prioritise when choosing the best UK Euro account for my needs?

Consider features like competitive FX rates, ease of currency exchange, instant payment processing, dedicated IBAN, and additional perks such as a Visa Corporate Card. Choose the account that aligns best with your financial goals and usage patterns.